By Rajat Gaur

Updated On

Air Vistara, which is India’s only full-service private sector airline, has its own loyalty program called Club Vistara. Air Vistara has partnered with many credit card issuers in the country so that the reward points earned on their credit cards can be converted into Club Vistara (CV) Points. Vistara partner card issuers in India include HDFC Bank, Axis Bank, American Express, Yes Bank, and IndusInd Bank. Vistara also offers co-branded credit cards in collaboration with Axis Bank, IndusInd Bank, and SBI Cards.

These cards not only earn you additional CV Points but also provide other Air Vistara benefits like a complimentary upgrade to the silver/gold tier of Club Vistara Membership, complimentary air tickets, etc. In this article, we have curated some of the credit cards available in India that offer some of the highest reward rates not only in terms of earning the Reward Points but also the rate of conversion of reward points into Club Vistara Points.

Table of Contents

- Axis Bank Vistara Signature Credit Card

- Axis Bank Vistara Credit Card

- Club Vistara SBI Card PRIME

- Axis Bank Vistara Infinite Credit Card

- Club Vistara SBI Card

- Club Vistara IDFC First Credit Card

- Axis Bank Atlas Bank Credit Card

- American Express Platinum Travel Credit Card

- Yes Bank Marquee Credit Card

- HDFC Bank Diners Club Black Metal Edition Credit Card

- Axis Bank Magnus Credit Card

- Club Vistara IndusInd Bank Explorer Credit Card

List of Credit Cards to Earn CV Points in India

Vistara Airlines is among the major airlines in India, and keeping this in consideration, many top card issuers in the country offer co-branded cards with Vistara Airlines. Some non-co-branded cards also offer reward points that can be converted into CV Points. There are various credit cards through which you can earn Club Vistara Points and get lots of other additional travel-related privileges. All these cards, along with their detailed features, are given below in the article:

(4.5/5)

Joining Fee

Rs. 3,000 + GST

Renewal Fee

Rs. 3,000 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

1 complimentary Premium Economy Class air ticket and complimentary Club Vistara Silver Membership

Card Details +

Vistara Signature Credit Card is a mid-range travel credit card by Axis Bank in collaboration with Air Vistara. The card offers many premium benefits like complimentary rounds of golf, complimentary domestic airport lounge access, and air accident protection worth up to ₹2.5 crore, etc. Being a Vistara co-branded card, you also get a few Air Vistara exclusive benefits-

- Complimentary Club Vistara Silver Membership.

- 1 complimentary Premium Economy Class air ticket.

- Additional Club Vistara Points or complimentary Premium Economy Class tickets on achieving the stipulated spends-based milestones-

| Amount Spent in a year | Reward |

| ₹75,000 | 3000 Bonus CV Points |

| ₹1,50,000 | 1 Premium Economy Ticket |

| ₹3,00,000 | 1 additional Premium Economy Ticket |

| ₹4,50,000 | 1 additional Premium Economy Ticket |

| ₹9,00,000 | 1 additional Premium Economy Ticket |

4 Club Vistara (CV) Points per ₹200 spent with the card (reward rate of 2%).

| Reward Rate | 2% (in terms of CV Points earned) |

(4.3/5)

Joining Fee

Rs. 1,500 + GST

Renewal Fee

Rs. 1,500 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

1 complimentary economy class ticket voucher

Card Details +

The Axis Bank Vistara Credit Card is a co-branded card offered by Axis Bank in partnership with Vistara Airlines. The card offers Club Vistara points on every transaction. Moreover, many other benefits come with the card, such as complimentary access to domestic lounges and a 20% discount on dining bills. The following are the benefits of the card:

- 2 CV Points for every ₹200 spent.

- 2 complimentary domestic lounge access per quarter.

- 3 complimentary economy class ticket vouchers on achieving the milestone spend.

- Air accident, lost/delayed baggage, and lost travel documents insurance covers.

| Reward Points Earning Rate | 2 CV Points per ₹200 |

| Miles conversion | N/A |

| Effective Reward Rate (for conversion of Reward Points into Club Vistara Points) | 1% (in terms of CV Points earned) |

(4.4/5)

Joining Fee

Rs. 2,999 + GST

Renewal Fee

Rs. 2,999 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

1 complimentary Premium Economy class ticket as a gift voucher on payment of the joining/renewal fee.

Card Details +

Club Vistara SBI Card Prime is a mid-range travel credit card by SBI Cards launched in collaboration with Air Vistara and comes with a membership fee of ₹2,999. Being a travel card, it comes with many travel benefits, including complimentary domestic and international airport lounge access, travel-related insurance covers, complimentary hotel vouchers, etc. As it is a Vistara co-branded credit card, it offers the following Air Vistara exclusive benefits-

- 1 Premium Economy Class air ticket from Air Vistara as a welcome gift.

- Bonus Club Vistara Points and complimentary Premium Economy Class tickets as milestone benefits-

| Spends Milestones | Reward |

| ₹75,000 in 90 days | 3,000 Bonus CV Points |

| ₹1.5 lakh per annum | 1 Premium Economy Ticket |

| ₹3 lakh per annum | 1 additional Premium Economy Ticket |

| ₹4.5 lakh per annum | 1 additional Premium Economy Ticket |

| ₹8 lakh per annum | 1 additional Premium Economy Ticket |

4 Club Vistara Points per ₹200 spent using the card (reward rate of 2%).

| Reward Rate | 2% (in terms of CV Points earned) |

(4.7/5)

Joining Fee

Rs. 10,000 + GST

Renewal Fee

Rs. 10,000 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

1 Complimentary Business Class ticket voucher

Card Details +

Axis Bank Vistara Infinite Credit Card is the most premium Vistara co-branded credit card in India. It is a premium travel credit card and comes with a membership fee of ₹10,000 (plus applicable taxes) per annum. You get a plethora of premium benefits and privileges with the Vistara Infinite Credit Card, including a 24×7 concierge service (for assistance regarding travel, dining, and shopping, (limited) complimentary domestic airport lounge access, multiple travel insurance benefits including personal air accident cover worth₹2.5 crore, etc. As far as Air Vistara benefits are concerned, you get the following Air Vistara benefits with the Axis Bank Vistara Infinite Credit Card-

- Complimentary Air Vistara business class ticket as a welcome benefit every time the card membership is renewed.

- Complimentary Club Vistara Gold membership.

- Additional Club Vistara Points or complimentary business class tickets on achieving the stipulated milestones-

| Amount spent | Reward |

| ₹1,00,000 (if spent in the first 90 days from the issuance of card) | 10,000 bonus CV Points |

| ₹2,50,000 (annually) | 1 Business Class ticket |

| ₹5,00,000 (annually) | 1 additional Business Class ticket |

| ₹7,50,000 (annually) | 1 additional Business Class ticket |

| ₹12,00,000 (annually) | 1 additional Business Class ticket |

6 Club Vistara Points for every ₹200 spent with the card (reward rate of 3%).

| Reward Rate | 3% (in terms of CV Points earned) |

(4.2/5)

Joining Fee

Rs. 1,499 + GST

Renewal Fee

Rs. 1,499 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

1 economy class air ticket e-voucher as a complimentary gift and Club Vistara Base membership

Card Details +

Club Vistara SBI Card is another Vistara co-branded credit card by SBI Cards launched in collaboration with Air Vistara. It is an entry-level travel card and comes with a membership fee of ₹1,499. You get complimentary domestic airport lounge access, Priority Pass Membership, and travel insurance coverage, including personal air accident cover worth ₹50 lacs and flight cancellation cover worth ₹3,500 (limited to 4 cancellations per year) and many other travel benefits with Club Vistara SBI Credit Card.

Being a Vistara co-branded card, you get the following Air Vistara-specific benefits with the card-

- 1 complimentary economy class ticket and Club Vistara Base membership as a welcome benefit.

- Bonus Club Vistara Points and complimentary economy class tickets on achieving the stipulated spending milestones-

| Spends Milestones | Reward |

| ₹50,000 in 90 days | 1,000 Bonus CV Points |

| ₹1.5 lakh per annum | 1 Economy Ticket |

| ₹2.5 lakh per annum | 1 additional Economy Ticket |

| ₹4.5 lakh per annum | 1 additional Economy Ticket |

3 Club Vistara Points for every ₹200 spent with the card.

| Reward Rate | 1.5% (in terms of CV Points earned) |

(4.6/5)

Joining Fee

Rs. 4,999 + GST

Renewal Fee

Rs. 4,999 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Complimentary class upgrade voucher and 1 premium economy flight ticket voucher for Air Vistara

Card Details +

The Club Vistara IDFC First credit card is a mid-range travel co-branded card that comes at a joining fee of ₹4999 plus taxes. The card is packed with many benefits for frequent Vistara flyers, along with other lifestyle, dining, milestone, and travel benefits. You can enjoy complimentary lounge access with the card, complimentary golf rounds, low forex markup fees, exclusive insurance benefits, and more. You even reward points in the form of Club Vistara points with this card. The following are the exclusive Air Vistara benefits offered by the card –

- Complimentary Air Vistara Premium Economy flight ticket voucher and 1 Class Upgrade voucher as a welcome benefit

- Complimentary Club Vistara Silver Tier membership

- Complimentary Premium Economy flight tickets on reaching the target spend milestones –

| Annual Spends | Reward |

| ₹1.5 Lakhs | 1st Premium Economy Vistara flight ticket voucher |

| ₹3 Lakhs | 2nd Premium Economy Vistara flight ticket voucher |

| ₹4.5 Lakhs | 3rd Premium Economy Vistara flight ticket voucher |

| ₹9 Lakhs | 4th Premium Economy Vistara flight ticket voucher |

| ₹12 Lakhs | 5th Premium Economy Vistara flight ticket voucher |

Up to 6 CV Points per ₹200 spent with the card (reward rate of 3%)

| Reward Rate | 3% (in terms of CV Points earned) |

(4.5/5)

Joining Fee

Rs. 5,000 + GST

Renewal Fee

Rs. 5,000 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

2,500 Edge Miles on Completing 1 Transaction Within 37 Days of Card Issuance

Card Details +

This is a sub-premium travel credit card offered by Axis Bank. The card offers a good reward rate and many other benefits in travel, dining, fuel, and much more. The following are the features of the card:

- 5,000 Edge Miles worth ₹5,000 as a welcome benefit.

- 5 Edge Miles per ₹100 on all travel spends.

- 2 Edge Miles per ₹100 on all other transactions

- Complimentary domestic/international airport lounge access.

- Complimentary airport concierge service.

The Edge Miles can be converted to Club Vistara Points, where 1 Edge Mile = 2 Club Vistara Points, at a 2:1 ratio, and the effective reward rate becomes 10% on travel and 4% on other spends.

| Reward Points Earning Rate | 5 Edge Miles per ₹100 on travel spends 2 Edge Miles per ₹100 on other spends |

| Miles conversion | 1 Edge Mile = 2 CV Points (1:2 conversion ratio) |

| Effective Reward Rate (for conversion of Reward Points into Club Vistara Points) | 10% on travel, 4% on other spends |

(4.6/5)

Joining Fee

Rs. 3,500 + GST

Renewal Fee

Rs. 5,000 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

10,000 Membership Rewards Points

Card Details +

American Express Platinum Travel Credit Card is a premium travel card by American Express. The card comes with a membership fee of ₹3,500 per annum and is a travel credit card that offers many travel benefits to the customers, including complimentary (limited) domestic and international airport lounge access, gift vouchers from premium hotel chains like Taj, SleQtions, and Vivanta on achieving the stipulated spends based milestones, etc.

American Express Platinum Travel Credit Card earns you 1 Membership Rewards Point per ₹50 spent with the card and accelerated 3X Membership Rewards Points on the Reward Multiplier portal. Like other AmEx cards, the Membership Rewards Points earned on the Platinum Travel Credit Card can be transferred to the Club Vistara loyalty program as Air Vistara is one of American Express’s partner airlines. 3 Membership Rewards Points = 1 Club Vistara Point (conversion ratio of 3:1). The reward rate of American Express Platinum Credit Card on redemption against Club Vistara Points is 0.67%.

| Reward Points Earning Rate | 1 Membership Rewards Points per ₹50 |

| Miles Conversion | 3 Membership Rewards Points = 1 CV Point |

| Effective Reward Rate (for redemption against Miles) | 0.67% (on redemption of Membership Rewards Points against CV Points) |

(4.6/5)

Joining Fee

Rs. 9,999 + GST

Renewal Fee

Rs. 4,999 + GST

Best Suited For

Movies | Travel | Shopping

Reward Type

Reward Points

Welcome Benefits

60,000 Reward Points

Card Details +

One of the most premium offerings by Yes Bank, the Marquee Credit Card offers a great reward structure. You can earn 36 Yes Rewardz Points/₹200 with this card for online spends. You can convert your reward points earned with the Marquee Credit Card for Club Vistara Points. For every 10 Yes Bank Rewardz Points, you would get 1 Club Vistara Point.

(4.7/5)

Joining Fee

Rs. 10,000 + GST

Renewal Fee

Rs. 10,000 + GST

Best Suited For

Travel | Dining | Shopping

Reward Type

Reward Points

Welcome Benefits

Complimentary Membership of Club Marriott, Swiggy One and Amazon Prime (On Spends of Rs. 1.5 Lakh Within 90 Days of Card Issuance)

Card Details +

The Diners Club Black Metal Edition is a super-premium credit card offered by HDFC Bank that comes with an annual fee of ₹10,000 plus taxes. It offers 5 Reward Points on every spend of ₹150, 10 Reward Points on select brands through SmartBuy, and 2X Reward Points on weekend dining. The card is also great for frequent travelers as it offers both domestic and international airport lounge access, airport concierge service, air accident cover, and other travel-related insurance benefits. The Reward Points earned through the credit card can be converted to Club Vistara points at a remarkable 1:1 ratio (1 RP = 1 CV Point) that makes the effective reward rate 3.3%.

| Reward Points Earning Rate | 5 Reward Points per ₹150 spent |

| Miles Conversion | 1 RP = 1 CV Points (1:1 conversion ratio) |

| Effective Reward Rate (for conversion of Reward Points into Club Vistara Points) | 3.33% (on redemption against Club Vistara Points) |

(4.6/5)

Joining Fee

Rs. 12,500 + GST

Renewal Fee

Rs. 12,500 + GST

Best Suited For

Travel | Dining | Shopping

Reward Type

Reward Points

Welcome Benefits

Choose a gift voucher worth Rs. 12,500 from any one of Luxe, Yatra, or Postcard Hotels

Card Details +

The Axis Bank Magnus Credit Card is a super-premium credit card offered by Axis Bank. The Magnus Card is a reward points-based car that offers great travel benefits, including complimentary airport lounge access and travel-related insurance covers. It also provides many other benefits, including 24×7 dedicated concierge services, discounted stays at Oberoi Hotels, and much more.

The Magnus card earns you up to 12 Axis EDGE REWARD Points for every ₹200 spent and 5x reward points on travel spends. The EDGE Points earned can be converted into Club Vistara Points, where 5 EDGE REWARD Points = 2 Club Vistara (Ratio 5:2), and therefore, the effective reward rate of the Magnus credit card becomes 2.4%. Clients who have a Burgundy account relationship with the bank can continue to transfer their reward points at a ratio of 5:4, where 5 Edge reward points = 4 Club Vistara points at a reward rate of 4.8%.

| Reward Points Earning Rate | 12 Axis EDGE REWARDS Points per ₹200 spent on retail upto ₹1.5 Lakhs. 35 RPs per ₹200 spent on spends above ₹1.5 Lakhs and 5X EDGE REWARDS on travel spends. |

| Points Conversion | 5 EDGE REWARD Points = 2 Club Vistara Point |

| Effective Reward Rate (for redemption against Miles) | 2.4% on retail spends, 7% on spends above ₹1.5 Lakhs and 12% on Travel Edge spends |

(4.5/5)

Joining Fee

Rs. 40,000 + GST

Renewal Fee

Rs. 10,000 + GST

Best Suited For

Movies | Travel

Reward Type

Reward Points

Welcome Benefits

Complimentary Club Vistara Gold Membership, complimentary business class ticket, and exclusive gift vouchers worth Rs 25,000.

Card Details +

The Indusind Bank Explorer Credit Card is a premium co-branded credit card offered by the IndusInd Bank in partnership with Club Vistara. The card offers a great reward rate where you can earn tons of Club Vistara points and also many other benefits like complimentary visits to airport lounges, movie benefits with BookMyShow, and many others. Following are the benefits of the Explorer card:

Complimentary Club Vistara Gold Tier membership.

- 8 CV points on every ₹200 spent at airvistara.com

- 6 CV points on other travel-related spends.

- Zero Foreign Markup fee.

- Complimentary domestic & international lounge access.

| Reward Points Earning Rate | 8 CV Points on spending ₹200 on the Club Vistara website. 6 CV Points on spending ₹200 on travel 2 CV Points on spending ₹200 elsewhere |

| Miles conversion | N/A |

| Effective Reward Rate (for conversion of Reward Points into Club Vistara Points) | 4% (in terms of CV Points earned) |

Club Vistara Points Earning Rate

For a quick reference, here is a comparison between the reward rates of the various credit cards that allow conversion of Reward Points into Club Vistara Points. The reward rates can be different with different cards, and the conversion value may also vary. You will get to know all about it in the following table:

| Credit Cards | Reward Points Earning Rate | Miles Conversion | Effective Reward Rate (for conversion of Reward Points into Club Vistara Points) |

| Axis Bank Vistara Signature Credit Card | 4 CV Points per ₹200 | N/A | 2% (in terms of CV Points earned) |

| Axis Bank Vistara Credit Card | 2 CV Points per ₹200 | N/A | 1% (in terms of CV Points earned) |

| Club Vistara SBI Card Prime | 4 CV Points per ₹200 | N/A | 2% (in terms of CV Points earned) |

| Axis Bank Vistara Infinite Credit Card | 6 CV Points per ₹200 | N/A | 3% (in terms of CV Points earned) |

| Club Vistara SBI Card | 3 CV Points per ₹200 | N/A | 1.5% (in terms of CV Points earned) |

| Club Vistara IndusInd Bank Explorer Credit Card | 8 CV Points on spending ₹200 on Club Vistara website. 6 CV Points on spending ₹200 on travel 2 CV Points on spending ₹200 elsewhere | N/A | 4% (in terms of CV Points earned) |

| Axis Bank Atlas Bank Credit Card | 5 Edge Miles per ₹100 on travel spends 2 Edge Miles per ₹100 on other spends | 1 Edge Mile = 2 CV Points (1:2 conversion ratio) | 10% on travel, 4% on other spends |

| Yes Bank Marquee Credit Card | 36 YES Rewardz Points on Online Shopping/₹200 and 18 YES Rewardz Points/₹200 on Offline Spends | 4 YES Rewardz Points = 1 Club Vistara Point | 3% CV Points on Online Spends |

| Axis Bank Magnus | 12 Axis EDGE REWARDS Points per ₹200 spent on retail upto ₹1.5 Lakhs. 35 RPs per ₹200 spent on spends above ₹1.5 Lakhs and 5X EDGE REWARDS on travel spends. | 5 EDGE REWARD Points = 2 Club Vistara Points (5:2 conversion ratio) | 2.4% on retail spends, 7% on spends above Rs. 1.5 Lakhs and 12% on Travel Edge spends |

| HDFC Bank Diners Club Black Credit Card | 5 Reward Points per ₹150 spent | 1 RP = 1 CV Points (1:1 conversion ratio) | 3.33% (on redemption against Club Vistara Points) |

| American Express Platinum Travel Credit Card | 2 Membership Rewards Points per ₹100 | 3 Membership Rewards Points = 1 CV Point | 0.67% (on redemption of Membership Rewards Points against CV Points) |

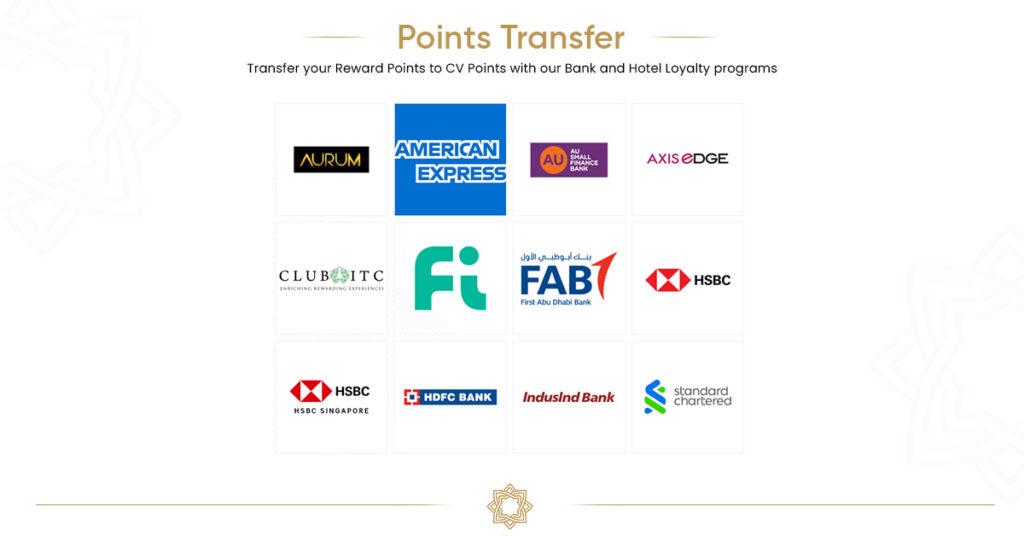

You can check the complete point transfer partners and their ratios here.

Club Vistara Tiers

Various card issuers offer co-branded travel cards in partnership with Vistara Airlines, and these cards come with some great travel privileges, especially across Vistara Airlines. These cards also offer complimentary Club Vistara membership, which comes in four tiers, and the cardholders get more & more exciting privileges with higher tiers. The benefits that you may get with the Club Vistara membership and CV Points are as follows:

- CV Base Membership: With the CV base membership, the cardholders earn CV Points on all their flight bookings. Other than this, the members can avail themselves of several short- and long-term offers that Club Vistara keeps launching.

- CV Silver Tier Membership: With the Silver tier, the members earn a slightly higher number of CV Points on their flight bookings. Moreover, they get priority airport check-in at the Premium Economy Counter and one-class Upgrade vouchers on Tier Renewal & upgrades.

- CV Gold Tier Membership: The Gold tier comes with some additional privileges. The members get an accelerated reward rate (CV Points), complimentary class upgrade vouchers, priority check-in at airports, and many more benefits. Other features of this tier include access to various offers & discounts and guaranteed reservation in economy class up to 48 Hours prior to the flight.

- CV Platinum Tier Membership: The Platinum tier is the most exclusive class out of all the four CV membership tiers. Therefore, the members get the maximum number of CV Points with this and a number of other benefits, including priority check-in to the airport, complimentary in-flight wifi, and many more.

The Club Vistara Points that you earn using the Vistara co-branded credit cards can be redeemed against Vistara flights and various other travel-related categories.

Credit Card Milestone Benefits – Complimentary Air Vistara Flight Tickets

Most of the credit cards that we discussed above also offer complimentary Air Vistara flight ticket milestone benefits upon reaching the target spend amount. Here are the credit cards that offer flight tickets to cardholders –

Axis Bank Vistara Infinite Credit Card

The credit card offers a complimentary Air Vistara Business class flight ticket as a welcome benefit and upon card renewal. It also offers complimentary flight tickets as a milestone benefit –

| Milestone Amount | Reward |

| ₹1 Lakh (within 90 days of card issuance) | Bonus 10,000 CV Points |

| ₹2.5 Lakhs | 1 Business Class flight ticket |

| ₹5 Lakhs | 1 Business Class flight ticket |

| ₹7.5 Lakhs | 1 Business Class flight ticket |

| ₹12 Lakhs | 1 Business Class flight ticket |

Axis Bank Vistara Signature Credit Card

The credit card offers a complimentary Vistara Premium Economy class flight ticket as a welcome benefit and upon card renewal. It also offers complimentary flight tickets as a milestone benefit –

| Milestone Amount | Reward |

| ₹75,000 | Bonus 3000 CV Points |

| ₹1.5 Lakhs | 1 Premium Economy class flight ticket |

| ₹3 Lakhs | 1 Premium Economy class flight ticket |

| ₹4.5 Lakhs | 1 Premium Economy class flight ticket |

| ₹9 Lakhs | 1 Premium Economy class flight ticket |

Axis Bank Vistara Credit Card

The credit card offers a complimentary Vistara Economy class flight ticket as a welcome benefit and upon card renewal. It also offers complimentary flight tickets as a milestone benefit –

| Milestone Amount | Reward |

| ₹50,000 (Within 90 days of card issuance) | Bonus 1000 CV Points |

| ₹1.25 Lakhs | 1 Economy class flight ticket |

| ₹2.5 Lakhs | 1 Economy class flight ticket |

| ₹6 Lakhs | 1 Economy class flight ticket |

Club Vistara SBI Card Prime

The credit card offers a complimentary Air Vistara Premium Economy class flight ticket as a welcome benefit and upon card renewal. It also offers complimentary flight tickets as a milestone benefit –

| Milestone Amount | Reward |

| ₹75,000 (Within 90 days of card issuance) | Bonus 3000 CV Points |

| ₹1.5 Lakhs | 1 Premium Economy class flight ticket |

| ₹3 Lakhs | 1 Premium Economy class flight ticket |

| ₹4.5 Lakhs | 1 Premium Economy class flight ticket |

| ₹8 Lakhs | 1 Premium Economy class flight ticket |

Club Vistara SBI Card

The credit card offers a complimentary Vistara Economy class flight ticket as a welcome benefit and upon card renewal. It also offers complimentary flight tickets as a milestone benefit –

| Milestone Amount | Reward |

| ₹50,000 (Within 90 days of card issuance) | Bonus 1000 CV Points |

| ₹1.25 Lakhs | 1 Economy class flight ticket |

| ₹2.5 Lakhs | 1 Economy class flight ticket |

| ₹5 Lakhs | 1 Economy class flight ticket |

Club Vistara IDFC First Credit Card

The Club Vistara IDFC First Credit Card provides complimentary flight tickets as a milestone benefit along with many other valuable benefits.

| Annual Spends | Reward |

| ₹1.5 Lakhs | 1st Premium Economy Vistara Ticket |

| ₹3 Lakhs | 2nd Premium Economy Vistara Ticket |

| ₹4.5 Lakhs | 3rd Premium Economy Vistara Ticket |

| ₹9 Lakhs | 4th Premium Economy Vistara Ticket |

| ₹12 Lakhs | 5th Premium Economy Vistara Ticket |

Club Vistara IndusInd Bank Explorer Credit Card

The credit card offers a complimentary Air Vistara business-class flight ticket as a welcome benefit upon card renewal. It also provides complimentary flight tickets as a milestone benefit –

| Milestone Amount | Reward |

| ₹3 Lakhs | 1 Business Class Ticket |

| ₹6 Lakhs | 1 Business Class Ticket |

| ₹9 Lakhs | 1 Business Class Ticket |

| ₹12 Lakhs | 1 Business Class Ticket |

| ₹15 Lakhs | 1 Business Class Ticket |

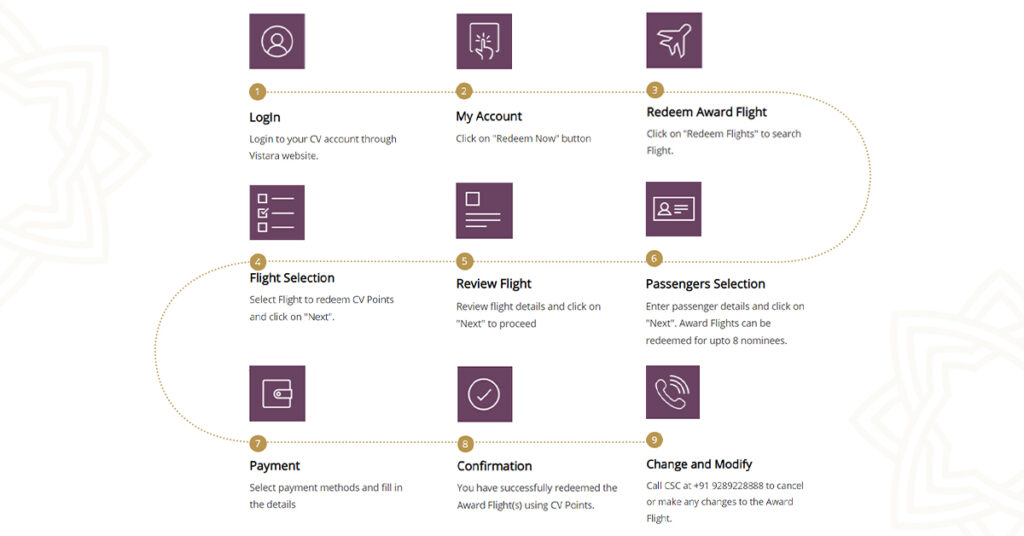

How to Redeem Club Vistara Points?

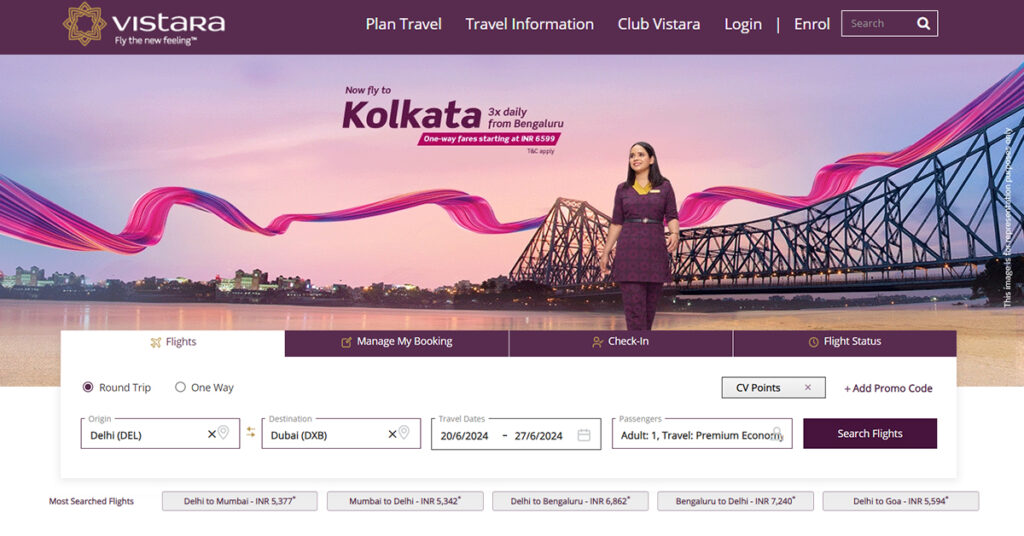

- Log in to your Club Vistara account on the Air Vistara website.

- Go to the Flight Bookings page and choose your payment method as CV Points

- Next, enter your departure and arrival city, departure date, return date, and passengers.

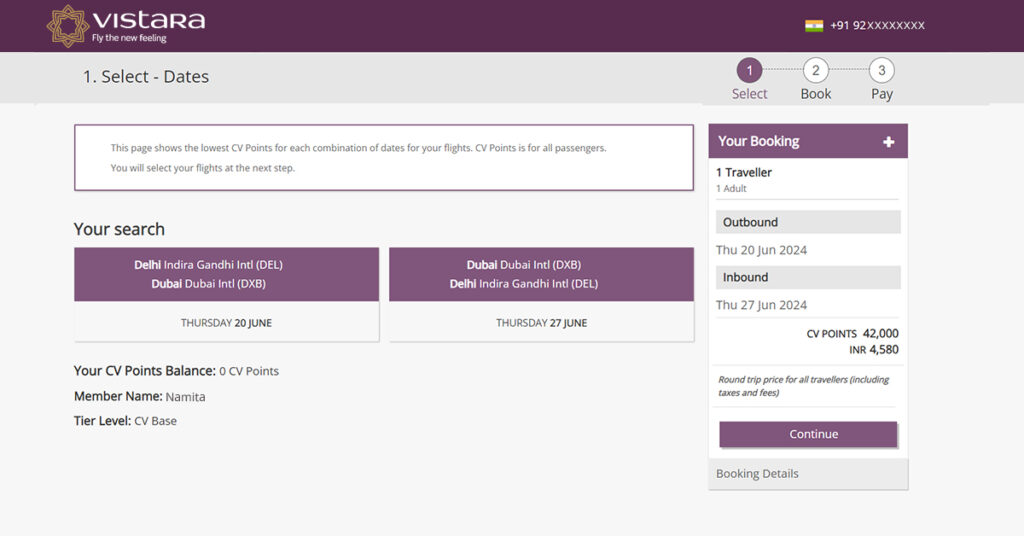

- You can go to the My Nominees page to add your family members or friends. You can add up to 8 nominees to your Club Vistara account, and once you add a nominee, you cannot remove them until one year.

- Next, you will see the available flights on your chosen and nearby dates.

- Once you click on your desired departure date, you will see the available flights and the CV Points needed to book different flight classes.

- After choosing the flight in which you want to travel, click on Continue and make the payment using your CV Points. You will receive the flight ticket booking confirmation.

How to Check Air Vistara Flight Availability?

We discussed how to book Air Vistara flights above by redeeming your CV points. When it comes to checking availability on Air Vistara flights, it is possible on their website only if you have the required CV Points to do so. If you do not have the required points, then you would have to look elsewhere to check Air Vistara flight availability.

You can search for Air Vistara availability on other partner websites like Air Canada, Japan Airlines, Singapore Airlines, United Airlines, and Lufthansa to travel across the world. Here is how you can do it –

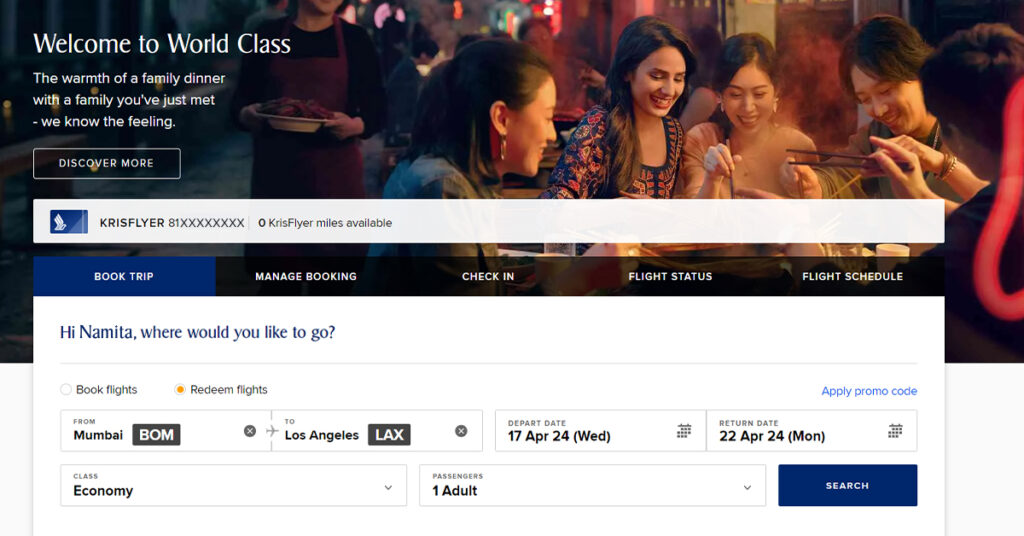

Singapore Airlines

- Visit the official website of Singapore Airlines and sign into your account to view flights. Then click on Book Trip > Redeem flights to begin your search.

- Enter your arrival and departure location, date of travel, passengers, etc., and click on Search.

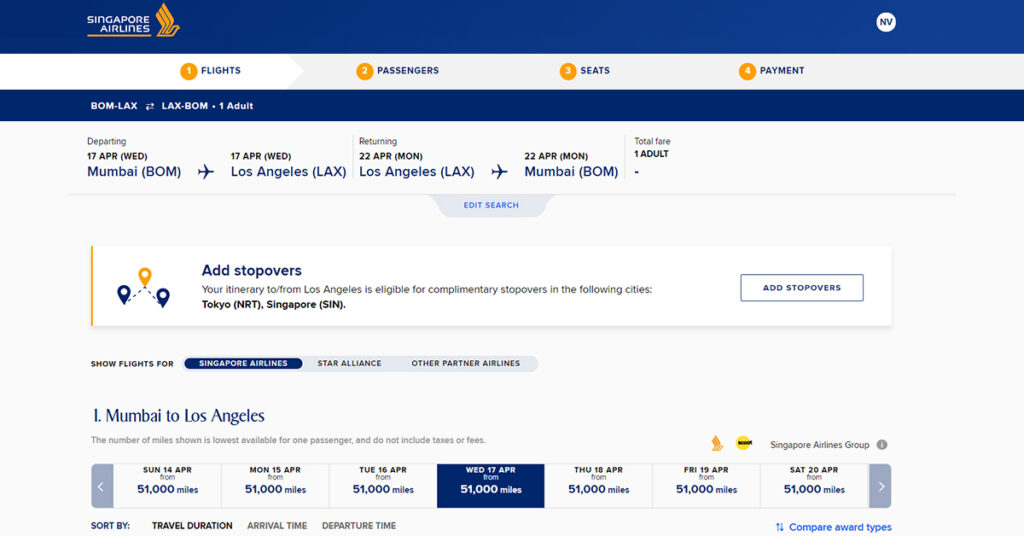

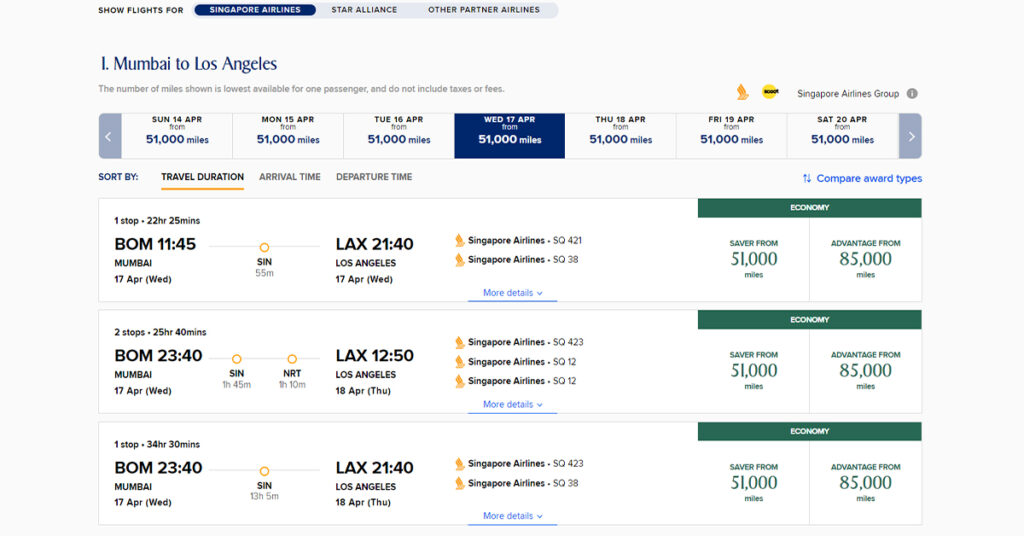

- Next, in the search results, you will first see flights for Singapore Airlines. Click on Show Flights For Other Partner Airlines to check out Vistara flights.

- You will see all available flights on your date of travel, along with the miles required to book each flight. You can also see flights for that particular week.

- Click on any flight to see more details about it and proceed with booking.

Best Ways to Use Club Vistara Points

The Reward Points or Miles earned on any of the aforementioned credit cards can be transferred as Club Vistara (CV) Points to the Club Vistara frequent flyer program. Their CV Points can be used to book flight tickets, for class upgrades, or for choosing the season of your choice. In order to get the best value of the Club Vistara Points accumulated in your account, you must keep in mind the following pointers-

- In case you are getting a higher than usual price of a flight ticket, it is a better idea to complete the booking using the CV Points in your account. This is because, although the value of the ticket is much higher when paid in cash, if you make the payment with CV Points, the number of CV Points used will be the same.

- You get a better value of the Club Vistara (CV) Points on shorter routes than that on longer routes.

- Sometimes, there is an offer on Air Vistara under which you can get a higher value of the Reward Points earned on your credit card by transferring them to your Club Vistara (CV) account. Currently, you are getting up to 40% bonus CV Points on transferring your credit card Reward Points to your Club Vistara account.

Also Read – Club Vistara Points Fest

Club Vistara Points Expiry and How to Extend

The Club Vistara points you earn are valid for a period of 36 months, and you can further extend them by paying a fee. You can only extend the CV points that will expire within three months. Log in to your account and click on Extend CV Points in the My Account section.

You can choose the CV points that are about to expire in 3 months. Next, you must choose the extension period and then on Get Fee. You will see the fees required to extend the CV points, including taxes. Just make the payment, and the CV points will be extended. However, remember that you can extend CV points just once, and they won’t be available for extension again.

Miles Redemption for Others

Yes, you can redeem your earned Club Vistara points for flights for your friends and family members. You can redeem an award flight for yourself and up to 8 other individuals that you will need to add as Nominees on your Club Vistara membership account. You need to log into your Club Vistara account and then head over to the My Nominees page. You can add up to 8 friends and family members as Nominees in your Club Vistara account. Also, you cannot remove a nominee for one year once you add them.

Cancellation Charges of Award Tickets

The following are the fees and charges related to award flights –

| Category | Economy | Premium Economy | Business |

| Change Fee | 10% | 10% | 10% |

| Cancellation Fee 3 Days Before Departure | 15% | 15% | 15% |

| No Show Fee | Taxes Refundable (Refund fee is charged) | Taxes Refundable (Refund fee is charged) | Taxes Refundable (Refund fee is charged) |

| Cancellation Fee up to 2 Hours and less than 3 Days before Departure | 25% | 25% | 25% |

Bottom Line

Air Vistara is one of the best airlines in India and runs many exciting offers and promotions throughout the year. Its Club Vistara frequent flyer program is highly rewarding, and you can earn free flights, fare class upgrades, and other privileges with your CV points.

You earn CV points when you fly with Vistara and its partner airlines. Also, you can earn CV points through Vistara’s co-branded credit cards with Axis Bank, SBI, etc., and convert your credit reward points to CV points. When it comes to booking Air Vistara flights, you can do so using CV points as well as partner airlines’ miles. We discussed both these ways in the above article, and it is a great choice to save money on your flights.

All these credit cards are some of the best cards for frequent domestic flyers. These cards shall also fit your needs if you’re a frequent traveler to Singapore or Dubai, as Air Vistara is one of the only two full-service careers currently operational in the country (the other one being Air India) and the only airline in the country with a premium economy class, allowing you to enjoy premium service at pocket-friendly rates. Most of these credit cards also offer many other travel benefits like complimentary lounge access, hotel vouchers, etc.

FAQs:

Axis Bank, IndusInd Bank, and SBI Cards are the only card issuers in India that offer Air Vistara co-branded credit cards.

HDFC Bank, American Express, and Yes Bank have Air Vistara as one of the partner airlines, and the reward points earned on their credit cards can be redeemed for Club Vistara Points. Apart from these card issuers, SBI Cards, IndusInd Bank, and Axis Bank offer co-branded cards in partnership with Air Vistara.

Axis Bank offers 3 co-branded credit cards in partnership with Air Vistara- Axis Bank Vistara Infinite Credit Card, Axis Bank Vistara Signature Credit Card, and Axis Bank Vistara Credit Card.

SBI Cards offers 2 co-branded credit cards in partnership with Air Vistara- Club Vistara SBI Card Prime and Club Vistara SBI Card.

The conversion rate of HDFC Reward Points into Club Vistara Points is different for different HDFC Bank credit cards. For Infinia, Diners Club Black, and Diners Club Miles credit cards, 1 Reward Point = 1 Club Vistara Point (1:1 conversion ratio), while for Regalia and Diners Club Premium credit cards, 2 Reward Points = 1 Club Vistara Mile (conversion rate of 2:1).