By Rajat Gaur

Updated On

Using your regular credit card while you’re on an international trip might not be the wisest of decisions, as international transactions, which are usually in a foreign currency, attract an additional forex markup fee, which, for most credit cards, is around 3.5% of the transaction amount. For this reason, banks offer forex cards, which are tailored to the needs of customers who make frequent international transactions. With the best forex card, a person can get the most out of their foreign transactions.

Forex credit cards are basically prepaid cards. Unlike credit cards, you need to load a balance on these cards before you can make any purchases. Almost all the best forex cards in India support multiple currencies—you can load the card using any of the supported currencies. Spending in the currency loaded on the card does not attract any foreign currency mark-up fee. Therefore, it’s a good idea to carry a Forex card on an international trip loaded with the home currency of the country you are visiting.

Table of Contents

- Niyo Global Card by Equitas Bank

- BookMyForex YES Bank Forex Card

- Axis Bank Multi-Currency Forex Card

- HDFC Bank Regalia ForexPlus Card

- HDFC Bank Multicurrency Platinum ForexPlus Chip Card

- Axis Bank Club Vistara Forex Card

- ICICI Bank Student Forex Prepaid Card

- Axis Bank World Traveller Forex Card

- State Bank Multi-Currency Foreign Travel Card

- IndusInd Bank Multi-Currency Travel Card

- ICICI Bank Sapphiro Forex Prepaid Card

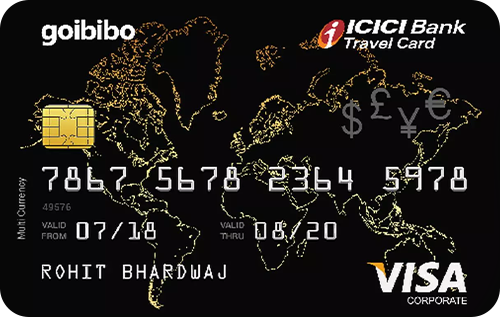

- Goibibo ICICI Bank Forex Prepaid Card

- ICICI Bank Coral Prepaid Forex Card

- IDFC FIRST Multi-Currency Forex Card

- Yes Bank Multicurrency Travel Card

List of Top Forex Cards in India

Here, we have shortlisted some of the best Forex cards offered by the various banks in the country. Many of these cards, just like credit cards, also offer add-on benefits like complimentary lounge access, insurance plans, discount vouchers, etc. You can go through their detailed features and advantages in this article and then choose one that seems to suit you the best:

(4.5/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

NA

Card Details +

Niyo Solutions launched the Niyo Global card in partnership with Equitas Small Finance Bank. It is a premium, high-interest digital savings account that offers up to 7% interest on savings and zero forex markup charges on international transactions worldwide.

The Niyo Global card provides convenient and affordable ways to handle international payments in more than 130 currencies. It offers domestic and international lounge access at all Indian airports, and its user-friendly app has features like Global ATM Locator, real-time currency conversion, and more.

- Cash Withdrawal Charges – 3 free withdrawals per month, and Rs. 21 plus taxes from the 4th withdrawal onwards for Domestic ATMs.

- Rs. 110 plus taxes for International ATMs.

- Currencies Supported – More than 130 currencies supported

- Cross-Currency Usage Fee – Nil

- Additional Benefits – High 7% interest rate on your savings, complimentary lounge access, and user-friendly mobile application.

- No TCS Up to Rs. 7 Lakhs -TCS is exempted from international spends up to Rs. 7 Lakhs per year. However, 20% TCS is applicable beyond the Rs. 7 Lakhs threshold.

(4.5/5)

Joining Fee

Nil

Renewal Fee

A reissuance fee of Rs. 250 (if the cardholder is in India) and INR 3000 (if the cardholder is outside the country).

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Get Rs. 200 discount on your first transaction with BookMyForex. Use Promo code-NEWTOBMF.

Card Details +

The BookMyForex YES Bank Prepaid Card is a recently launched co-branded foreign travel card. The card aims to provide its customers with hassle-free international travel experiences. It also supports multiple currencies, making it even more convenient to travel to different countries without any worries about finding a currency conversion center there. Along with all these features, the card also offers several great deals and discounts across different categories.

(4.5/5)

Fees

Joining Fee

Rs. 300 (plus applicable taxes)

Renewal Fee

N/A

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

N/A

Card Details +

The multi-currency Forex Card by Axis Bank is a prepaid international travel card. The card supports 16 widely used currencies, including the United States Dollar, Euro, Pound Sterling, Australian Dollar, Canadian Dollar, Swiss Franc, and Japanese Yen. As with all foreign exchange credit cards, transactions in the currency loaded on the card do not attract any markup fee; however, transactions in a currency other than the one loaded on the card attract a cross-currency markup fee of 3.5% of the transaction amount.

The Axis Bank Multi-Currency Forex Card comes with an initial issuance fee of Rs. 300 (plus GST), which is waived for Burgundy and Priority account holders. Although the card does not have any reward structure, you do get many value-added benefits like discounts on international roaming packs by VI, a lower currency conversion rate for Southeast Asian currencies, and 247×7 travel assistance by TripAssist. You may want to refer to this article for more information on Axis Bank Multi-Currency Forex Card.

(4.5/5)

Fees

Joining Fee

Rs. 1,000 (plus applicable taxes)

Renewal Fee

N/A

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

N/A

Card Details +

The Regalia ForexPlus Card is a sub-premium prepaid foreign exchange credit card by HDFC Bank. Although the card comes with zero annual fee, an initial fee of Rs. 1,000 is payable at the time of card issuance.

Regalia ForexPlus Card can be loaded in US Dollars. The best part about the Regalia ForexPlus Card is that not only do you not get charged any mark-up fee on transactions in USD, but there is no cross-currency usage fee applicable on transactions done in any other currency. You may refer to this article for more information on the HDFC Regalia ForexPlus Card.

(4.5/5)

Fees

Joining Fee

Rs. 500 (plus applicable taxes)

Renewal Fee

N/A

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Issuance fee waiver on the first loading of a minimum of USD 1,000 (or its currency equivalent)

Card Details +

Just like the MakeMyTrip HDFC ForexPlus Card, the Multicurrency Platinum card can also be loaded in 22 different foreign currencies- Australian Dollar, Dirhams, Canadian Dollar, Euro, Hongkong Dollar, Japanese Yen, Singapore Dollar, Sterling Pound, Swiss Franc, Swedish Krona, Thailand Baht, South African Rand, Oman Riyal, New Zealand Dollar, Danish Krone, Norwegian Krone, Saudi Riyal, Korean Won, Bahrain Dinar, Qatari Riyal, Kuwait Dinar and US Dollar. No markup fee is charged on transactions made in the currency loaded on the card; a cross-currency usage fee of 2% of the transaction amount is applicable on transactions made in a currency other than the one loaded on the card.

Multicurrency Platinum ForexPlus Chip Card comes with an initial issuance fee (joining fee) of Rs. 500 (plus GST), which is waived off on the first-time loading of a minimum of USD 1,000. Although the card does not earn you any reward points/cashback, you do get plenty of add-on benefits like Amazon vouchers, emergency assistance, global concierge service, etc. with the card. Check out this article for more info on HDFC Multicurrency Platinum ForexPlus Chip Card.

(4.5/5)

Fees

Joining Fee

Rs. 500 (plus applicable taxes)

Renewal Fee

N/A

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

500 Club Vistara Points (CV Points) on loading the card for the first time

Card Details +

Axis Bank Club Vistara Forex Card is a co-branded prepaid forex card by Axis Bank in collaboration with Air Vistara. Axis Bank Club Vistara Forex Card can also be loaded in 16 different currencies, including United States Dollar, Euro, Pound Sterling, Australian Dollar, Canadian Dollar, Swiss Franc, Japanese Yen, Singapore Dollar, Swedish Krona/Kronor, UAE Dirham, Saudi Royal, Thai Baht, New Zealand Dollar, Hong Kong Dollar, South African Rand and Danish Krone.

Since it is an Air Vistara co-branded Forex card, you earn Club Vistara Points (CV Points) as rewards on Axis Bank Club Vistara Forex Card. You earn 3 CV Points for every USD 5 spent with the card. Apart from CV Points, you also get a complimentary Club Vistara base membership. Other add-on benefits that you get with the Club Vistara Forex Card include cashback on international roaming packs and 24×7 emergency assistance during international travel.

(4.5/5)

Fees

Joining Fee

Rs. 499 + GST

Renewal Fee

Rs. 499 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Get an International Student Identity Card (ISIC) membership voucher worth INR 999 and several other deals & discounts as a joining benefit.

Card Details +

The ICICI Bank Student Forex Credit Card is a great option for those who are planning to go to a foreign country for higher studies. It comes with an issuance fee of Rs. 499 and a renewal fee of Rs. 199 plus taxes. This Student Forex Card allows you to make international transactions without any hassle and with much lower charges compared to credit & debit cards. The cardholders get introductory privileges worth Rs. 5,000, and several other benefits, such as complimentary insurance coverage and zero liability protection, are there.

(4.5/5)

Fees

Joining Fee

Rs. 500 (plus applicable taxes)

Renewal Fee

N/A

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

1,000 Miles on loading the card for the first time.

Card Details +

Axis Bank World Traveller Forex Card is another prepaid travel card by Axis Bank in collaboration with Germany-based Lufthansa Airlines. Like the other two Axis Bank forex cards, the World Traveller Forex Card can also be loaded in 16 different foreign currencies including United States Dollar, Euro, Pound Sterling, Australian Dollar, Canadian Dollar, Swiss Franc, Japanese Yen, Singapore Dollar, Swedish Krona/Kronor, UAE Dirham, Saudi Royal, Thai Baht, New Zealand Dollar, Hong Kong Dollar, South African Rand and Danish Krone.

Like most other forex cards, no forex markup fee applies to transactions made in the currency loaded on the card. However, a cross-currency usage fee of 3.5% of the transaction amount applies to transactions made in a currency other than the one loaded on the card.

(4.5/5)

Fees

Joining Fee

Rs. 100 (plus applicable taxes)

Renewal Fee

N/A

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

N/A

Card Details +

State Bank Multi-Currency Foreign Travel Card is a prepaid forex card issued by the State Bank of India. The card does not have an annual membership fee; however, an initial issuance fee of Rs. 100 (plus GST) is charged at the time of issuance. The issuance fee of the SBI Multi-Currency Foreign Travel Card is the lowest amongst all forex cards presently offered in India.

State Bank Multi-Currency Foreign Travel Card can be loaded in seven different currencies- USD, Euro, Pound, Singapore Dollar, Canadian Dollar, UAE Dirham, and Australian Dollar. No mark-up fee is charged on transactions made using the currency loaded on the card. However, a cross-currency usage fee of 3% of the transaction amount is applicable on transactions made in a currency other than the one loaded on the card. See this article for more details on the State Bank Multi-Currency Foreign Travel Card.

(4.5/5)

Fees

Joining Fee

Rs. 300 (plus applicable taxes)

Renewal Fee

N/A

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Rs. 150 discount of issuance fee on loading the card with a minimum amount equivalent to Rs. 50,000.

Card Details +

As the name suggests, IndusInd Multi-Currency Travel Card is a prepaid forex card issued by IndusInd Bank. The card does not have an annual membership fee, but an initial fee of Rs. 300 is payable at the time of issuance.

The card supports 14 international currencies- US Dollar, Australian Dollar, Canadian Dollar, Euro, Great Britain Pound, Hong Kong Dollar, Japanese Yen, New Zealand Dollar, Singapore Dollar, South African Rand, Swiss Franc, Thailand Baht, Saudi Riyal, and UAE Dirham. No forex markup fee is charged on transactions made in the currency loaded on the card; a cross-currency usage fee of 3% of the transaction amount is, however, applicable on transactions made in a currency other than the one loaded on the card. Check out this article to learn more about IndusInd Bank Multi-Currency Travel Card.

(4.5/5)

Fees

Joining Fee

Rs. 2,999 (plus applicable taxes)

Renewal Fee

Rs. 999 (plus applicable taxes)

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Central shopping voucher worth Rs. 500 and Uber vouchers worth Rs. 1,000

Card Details +

Sapphiro Forex Prepaid Card is a premium prepaid Forex card by ICICI Bank. The card comes with a hefty joining (issuance) fee of Rs. 2,999 (plus GST), and being a premium forex card, offers plenty of add-on privileges like shopping vouchers, Uber vouchers, complimentary international lounge access with Dragon Pass, discounts on international roaming packs and many other benefits. There is no annual membership fee applicable to the ICICI Sapphiro Forex Prepaid Card.

One differentiating feature of the Sapphiro Forex Prepaid Card is that, like the HDFC Regalia Forex Card, the ICICI Sapphiro Forex Prepaid Card does not charge a cross-currency usage fee. This means that you can transact in any currency without being charged an extra fee.

(4.5/5)

Fees

Joining Fee

Rs. 499 (plus applicable taxes)

Renewal Fee

N/A

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

goCash+ gift vouchers worth Rs. 500, Goibibo vouchers worth Rs. 15,000

Card Details +

Goibibo ICICI Forex Prepaid Card, as is obvious from the name, is a co-branded forex card by ICICI Bank launched in collaboration with the travel portal Goibibo. The card comes with an initial issuance fee of Rs. 499 (plus GST), while no annual fee is applicable to the card.

Since it is a Goibibo co-branded card, you get many Goibibo exclusive benefits with the card, like a goCash+ gift voucher worth Rs. 500 and Goibibo vouchers worth Rs. 15,000 with the card as a welcome gift. Apart from these Goibibo exclusive benefits, you also get cab vouchers worth Rs. 1,000 on loading a minimum of USD 1,000 on the card, discounted rates on dining at Indian restaurants across Kuala Lumpur, Dubai, London, Singapore, Hong Kong, and Bangkok, and a comprehensive insurance plan with covers against air accident, checked-in baggage, loss of passport/ticket, etc.

(4.5/5)

Fees

Joining Fee

Rs. 499 (plus applicable taxes)

Renewal Fee

Rs. 299 (plus applicable taxes)

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

BookMyShow and Uber vouchers worth Rs. 500 each

Card Details +

Coral Prepaid Forex Card is another prepaid Forex card by ICICI Bank. The card has an initial joining fee of Rs. 499 (plus GST). However, an annual fee of Rs. 299 (plus GST) applies from the second year onwards.

Although the ICICI Coral Prepaid Forex Card does not have a reward structure (like Reward Points or cashback), it offers plenty of value-added benefits, like BookMyShow and Uber vouchers, a comprehensive insurance plan, complete card protection by OneAssist, etc. You may refer to this article for more information on the Card.

(4.5/5)

Fees

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

International Spends

Reward Type

Reward Points

Welcome Benefits

N/A

Card Details +

The IDFC FIRST Multi-Currency Forex Card stands out with its enticing zero issuance charges, making it appealing right from the start. Moreover, it offers the convenience of a replacement card in case of loss, ensuring peace of mind for travelers. What’s more, there are no charges for loading or reloading foreign currencies, making it a cost-effective choice for managing finances abroad. Whether working or on vacation, this Forex card will be useful for everyone going abroad.

(4.5/5)

Fees

Joining Fee

Rs. 125 plus taxes

Renewal Fee

Rs. 125 plus taxes

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

NA

Card Details +

The Yes Bank Multi-Currency card is one of the most beneficial cards in India as it is cost-effective and highly secure to use. You can get in touch with the online customer care department to help manage your card from anywhere around the world. Compared to most other cards, this one offers higher security and lower costs. The card supports over 10 currencies, and you get instant real-time SMS alerts whenever you transact with the card. You can analyze and check the previous 10 transaction details and can even temporarily lock the Yes Bank Multi-Currency card.

What are The Types of Forex Cards?

Forex cards are generally of two types. These have been classified on the basis of the number of currencies that they support. The following are the two major types of forex cards:

- Single Currency Forex Cards: Single Currency Forex Cards, as suggested by their names, support a single currency, and these cards are suitable for individuals who often travel to a particular country for some time. These cards can only be loaded in the one currency that they support.

- Multi-Currency Forex Cards: Multi-currency Forex Cards support multiple currencies and can be used in different countries without any additional charges. Nowadays, most card issuers offer multicurrency forex cards so that cardholders can travel all across the world with a single forex card.

Forex Cards – Features and Benefits

Like the general credit cards, some of the forex cards are also issued by the major card issuers in the country. These cards come with various features and benefits across different categories. Some of the common advantages of the forex credit cards are as follows:

- Rewards Rate: Some of the forex credit cards, such as the Axis Bank World Traveller Forex Card & Axis Bank Club Vistara Forex Card, also reward their customers in all their spends. As these cards are most suitable for international travelers, they offer travel-based rewards such as air miles, CV points, etc.

- Support Multiple Currencies: Almost all forex credit cards support not just one or two but multiple currencies, and hence, one can make transactions in different currencies and different countries without any hassle.

- Lounge Access: Some premium Forex credit cards also offer complimentary airport lounge access. These cards let you use the airport lounge facility without paying a usage fee.

- Other Features: Some cards also provide cardholders with complimentary insurance covers and zero liability protection against lost/stolen cards.

How to Use a Forex Card?

Unlike Credit Cards, a Forex card doesn’t come with a credit limit, but you need to load it on your own. Forex Cards are of best use when you are traveling to a different country, as these cards allow you to make transactions in foreign currencies. Load your card as per your requirements and as per the currency of the country you are traveling to.

After that, you can use your card, just like a debit or a credit card. You can withdraw cash in a foreign currency using your Forex card, which you can also use for online/in-store transactions anywhere.

How to Apply for a Forex Card?

Getting a Forex card is as simple as getting a general debit card. The only difference is that you might have to submit a few additional documents like your Passport, Visa, and other travel documents. So, just check the eligibility and document requirements on the respective bank’s official website or by contacting their customer care.

You can visit the branch with all the necessary documents and ask the bank officials if there is an offline procedure to apply for the card. If there is one, you can apply for the card by filling out the physical application form and completing all other formalities. You can also apply online for the card of your choice as follows:

- Visit the respective bank’s official website.

- Find an option to apply for a Forex card.

- Choose the card of your choice.

- Proceed further to apply for it and fill in all the required details in the digital application form.

Bottom Line

While credit cards are an extremely useful financial tool, using them while on foreign trips can cost you a lot. Almost all credit cards charge a mark-up fee of around 3.5% of the transaction amount (it may be less in the case of some premium and super-premium credit cards) on transactions made in a foreign currency. Therefore, it is always a good idea to carry a Forex card on foreign trips and use the same for foreign currency transactions.

As you can see above, the SBI Multi-Currency Foreign Travel Card has the lowest issuance fee of just Rs. 100 amongst all forex cards, and premium forex cards like HDFC Regalia ForexPlus Card and ICICI Sapphiro Forex Card can be used to make payments in any currency without any cross-currency usage fee. Then, there are also co-branded Forex cards like Axis Bank Club Vistara Forex Card, Goibibo ICICI Forex Card, MakeMyTrip HDFC ForexPlus Card, etc. You must find the right Forex card that best suits your needs. For example, for someone who does not travel very frequently, a simple and less expensive forex card like the SBI Multi-Currency Foreign Travel Card might be a good pick; on the other hand, if you fly frequently via a particular airline, say Air Vistara, an Air Vistara co-branded forex card like Axis Bank Club Vistara Forex Card will suit you the best.

FAQs:

Forex cards or travel cards are prepaid cards tailored to the needs of frequent international travelers. One of the most common features of prepaid forex cards is that most can be loaded in multiple foreign currencies, and no mark-up fee is charged on transactions made in the currency loaded on the card.

State Bank Multi-Currency Foreign Travel Card has the lowest issuance fee of Rs. 100 (plus GST).

HDFC Regalia ForexPlus Card and ICICI Bank Sapphiro Forex Prepaid Card are two Forex cards that have zero cross-currency usage fee, i.e., you can spend in any currency with these cards without being charged any additional fee.

Forex Cards are different from credit cards, as you don't get a credit limit with them. Unlike credit cards, which allow you to pay later for your purchases, Forex cards are prepaid cards that need to be loaded by you first. Talking about their usage, you can use the forex cards online as well as for in-store transactions, just like credit cards.

Yes, the Forex cards are totally worth it for international travel as they make it convenient for you to make transactions and withdraw cash in different currencies without any additional charges.

A cross-currency fee is charged on a Forex Card when you want to make a transaction in a different currency from what you loaded onto your card.

Some of the best credit cards with low forex markup fees are HDFC Infinia, IndusInd Celesta, Axis Bank Magnus, and HDFC Regalia.

Some of the best multi-currency forex cards are State Bank Multi-Currency Foreign Travel Card, IndusInd Bank Multi-Currency Travel Card, ICICI Bank Sapphiro Forex Prepaid Card, Axis Bank Multi-Currency Forex Card, and HDFC Bank Multicurrency Platinum ForexPlus Chip Card.

No, you can not pay credit card bills using a forex card.

Yes, you can easily transfer the leftover amount from your Forex Card to your bank account.

You missed one of the most selling forex card.

It’s Thomas Cooks Forex card.

Same card is selling by many exchange houses and banks

I am planning to go to Europe for a year. Currently, I have a Diners Premium credit card from HDFC bank only. Can you suggest the best forex/debit or credit card that can help me save on exchange rates/taxes and can be widely used in Europe without any security issues? I have heard that Diners card acceptance is not good enough in Europe.