By Rajat Gaur

Updated On

Finding an ideal credit card can be a difficult task. We all are looking for the “perfect credit card” that would offer high rewards, cashback, insurance benefits, and our beloved – complimentary benefits such as access to airport lounges, railway lounges, and golf rounds/lessons. Many of us desire to have access to all of these services without any charges. However, this is a rather unrealistic expectation as card issuers cannot afford to offer such a rewarding credit card at a nominal or no fee

Instead, they offer credit cards with benefits in different categories to cater to the varying spending habits of individuals. Since everyone’s preferences differ based on their unique requirements and spending behavior, there is no single credit card that can be deemed the best for everyone. Therefore, to meet the needs of all segments of people, we have compiled a list of the best credit cards available in the Indian market. These top 15 cards are suitable for various kinds of spendings, whether you’re looking for a budget card or a premium one, a lifetime free card or one with moderate fees, or one for online shopping or fuel. Our list of best and top credit card features the cream of the crop when it comes to credit cards in India. If you’re looking to apply for a credit card or are unsure which one to choose, our list will be of great benefit to you.

Applying for a credit card without good research is never a good idea. You should understand your spending habits first and choose a card that fits you best.

Table of Contents

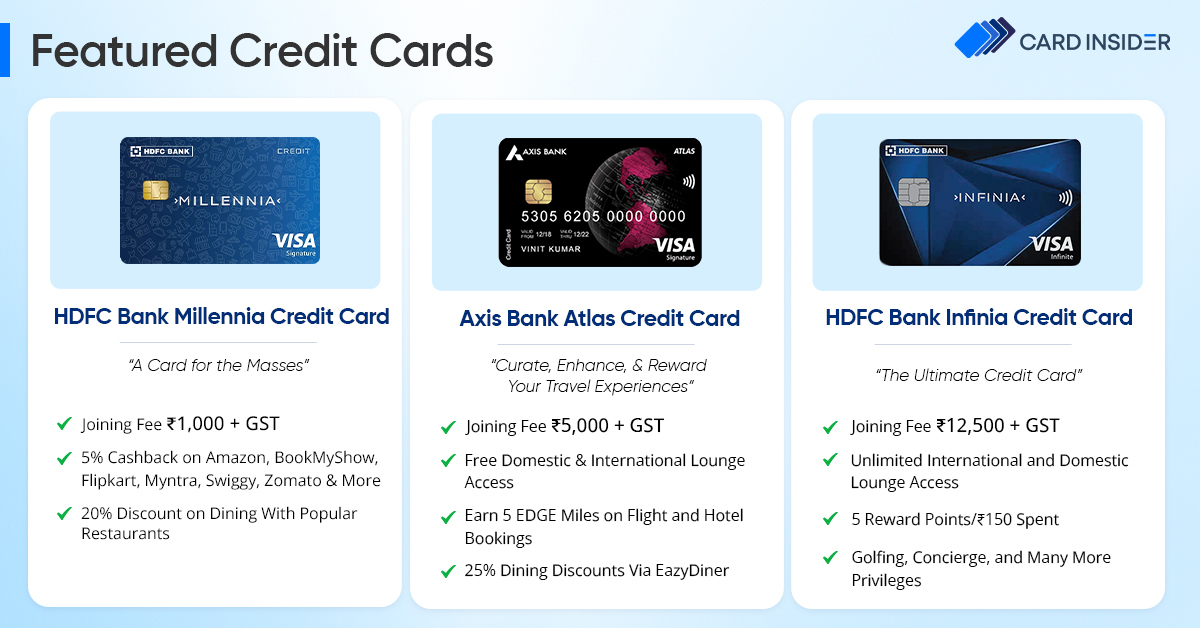

- HDFC Bank Millennia Credit Card

- AU Bank LIT Credit Card

- IDFC FIRST Millennia Credit Card

- Cashback SBI Credit Card

- HDFC Bank Regalia Gold Credit Card

- IndusInd Legend Credit Card

- American Express SmartEarn Credit Card

- Amazon Pay ICICI Bank Credit Card

- Indian Oil Axis Bank RuPay Credit Card

- BPCL SBI Card Octane

- Axis Bank Atlas Credit Card

- Yes Bank Marquee Credit Card

- HDFC Bank INFINIA Credit Card Metal Edition

- Axis Bank Magnus Credit Card

- American Express Platinum Charge Card

List of 15 Best Credit Cards In India

Before applying for a credit card, consider the benefits you expect from your new card. Are you signing up to save on daily expenses, or as a frequent flyer, do you aim to earn extra AirMiles and enhance your travel experience with complimentary airport lounge access? Having clear answers to these questions is crucial, as different categories of credit cards cater to various customer niches, as mentioned earlier.

People looking for a new and rewarding credit card can refer to this list and select the card of their choice.

(4.8/5)

Joining Fee

Rs. 1,000 + GST

Renewal Fee

Rs. 1,000 + GST

Best Suited For

Shopping

Reward Type

Cashback

Welcome Benefits

1,000 CashPoints as a Welcome Benefit.

(4.5/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Movies | Travel | Dining | Fuel | Shopping

Reward Type

Reward Points

Welcome Benefits

N/A

(4.7/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Movies | Shopping

Reward Type

Reward Points

Welcome Benefits

5% cashback on first EMI spend up to Rs. 1,000 and additional welcome gift vouchers worth Rs. 500 on spending Rs. 5,000 within 30 days of card generation

(4.7/5)

Joining Fee

Rs. 999 + GST

Renewal Fee

Rs. 999 + GST

Best Suited For

Shopping | Food

Reward Type

Cashback

Welcome Benefits

NA

(4.5/5)

Joining Fee

Rs. 2,500 + GST

Renewal Fee

Rs. 2,500 + GST

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Welcome benefit of complimentary MMT Black Elite and Club Vistara Silver Tier membership on spending over Rs. 1 Lakh inside 90 days of getting the card issued

(4.5/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Travel | Shopping

Reward Type

Reward Points

Welcome Benefits

N/A

(4.5/5)

Joining Fee

Rs. 495 + GST

Renewal Fee

Rs. 495 + GST

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Cashback of Rs. 500 and 2,000 Referral Bonus Membership Rewards Points

(5/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Shopping

Reward Type

Cashback

Welcome Benefits

Cashback and Discounts Up to Rs. 2,000 and Free 3-Month Prime Membership

(4.6/5)

Joining Fee

Rs. 500 + GST

Renewal Fee

Rs. 500 + GST

Best Suited For

Fuel | Shopping

Reward Type

Reward Points

Welcome Benefits

100% cashback (up to Rs. 250) on the first fuel transaction made within 30 days of card issuance.

(5/5)

Joining Fee

Rs. 1,499 + GST

Renewal Fee

Rs. 1,499 + GST

Best Suited For

Fuel

Reward Type

Reward Points

Welcome Benefits

6,000 bonus reward points worth Rs. 1500

(4.5/5)

Joining Fee

Rs. 5,000 + GST

Renewal Fee

Rs. 5,000 + GST

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

2,500 Edge Miles on Completing 1 Transaction Within 37 Days of Card Issuance

(4.6/5)

Joining Fee

Rs. 9,999 + GST

Renewal Fee

Rs. 4,999 + GST

Best Suited For

Movies | Travel | Shopping

Reward Type

Reward Points

Welcome Benefits

60,000 Reward Points

(5/5)

Joining Fee

Rs. 12,500 + GST

Renewal Fee

Rs. 12,500 + GST

Best Suited For

Travel | Dining | Shopping

Reward Type

Reward Points

Welcome Benefits

Welcome bonus of 12,500 Reward Points and complimentary Club Marriott membership for the first year offering 20% discounts on dining and stay in the Asia-Pacific region.

(4.6/5)

Joining Fee

Rs. 12,500 + GST

Renewal Fee

Rs. 12,500 + GST

Best Suited For

Travel | Dining | Shopping

Reward Type

Reward Points

Welcome Benefits

Choose a gift voucher worth Rs. 12,500 from any one of Luxe, Yatra, or Postcard Hotels

(4.8/5)

Joining Fee

Rs. 60,000 + GST

Renewal Fee

Rs. 60,000 + GST

Best Suited For

Travel | Shopping

Reward Type

Reward Points

Welcome Benefits

SeleQtions, Taj, and Vivanta Hotels Vouchers Worth Rs. 45,000. 10,000 Referral Bonus Membership Rewards Points

Compare India’s Best Credit Cards

Here are the most important features of best credit cards in India.

| Features | HDFC Bank Millennia Credit Card | Cashback SBI Credit Card | IDFC First Millennia Credit Card |

| Joining/Renewal Fees | ₹1,000 + GST | ₹999 + GST | Lifetime Free |

| Welcome Benefits | 1,000 CashPoints | N/A | 5% Cashback on First EMI Spend up to ₹1000 and Welcome Gift Vouchers Worth ₹500 |

| Reward Rate | 5% Cashback at Select Online Partners (Flipkart, Myntra, and Zomato) and 1% Cashback on All Other Spends | 5% Cashback for Online Transactions and 1% for Offline Transactions | 3 Reward Points on Each Offline Spend of ₹150, 6 RPs Online Spend of ₹150, and 10 Rewards on Every ₹150 on Spends Above ₹20,000 |

| Reward Type | CashPoints (1 CashPoint = ₹1) | Cashback Against Statement | Reward Points (1 RP= ₹0.25) |

| Domestic Airport//Railway Lounge Access | 1 Domestic Airport Lounge Access Every Quarter (4 Each Year) | N/A | 4 Free Railway Lounge Access |

| Renewal Fee Spend-Based Waiver | On Spends of ₹1 Lakh | N/A | N/A |

Review of the Top Credit Cards in India

CardInsider has put together detailed features and reviews of the top credit cards in India so that you make the best choice.

HDFC Bank Millennia Credit Card

The HDFC Bank Millennia Credit Card is widely considered to be one of the most rewarding credit cards in India. It is especially suitable for young people who prefer to shop online for everything, including food. By using this card, you can get a straight 5% cashback on your purchases from popular merchants and platforms like Amazon, Flipkart, Myntra, cult.fit, Zomato, Swiggy, BookMyShow, and many others.

This credit card can help you save money on different kinds of expenses such as food, shopping, fitness, and movies. However, it’s important to note that there is a limit to the amount of cashback you can earn, which is capped at Rs. 1,000 per statement cycle.

AU Bank LIT Credit Card

AU Bank is the first customizable credit card in our country. Earn 1 Reward point per Rs. 100 spent with the card, 5x or 10x accelerated reward points on offline as well as online transactions, and 5% cash back on grocery, travel, and dining spends. The AU Bank LIT Credit Card also offers 4 complimentary domestic lounge access every quarter. All of these features can be obtained by paying an extra fee.

This card stands out among the best credit cards because you can customize your features and pay accordingly.

IDFC First Millennia Credit Card

This card offers up to 10 times reward points when you spend Rs 20,000 or more. On your birthday, you can earn 10 times reward points for all spends made using this card. Additionally, you can earn rewards 6 times on online purchases and 3 times on offline purchases up to Rs. 20,000. This card also provides complimentary access to railway lounges, which is highly beneficial for domestic travelers who prefer rail travel.

One of the best advantages of this card is that it is free for a lifetime.

Cashback SBI Credit Card

The SBI Cashback Credit Card has stood the test of time and proven itself to be, as many call it, a truly no-nonsense cashback credit card. Shopping, payments, and food deliveries these days everyone can order anything online in an instant. In an era of comfort and online spending, the SBI Cashback Card reigns supreme.

You can earn 5% cashback on most online transactions and 1% cashback on offline transactions and bill payments.

HDFC Bank Regalia Gold Credit Card

You can get a complimentary MMT Black Elite and Club Vistara Silver Tier membership when you spend Rs. 1 Lakh or more within 90 days of getting the card. You can also get vouchers worth Rs. 1500 from M&S, Marriott, Reliance Digital, Myntra, and other brands. Additionally, you can get Rs. 5000 worth of complimentary flight tickets when you spend Rs. 7.5 Lakhs or more in a year. You will earn 4 RPs per Rs. 150 spent and 5x reward points on partner brands. Also, you can get access to 12 complimentary domestic lounges and 6 complimentary international lounges through Priority Pass.

IndusInd Legend Credit Card

The IndusInd Legend Credit Card is a lifetime free offering that comes with a decent reward rate. You shall earn 1 Reward Point on each spend of Rs. 100. What’s more, you can earn even higher rewards on spends made over the weekend, 2 Reward Points on spend of Rs. 100. If you’re a movie buff, you’ll particularly love this card as it offers Buy One Get One on monthly movie ticket bookings.

But what really sets this card apart is its low foreign markup charges – it only charges a 1.8% forex fee. This means you can make international payments without worrying about exorbitant charges.

American Express SmartEarn™ Credit Card

AMEX Credit Cards have their own appeal and brand value. For beginners looking for a simple American Express Credit Card, the SmartEarn Card is the best choice. With a joining fee of less than Rs. 500, you can get 10X and 5X Membership Reward Points with this card. Not only this the SmartEarn Card also offers multiple spend-based milestone benefits. While you apply with CardInsider you get bonus Membership Reward Points.

| 10X Partners | 5X Partners |

| Zomato, Ajio, Nykaa, BookMyShow, and Uber | Amazon and Paytm Wallet |

Easily waive the annual charges with this card by spending Rs. 40,000 or more in a card anniversary year.

Amazon Pay ICICI Bank Credit Card

One of India’s most popular shopping credit cards, the Amazon Pay ICICI Bank Card offers a 5% cashback on shopping from Amazon for Amazon Prime members, 3% cashback on shopping from Amazon for all non-Prime members, 2% cashback on payments made to over 100 Amazon Pay partner merchants and 1% cashback on every other category of transactions made with the card.

When you receive your credit card for the first time, you will also receive benefits worth Rs. 2,500. As this credit card is a lifetime-free card (no annual or renewal charges), these benefits are very valuable. By simply making a few bill payments, you can get Rs. 2,500. Not only that, but you can also enjoy a 3-month Amazon Prime membership as a joining benefit. Amazon Pay ICICI Bank Credit Cards offer a wide range of benefits, from shopping to paying utility bills.

The Amazon Pay ICICI Bank Credit Card is a must for everyone’s wallet.

IndianOil Axis Bank Credit Card

Fuel expense is a common cost for automobile owners. It is common and expensive. However, the IndianOil Axis Bank Credit Card can make your fueling experience rewarding. As a welcome benefit, you can get 100% cashback up to Rs. 250 on your first fuel transaction. Also, for fuel spends up to Rs. 5,000 each month, you can avail of 4% value back as Reward Points. This card is a must-have for those who do not get rewarded for fuel transactions with their existing credit card.

Moreover, the IndianOil Axis Bank Credit Card not only rewards your fuel expenses but also offers Reward Points on online shopping. You can easily earn a 1% value back on online shopping with this card.

BPCL SBI Card Octane

The BPCL SBI Card Octane is an excellent fuel credit card that offers a fantastic reward program and several other exciting benefits. You can earn reward points at an accelerated rate of 10X (10 reward points for every Rs. 100 spent) on dining bills at selected restaurants, with a maximum of 7,500 Reward Points every month.

Additionally, you can earn 25X reward points (25 reward points every time you spend Rs. 100) on fuel transactions at BPCL fuel stations using the BPCL SBI Card Octane, with a maximum of 2,500 Reward Points per billing cycle. This card basically offers you a 7.25% value back on fuel purchases from BPCL petrol pumps.

Axis Bank Atlas Credit Card

The Axis Bank Atlas Credit Card is a travel category card that offers exclusive air miles to users who frequently travel by air. Unlike other travel cards offered by Axis Bank, the Atlas credit card is not co-branded. It offers exclusive travel benefits, airport lounge access, and dining benefits. With the Atlas Card, you can enjoy complimentary access to international and domestic airport lounges, higher reward rates on foreign currency transactions, and complimentary airport concierge services, making it the perfect card for frequent flyers.

This card comes at a fee of Rs. 5,000 and is considered to be one of the best credit cards in India. You can earn a 4% value back on education, government, and utility payments with this card. Even rent payments made with this card earn 3%. The only drawback is that there is no spend-based renewal fee waiver with this card. You would have to pay the joining fee.

Yes Bank Marquee Credit Card

The Yes Bank Marquee Credit Card is a premium offering that can be availed for a joining fee of Rs. 9,999. The welcome benefits of this card are worth Rs. 15,000, which are offered in the form of 60,000 Reward Points. This card offers 36 Reward Points for every Rs. 200 spent online and 18 Reward Points for every Rs. 200 spent offline. Cardholders would also get 10 Reward Points on Select Categories like Rental Payments, Wallet Loading, Recharge & Utility Bill Payments, Insurance, Education, and Government payments.

Although it was launched in late 2023, it has already become everyone’s favorite.

HDFC Bank INFINIA Metal Credit Card

One of the most famous and premium credit cards in India, the Infinia Credit Card offers a higher reward rate of 5 points for every Rs. 150 spent, with each reward point valued at Re. 1 when redeemed for travel-related expenses such as flight bookings and hotel reservations.

The travel benefits offered with this card include lower foreign currency markup charges, complimentary Club Marriott membership, and unlimited complimentary domestic and international airport lounge access with Priority Pass membership. Furthermore, the insurance benefits include a personal air accident cover worth Rs. 3 crore.

This is an invite-only card and is offered to high-net individuals.

Axis Bank Magnus Credit Card

The Axis Bank Magnus Credit Card is a premium offering by the bank. There is also another variant of the card – Magnus for Burgundy which is only available to the customers who maintain a Burgundy relationship with the bank.

Earn 12 EDGE Reward Points for every INR 200 on cumulative monthly spends up to Rs. 1.5 Lakhs. Further, earn 35 EDGE Reward Points per Rs. 200 on cumulative monthly spends above Rs. 1.5 Lakhs Accelerated 2X EDGE REWARDS Points on travel portals like MakeMyTrip, Yatra, Goibibo, etc. Travel benefits include unlimited complimentary domestic and international airport lounge access, discounts at Oberoi hotels, and a 24×7 hotel concierge service. Apart from all the above you would also get discounts on movie and event tickets on BookMyShow and dining bills at partner restaurants across the country.

American Express Platinum Charge Card

The American Express Platinum Charge Card is a premium credit card that comes with a host of travel benefits to enhance your travel experience. With this card, you can enjoy exclusive discounts on hotels, airlines, and other travel-related expenses. One of the most unique features of this card is that it doesn’t have a pre-set credit limit. Additionally, you can access unlimited complimentary airport lounges both domestically and internationally. This is one of the two Charge Cards that American Express currently offers in India.

What to Keep in Mind While Applying for a Credit Card?

You must have a particular set of criteria in mind before applying for a new credit card. The criteria may be different for different individuals depending upon their needs, income, financial habits, and, most importantly, the reason for applying for the card. This is how you can compare the best credit cards in India and choose one for yourself.

Your Spends

For example, suppose you are searching for a credit card that can save you on travel spends. In that case, you will give more importance to travel-related benefits like AirMiles, membership in frequent flyer programs, or complimentary air tickets. Consider complimentary lounge access at airports if you are also concerned about making your travel experience a pleasurable one. In contrast, other benefits like discounts on dining bills or complimentary golf games might not matter to you that much.

Annual Charges

The annual membership fee is another very important parameter to look for in a credit card. Many credit cards are free for a lifetime, while some premium credit cards are issued with an annual fee as high as over Rs. 50,000 per annum; for example, the annual fee of the American Express Platinum Credit Card is Rs. 60,000 per year. Rather than looking for a card that is lifetime free or a card with a lesser annual fee, what you should consider instead is whether the benefits that a card offers outweigh its annual fee and by what margin.

Rewards

This is the very first and the most obvious thing to look for when applying for a new credit card. You must know whether a credit card earns you cashback (which is later adjusted against your card’s statement balance) or rewards you with Reward Points. In the latter case, another point that becomes very important is Reward Points redemption.

Milestone Benefits

Many credit cards reward you for achieving a certain spend-based milestone, i.e., on spending a certain minimum amount with the card within a given time period, which may be one statement cycle, calendar quarter, or calendar year (or any other time period specified by the card issuer.). Any milestone benefit that a card offers is beneficial for you only if you are able to achieve the stipulated milestone. You must evaluate your spends in order to understand the utility of the milestone benefits that the card offers.

Lounge Access

Many credit cards (in fact, all credit cards in the mid to premium and super-premium segment) offer some additional privileges like complimentary lounge access at airports/railway stations, on top of the regular Reward Ponts/cashback benefit. Before making up your mind about a particular credit card, it is essential to know whether it offers any additional benefits and, if yes, what the utility of the benefit is for you. For example, if you frequently fly overseas, a value-added benefit like complimentary lounge stays at international airports might be important for you.

Forex Mark-Up Fee

International transactions made with credit cards attract a mark-up fee known as a foreign currency mark-up fee or forex mark-up fee. The standard is to charge 3.5% on the transacted amount as a forex markup fee on international transactions. However, some credit cards in the premium and super-premium categories charge a lower foreign markup fee on international transactions. For someone who plans to use the card for international transactions frequently, a lower foreign mark-up fee becomes an important feature.

The Process Behind Selecting the Best Credit Cards in India

The team at CardInsider has put in a lot of effort to research different cards offered by issuers and banks in India in order to compile a list of the top credit cards available in the country. Our list includes the best credit cards for the masses, fuel credit cards, and credit cards for high-income individuals.

We have curated the most popular and literally the best cards available in the country. Everyone can find a card on our list that suits their needs.

Bottom Line

Choosing the most beneficial credit card in india can be a daunting task unless you are very clear about your spending needs. But, if that is not the case, you must first evaluate your spending habits. For that, you should determine what portion of your credit card bill the various categories of spends account for. This data will make the choice of the best credit card easier for you. It’ll obviously be better to go for a card that gives you maximum benefit in your favorite spends category.

With our list of the best credit cards in India, you can easily choose the best-suited credit card for yourself and apply for it through our website. Card Insider allows you to compare the various credit cards available in India. You can also read detailed credit card reviews and apply for the one that suits your needs the best.

Share your thoughts on our list of the top cards in India. Did we miss any? Tell us in the comments below.

FAQs:

No credit card can be labeled as "the best" for everyone. The best card for you depends upon your financial habits and your needs at the end of the day. People who love traveling will find the travel cards best, and those who are shopping lovers will like to go for a card with the best shopping benefits. Another factor that may affect your decision while choosing the best credit card is the annual fee associated with it. This is how different people have different choices, and hence, no single credit card is best for everyone.

Two of the best credit cards for online shopping are the Amazon Pay ICICI Bank Credit Card and HDFC Millennia Credit Card. If you are someone who shops very often through Amazon, you should go with the Amazon Pay ICICI Card (which is lifetime free), and if you tend to spend on different platforms like Flipkart and Myntra, then you should opt for the HDFC Millennia which offers 5% cashback on multiple platforms.

There are lots of credit cards with good reward programs in India; some of the most popular ones are Axis Bank Magnus Credit Card, Infinia Metal, Millennia Card, and AmEx SmartEarn Credit Card.

Rather than narrowing your search to a particular card issuer, it's better to look for a credit card that is the best suited for your needs. HDFC, Axis, SBI, AU, and IDFC Bank are all known for their rewarding and affordable credit cards.

Very Best Understand & Easy to choose best credit card details from U All credit Card details given good best very Easy way to understand to which credit Card u want

Nice Article! Covers all top credit cards in India. Now I can easily select by comparing each credit card of any category. Thanks!

I Have an Amazon ICICI Credit Card and it is a fantastic option for those who are spending a lot on groceries because it offers great cashback and points, it has more than sufficient limit and the Amazon Pay ICICI credit card has great value in terms of everyday spending of an individual after owning both the card my spending has become more efficient and easy and i think every individua should own these cards

I read the whole article but there was no mention of the Airtel Axis Bank credit card, I think It should be in the list of top 20 credit cards because it offers great cashback on bill and utilities.

Hey, Ankur, I appreciate the initiative that you have taken to showcase all best Indian credit cards at one place. I have both IDFC hpcl FIRST Power Credit Card and SBI octane I’ev saved a lot on my fuel using this it has to be owned by individuals like me who have a lot of running on vehicles. I also own a amazon pay which flawlessly helps me to save on personal and daily spending.

All the cards have their benefits such as a welcome bonus and fewer annual charges by making a quick comparison it is easy for me to choose what kind of card is best for me.

Talking about the Axis Bank Magnus credit card, what is the value of 1 reward point? Is it also available on websites apart from the mentioned one?

1 EDGE Reward Point = 0.20 Paise

Axis Bank Vistara Infinite Credit Card has reward points for buying insurance. Like just bought insurance for my car, so am I getting any reward points for that?

Yes, you shall receive reward points on insurance payments.

Amazon ICICI bank credit card and Flipkart Axis bank credit card offer almost the same types of benefits, but Amazon seems to be offering a bit less than Flipkart. Can you please suggest a card that offers more benefits than Flipkart?

I think the Amazon ICICI Credit Card is one of the best credit cards out there. It is a reliable and rewarding card that is available free for lifetime so. If you are looking for features like lounge access then you should go for other cards. But for purchases on Amazon this is one of the best cards.

Hi! I have recently started working in an MNC and earning good and would like to get a credit card to pay for my regular expenses such as online shopping on Flipkart, Myntra, Amazon, food delivery services like Swiggy, and dining out at restaurants. My monthly expenses would be around 7-8k. I am considering the Flipkart Axis Bank Credit Card and HDFC credit cards. Can you please suggest the best credit card for me? Thank you!

I think the HDFC Millennia Credit Card would be best for you. You would get 5% off on all the platforms and brands you mentioned and then some more. If you reach the minimum spend you shall also be able to access airport lounges free. The Millennia Card is simply one of the best ones out there and you can get it at a fee of Rs. 1,000. Which can be waived on spends of Rs. 1 lakh. You shall also receive vouchers on reaching the quarterly spend milestone.

Thank you for sharing details about the hdfc millenia credit card. I appreciate your input, it helps in my decision.

Thank you J!

I recently did some research on credit cards and found the best one for my needs. After comparing multiple cards and their benefits, I decided to go with the HDFC Bank Millennia Credit Card.

My approach to handling my finances has totally changed since I recently received Cashback SBI Credit Card. The card has not only helped me manage my expenses efficiently but also provided me with various benefits that have saved me a significant amount of money.

I am using HDFC Diners Clubmiles card from last 1 year and have a good credit score and spending pattern as well. But I didn’t got a limit enhancement option once till now. I want to upgrade my card but unable to do so talked with the manager, but he has no clue how to upgrade this card. Could you suggest me a way to upgrade?

SBI offers the best cashback deal – 5% cashback on all online transactions, regardless of the merchant. For offline transactions and utility bills, Axis Ace is a good card. For UPI transactions, HDFC Tata Neu is the best one.

These 3 cards would be perfect for anyone.