By Rajat Gaur

Updated On

Most individuals use credit cards to have more financial stability. However, many people use credit cards to enjoy the credit limit and the benefits they provide. Credit cards come with benefits in various forms, such as Rewards, cashback, travel benefits, lifestyle benefits, etc. Cashback is the simplest form of the benefits provided by credit cards, and Cashback Credit Cards are the tools that offer you the same. A credit card with cashback earns you cash back on all your spending and allows you to save a percentage of what you spend every time you make a purchase.

Who doesn’t want to save on their spends? You might also be looking to apply for the best cashback credit card that can get you the maximum benefit. Cashback credit cards not only allow you to save more & more money, but you can also avail a lot of other exciting benefits, such as entertainment benefits, travel privileges, and much more. We are here to make you understand what a cashback credit card actually is, how it works, and how you can choose the right cashback credit card for you. Keep reading to know all these answers & check the list of the best cash-back credit cards in India:

Table of Contents

List of Best CashBack Credit Cards in India 2024

With lots & lots of credit cards offered in the Indian market, you may find it very difficult to filter out cash-back cards from different credit card issuers. Every card issuer offers various cards in different categories, including travel, rewards, cashback, shopping, and many more, so it becomes quite difficult to check all the websites and note down the credit cards. To make the take easier for you, we have made a list of the best cashback credit cards that are available in India. You can check out the features, benefits, and charges and compare cash-back credit cards to choose the best-suited card for you.

(4.7/5)

Joining Fee

Rs. 999 + GST

Renewal Fee

Rs. 999 + GST

Best Suited For

Shopping | Food

Reward Type

Cashback

Welcome Benefits

NA

Card Details +

The Cashback SBI Card is a highly rewarding card that provides cashback on all online and offline spends, with a few exceptions. The card carries an annual fee of Rs. 999 plus taxes, and the total cashback you can earn is capped at a maximum of Rs. 5000 per statement cycle. Moreover, you can get the renewal fee of the SBI Cashback card waived on spending Rs. 2 Lakhs or more in the card anniversary year. The following are the features of the Cashback SBI Card:

- 5% cashback on all online spends

- 1% cash back on all offline spends

(4.8/5)

Joining Fee

Rs. 1,000 + GST

Renewal Fee

Rs. 1,000 + GST

Best Suited For

Shopping

Reward Type

Cashback

Welcome Benefits

1,000 CashPoints as a Welcome Benefit.

Card Details +

The HDFC Bank Millennia Credit Card is a cashback credit card issued by HDFC to provide its customers with the best cashback offers. The card lets you save a lot on almost all your spends, and is best suited for online shopping & flight/hotel bookings at SmartBuy or Payzapp. Following are some of the key features of this card:

- Welcome gift of 1,000 cash points.

- Complimentary airport lounge access.

- Spend-based joining/annual fee waiver.

- 1% fuel surcharge waiver.

(4.7/5)

Joining Fee

Rs. 500 + GST

Renewal Fee

Rs. 500 + GST

Best Suited For

Food | Bill Payment

Reward Type

Cashback

Welcome Benefits

Amazon Voucher Worth Rs. 500

Card Details +

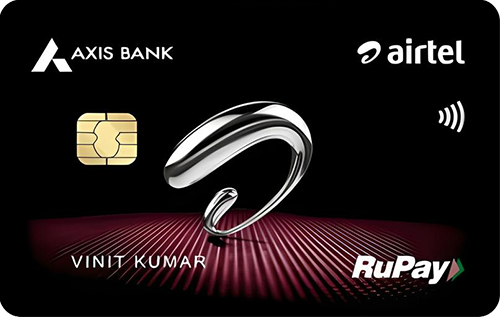

The Airtel Axis Bank Credit Card is a collaboration between Axis Bank and Bharti Airtel. This co-branded card is designed for people who use Airtel services frequently and comes with a modest annual fee of only Rs. 500. To welcome new customers, the card offers an exclusive Amazon gift voucher. It is a cashback credit card that offers up to 25% cashback on Airtel Mobile, DTH, and broadband bill payments made through the Airtel Thanks app, 10% cashback on water, gas, and other utility bill payments through the same app, and 10% cashback on partner merchants. The redemption process is hassle-free, as the earned cashback is automatically credited to your account.

(5/5)

Joining Fee

Rs. 500 + GST

Renewal Fee

Rs. 500 + GST

Best Suited For

Shopping

Reward Type

Cashback

Welcome Benefits

Introductory Benefits Worth Rs. 600 on Card Issuance

Card Details +

Axis Bank offers the Flipkart Axis Credit Card in association with Flipkart to deliver its customers exclusive cashback benefits on all their spending. With this card, you get accelerated cashback on online shopping through Flipkart. Avail various benefits with this card, including welcome benefits worth Rs. 600, complimentary lounge visits at domestic airports, and exciting discount offers on dining through the Axis Bank Dining Delights program.

(4.6/5)

Joining Fee

Rs. 500 + GST

Renewal Fee

Rs. 500 + GST

Best Suited For

Dining | Food

Reward Type

Cashback

Welcome Benefits

Complimentary 3-Month Swiggy One Membership

Card Details +

The Swiggy HDFC Bank credit card is a nice offering for loyal Swiggy users who regularly order food or dine out, and this is the first time that Swiggy has partnered with a bank for a credit card. The card charges a joining fee of Rs. 500 and comes with a complimentary 3-month Swiggy One membership. You can earn exclusive 10% cashback on spending across the Swiggy app and 5% on other partner brand spends. The following are the top features of the card.

- 3-month Swiggy One membership as a welcome benefit

- 10% cashback across the Swiggy app on Food, Instamart, Dineout, and Genie

- 5% cashback on online spends at partner brands

- 1% cashback on other spends

- Renewal fee waiver on spending Rs. 2 Lakhs or more in the year

(5/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Shopping

Reward Type

Cashback

Welcome Benefits

Cashback and Discounts Up to Rs. 2,000 and Free 3-Month Prime Membership

Card Details +

The Amazon Pay ICICI Bank Credit Card is a co-branded shopping credit card launched by ICICI Bank in collaboration with Amazon India on the Visa payment platform. Upon its launch, it quickly became a popular choice for online shoppers in the country. Currently, it is considered one of the best credit cards available for shopping in India, particularly for those who frequently shop on Amazon and are Prime members. One of the reasons why the Amazon ICICI Credit Card is so popular is due to the cashback rewards it offers in the form of an Amazon Pay balance. Amazon Prime members can benefit even more from this credit card, as they can receive up to 5% cashback on purchases made on Amazon.

(4.8/5)

Joining Fee

Rs. 499 + GST

Renewal Fee

Rs. 499 + GST

Best Suited For

Bill Payment

Reward Type

Cashback

Welcome Benefits

N/A

Card Details +

The Axis Bank ACE credit card, launched in partnership with Google Pay, aims to take advantage of the growing internet usage and the increasing trend of online payments in the country. This card offers 5% cashback on electricity, gas, water, and internet bill payments made through the Google Pay application and 4% cashback on popular merchants such as Swiggy, Zomato, and Ola. This is quite a useful card as it offers cashback on our regular utility spends. Aside from the cashback offers, the ACE credit card also provides complimentary domestic airport lounge access.

(4.6/5)

Joining Fee

Rs. 999 + GST

Renewal Fee

Rs. 999 + GST

Best Suited For

Shopping

Reward Type

Cashback

Welcome Benefits

₹1,000 Cashback on Spending ₹20,000 in the First 30 Days

Card Details +

The HSBC Cashback Credit Card comes with great cashback offers on all your spends and 10% accelerated cashback on grocery, dining, and food delivery spending. Besides the cashback offers, the card has several advantages that allow you to save more and more on your spending. Some of its benefits are:

- Buy 2 get 1 free offer on movies on Saturdays through BookMyShow.

- 10% cashback on grocery, dining, and food delivery and 1.5% on all spends.

- 4 complimentary domestic lounge access per annum.

- Spend-based annual fee waiver on spending Rs. 2 lakh.

(4.5/5)

Joining Fee

Rs. 499 + GST

Renewal Fee

Rs. 499 + GST

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Extended 90 days interest period from the date of the card issuance date.

Card Details +

Standard Chartered Bank recently launched a new entry-level credit card- Standard Chartered Smart Credit Card. It is a cashback card, and you can earn up to 1,500 Reward Points per month on Standard Chartered Smart Credit Card. The Smart Card has a yearly fee of Rs. 499 (plus GST). The key features of the Standard Chartered Smart Credit Card are as under.

- 2% cashback on all online spends with Standard Chartered Smart Credit Card (the maximum cashback under this category is Rs. 1,000 per month).

- 1% cashback on offline spends with the card (max cashback under this category has a capping of Rs. 500 per month).

- The card’s annual fee is waived on a minimum annual expenditure of Rs. 1.2 lacs.

Benefits Of Cashback Credit Cards

Cashback cards might be the best option for individuals who aim to save more on spending via their credit cards. With these cards, you earn a cashback every time you spend, and this cashback is credited to your account, which can be used against your statement balance as well. Following are some of the reasons why you should consider having a cashback credit card:

- A credit card with cashback lets you save up to 25% of your spends. You save something almost every time you spend.

- Unlike reward points, cashback redemption is easy and hassle-free, as it is automatically credited to your account. Moreover, you can use your earned cashback wherever you want.

- Most cash-back cards are affordable. They generally have a low joining fee, and some are even lifetime-free.

Besides these general benefits, cashback cards can also provide additional privileges to their customers. These cards mostly focus on cashback offers, but you may also get other benefits with some of the best cash-back credit cards. The cashback credit card benefits may be as mentioned below:

Welcome Benefits

With most of the cashback cards, you get a welcome benefit. Different cards offer different welcome benefits to their customers, which may be accelerated cashback in a particular category, a premium subscription, or anything else. You generally get a welcome benefit when you join the card membership by settling the joining fee.

Milestone Benefits

Under the milestone program of a credit card, you can get exciting offers and benefits by spending the required minimum amount within a given time period.

Travel Benefits

Some cashback credit cards offer exclusive travel perks, including exciting flight and hotel booking discounts and complimentary access to domestic and international airport lounges.

Movie & Dining Benefits

Considering the people who love to go to movies frequently or who dine out very often, many card issuers offer cards with exciting movie & dining benefits. These benefits may include complimentary movie tickets, discounts on dining, and exclusive premium memberships for complimentary dine-out apps.

Rewards & Features

| Credit Card | Best Suited For | Key Features | Other Features |

| Cashback SBI Credit Card | Online Spends | 5% Cashback on Online Spends and 1% Cashback on Online Spends | N/A |

| HDFC Millennia Credit Card | Shopping on Amazon & Flipkart |

|

N/A |

| Flipkart Axis Bank Credit Card | Shopping on Flipkart |

|

|

| Swiggy HDFC | Spends Made With Swiggy (Food Deliveries, Instamart, Dineout) |

|

Avail Mastercard World offers |

| Axis Bank ACE Credit Card | Bill Payments on Google Pay & Zomato, Swiggy, and Ola |

|

4 complimentary domestic lounge access every year. |

| Amazon Pay ICICI Credit Card | Shopping on Amazon |

|

A discount of 15% or more on dining. |

| HSBC Cashback Credit Card | Food Spends |

|

|

How to Choose The Right Cashback Credit Card?

Almost everyone wants to save on their spends by earning cashback or discounts, and one of the best ways to do so is to use credit cards. To save more by earning cashback, you might think of having a cashback credit card. However, it is always confusing to choose which credit card to use. Which one will earn you the maximum benefit? If you are also going through the same questions in your mind, we are here with the answers & options for you.

The first thing you need to understand before choosing a cashback credit card is your shopping habits. Determine whether you prefer online or offline shopping and the categories where you spend the most. If you frequently order food from Zomato, choose a card with the best cashback offers on Zomato. So, take your time and apply for a credit card wisely.

How to Apply for Cashback Credit Cards Online?

To apply for a cashback credit card, you have the option to apply online or offline. If you choose to apply online, you can click on the “Apply Now” button. This will redirect you to the official application page, where you can fill out the application form with all the required information and upload the necessary documents. Individuals who don’t prefer online methods to apply for a credit card can visit their nearest bank with all the required documents to apply for a credit card. Whichever method you choose, apply for a cashback that best suits your needs.

Best Cashback Credit Cards in India With No Annual Fee

Almost everyone wants a credit card, but many people are afraid of applying for a card due to the high annual charges on them. However, it must be understood that some of India’s best cashback credit cards come with a zero annual fee and target low-income individuals. Everyone can apply for these cards as long as they fulfill the age eligibility and have a source of income. Some of the best cashback cards in India with no annual fee include the Amazon Pay ICICI Credit Card.

Difference Between Rewards & Cashback Credit Cards

Many people consider rewards credit cards and cash-back credit cards to be the same thing, but both are different. Rewards credit cards earn you reward points, whereas cashback cards reward you with cashback. Some people prefer having a credit card for cashback, and others like rewards cards. If you don’t understand all the differences between the two, refer to the table given below to understand the same:

| Rewards Credit Card | Cashback Credit Card |

| The Rewards Credit cards earn you Reward Points on every spend you make using the card. | A credit card with cashback earns you cashback on your spends made using the card. |

| The Reward Points need to be redeemed on a particular website/portal or through net banking to use them. | You don’t need to redeem the cashback, as it is automatically credited to your account. |

| The Reward Points you earn through the Rewards Credit cards are valid for a fixed time period, and if you don’t use them within that time period, they expire. | The cashback you earn using the cashback cards never expire. You can use it anytime once it is credited to your account. |

| The reward points can be redeemed against selected categories/products only that are available in the reward catalog of that particular bank. | The cashback earned through the Cashback cards can be used to buy anything you want. |

Bottom Line

A credit card with cashback can benefit each and every one of you no matter what you do with your card. The only thing you need to do is just choose the card according to your spending habits. As most cash-back credit cards provide maximum benefit for one or two particular categories, it is essential to understand the categories where you spend the most to get the utmost advantage out of your cash-back credit card. You should also compare the cards based on other aspects, including travel, movie, dining, fuel benefits, etc. The best advantage of having a cashback credit card is its easy and hassle-free redemption process. You don’t need to go through a lengthy and confusing redemption process like rewards credit cards, but the cashback is generally credited to your account by itself. Moreover, cashback cards are affordable to have & easy to use, giving you another significant reason to have one. So, if you know your spending behavior, just find the right cashback credit card & go for it.

Also, make sure to let us know which credit card for cashback you will choose and why. Also, if you have any doubts concerning any information in this article, you can freely ask us in the comment section below!

FAQs:

If you want to earn rewards instantly on your purchases, then cashback credit cards would be a good choice as you get cashback instantly in your account rather than using rewards in the future (in the case of reward points).

When you use your credit card to make a transaction, you earn a percentage of the transaction in cashback. For example, if your card offers 5% cashback on a transaction, then on a purchase of Rs. 100, you will earn Rs. 5 as cashback.

Cashback is provided on the transactions you make with your credit card; therefore, the more you spend, the more cashback you will receive. However, to maximize the cashback from a card, one should use the credit card for every usual purchase they make in a day.

There are no joining or annual fees associated with the Amazon Pay ICICI Credit Card, i.e., it is lifetime free.

Yes, non-Amazon Prime members can also get a 3% cashback on Amazon using the Amazon Pay ICICI Credit Card.

The comparison chart of REWARDS & FEATURES must also HIGHLIGHT the Cash Back capping Limit & Redemption rules of each card for better clarity of the users to choose the best card.

Hello, Sir. Surely will add a table for maximum cap on cashback also.

Cashback cards which I personally consider are:

HDFC Bank Millennia Credit Card – 5% cashback on Flipkart and Amazon

Flipkart Axis Bank Credit Card – Rs. 500 Flipkart Voucher, 5% cashback on Flipkart, 4% cashback on Swiggy, Uber, PVR, and Cult.fit.

Myntra Kotak Credit Card – Rs. 500 Myntra Voucher, 7.5% discount on Myntra shopping, 5% cashback on Swiggy, Swiggy Instamart, Cleartrip, Urban Company, and PVR.

I’m glad to see a comprehensive list of best cashback credit cards in India for 2024! As a frequent traveler, I’m especially interested in the cards that offer higher cashback rates on flights and hotel bookings.

Also buy IOCL fuel voucher at 2% + 5% SBI cashback credit card (total 7% profit).

Better than SBI Simplyclick and SBI BPCL cards benefit.

Sbi Cashback and few other cards were missing in the table but they were in the top.

It has been corrected.