By Rajat Gaur

Updated On

Credit cards have become a need for lots of individuals as they give you financial stability and the power to make big purchases & pay later for them. But, having a credit card with a high-interest rate can sometimes become very costly, especially when you have a high outstanding balance to pay month on month. In such a case, it becomes really important to have low interest credit cards as you can save a lot of extra amounts you are paying in the form of interest. If you don’t know what a low interest credit card is, keep reading to know all about it and the top low interest credit cards available in the Indian market.

Table of Contents

- IDFC First Wealth Credit Card

- Axis Bank Burgundy Private Credit Card

- IndusInd Bank Indulge Credit Card

- HDFC Bank INFINIA Credit Card Metal Edition

- HDFC Bank Diners Club Black Metal Edition Credit Card

- IDFC FIRST Select Credit Card

- Yes Private/Private Prime Credit Card

- Yes Bank First Exclusive Credit Card

- HSBC Premier Mastercard Credit Card

- IDFC FIRST Classic Credit Card

- IDFC FIRST Millennia Credit Card

- IndusInd Bank Celesta Credit Card

- Indusind Bank Crest Credit Card

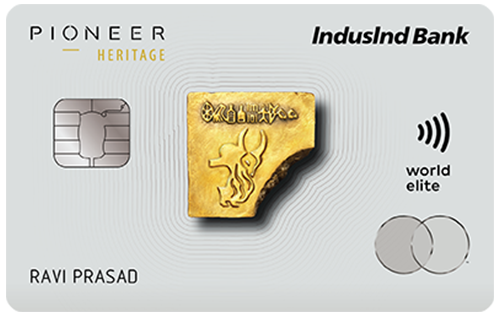

- Indusind Bank Pioneer Heritage Credit Card

List of Best Low-Interest Credit Cards in India 2024

The interest rate of a credit card is one of the most important factors to be checked before you get a credit card. Different credit cards come with different interest rates, however, most of them have an average interest between 3% to 3.5% per month. But, there are some credit cards that come with lower interest rates and many of us want to have such a credit card. In this article, you can find the list of best low-interest credit cards along with their other fees & charges and benefits:

(4.5/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Movies | Shopping

Reward Type

Reward Points

Welcome Benefits

Gift vouchers worth Rs. 500 from popular brands on spending over Rs. 15,000 within 90 days and a 5% cashback on the first EMI transaction made within the first 30 days.

Card Details +

Annual Fee – Nil

Interest Rate – 0.75% to 2.99% per month (9% to 36% per annum)

Key Features:

- Welcome gift voucher worth Rs. 500.

- Up to 10 Reward Points on every spend of Rs. 100.

- Buy 1 Get 1 Free offer on movie tickets on BookMyShow.

- 4 complimentary international and domestic lounge visits per quarter.

(4.3/5)

Joining Fee

Rs. 50,000 + GST (Nil for Burgundy Private Account Holders)

Renewal Fee

Rs. 50,000 + GST (Nil for Burgundy Private Account Holders)

Best Suited For

Movies | Travel | Dining

Reward Type

Reward Points

Welcome Benefits

30,000 EDGE Reward Points

Card Details +

Annual Fee – Rs. 50,000 (Zero for burgundy private account holders)

Interest Rate – 1.5% per month (19.56% per annum)

Key Features:

Interest Rate – 1.5% per month (19.56% per annum)

Key Features:

- Welcome gift of 30,000 Edge Reward Points.

- No foreign currency markup fee.

- 15 Edge Reward Points on every Rs. 200 you spend.

- Unlimited access to complimentary domestic as well as international lounges.

(4.1/5)

Joining Fee

Rs. 2,00,000 + GST

Renewal Fee

Nil

Best Suited For

Travel | Dining | Shopping

Reward Type

Reward Points

Welcome Benefits

N/A

Card Details +

Annual fee – Nil (with a joining fee of Rs. 2,00,000)

Rs. 10,000 (with a joining fee of Rs. 1,00,000)

Interest rate – 1.79% per month (21.48% per annum)

Key Features:

- 1.5 Reward Points on every spend of Rs. 100.

- Buy 1 Get 1 free (BOGO) offer on movie tickets through BookMyShow.

- 4 complimentary domestic and 2 international lounge access every quarter.

- 1 Reward Point = Re. 1 for redemption against cash credit.

(5/5)

Joining Fee

Rs. 12,500 + GST

Renewal Fee

Rs. 12,500 + GST

Best Suited For

Travel | Dining | Shopping

Reward Type

Reward Points

Welcome Benefits

Welcome bonus of 12,500 Reward Points and complimentary Club Marriott membership for the first year offering 20% discounts on dining and stay in the Asia-Pacific region.

Card Details +

Annual Fee – Rs. 10,000

Interest Rate – 1.99% per month (23.88% per annum)

Key Features:

- Welcome benefit of 10,000 Reward Points.

- 5 Reward Points per Rs. 150 spent.

- Unlimited complimentary domestic/international airport lounge visits.

- Exclusive dining benefits with the Good Trail Program.

(4.7/5)

Joining Fee

Rs. 10,000 + GST

Renewal Fee

Rs. 10,000 + GST

Best Suited For

Travel | Dining | Shopping

Reward Type

Reward Points

Welcome Benefits

Complimentary Membership of Club Marriott, Swiggy One and Amazon Prime (On Spends of Rs. 1.5 Lakh Within 90 Days of Card Issuance)

Card Details +

HDFC Bank Diners Club Black Metal Edition Credit Card is one of the newest offerings by HDFC Bank. It competes with HDFC Bank Infinia Credit Card. This card is a premium offering and offers multiple benefits like complimentary lounge access and welcome benefits like complimentary membership of Amazon Prime and Swiggy One.

(4.6/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Travel | Shopping

Reward Type

Reward Points

Welcome Benefits

Vouchers worth Rs. 500 on spends of Rs. 15,000 within 90 days of card issuance. Also, get a 5% cashback on EMI transactions (up to Rs. 1,000) within 30 days of card issuance.

Card Details +

Annual Fee – Nil

Interest Rate – 0.75% to 2.99% (9% to 36% per annum)

Key Features:

- Up to 10 Reward Points per Rs. 100 you spend using the card.

- Welcome benefit of gift vouchers worth Rs. 500.

- 4 complimentary domestic lounge access per quarter.

- Lower foreign currency markup-fee of 1.5% only.

Invite Only

(4.4/5)

Joining Fee

Rs. 50,000 + GST for Yes Private and Rs. 20,000 + GST for Yes Prime

Renewal Fee

Rs. 10,000 + GST

Best Suited For

Travel | Shopping

Reward Type

Reward Points

Welcome Benefits

Upon successful first transaction made using this credit card, you will get up to 25,000 Reward Points.

Card Details +

Annual Fee – Rs. 10,000

Interest Rate – 1.2% per month (for individuals holding an account in YES Bank)

1.99% per month (for others)

Key Features:

- Welcome bonus of 25,000 Reward Points.

- Up to 3 Reward Points on every Rs. 100 you spend.

- Unlimited complimentary domestic lounge access.

- 12 complimentary golf rounds and 12 lessons every year.

(4.5/5)

Joining Fee

Rs. 1,999 + GST

Renewal Fee

Rs. 1,999 + GST

Best Suited For

Travel | Shopping

Reward Type

Reward Points

Welcome Benefits

N/A

Card Details +

Annual Fee – Rs. 9,999

Interest Rate – 1.99% per month

Key Features:

- Welcome benefit of 40,000 bonus Reward Points.

- Up to 12 Reward Points on every Rs. 200 you spend.

- Unlimited complimentary international lounge access and 3 complimentary domestic lounge access per quarter.

- Exciting discount on movie tickets on BookMyShow.

(4.4/5)

Joining Fee

Rs. 12,000 + GST

Renewal Fee

Rs. 20,000 + GST

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Complimentary Epicure and EazyDiner Prime Membership. Taj Experiences Gift Card Worth Rs. 12,000

Card Details +

Annual Fee – Nil

Interest Rate – 2.49% per month

Key Features:

- 2 Reward Points for Rs. 100 you spend using the card.

- Complimentary LoungeKey membership.

- Complimentary domestic and international lounge access.

- Low foreign currency markup fee.

(4.5/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Travel | Shopping

Reward Type

Reward Points

Welcome Benefits

Get a welcome gift voucher worth Rs. 500 on spending Rs. 15,000 or more within the first 90 days. Also, get 5% cashback on the value of your first EMI transaction done inside 90 days of card generation.

Card Details +

Annual Fee – Nil

Interest Rate – 0.75 to 2.99% (9% to 36% per annum)

Key Features:

- Gift voucher (worth Rs. 500) as a welcome gift.

- Up to 10 Reward Points per Rs. 100.

- A discount of up to Rs. 100 each month on movies.

- 16 complimentary railway lounge access per quarter.

(4.7/5)

Joining Fee

Nil

Renewal Fee

Nil

Best Suited For

Movies | Shopping

Reward Type

Reward Points

Welcome Benefits

5% cashback on first EMI spend up to Rs. 1,000 and additional welcome gift vouchers worth Rs. 500 on spending Rs. 5,000 within 30 days of card generation

Card Details +

Annual Fee – Nil

Interest Rate – 0.75 to 2.99% (9% to 36% per annum)

Key Features:

- Up to 10 Reward Points per Rs. 100 spent.

- Reward points earned using this card never expire.

- 4 complimentary railway lounge access per quarter.

- Gift voucher (worth Rs. 500) as a welcome gift.

(4.3/5)

Joining Fee

Rs. 50,000 + GST

Renewal Fee

Rs. 5,000 + GST

Best Suited For

Movies | Travel

Reward Type

Reward Points

Welcome Benefits

You get either of Oberoi hotels/resorts vouchers worth Rs. 50K or Montblanc vouchers worth Rs. 50,000.

Card Details +

Annual Fee – Rs. 5,000

Interest rate – 2.99% per month

Key Features:

- Welcome gift vouchers from Oberoi hotels and Montblanc worth Rs. 50,000.

- Up to 3 RPs on every Rs. 100 spent.

- Unlimited access to the domestic lounges.

- Buy 1 get 1 free (BOGO) offer on movie tickets and 20% off on movies on BookMyShow.

(4.2/5)

Joining Fee

Rs. 1,00,000 (annual fee of Rs. 10,000 to be paid in this case) or Rs. 2,00,000 (annual fee waived in this case)

Renewal Fee

Rs. 10,000 (if joining fee of Rs. 1,00,000 was paid), Nil (if joining fee of Rs. 2,00,000 was paid)

Best Suited For

Travel | Shopping

Reward Type

Reward Points

Welcome Benefits

N/A

Card Details +

Annual Fee – Rs. 10,000 (joining fee of Rs. 1 lakh)

Nil (with a joining fee of Rs. 2 lakhs)

Interest Rate – 2.99% per month

Key Features:

- Up to 2.5 Reward Points for every Rs. 100 you spend with the card.

- 2 complimentary international and 2 domestic lounge access each quarter.

- Up to Rs. 3000 off on dining at several premium restaurants.

- Up to 3 complimentary movie tickets each month on BookMyShow.

(4.2/5)

Joining Fee

Rs. 90,000 + GST

Renewal Fee

Rs. 25,000 + GST

Best Suited For

Movies | Travel

Reward Type

Reward Points

Welcome Benefits

Oberoi e-gift voucher and a Luxe Gift card.

Card Details +

Annual Fee – Rs. 25,000

Interest Rate – 2.99% per month

Key Features:

- Welcome benefit of Oberoi gift vouchers and Luxe gift cards.

- 2.5 Reward Points per Rs. 100.

- 8 complimentary and domestic lounge access every year (unlimited with Pioneer heritage Metal Credit card variant).

- Up to 4 complimentary movie tickets every quarter on BookMyShow.

What Are Low-Interest Credit Cards?

Low-interest credit cards are credit cards that charge lower interest on the outstanding balance than other credit cards. Most of the credit cards generally have an interest rate of around 3% to 3.5% per month. But, some of the credit cards in the market charge interest of as low as 0.75% to 2% per month. These cards can be great tools for people who carry a balance month to month on their credit cards. Although it is always best to pay the full amount due before the due date, low-interest credit cards are the best choice in case you are not able to do so.

Advantages And Disadvantages Of A Low-Interest Rate Credit Card

Since nothing comes without advantages and disadvantages, the same is the case with low-interest credit cards as well. Following are the advantages of low-interest rate credit cards –

- Lower Interest Rate – The first and foremost advantage of these credit cards is that they come with a low-interest rate. The interest rate on these credit cards is quite low as compared to regular credit cards.

- Low Annual Fee – Another advantage of having these credit cards is that the credit card companies charge a low annual fee on these cards which is quite high in the case of general credit cards. Additionally, the annual fee on your credit card gets waived off if you spend a particular predefined amount using your credit card.

- Interest Savings – Since the credit card carries a low-interest rate, therefore, if the cardholder chooses to use the rollover credit facility, then the interest incurred on the bill will be much lesser. Hence, with these credit cards, you do not have to pay a high-interest charge on the outstanding amount.

- Clearance of existing credit card debts – With the help of low-interest-bearing credit cards, cardholders can pay off the debts that have been accumulated on their existing credit cards.

Where there are advantages, there are disadvantages as well. Below-mentioned are the disadvantages of low-interest rate credit cards-

- Incur a high fee – These credit cards are generally offered when an individual pays off all the existing debt using this card. Therefore, while in the process of a balance transfer, a fee is being charged in such process. Therefore, an individual needs to examine all the details very carefully while switching from a high-interest rate credit card to a low-interest rate credit card.

- Extended to the people with high CIBIL Score – This credit card is generally offered to those people who have a high credit score, no discrepancies in credit card repayment, etc.

- No additional benefit – Since these credit cards offer a low-interest rate to the cardholders, you may not be provided with additional benefits such as bonus reward points, cashback, and other deals and benefits that you get with regular credit cards.

- High-interest rate on other benefits – With low-interest rate credit cards, you have to pay a high fee on the other benefits that you avail with these credit cards, such as a high fee on the cash advance facility.

Who Can Apply for A Low-Interest Rate Credit Card?

Low-interest credit cards are not offered to all applicants. Only the applicants who have a high credit card or those who have High-Net-Worth are given the offer to avail this facility.

The reason behind this is that these credit cards are designed in such a way that suits people with strong credit profiles, hence offering a low risk to the bank.

An applicant who would want to apply for this credit card must ensure to have a great credit score and should take care to pay his dues on time. By following such simple steps, in the due course of time, he will get eligible to avail the facilities of a low-interest rate credit card.

Is It Worth Having A Low-Interest Credit Card?

Having a low-interest-rate credit card can help you save a lot when you carry an outstanding balance on your card from the previous billing cycle. So, Yes, it is worth it having a low-interest credit card because the cards keep their promise of low interest. But the thing to remember is that most of the low-interest credit cards come with a high annual fee targeting super-rich individuals (other than the IDFC FIRST Bank credit cards). So, before choosing one, you must think about whether you really need it or not.

If you make big purchases with your credit card carrying an outstanding balance month on month, you should undoubtedly go with a low-interest credit card keeping all your other requirements in mind. We are here with a list of the best low-interest credit cards in the country to help you out choosing one!

Bottom Line

After going through the article, you might have understood all about low-interest rate credit cards and their benefits. If you are paying high interest on your credit card’s outstanding balance, you must apply for one of these cards in order to avoid it. Also, don’t forget to compare the low-interest credit cards with other factors as well, such as annual fees, benefits of the cards, etc. If you already have a low-interest credit card, share your experience having it with us and other readers in the comment section below.

FAQs:

No, if you pay the full amount due before the billing due date, you don’t have to pay any interest on it.

The IDFC FIRST Bank credit cards (IDFC First Wealth, IDFC First Select, IDFC First Classic, and IDFC First Millennia) have the lowest interest rate starting from 0.75%.

With time, by increasing and maintaining your CIBIL Score, you can always ask your respective bank to provide you with low-interest on your credit card.

APR stands for Annual Percentage Rate. A 0% APR means that you do not have to pay interest on certain transactions for a particular period of time. When it comes to credit cards, 0% APR is often associated with the introductory rate you may get when you open a new account.

Fraud protection, unsecured lending, and other expenses are the reason behind the high-interest rates of credit cards.

The most effective way to get a credit card with a low APR is to shift to a balance transfer credit card.