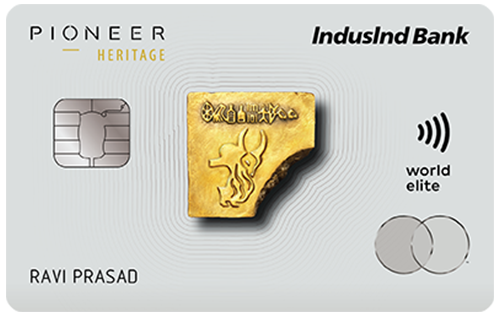

IndusInd Pioneer Heritage credit card is one of the few Mastercard world elite cards in India, which is offered to their elite customers. The card comes in two variants: Pioneer Heritage credit card and Pioneer Heritage Metal credit card. The Pioneer Heritage Metal variant is the first metal card issued by IndusInd Bank and comes with more premium benefits. The card provides you with welcome gift vouchers from the Oberoi hotels and a Luxe Gift card. You get exclusive benefits on this credit card across a wide range of categories, including entertainment, dining, traveling, and shopping. With the metal card, you get unlimited lounge access in India and worldwide, and with another one, you get 8 complimentary domestic & international lounge access every year.

Moreover, this card provides you with 1+1 movie ticket bookings and a 20% discount on no-movie bookings with BookMyShow. You get exclusive offers and special discounts on dining on this credit card. Other than all these exclusive benefits, the card comes with a great reward program providing 2.5x reward points on international transactions. Read below to learn more details about this credit card.

IndusInd Bank Pioneer Heritage Credit Card

Joining Fee

Renewal Fee

Best Suited For

Movies | Travel |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

Up to 3 complimentary tickets every month on Pioneer Heritage credit card and 4 Complimentary tickets every calendar quarter on Pioneer Heritage Metal credit card. Also, you get 20% off on your non-movie bookings.

Rewards Rate

2.5 Reward Points for Rs 100 spent on international transactions and 1 Reward Points for Rs 100 spent on domestic transactions.

Reward Redemption

1 RP = Rs 1 redeemed against a host of redemption options such as the Indus Moments reward portal, AirMiles, and against statement cash

Travel

Complimentary Domestic and International lounge access, complimentary LoungeKey membership and get a complimentary third-night stay at Oberoi Hotels and Resorts.

Domestic Lounge Access

Unlimited (with Pioneer Heritage Metal credit card) and 2 per quarter (with Pioneer Heritage credit card)

International Lounge Access

Unlimited (with Pioneer Heritage Metal credit card) and 2 per quarter using LoungeKey membership (with Pioneer heritage Credit Card).

Golf

12 complimentary rounds of green fees & 12 complimentary golf lessons every year. Also, you get 4 complimentary green fees rounds for guests.

Insurance Benefits

Complimentary air accident protection cover worth upto Rs 2.5 crore on this credit card

Spend-Based Waiver

Waiver of the annual fee on the amount spent using this credit card in the previous year.

Rewards Redemption Fee

Rs. 100 per redemption request

Foreign Currency Markup

1.8% of the amount transacted.

Interest Rates

2.99% per month (35.88% per annum)

Fuel Surcharge

Surcharge waiver of 1% on fuel transactions between Rs. 400 and Rs. 4,000.

Cash Advance Charges

Nil

- A Luxe Gift Card and Oberoi e-gift voucher as a welcome gift.

- For every Rs. 100 spent on international transactions, you will get 2.5 Reward Points.

- For every Rs. 100 spent on domestic transactions, you will get 1 Reward Point.

- Buy 1 Get 1 offer on movie ticket bookings with BookMyShow

- Get Up to Rs. 3,000 off on your Dining Spends

- Privileges with Club ITC Culinary Program

- Complimentary Domestic and International lounge access

- Discounted Markup fee of 1.8% on the conversion amount.

- Complimentary air accident protection cover worth upto Rs 2.5 crores.

IndusInd Bank Pioneer Heritage Credit Card Features

Welcome Benefits

- As a welcome gift, you are provided with an Oberoi e-gift voucher. The voucher is valid for 6 months from the date of issuance. You can redeem upto 2 gift vouchers against a single-stay reservation.

- Moreover, you also get premium access to 30+ luxury brands with Luxe gift vouchers worth Rs 5,000. The voucher is valid for 6 months from the date of issuance You are allowed multiple redemptions upto the cash limit of the voucher.

Get Up to Rs. 3,000 off on your Dining Spends

Pioneer Heritage program provides you with upto Rs 3,000 off on your total bill amount in a year with exclusive partner restaurants.

- To avail of this benefit, visit Indus Moments for bookings

- Maximum discount subject to Rs 3000 on your Pioneer Heritage card

- The offer is not valid on home deliveries.

- Check the complete list of restaurants where you can get this benefit by clicking here.

BOGO on Movie Booking with BookMyShow

- With the Pioneer Heritage credit card, you get a buy 1 get 1 offer on movie ticket bookings on BookMyShow. You can get up to 3 complimentary tickets every month, with the maximum price capped at Rs 700 per ticket.

- With a Pioneer Heritage Metal credit card, you get 4 complimentary tickets every quarter. The price of complimentary tickets is capped at Rs. 1,000 per ticket.

- You get upto 20% off on your non-movie bookings, subject to a maximum discount of Rs 350 for every 2 tickets purchased.

Privileges with Club ITC Culinary Program

IndusInd Pioneer Heritage credit card provides you with exclusive dining privileges with the Club ITC Culinary Program.

- You get green points upto 25% on all dining spends at select ITC Hotels & Welcomhotels

- Get green points upto 5% on non-dining spending with select ITC Hotels, Welcomhotels & Fortune Hotels

- You can save up to 20% on dining expenses at select Fortune Hotels.

Travel Benefits

- You get unlimited Domestic as well as International lounge access with a Pioneer Heritage Metal credit card.

- You get 8 complimentary domestic lounge access every year (2 per quarter) at select airports with your Pioneer Heritage credit card.

- With complimentary LoungeKey membership, you get access to 8 international lounges every year (2 per quarter) with the Pioneer Heritage credit card.

Golf Benefits

- The primary cardholders get 12 complimentary rounds(3 per quarter) at selected golf courses every year.

- Furthermore, you get 4 complimentary golf access for guests subject to 1 complimentary access every calendar quarter.

- You also get 12 complimentary golf lessons on select golf courses subject to a maximum of 3 golf lessons every calendar quarter.

Insurance benefits

- You get a complimentary air accident protection cover worth upto Rs 2.5 crore on this credit card

- A protection liability cover in case of any fraudulent transactions reported within 48 hours.

Low Foreign Currency Markup Fee

This card comes with a relatively low foreign markup fee of 1.8%. You are charged 3.5% on the foreign conversion, and the differential amount will be credited to your credit card account.

Spend-Based Annual Fee Waiver

The annual fee of this credit card will be waived if the cardholder spends Rs. 10 Lakhs or more using this credit card in an anniversary year.

Fuel Surcharge Waiver

On all the fuel transactions done between Rs. 400 and Rs. 4,000 at all fuel stations in India, you will get a surcharge waiver of 1%.

IndusInd Bank Pioneer Heritage Credit Card Rewards

Following is the reward structure of this credit card:

- For every Rs. 100 spent on international transactions, you will get 2.5 Reward Points.

- For every Rs. 100 spent on domestic transactions, you will get 1 Reward Point.

How to Redeem Reward Points

The reward points accumulated can be redeemed against a host of redemption options, such as the Indus Moments reward portal, AirMiles, and statement cash.

| Redemption Methods | AirMiles

100 RP = 100 Intermiles |

| Cash Credit

1 RP = ₹ 1 Cash Value |

|

| Indus Moments

You can redeem your Reward Point Accumulated at Indus Moments Reward Portal for special gifts/vouchers |

You can redeem a minimum of 500 reward points against Cash Credit and AirMiles. Only up to 30,000 reward points can be redeemed per statement cycle.

Conclusion

IndusInd Pioneer Heritage credit card is a top-tier card for premium customers, providing best-in-class features and privileges on your spending. The sleek metal design on this credit card looks attractive. Besides that, you earn 2.5 reward points on every Rs. 100 spent on international spending and 1 reward point on every Rs 100 spent. The card provides you with multiple redemption options against cash credit, AirMiles, and IndusMoments. Like most IndusInd credit cards, this credit card offers you a significant cash credit ratio on redemption against statement cash. The joining fee charged is quite high on this credit card. However, you also get provided with a spend-based waiver on an annual fee on the spending of Rs 10,00,000. What do you think about this credit card? Do let us know in the comments.