The Infinia Credit Card is the most premium product offered by HDFC Bank. Recently, HDFC relaunched the Infinia Credit Card in the metallic variant (all new issuances of the card will now be on the metallic variant). It is an invite-only card as HDFC is targeting HNIs (High Net-Worth Individuals) with this card who want a luxurious lifestyle. The card offers exclusive privileges like 24*7 concierge services, access to premium golf destinations, and attractive dining benefits at some of the country’s most premium restaurant chains. All these benefits put this card in direct competition with ICICI Bank Emeralde Private Metal Credit Card, Yes Bank Marquee Credit Card, and Standard Chartered Ultimate Credit Card.

Keeping the international traveling needs of its premium customers in consideration, HDFC offers a lower foreign currency exchange rate of 2% and a complimentary membership to the Priority Pass program with this card. HDFC Infinia Metal is a Reward Points-based card: you earn 5 Reward Points for every Rs. 150 spent using this card. Although the membership fee for this card is slightly on the higher side, Rs. 12,500/annum is most certainly worth it, and it can be the card of preference for you if you’re someone who is financially stable and can not compromise with your lifestyle needs. To understand the features of this card in more detail, go through the article.

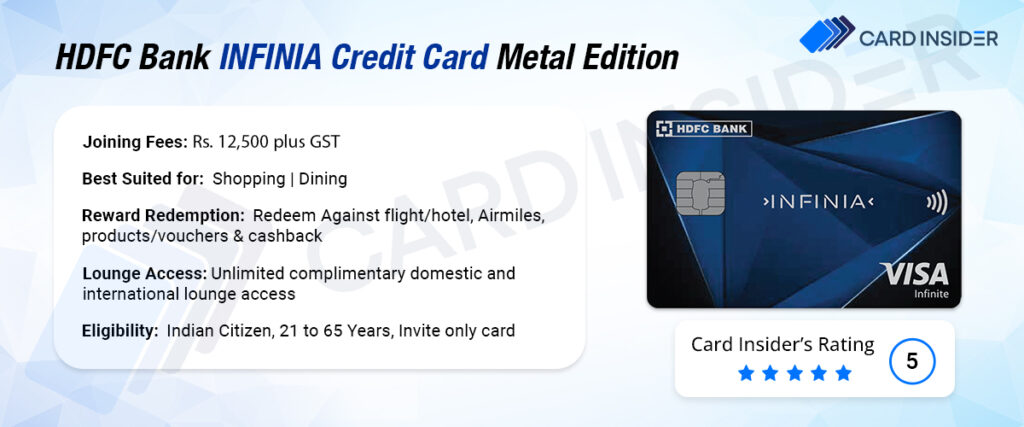

HDFC Bank INFINIA Metal Credit Card

Joining Fee

Renewal Fee

Best Suited For

Travel | Dining | Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

1 + 1 Complimentary Buffet at ITC Hotels and 15% off With Swiggy Dineout

Rewards Rate

5 Reward Points on every retail spend of Rs. 150, reward rate of up to 3.3%

Reward Redemption

RPs can be redeemed for flight and hotel bookings via SmartBuy (1 RP = Re. 1), Airmiles through net banking (1 RP = 1 Airmile), products and vouchers via net banking or SmartBuy (1 RP = Rs. 0.50), Apple and Tanishq vouchers (1 RP = Re. 1) cashback (1 RP = Rs. 0.30)

Travel

Complimentary Priority Pass Membership

Domestic Lounge Access

Unlimited Free Domestic Airport Lounge Access

International Lounge Access

Unlimited free access to international lounges across the globe for the primary cardmember and all add-on cardholders.

Golf

Unlimited complimentary golf games at leading golf courses across India and abroad. Unlimited golf coaching at multiple golf courses across India

Insurance Benefits

Insurance cover worth Rs. 3 crores against accidental air death, a cover worth Rs. 50 lakh against medical emergencies during international air travel, and credit shield cover worth Rs. 9 lakh

Spend-Based Waiver

Get renewal fee waived by spending Rs. 10 lakh in the previous year.

Rewards Redemption Fee

Nil

Foreign Currency Markup

2% of the total transaction amount + taxes

Interest Rates

1.99% per month or 23.8% annualized

Fuel Surcharge

1% fuel surcharge waiver up to Rs. 1,000 each month

Cash Advance Charges

NIL (Interests charges applicable)

- 1 year complimentary Club Marriott membership.

- 12,500 Reward Points as an introductory benefit.

- Unlimited access to airport lounges across the globe for both primary and add-on cardholders.

- Get 5 Reward Points on every Rs. 150 spent (except fuel transactions) with your HDFC Bank Infinia Card.

- 24×7 global concierge service.

- Unlimited golf games at leading golf destinations in India and abroad.

- 1+1 complimentary buffet on weekends at participating ITC hotels.

- 2+1 complimentary night stay at participating ITC hotels.

- Spend-based waiver annual membership fee.

Pros

- Unlimited lounge access at domestic as well as select foreign airports.

- Unlimited complimentary golf games at premier golf courses.

Cons

- The Infinia credit card doesn’t offer any yearly or monthly benefits.

HDFC Infinia Credit Card Metal Edition Features and Benefits

The Infinia Card issued by the HDFC Bank is the most premium and exclusive card offered by the issuer. This credit card offers some exceptional world-class privileges over different categories, including dining, travel, insurance, and many more. Following is detailed information about the features and benefits of the HDFC Infinia Metal credit card:

Welcome Benefits

- As a Welcome gift, HDFC gives you a complimentary Club Marriott membership for one year, as a part of which you get up to 20% off on restaurant bills for a maximum of 10 guests and 20% off on the best available rates at participating Marriott hotels in India and on Weekend Rates in the Asia Pacific with this card.

- Another Welcome Benefit that you get is 12,500 bonus Reward Points after successful payment of the joining fee.

Travel Benefits

| Benefit | Description |

| Airport Lounge Access | Get unlimited complimentary domestic as well as international lounge access (for primary as well as add-on Infinia cardholders) across the globe with the Priority Pass membership. In order to avail of the complimentary lounge access, always carry your Priority pass card with you and show the same to the lounge staff. |

| Club Marriott Membership | You also get a 1-year membership of the Club Marriott loyalty program, which entitles you to a 20% discount on the best available rates at some of the most luxurious hotels across India and on the Weekend Rates in the Asia Pacific. |

| ITC Hotels Complimentary Stay Benefits | Get a complimentary one-night stay at partner ITC hotels on booking a 2-night stay. Stay for 3 nights and pay for only 2 at participating ITC Hotels with the HDFC Bank Infinia credit card. This offer is only applicable for advance booking. |

Flight Bookings

The Smartbuy portal of HDFC Bank allows the HDFC Bank Infinia Credit Cardholders to book flights using the Reward points they have earned on their credit card. The value of 1 Reward Point for redemption against the flight booking is Re. 1. Other than this, you can also get exciting discounts and deals.

Dining Benefits

Club Mariott Membership

Enjoy a complimentary Club Mariott membership, which you get as a welcome Benefit for the first year with the INFINIA Credit Card Metal Edition. With this, you are entitled to enjoy the following privileges:

- Get up to 20% off on Food & Beverage bills at top restaurants.

- Get up to 15% off select hotels for a maximum of 10 guests.

- Enjoy 20% off on the Best Available Rates on rooms at participating Marriott hotels in India and on Weekend Rates in Asia Pacific.

- Get 20% off on Spa services at select participating Marriott hotels in India between Monday and Friday.

- Apply for membership with the Club Marriott South Asia App, where you can enter your membership number and verify your mobile number and email to create your login credentials. Then, unlock your Membership to access a range of benefits at Marriott hotels.

ITC Complimentary Buffet

Enjoy exclusive offers on Travel and Dining with ITC Hotels on the HDFC Bank INFINIA Credit Card.

- Get a 1+1 complimentary buffet at participating ITC Hotels with the HDFC Bank Infinia Credit Card (one complimentary buffet per booking and one booking per month). To avail of this offer, Call HDFC INFINIA 24×7 concierge services and book your reservation.

Golf Privileges

With INFINIA Credit Card, you are entitled to enjoy unlimited Complimentary golf games at leading courses across India and select courses across the world.

Each golf lesson will span a minimum of 30 minutes and will include:

- Green Fees to access the golf course or driving range.

- Cost of instructor’s fees

- Range golf balls at 50 golf balls per lesson.

Also, enjoy the benefit of Unlimited complimentary Golf coaching at select golf courses across India. In order to avail of this benefit, you need to book your slot through HDFC INFINIA 24×7 concierge services.

Fuel Surcharge Waiver

A 1% fuel surcharge is waived on all fuel purchases between Rs. 400 and Rs. 1,00,000 at all fuel stations across the country (maximum waiver is capped at Rs. 1,000 every month) done with the HDFC Bank Infinia credit card. Do note that no RPs can be earned for any purchases at fuel stations.

Spend-Based Renewal Fee Waiver

The renewal fee of Rs. 12,500 is waived for your card if Rs. 10,00,000 has been spent in the previous year.

HDFC Infinia Concierge Services

The HDFC Infinia Credit Card also offers 24*7 concierge services, some of which are as follows:

- Golf Booking

- Private dining assistance

- Airport VIP service

- Itinerary planning and reservation assistance

- International gift delivery

- Event planning and referrals

HDFC Infinia Rewards

- For every Rs. 150 spent using the Infinia HDFC card (except fuel spends), you earn 5 Reward Points.

- You earn accelerated 10X RPs on travel and shopping spends on the SmartBuy platform.

- The accelerated Rewards that you can earn with Infinia are capped at 15,000 points per month.

- Transactions like fuel, rent, property management, government spends, EasyEMI, and e-wallet reloading will not be eligible for RPs.

Being one of the best Rewards Credit Cards in the country, the Infinia metal edition card earns you Reward Points, which can be used to buy shopping vouchers, hotel bookings, and flight tickets and can be adjusted against the card’s statement balance (as has been discussed in detail in the next section).

HDFC Infinia Reward Redemption

- The Rewards earned using the Infinia HDFC credit card are redeemable on HDFC’s SmartBuy platform or via Netbanking.

- You can redeem the RPs against hotel/flight bookings, DTH recharges, etc., on SmartBuy (1 RP = Re. 1).

- Reward Points can also be converted into AirMiles via Netbanking (1 RP = 1 AirMile).

- You can also purchase products and vouchers via Netbanking or on SmartBuy using your RPs (1 RP = Rs. 0.50).

- Reward Points can also be redeemed against Tanishq and Apple vouchers on SmartBuy (1 RP = Re. 1).

- The RPs can also earn you cashback (i.e., can be redeemed against the statement balance of the card). The rate of redemption is, however, lower (1 RP = Rs. 0.30) in this case. It should be noted that for flight and hotel bookings and Apple and Tanishq vouchers, only 70% of the total payment can be made through the RPs.

- Reward point redemeption on Smartbuy against hotel and flight bookings are capped at 1,50,000 RPs per month.

- Reward point redemeption on Smartbuy against Tanishq vouchers is capped at 50,000 RPs per month.

- 14 new partners have recently been added to the reward points transfer program of the Infinia Credit Card. These partners include British Airways, Etihad Airways, Vietnam Airlines, and several more. You can redeem your earned points against the miles/loyalty points of these merchants via the Rewards360 portal at the following redemption rates:

| Value of 1 Reward Point | |

| Air Canada Aeroplan, British Airways, Etihad Airways, United Mileage Plus | 0.5 Mile/Loyalty Points |

| AirAsia Rewards, Accor Live Limitless, Avianca LifeMiles, Finnair Plus, Flying Blue, Hainan Airlines Fortune Wings Club, IHG One Reward, Vietnam Airlines Lotusmiles, Turkish Airlines, Wyndham Rewards | 1 Corresponding Mile/Loyalty Point |

HDFC Infinia SmartBuy

SmartBuy is a rewards portal exclusively made for HDFC bank customers where they can avail of exciting offers and deals over different categories. You get accelerated reward points on your Infinia Card when you make purchases via HDFC SmartBuy.

As discussed above, you can also redeem the reward points you earned using the HDFC Infinia Card on SmartBuy. Moreover, HDFC Bank keeps launching different offers on its credit/debit cards via the SmartBuy portal. To be updated on all HDFC SmartBuy offers and deals on Infinia Card, you can check this page regularly.

HDFC Infinia Metal Card Fees and Charges

The fees and charges associated with the HDFC Bank Infinia Credit Card are as follows:

- Joining Fee: HDFC Bank charges Rs. 12,500 (plus applicable taxes) as the joining fees for the HDFC Bank Infinia Credit Card.

- Annual Fee: HDFC Bank charges an annual membership fee of Rs. 12,500 (plus applicable taxes) for HDFC Bank Infinia Credit Card.

- Interest Rate: An interest of 1.99% per month (23.8% annually), which is only applicable on the due amount. This is incredibly low compared to a lot of other credit cards, which have an interest of 3.5% per month.

- Forex Markup Fee: The foreign currency markup fee of the HDFC Infinia Metal Edition Credit Card is 2% of the transaction amount, and it is very low. This fee is applicable when you transact in a different currency using your Infinia Card.

HDFC Infinia Credit Card Eligibility

The Infinia Card is an invite-only credit card, so there are no pre-defined eligibility criteria for this card. However, there are a few basic eligibility requirements that you will need to fulfill if you want to get invited for this card:

- Your age should be above 21 years and below 65 years.

- You should have a stable source of monthly income.

- You should have a very good credit history and an existing relationship with HDFC Bank.

Who Can Get Approved For HDFC Infinia Credit Card Metal Edition?

One can get invited for the HDFC Bank Infinia Credit Card if they already have an HDFC Credit Card, which they have used responsibly with no payment defaults. Other requirements for this card are an excellent credit score, a high annual income, etc.

Cards Similar To HDFC Infinia Metal Card

| Features | HDFC Infinia Metal Credit Card | Axis Bank Magnus Credit Card | Yes Bank Marquee Credit Card |

| Joining Fee | ₹12,500 + GST | ₹12,500 + GST | ₹9,999 + GST |

| Annual Fee | ₹12,500 + GST | ₹12,500 + GST | ₹4,999 + GST |

| Rewards Rate | 5 Reward Points on Every Spend of Rs. 150. 2X RPs on Dining. | 12 Axis EDGE REWARDS Points for Each Rs. 200 Spent, 5X EDGE REWARDS on Travel Spends. | 36 RPs for Each Spend of Rs. 200 on Online Shopping and 18 RPs for Each Offline Spend of Rs. 200. |

| Free Lounge Access | Unlimited Complimentary Access to Domestic and International Airport Lounges. | Unlimited Free Domestic and International Airport Lounge Access. | 6 Free Domestic Airport Lounge Visits Each Quarter (24 in a Year) and Unlimited International Lounge Access. |

Who Should Opt for the Infinia Credit Card?

The HDFC Bank Infinia credit card is an invite-only offering available only to clients who receive an official invitation from HDFC Bank. You might be eligible for the card based on your credit score, credit history, and other factors that the bank considers.

The card does charge a high joining and annual fee, but it is perfect for high net-worth individuals who desire unlimited lounge access, bonus reward points, high reward rates, and more privileges. If you get an invitation for this card, then you should definitely take advantage and use it to the maximum.

Review of HDFC Infinia Credit Card

HDFC Bank Infinia credit card offers a plethora of benefits to its customers, including lifestyle benefits like a 24×7 concierge service, complimentary access to the country’s leading golf destinations, dining and travel benefits like unlimited complimentary lounge access to all around the world with the Priority Pass membership, flight/hotel bookings using Reward Points and, obviously, shopping benefit of 5 Reward Points per Rs. 150 spent with the card.

Considering all these benefits and privileges, it’s safe to say that this card fits the needs of almost all types of customers. Of course, since it’s a premium credit card, although the bank has not mentioned it explicitly in their terms and conditions, your net worth must be fairly high to be eligible for this card.

This was HDFC Infinia Credit Card Review from our side. What do you think of this card? We’d love to know your opinion, so feel free to leave a comment. And if you’re an existing cardholder, do let us know about your experience with the card.

FAQs:

- Login to your HDFC Net banking account.

- Click on the tab 'Credit Cards.'

- Register your credit card if not already done.

- Click on the option 'Redeem reward points' on the left navigation bar.

- Select your card and click on continue.

- Select the required category/products and redeem your points.

- You should have a long relationship with the HDFC Bank.

- You should have a high net relationship value with the bank (in the form of loans, life insurance, FDs, mutual funds, etc).

- Regular and responsible use of the existing HDFC credit card.

I have the PVC version of HDFC Infinia LTF and I don’t intend to upgrade to metal just for a cosmetic upgrade. No doubt the card is quite rewarding but I have starting using axis Magnus more due to frequent devaluations in case of Infinia. If used for air miles, Magnus is more rewarding than Infinia. And if you can spend more than a lakh a month even 2-3 times in a year, Magnus becomes head and shoulders above Infinia

Guess after the recent Magnus devaluation Infinia is better again.

How to get HDFC infinia as LTF? I am using LTF DBC from last 1 year with limit of 12L+. Is there any criteria to upgrade to LTF infinia.

You should have very good standing with the bank to get Infinia.

Can someone clarify the daily cap on SmartBuy which is 7500 points, is that for bonus or regular+bonus?

I remember earlier posts mentioning that it is just for bonus so you can spend upto some 56K to hit that limit(for 5X partners). However I just called smart buy customer care, and they were very clear. 7500 includes normal rewards so daily limit is not 56K but 45K. So let’s say you send 50K, you will get 7500 reward points for 45K, and for remaining 5K INR value, you will get 1X points which is 166 points

I beg to disagree from your observation that “7500 includes normal rewards points”. I recently purchased iPhone 14 worth Rs 73900 from imagine tressor. Against this Credit card transaction (By Infinia Metallic) they gave me Rs 4000/- cashback & 2460 Base reward point & 7500 reward point. So I am happy after paying Rs 59940/- (73900-4000-2460-7500) for iPhone 14. But I do agree that frequent devaluations of Infinia reward points are taking this card down.

is insurance payments considered in milestone for 10 Lakh spend of fee reversal ?

Is there any reward points for annual fee payment?

I would also like to know this. Have you figured it yet?

You would receive 10,000 Reward Points on realisation of annual renewal fees.

2x benefit for standalone restaurants has been discontinued since 2021 end, kindly update and thanks for the informative article.

The page has been updated and reflects the latest information as of Dec, 2023.

How can this can gets 5 out of 5, when they don’t offer BOGO offer on Movie or Activity Tickets?

ICICI Bank Emeralde Card offers almost same benefits with unique BOGO Movie / Activity Tickets on Bookmyshow up to Rs.750 per ticket.

IDFC First Wealth Card offers similar benefits as well.

Although Infinia doesn’t have any movie benefits since its on VISA Infinite you can get great offers and discounts on movies like 50% off on movie bookings etc. You can also get discounts on food and beverages.

Needless to be a benefit as the VISA Infinite ticket prices are limited to Rs.300 (not typical 50%). Which movie tickets are prices less than Rs.300 these days (apart from exceptional in TN state)?

On top of this, most of the times the limit of this offer gets exhausted with limited quota.

ICICI Bank Emeralde & IDFC First Wealth cards provides over and above VISA Infinite privileges, from Bookmyshow and Paytm platforms.

I had earlier used HDFC Infinia credit card and sad to say, they still follow cheap marketing tactics and legacy policies which always not Client-Friendly.

VISA Infinite Offer Source page: https://in.bookmyshow.com/offers/visa-infinite-card-offer/VIP0116

Cardinisider.com should provide voting option to users for authentic ratings, instead fabricated and misleading.

Tanishq vouchers are no longer there to purchase.. please confirm.

it is available on smartbuy infinia rewards section as luxury vouchers , available as 10k ,5k, 2k, 1k vouchers.

do we get 5x rewards on redeeming at tanishq voucvhers for 30% paid by card ?? can any one update ???