Crest credit card by IndusInd bank is a top-end offering that comes packed with many premium benefits, including a 24×7 concierge service, personal air accident cover, complimentary LoungeKey membership, and multiple best-in-class privileges that one expects from a premium credit card. The Crest card is very similar to IndusInd Bank’s own Indulge Credit Card (we’ve already covered the Indulge card in our earlier posts). That being said, the Crest credit card offers a few additional travel benefits. Not only lounge access, but it comes with various other premium advantages, such as complimentary stays at Oberoi hotels, special airport services, etc.

Coming to its entertainment benefits, one can avail of complimentary movie tickets (3 per month) by booking through BookMyShow. Making your dining experiences more rewarding, it provides you with Club ITC Culinaire membership and up to 25% savings on your dining bills. To know more about this card, keep reading.

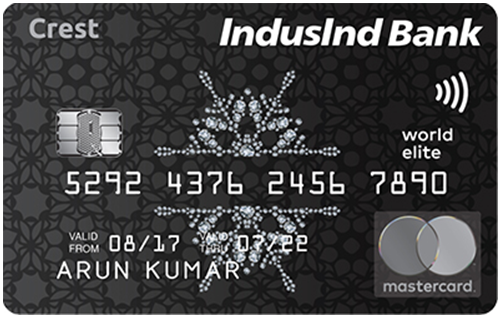

IndusInd Bank Crest Credit Card

Joining Fee

Renewal Fee

Best Suited For

Travel | Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

Buy One Get One ticket offers on BookMyShow (max 3 free tickets per month), exclusive dining benefits with Club ITC Culinaire membership.

Rewards Rate

0.70 Reward Points per Rs. 100 on international & domestic spends

Reward Redemption

1 RP = Rs.0.75 for redeeming against cash credit and 1 RP = 1 AirMile when redeeming against partner airlines' airmiles.

Travel

LoungeKey membership with complimentary lounge access per quarter, and complimentary access to domestic lounges under the MasterCard India lounge access program.

Domestic Lounge Access

2 complimentary domestic lounge visits quarterly under the MasterCard Lounge access program.

International Lounge Access

2 complimentary international lounge visits every quarter with the LoungeKey membership

Golf

3 complimentary golf rounds and golf lessons every month with the exclusive golf program and 12 complimentary golf lessons & golf games every year with the Mastercard Golf program.

Insurance Benefits

Personal air-accident cover worth Rs. 2.5 crores, lost card liability protection from 48 hours prior to the time of reporting the loss of card.

Spend-Based Waiver

Annual membership fee waived off on spending Rs. 20,00,000 in the previous year

Rewards Redemption Fee

Rs. 100

Foreign Currency Markup

3.5% + GST

Interest Rates

2.99% per month (or 36% annually)

Fuel Surcharge

Waived for transactions between Rs. 400 and Rs. 4,000

Cash Advance Charges

2.5% of the advanced amount, subject to a minimum amount of Rs. 300

- 0.70 Reward Points for every Rs. 100 spent on all domestic & international purchases.

- Reward Points can be transferred to partner airlines’ AirMiles programs or redeemable against Cash Credit.

- Complimentary access to domestic and international lounges.

- Airport benefits include private check-in, private (arrival and departure) lounge, chauffeured car (to and from the aircraft), luggage delivered directly to the private arrival lounge, etc.

- Discount on dining bills with Club ITC Culinaire membership.

- Complimentary golf lessons and golf games every year with the exclusive golf program and MasterCard golf program each.

- Buy One Get One offer on BookMyShow movie tickets (max three free tickets/month). Free ticket price capped at Rs. 700. Additional discount of Rs. 50 on selecting the F&B option.

- Up to Rs. 3,000 off on dining bills at over 100 partner restaurants.

- Lost card liability cover from up to 48 hours prior to reporting the loss of card.

- Personal air accident cover (worth Rs. 2.5 crores).

IndusInd Bank Crest Credit Card Features and Benefits

Given below are some of the features and benefits of this credit card-

Travel Benefits

- Reward Points are redeemable for AirMiles at partner airlines.

- LoungeKey membership with 2 free international lounge visits per quarter per guest.

- 2 complimentary domestic lounge access every quarter under the MasterCard India Lounge program.

- 15% discount on Meet and Greet services with the Mastercard Airport Concierge service

- Premium airport services include a private lounge, chauffeured car, direct delivery to the arrival lounge, etc.

- Global Data Roaming by Flexiroam

Dining Benefits

- Discount on dining bills with Club ITC Culinaire membership.

- Green Points is equivalent to 25% of the spends on the eligible food and beverages at ITC Hotels and Welcome Hotels.

- 20% savings on dining bills at Fortune and WelcomHeritage Hotels.

- 1,000 bonus Green Points on every accumulated spend of Rs. 25,000 on food and beverages (up to a maximum spend of Rs. 1,00,000).

- Receive 50% bonus Green Points during your or your spouse’s birthday week on your dining spends.

Movie Benefits

- Buy one movie ticket from BookMyShow and get another ticket absolutely free. You can get a maximum of 3 tickets per month. Maximum discount capped at Rs. 700 (if the ticket price exceeds Rs. 700, the rest of the amount has to be paid with the card). Additional discount of Rs. 50 on selecting the F&B option.

- 20% off on theatre and events bookings on BookMyShow (max discount capped at Rs. 700).

Golf Privileges

- 3 complimentary golf games and 3 golf lessons every month with the exclusive Golf Program.

- 12 complimentary rounds of green fees and 12 complimentary golf lessons (3 per quarter) every year with the MasterCard golf Program.

- 4 complimentary green fees for guests (not more than 1 per quarter).

- Private Club Access to TPC private golf courses. Choose from over 15 premium properties in the USA and experience the lifestyle of professional golfers.

Insurance Benefits

- Complimentary cover for personal air accident worth Rs. 2.5 crores.

- Lost card liability protection is applicable from up to 48 hours before reporting the loss of the card.

Other Benefits

- With Crest Auto Assist, you can call for roadside assistance anytime and get help with Roadside repair, emergency fuel supply, battery service, flat tyres, etc.

- With the Advance Medical privilege, get complimentary access to the top 50,000 doctors in the world.

IndusInd Bank Crest Credit Card Rewards

- 0.70 Reward Points per Rs. 100 on all international and domestic spends.

- No reward points shall be awarded on rental payments, utility bill payments, education institute fees and insurance premium payments.

Reward Redemption

- Redeem the reward point earned against an array of options at Indus Moments.

- Transfer the Reward Points to partner airlines’ AirMiles programs. 1 RP = 1 AirMile.

- Reward Points are redeemable for cash credit (i.e. to pay your card bills). 1 Reward Point = Rs.0.75.

- The maximum redemption limit for the cash credit option is 30,000 reward points in one statement cycle.

How to Apply for IndusInd Bank Crest Credit Card?

Easily apply for the Crest Credit Card with Card Insider. On our website, you can compare multiple credit cards, check their features and benefits and apply for them also. Click on the Apply Now button on your screen to successfully apply for the IndusInd Bank Crest Credit Card. You need to submit a few documents, including address/identity proof and proof of income, to get your application processed.

To apply offline for the same, visit your nearest IndusInd Bank branch.

IndusInd Bank Customer Care

For any assistance or to report the loss of a card, you may dial IndusInd Bank’s customer care number, 1860 267 7777, from your registered phone number.

IndusInd Bank Crest Credit Card Review

Keeping all its benefits in mind (travel benefits in particular) and a high reward rate on both domestic as well as international spends, the Crest credit card by IndusInd bank, despite its high membership fee, can be considered a really attractive offering at least for the high net-worth customers of the bank who don’t want to compromise with their lifestyle requirements. That’s our take on this top-end offering by the IndusInd bank.

What are your views on this credit card? Let us know in the comments. And in case you have already used the card, don’t forget to share your experience.