Etihad Airways is a UAE-based airline brand and is among one of the top airline companies in the world. The airline has flights to all corners in the world and is perfect for Indian travellers who frequently visit to the Middle East and Dubai region. There are many Indian high net-worth individuals and NRIs that regularly visit Dubai and Etihad Airlines is the perfect choice for them.

Etihad Guest, the airline’s loyalty program offers exclusive privileges and benefits to members who can earn Etihad Guest Miles for their travels. Etihad Airways and SBI launched their co-branded travel cards that offer Etihad Guest Tier status to the cardholders and bonus Miles as rewards.

Other than that, there are many credit cards by different issuers that allow cardholders to transfer their reward points to Etihad Guest Miles. In this article, we will check out both co-branded Etihad cards and other top cards to earn Etihad Guest miles in India.

- Etihad Co-Branded Cards in India:

- Best Credit Card to Earn Etihad Guest Miles:

- Axis Bank Reserve Credit Card

- Axis Bank Magnus Credit Card

- Axis Bank Atlas Credit Card

- Axis Bank Privilege Credit Card

- Axis Bank SELECT Credit Card

- HDFC Bank INFINIA Credit Card Metal Edition

- HDFC Bank Diners Club Black Credit Card

- Citibank Prestige Credit Card

- Citibank PremierMiles Credit Card

- American Express Platinum Credit Card

Etihad Co-Branded Cards in India

SBI partnered with Etihad Airways to launch two co-branded travel credit cards in 2019 – Etihad Guest SBI and Etihad Guest SBI Premier.

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

The premium variant out of the two co-branded cards, the Etihad Guest SBI Premier credit card has a higher annual fee of Rs. 5000 and offers a complimentary Etihad Guest Gold tier status to the cardholder. You even receive 5000 Miles and 2 free WiFi vouchers for your first Etihad flight as a welcome benefit. Being a co-branded card, you get exclusive discounts on flights booked at Etihad portal and other privileges with the airline. The Guest Miles earned by you can be redeemed on etihadguest.com against flights/hotel bookings, car rentals, or other products.

- Complimentary Etihad Guest Gold tier status

- 2 complimentary WiFi vouchers for 1st Etihad booking and 5000 Guest Miles as welcome benefit

- 6 Guest Miles per Rs. 100 spent on Etihad.com

- 4 Guest Miles per Rs. 100 on international spends and 2 Guest Miles per Rs. 100 spent elsewhere

- Up to 10% off on Etihad Airways flight booking and on travel, miles redemption

- 1500 Guest Miles on spending Rs. 1,50,000 per quarter

- Etihad Companion voucher on spending Rs. 8 Lakhs in the previous year

- Domestic and international lounge access with Priority Pass membership

- Fuel surcharge waiver and renewal fee waiver

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

The co-branded Etihad Guest SBI card is the basic variant out of the two and charges a joining fee of Rs. 1500. The card offers a complimentary Etihad Guest Silver tier status to the cardholder along with 2500 Etihad Guest Miles, and a complimentary WiFi voucher for 1st Etihad booking as welcome benefits. The card is ideal for people who frequently travel especially to the Middle East and Dubai area. You also get complimentary lounge access and exclusive discounts on Etihad flight bookings.

- 2500 Guest Miles and complimentary Etihad Guest Silver tier status as welcome benefit

- 1 complimentary free WiFi voucher on first Etihad flight booking

- 3 Guest Miles per Rs. 100 spent on Etihad.com

- 2 Guest Miles per Rs. 100 on international spends and 1 Guest Mile per Rs. 100 on other spends

- 10% discount on business class and 3% discount on economy class Etihad flight ticket

- 1 companion voucher on spending Rs. 10 Lakhs or more and 5000 Guest Miles on spending Rs. 5 Lakhs in the year

- Complimentary Priority Pass membership and 8 complimentary domestic lounge access, max 2 per quarter

- 1% fuel surcharge waiver and renewal fee waiver

Best Credit Card to Earn Etihad Guest Miles

Etihad Airways has partnership with multiple top card issuers and you can transfer your card reward points to Etihad Guest Miles. Different credit cards have different transfer ratio and minimum redemption amounts. The following are the best credit cards in India to earn Etihad Guest Miles.

Fees

Joining Fee

Renewal Fee

Best Suited For

Movies

Reward Type

Reward Points

Welcome Benefits

Card Details +

The topmost offering by Axis Bank and the most premium card in their lineup, the Reserve credit card has a very high Rs. 50,000 joining fee. You can get a complimentary Club ITC Culinaire membership, Club Marriott, and Accor Plus membership along with 2x reward points on foreign currency spends with the card. Other travel privileges include airport transfers, lounge access, exclusive offers at Oberoi and Postcard hotels, etc.

You can get exclusive movie and dining benefits and can benefit from the low 1.5% forex markup fee of the card. You get 50,000 EDGE reward points as a welcome benefit and 15 RPs per Rs. 200 spent and 2x RPs on international spends. The reward points can be converted Etihad Miles at a 5:2 ratio, where 5 RPs = 2 Etihad Miles. Customers with a Burgundy account can continue using the transfer ratio of 5:4.

| Reward Point Earning Rate | 15 RPs per Rs. 200 spent and 2x RPs on international spends. |

| Points Conversion | 5 EDGE RPs = 2 Etihad Miles |

| Effective Reward Rate | 3% on normal and 6% on international spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Movies

Reward Type

Reward Points

Welcome Benefits

Card Details +

The Axis Bank Magnus is the bank’s most popular card offering and it is packed with the top privileges across all categories. You have to pay a joining fee of Rs. 12,500 for the card and it offers several travel benefits include complimentary lounge access, airport concierge services, discounted hotels stays, and more. You can even benefit from the movie ticket offers and exclusive dining discounts. The Magnus credit card has a decent reward rate and offers 12 reward points per Rs. 200 spent up to Rs. 1.5 Lakhs in the month, 35 RPs on spends above Rs. 1.5 Lakhs, and 5x reward points on spends made at the Travel Edge portal. You can transfer your EDGE reward points to Etihad Miles at a 5:2 ratio, where 5 RPs = 2 Etihad Miles. Customers with a Burgundy account can continue using the transfer ratio of 5:4.

| Reward Points Earning Rate | 12 Axis EDGE REWARDS Points per Rs. 200 spent on retail up to Rs. 1.5 Lakhs. 35 RPs per Rs. 200 spent on spends above Rs. 1.5 Lakhs and 5X EDGE REWARDS on travel spends. |

| Points Conversion | 5 EDGE REWARD Points = 2 Etihad Guest Miles |

| Effective Reward Rate (for redemption against Miles) | 2.4% on retail spends, 7% on spends above Rs. 1.5 Lakhs, and 12% on Travel Edge spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

A sub-premium offering in the travel segment, the Axis Bank Atlas credit charges a joining fee of Rs. 5000. It is not a co-branded card but still offers lots of exclusive travel privileges and benefits to the cardholder. The best benefit for frequent travellers is that the card offers Edge Miles as reward points. These miles can be redeemed for flight/hotel bookings, points transfer to airline, hotel partners, etc.

Other benefits with the card include complimentary lounge access, high rewards on international spends, airport concierge service, etc. The card has three tiers- Silver, Gold, and Platinum and you get added perks with higher tiers. You get 5 Edge Miles per Rs. 100 spent on travel and 2 Edge Miles per Rs. 100 spent elsewhere. The Edge Miles can be converted to Etihad Miles at a 1:2 ratio, where 1 Edge Mile = 2 Etihad Miles.

| Reward Point Earning Rate | 5 Edge Miles per Rs. 100 spent on travel and 2 Edge Miles per Rs. 100 spent elsewhere. |

| Points Conversion | 1 Edge Mile = 2 Etihad Miles |

| Effective Reward Rate | 4% on normal and 10% on travel spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Card Details +

A decent mid-range card offering by Axis Bank, the Privilege credit card charges a Rs. 1500 joining fee and is packed with several travel and shopping benefits for the cardholder. The card offers bonus 12,500 EDGE reward points as welcome benefit and the card is free for Priority Banking customers. You can get access to airport lounges and get exclusive discounts at partner restaurants across India.

Apart from this, you get bonus 3000 reward points whenever the card is renewed. These points can even be converted to shopping and travel vouchers worth twice their value on reaching annual spend milestone. You get 10 RPs per Rs. 200 spent with the card and these points can be converted to Etihad Miles at a 5:1 ratio, where 5 RPs = 1 Etihad Mile.

| Reward Point Earning Rate | 10 EDGE RPs per RS. 200 spent with the card |

| Points Conversion | 5 RPs = 1 Etihad Mile |

| Effective Reward Rate | 1% on normal spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

Another nice lifestyle card offering by Axis Bank, the Select credit card has a joining fee of Rs. 3000 and offers multiple benefits and privileges across different categories like shopping, movies, dining, travel, etc. The card offers a complimentary Priority Pass membership to the cardholder with domestic and international lounge access, exclusive offers on Swiggy, and more. You can even get discount on BookMyShow movie ticket bookings and complimentary golf rounds.

The Select credit card has a nice reward rate and you get 10 EDGE reward points on every spend of Rs. 200 with the card and 20 RPs on retail spends. The reward points can be converted to Etihad Miles at a ratio of 5:1, where 5 RPs = 1 Etihad Mile.

| Reward Point Earning Rate | 10 RPs per Rs. 200 spent and 20 RPs on retail spends |

| Points Conversion | 5 RPs = 1 Etihad Mile |

| Effective Reward Rate | 1% on normal and 2% on travel spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

HDFC Bank’s most super-premium credit card, the Infinia features a metallic body and has a high Rs. 12,500 joining fee. It is an invite-only card exclusively meant for high net-worth individuals. The card is packed with top privileges like complimentary lounge access, golf rounds, hotel loyalty program memberships, and more. You can have access to exclusive dining and movie benefits, a low forex markup fee, and a great reward rate.

The card offers 12500 bonus reward points as welcome benefit and 5 RPs on every spend of Rs. 150 with the card. You can transfer your reward points to Etihad Miles at 1:0.5 ratio, where 1 RP = 0.5 Etihad Miles.

| Reward Point Earning Rate | 5 RPs per Rs. 150 spent |

| Points Conversion | 1 RP = 0.5 Etihad Miles |

| Effective Reward Rate | 1.66% |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

The HDFC Bank Diners Club Black credit card is another super-premium offering by the bank that comes at a joining fee of Rs. 10,000. Cardholders get a complimentary membership to Times Prime, Amazon Prime, and Zomato Gold as a welcome benefit. The card offers complimentary vouchers on achieving monthly spends, airport lounge access, golf rounds, and many other excusive privileges to the cardholder. With a low forex markup fee of 2%, it is good for people who make international spends.

The Diners Club Black card offers 5 reward points per Rs. 150 spent, with accelerated 10x RPs on partner brands, and 2x RPs on weekend dining. You can transfer your reward points to Etihad Miles at 1:0.5 ratio, where 1 RP = 0.5 Etihad Miles.

| Reward Point Earning Rate | 5 RPs per Rs. 150 spent |

| Points Conversion | 1 RP = 0.5 Etihad Miles |

| Effective Reward Rate | 1.66% on normal and 16.6% on partner brand spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

A super-premium lifestyle and travel card by Citibank, the Prestige credit card offers a high reward rate and is packed with lots of travel privileges. You get a Taj or ITC hotel welcome gift voucher and a complimentary stay at hotels around the world. The card offers a Priority Pass membership with unlimited domestic and international lounge access. It also provides lifestyle benefits like movie discounts, and complimentary golf rounds across the world.

With this credit card, you get 2500 reward points as a welcome benefit. Moreover, you get 1 RP per Rs. 100 on domestic spends and 2 RPs per Rs. 100 on international spends. You get a high transfer ratio and you can convert your RPs to Etihad Miles at a 1:4 ratio, where 1 RP = 4 Etihad Miles.

| Reward Point Earning Rate | 1 RP per Rs. 100 on domestic spends and 2 RPs per Rs. 100 on international spends |

| Points Conversion | 1 RP = 4 Etihad Miles |

| Effective Reward Rate | 4% on domestic and 8% on international spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

One of the best travel credit cards in the country, the CitiBank PremierMiles credit card is perfect for people who fly regularly. The card offers AirMiles as reward points for your spends which can be redeemed for shopping, booking hotel/flight tickets, and transferring to partner airlines miles. As a welcome benefit, you receive 10000 Miles as a welcome benefit and 3000 Miles upon card renewal. You get up to 8 complimentary domestic lounge access, dining discounts, and insurance benefits with the card.

Apart from the bonus AirMiles as welcome benefit, the card offers 10 Miles per Rs. 100 spent on airline transactions and 4 Miles per Rs. 100 spent elsewhere. The AirMiles earned by you can be transferred to Etihad Guest Miles at a 2:1 ratio, where 2 AirMiles = 1 Etihad Mile.

| Reward Point Earning Rate | 10 Miles per Rs. 100 spent on airline transactions and 4 Miles per Rs. 100 spent elsewhere. |

| Points Conversion | 2 Miles = 1 Etihad Mile |

| Effective Reward Rate | 5% on airline and 2% on spends elsewhere |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

The Platinum credit card is the flagship offering by American Express and is a super-premium card packed with multiple benefits and privileges. You get special discounts at top hotels, airlines, and other brands. It is a Charge card that does not have a preset limit and changes based on your spending patterns.

Some other benefits include complimentary international and domestic lounge access, EazyDiner membership, complimentary golf rounds, and more. You get 1 Membership Reward points per Rs. 40 spent, 3x rewards on international spends, and 5x RPs on spends via Amex Reward Multiplier. You can transfer your MR points to Etihad Miles, where 1600 MR Points = 800 Etihad Miles.

| Reward Point Earning Rate | 1 MR point per Rs. 40 spent, 3x rewards on international spends, and 5x RPs on spends via Amex Reward Multiplier. |

| Points Conversion | 1600 MR Points = 800 Etihad Miles |

| Effective Reward Rate | 5% on normal spends, 15% on international spends, and 25% on Amex Reward Multiplier |

Etihad Guest Program – Tiers and Status

The Etihad Guest program has 4 status tiers – Bronze, Silver, Gold, and Platinum. The higher your tier status, the more privileges and benefits received by you on Etihad flights. As you fly more and more, apart from Guest Miles, you earn Tier Miles that are used to attain higher tier status.

The following criteria must be fulfilled to attain a particular tier –

- Etihad Guest Bronze – Automatically upon membership

- Etihad Guest Silver – 25000 Tier Miles or 20 Tier Segments

- Etihad Guest Gold – 50,000 Tier Miles or 40 Tier Segments

- Etihad Guest Platinum – 125,000 Tier Miles or 60 Tier Segments

Benefits and Privileges

Based on your Etihad Guest tier status, you get the following benefits and privileges –

Bronze – When you register to the program, you automatically attain the Bronze status tier. You earn Guest Miles that can be redeemed at the Reward Shop or used to book flights or upgrade cabins. You start getting benefits such as priority check-in, complimentary lounge access, baggage allowance, etc.

Silver – When you attain the Etihad Guest Silver tier, you get extra 25% Tier Bonus Miles, priority check-in, lounge access in Abu Dhabi, and more.

Gold – When you attain the Etihad Guest Gold tier, you get complimentary lounge access, priority check-in, 50% extra Tier Bonus miles, priority boarding, fast track immigration, and more with the card. You can access the Premium Twitter account to stay updated regarding discounts and offers.

Platinum – When you attain the Etihad Guest Platinum tier, you get lounge access, priority boarding, priority check-in, fast-track immigration, 75% Bonus Tier miles, and many other benefits. You also get access to the Premium Twitter account.

How to Book Etihad Flights Using Guest Miles?

You must have valid Etihad Guest Miles in your account to book flights through them. If you have a co-branded SBI Etihad Credit Card, you will get complimentary Etihad Guest tier status and bonus Guest Miles. If you do not have it, then you will first need to transfer your credit card reward points to Etihad Guest Miles.

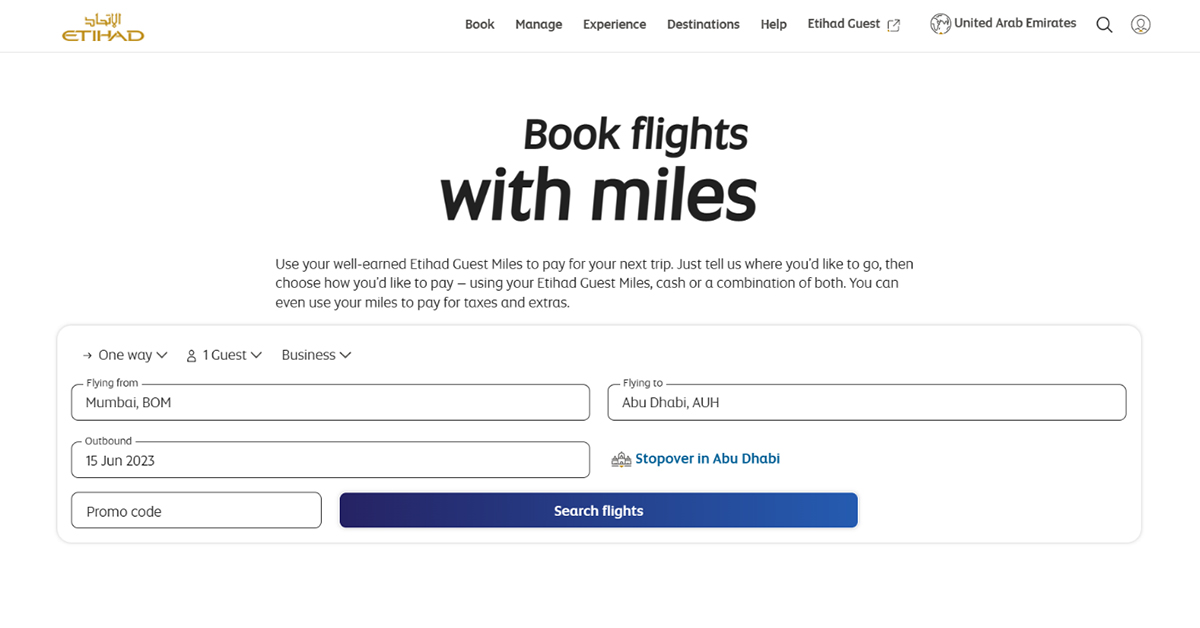

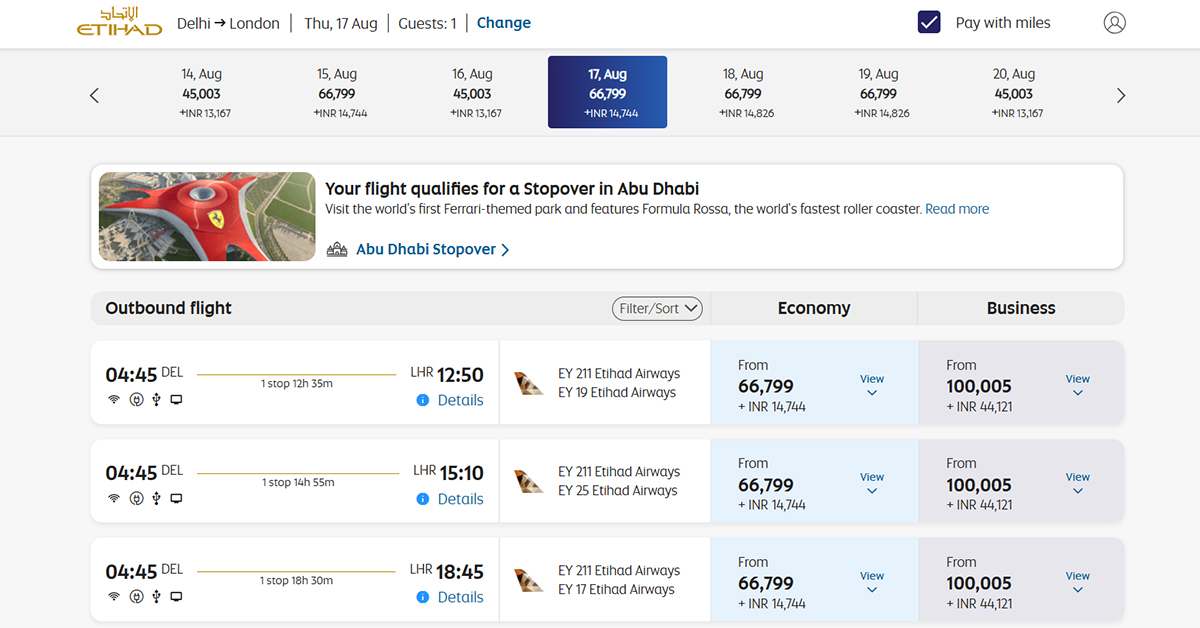

Once you have done that, follow these steps to book Etihad Flights using Miles –

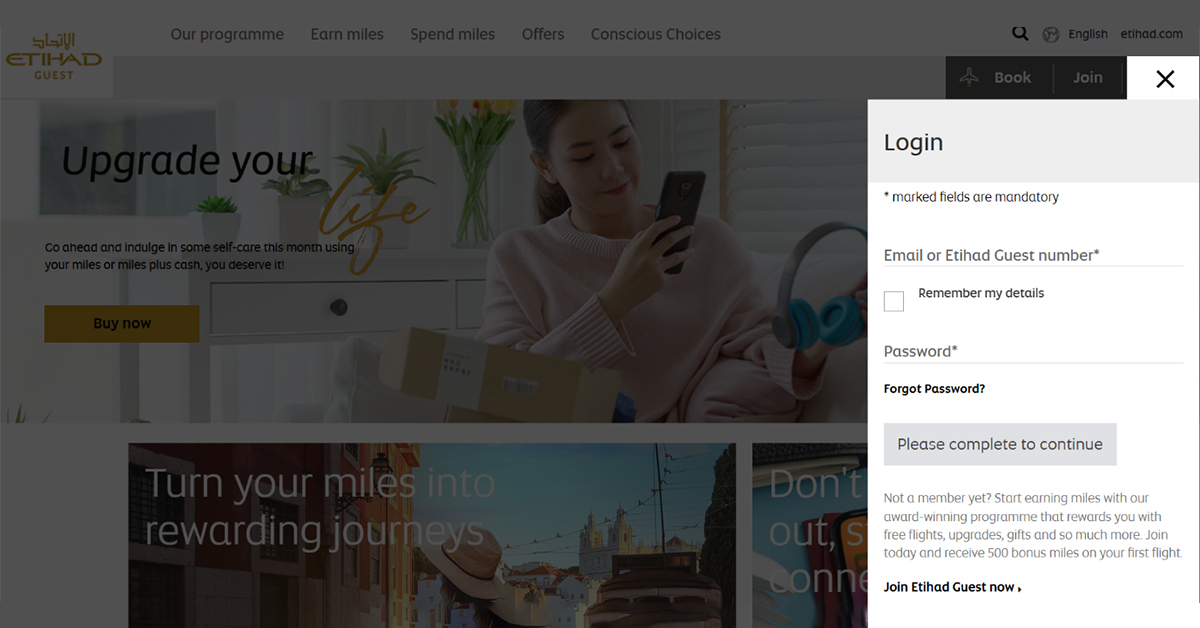

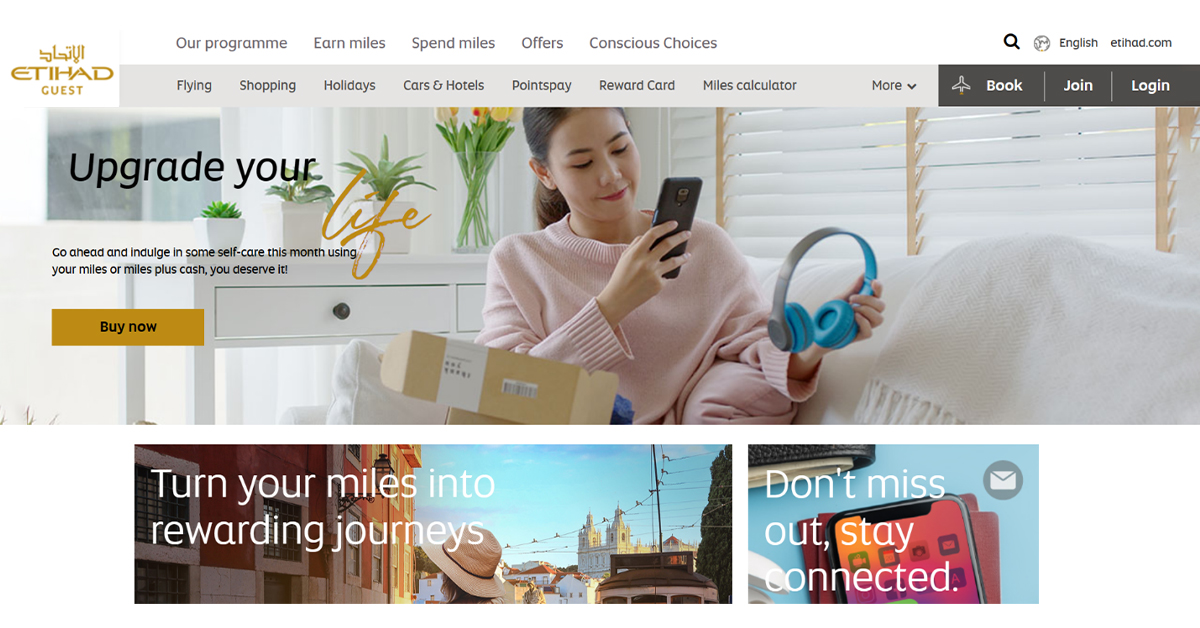

- Visit the Etihad Guest website and log in to your account.

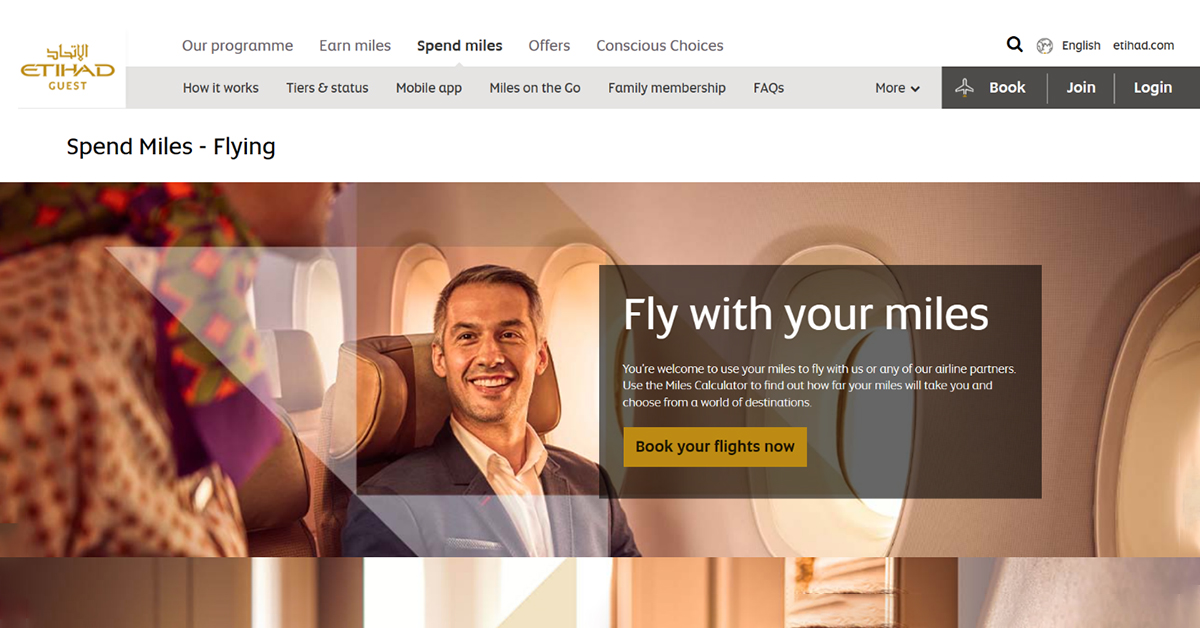

- Hover your mouse over ‘Spend Miles’ in the top menu and then click on ‘Flying’

- Next, you have to click on Book your Flights Now.

- Enter your destination and arrival location, date of travel, fare class, and other details. Click on Find Flights after.

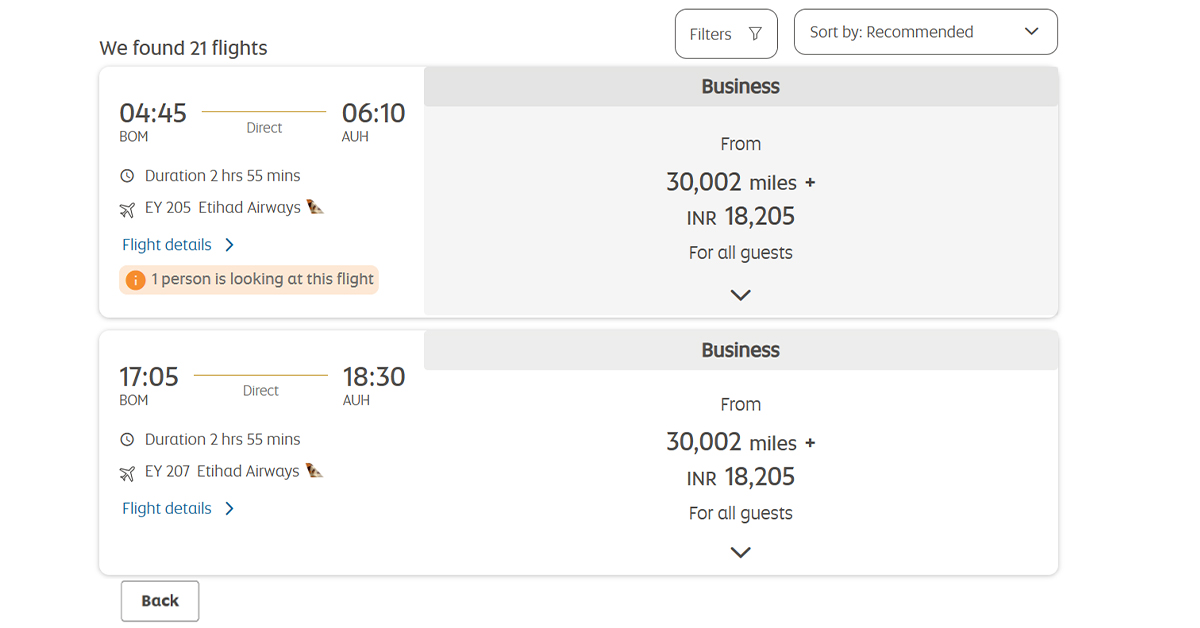

- You will see all available flights with the the Miles required to book them along with the amount to be paid in cash.

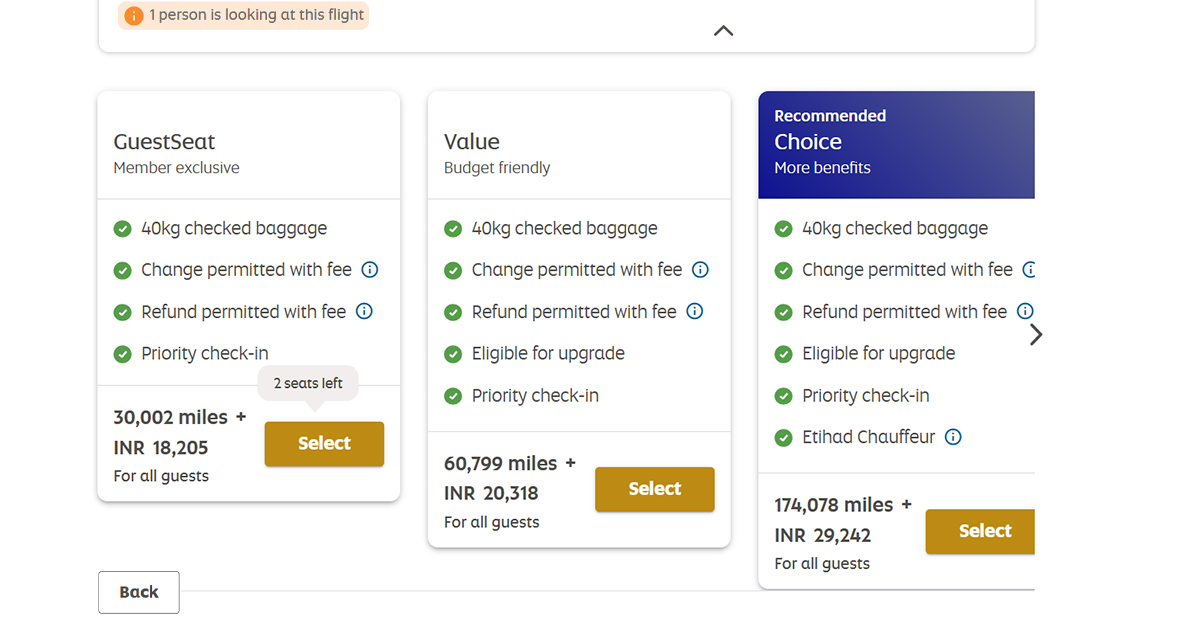

- Next, choose the flight package you want and proceed to finalize the booking by redeeming Guest Miles and paying the rest of the amount.

Booking Etihad Flights via Partner Airlines Miles

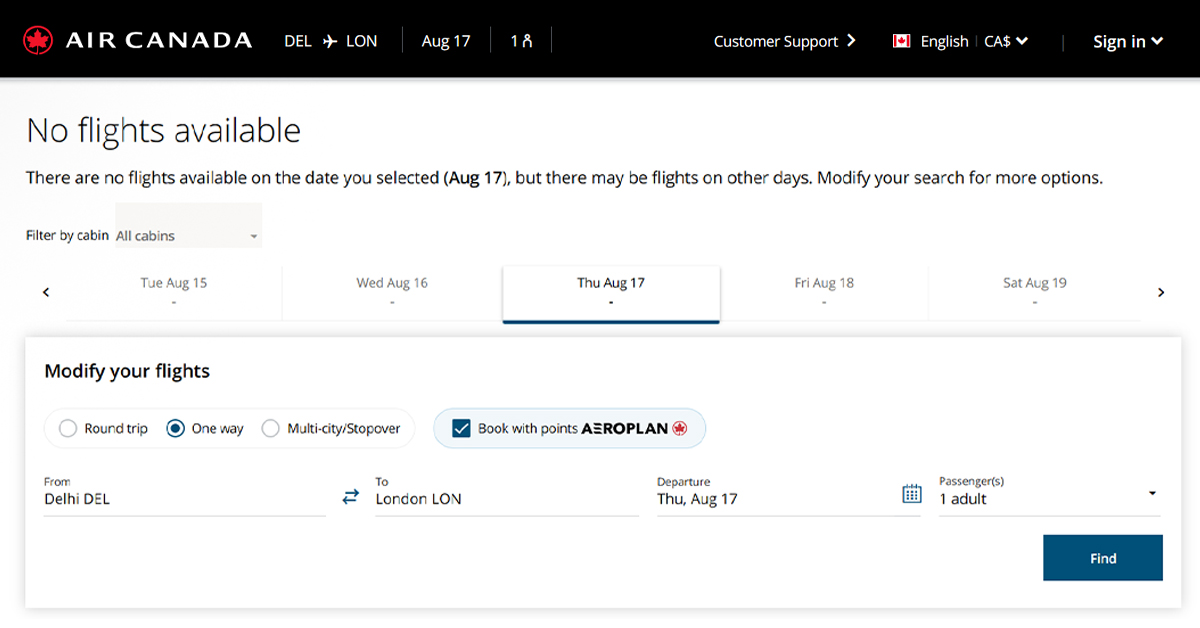

Other than booking Etihad flights on the Etihad website via Guest Miles, you can even book Etihad Flights via partner airlines miles like Aeroplan. Currently, you can only book Economy Class flights via Aeroplan and here is how you can do so –

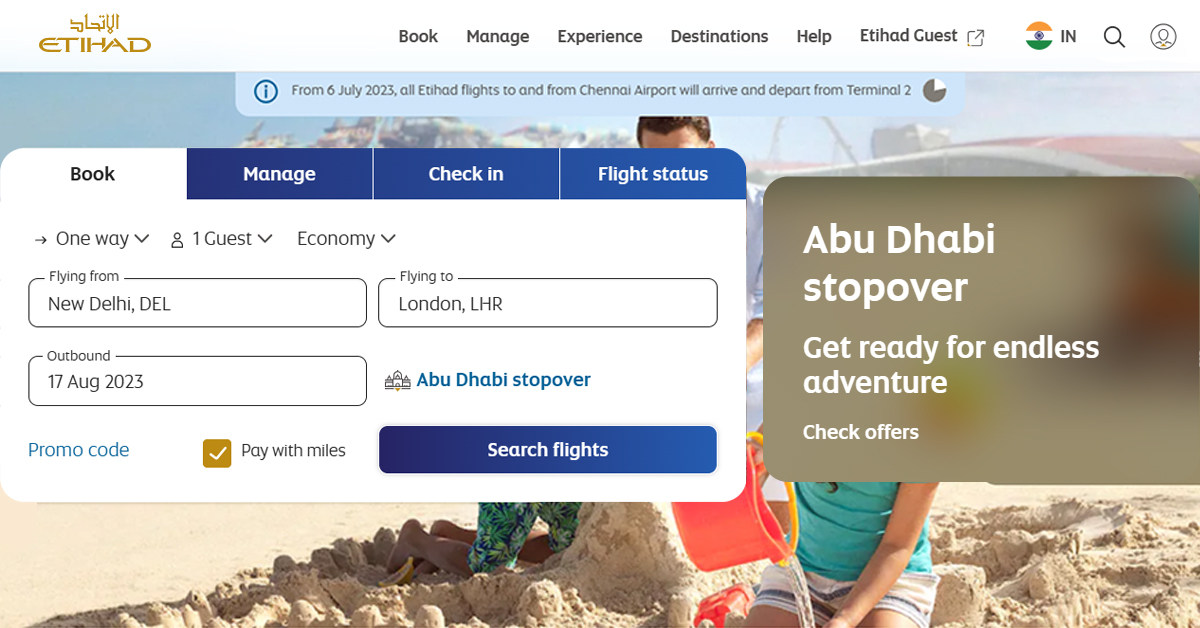

- First of all, you need to head over to the official Etihad Airways website.

- Enter the flight details like departure, arrival, guests, fare class, etc. and search for flights.

- You will see the flight search results on the next page along with the miles required to book the flight and other charges.

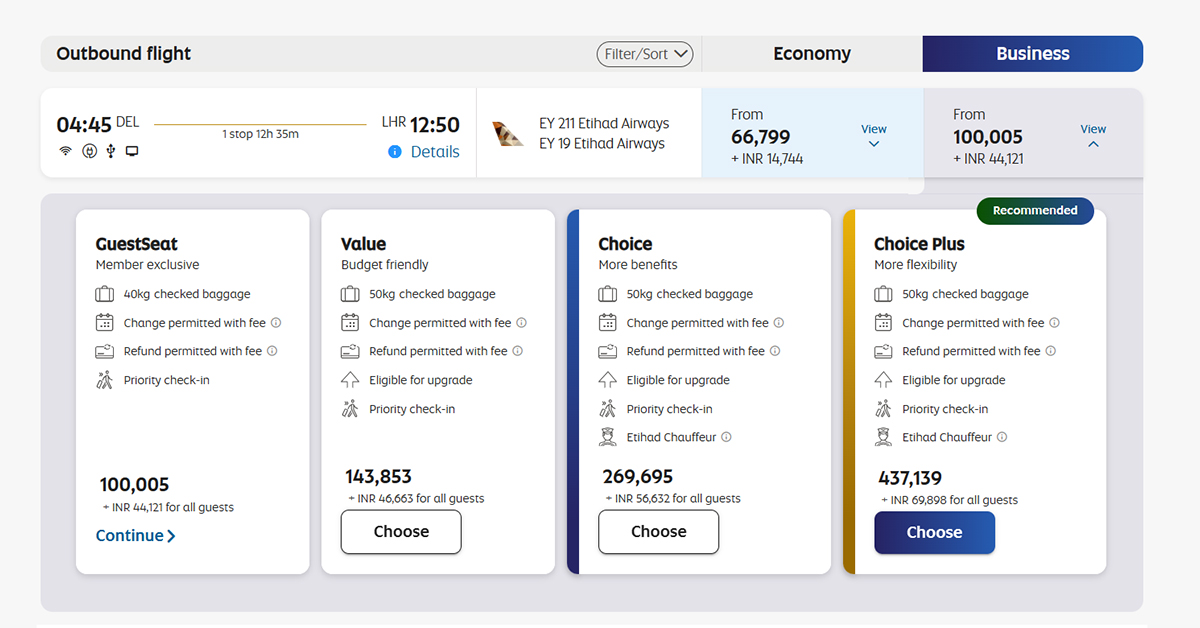

- Click on flight details and look for the GuestSeat option. Only the flights that have the GuestSeat option can be booked via Aeroplan.

- If you directly search for flights on the Aeroplan website, you will not see any available partner flights. Therefore, you first have to check flight availability on Etihad’s website.

- You can only book flights to North America from India online, and you will have to call the Aeroplan customer support to help you with the flight booking. You can book the concerned Etihad Airways flight using your Aeroplan Miles.

Miles Expiry and How to Extend Them

Etihad Guest Miles earned will expire after 18 months for Bronze, Silver, and Gold tier members in case of no qualifying activity by them. With effect from 1st August 2020, Etihad Guest Miles are valid 18 months and an extra 18 months when you make any eligible miles transaction. For those who are Etihad Guest Platinum members, the Miles never expire

In order to extend your Etihad Guest Miles’ validity, you can either earn, spend, or buy miles and the validity of your Miles will be extended. However, you can extend Miles only once every month and it does not matter how many qualifying actions you perform.

Cancellation Charges of Award Tickets

The cancellation date change, and the fee needed for refund of miles depend on the rate at which you booked the award flight. It is different based on the class type chosen by you – Guest, Value, Choice, or Choice Plus.

Miles Redemption for Others

You can use your Etihad Guest Miles to redeem award flights for your family members and loved ones. There is no need to add any nominees to your account or anything else. You just have to visit the Etihad Airways website and can book award flight tickets for anyone you want.

Miles Redemption for Infant/Child

If you plan to travel with your infant kids, it is possible to get award tickets for them. To book an infant award, you will have to pay 10% of the adult mileage required for the award ticket along with other international fees and taxes.

Bottom Line

For those who travel frequently, especially Indians who regularly visit Dubai and UAE, Etihad Airways is a great airline. The Etihad Guest membership is nice and allows members to get exclusive privileges and benefits on their flights.

You can get the Etihad and SBI co-branded credit cards that offer complimentary Etihad Guest tier status and bonus Etihad Miles. Additionally, you can use your credit card reward points and convert them to Etihad Guest Miles. The Miles earned by you can be redeemed to book flights, class upgrades, and for shopping as well.

Let us know your experience with Etihad Airlines’ in comments.

FAQs:

- Visit the Etihad Guest websiteand log in to your account.

- Hover your mouse over ‘Spend Miles’ in the top menu and then click on ‘Flying’

- Next, you have to click on Book your Flights Now.

- Enter your destination and arrival location, date of travel, fare class, and other details. Click on Find Flights after.

- You will see all available flights with the the Miles required to book them along with the amount to be paid in cash.

- Next, choose the flight package you want and proceed to finalize the booking by redeeming Guest Miles and paying the rest of the amount.