The Axis Bank Privilege Credit Card aims to provide exclusive travel and shopping experiences to customers. The card is lifetime free for priority banking customers, and for others, this credit card charges a joining fee of Rs. 1,500. You can earn up to 12,500 EDGE Reward Points in the form of welcome benefits. With this card, you get 10 EDGE Points for every Rs. 200 you spend. Moreover, you also get exclusive travel & dining benefits, including complimentary airport lounge access and exclusive discount offers on dining.

You also get an opportunity to earn 3000 bonus EDGE Points every year on card renewal. If your total annual spend reaches Rs. 5 lakhs, your renewal fee for the next year is waived, and you can double your benefit by redeeming your milestone EDGE Reward Points. The list of this card’s benefits doesn’t end here. To know detailed information about the advantages of the Axis Bank Privilege Credit Card, refer to the information given below:

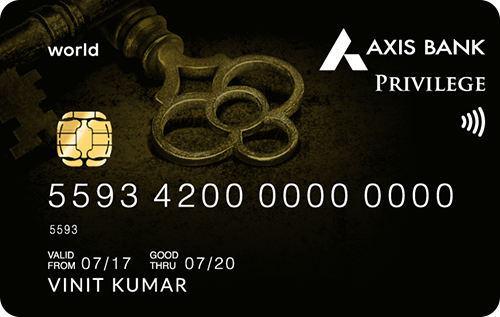

Axis Bank Privilege Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

While dining at 4,000+ partnered restaurants, you can enjoy up to 20% discount.

Rewards Rate

On every Rs. 200 spent using this credit card, you will get 10 EDGE Points.

Reward Redemption

You can redeem the EDGE Points, for 1 EDGE Point = Rs. 0.20 against a variety of products and vouchers.

Travel

N/A

Domestic Lounge Access

2 free visits to the domestic lounges every quarter.

International Lounge Access

NA

Golf

N/A

Insurance Benefits

You get insurance coverage for air accidents, lost/delayed baggage, lost travel documents, and purchase protection.

Spend-Based Waiver

Waiver of renewal fee on the spending of Rs. 5 lakhs in the anniversary year.

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.5% on all international transactions

Interest Rates

3.4% per month

Fuel Surcharge

1% waiver at all fuel stations on transactions between Rs. 400 and Rs. 4,000

Cash Advance Charges

Rs. 500 or 2.5% of the amount withdrawn, higher of the two.

- You can earn up to 12,500 Edge Rewards as a welcome benefit.

- You get 10 EDGE Points on every Rs. 200 you spend.

- Up to a 20% discount on dining through the Axis Bank Dining Delights.

- Complimentary domestic lounge access every year.

- Spend-based renewal fee waiver.

- 3,000 bonus EDGE Points on card renewal.

- Insurance benefits across several categories.

- A 1% fuel surcharge waiver.

Axis Bank Privilege Credit Card Top Features

The Axis Bank Privilege Credit Card is a basic card that offers a decent rewards rate and other benefits across various categories including travel, dining, insurance, and many more. Refer to the following points to understand the card’s benefits in detail:

Welcome Benefits

- You get 12,500 EDGE Reward Points, which are redeemable against multi-brand vouchers worth Rs. 2,500.

- To be eligible for this welcome benefit, you have to make 3 transactions within the first 60 days after the card issuance.

Milestone Benefits

On spending Rs. 2.5 lakhs in a card anniversary year cardholder shall be eligible for 10,000 EDGE Reward Points worth Rs. 2,000. (Multi-brand vouchers have now been discontinued)

Travel Benefits

You get 2 complimentary visits to the domestic lounge per calendar quarter to selected domestic airport lounges.

Must Check: List of Best Cards for Domestic Lounge Access

Dining Benefits

Get up to a 20% discount across more than 4,000 partner restaurants through the Axis Bank Dining Delights.

Insurance Benefits

The Axis Bank Privilege Credit Card also offers several insurance benefits, which are mentioned below in the table:

| Category | Insurance Coverage |

| Purchase Protection | Rs. 1 lakh |

| Loss of travel documents | Up to US $300 |

| Lost/delayed baggage | Up to US $500 |

| Credit Shield | Rs. 1 lakh |

Other Benefits

You can earn 3,000 EDGE Reward Points every year on the renewal of your Axis Bank Privilege Credit Card.

Joining and Renewal Fee Waiver

The renewal fee of this credit card can be waived if you are able to spend an amount exceeding Rs. 5 lakhs in an anniversary year.

Fuel Surcharge Waiver

- You get a fuel surcharge waiver of 1% on transactions between Rs. 400 and Rs. 4,000 at all fuel stations in India.

- The maximum surcharge waiver is capped at Rs. 400 per month.

Axis Bank Privilege Credit Card Rewards

The Axis Bank Privilege Credit Card Rewards you in the form of Edge Rewards, and the reward rate is as mentioned below:

- On every domestic/international spend of Rs. 200, you earn 10 EDGE REWARD Points.

- No reward points are earned on transactions done towards fuel, government services, utilities, education, wallet, insurance, and gold spends.

Rewards Redemption

- You can redeem the EDGE REWARDS against a wide variety of products available in the Axis Bank EDGE REWARDS catalog.

- 1 EDGE Reward Point = Rs. 0.20.

Axis Bank Privilege Credit Card Fees and Charges

The following are the details of the fees and charges that come along with this credit card –

- The joining and renewal fee of the Axis Bank Privilege Card has been placed at Rs. 1,500, and this credit card is free for a lifetime for priority banking customers.

- You have to pay an interest rate of 3.4% per month on the overdue amount.

- 3.5% of the transacted amount is to be paid as forex fee.

- 2.5% of the amount withdrawn, or Rs. 500, the higher of the two, has to be paid as a cash advance fee.

Axis Bank Privilege Card Eligibility Criteria

You need to fulfill the requirements mentioned below in order to apply for this credit card:

- The applicant needs to be a resident of India.

- The primary applicant should be of the age between 18 years and 70 years, and the add-on cardholder should be a minimum of 18 years of age

- The annual income of the applicant should be more than or equal to Rs. 6 lakhs per annum.

How to Apply for an Axis Bank Privilege Credit Card?

The Axis Bank Privilege Card can be applied both online and offline. To apply online, follow a few steps as mentioned below:

- Click on the option ‘Apply Now.’

- Apply for the card by completing all the required formalities.

- Submit your application.

You can also apply for this credit card offline by paying a visit to the nearest bank branch, filling out the physical application form, and submitting the required documents.

Axis Bank Privilege Credit Card Review

This Axis Bank Privilege Credit Card is for you if you love shopping and traveling. This card is comparable with the Regalia Gold Credit Card that is issued by HDFC Bank, which comes with slightly higher annual fees and great benefits. Coming back to the Axis Bank Privilege Card, you get a welcome gift of 12,500 EDGE Reward Points that you can redeem against shopping or travel vouchers worth Rs. 2,500. Along with this, the travel and dining benefits provided by the card give you extra luxurious experiences, which might be something you are looking for. Not only all these benefits, but you can also save incredibly with this card as it gives you several saving opportunities, including the spend-based renewal fee waiver, fuel surcharge waiver, exciting reward offers, etc. With all these benefits across multiple categories, the Axis Bank Privilege Credit Card becomes a great choice for everyone who wishes to have a credit card with such features.

You get 12,500 EDGE Reward Points, which are redeemable against multi-brand vouchers worth Rs. 5,000.

Is this incorrect?

12500 RP can be worth INR 2500.

Nope with privilege card, we can redeem for some vouchers whose value is 0.4 Re

Can i use it during international travels?

Any additional charges for international usage

There is a forex markup fee of 3.5% with the privilege card. So you can use it but you shall be charged.