A cashback credit card by HDFC Bank, the Millennia Credit Card targets the Gen-Y – the ‘90s kids or the millennials. Being a basic credit card, this is charged an annual fee of Rs. 1,000. Keeping its target customers in mind, HDFC Bank offers a 5% cashback on Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber, and Zomato, and a cashback of 1% on all other online and offline spends.

As the card gives you a reward rate of 5% on Amazon and Flipkart, you are essentially getting the benefit of both Amazon Pay ICICI and Flipkart Axis Credit Card (and much more) in one card. The cashback earned with the card is processed as CashPoints, which can be redeemed against the card’s statement balance for flight/hotel reservations or for purchasing products from the HDFC product catalog. Also, the card offers great gift vouchers and one free airport lounge visit for meeting the milestone spend criteria (Rs. 1 lakh) every quarter. Keep reading our HDFC Bank Millennia Credit Card review to know more about the card, its offerings, fees and charges, and other information.

HDFC Bank Millennia Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Cashback |

Welcome Benefits

Movie & Dining

Up to 20% discount at partner restaurants with Swiggy Dineout

Rewards Rate

5% cashback (as CashPoints) at select partner online merchants and 1% cashback (as CashPoints) on all other spends (except fuel, rental, and govt. related transactions)

Reward Redemption

Rewards processed as CashPoints, 1 CP = Re. 1 while redeeming against statement balance of credit card and 1 CP = Rs. 0.30 while redeeming against products and vouchers in the product catalogue, and against flight/hotel booking.

Travel

One free airport lounge visit on spending Rs. 1 lakh in a quarter (Milestone Benefit)

Domestic Lounge Access

N/A

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

The renewal fee is waived off if the cardholder spends Rs. 1 Lakh or more in the previous year.

Rewards Redemption Fee

Rs. 99 per redemption request (plus applicable taxes)

Foreign Currency Markup

3.5% (plus applicable taxes)

Interest Rates

3.6% per month (or 43.2% per annum)

Fuel Surcharge

A 1% Fuel surcharge is waived if you spend between Rs. 400 and Rs. 5,000 on fuel (Max Rs. 250 per statement cycle)

Cash Advance Charges

2.5% of the transaction amount, subject to a minimum fee of Rs. 500

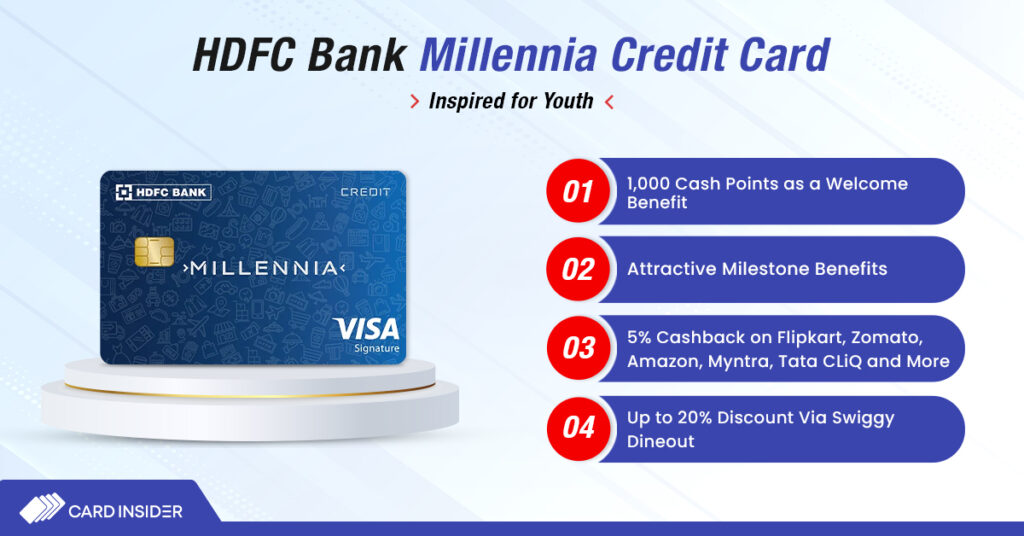

- 1,000 CashPoints as a welcome benefit on card setup (subject to realization of the joining fee).

- Gift vouchers worth Rs. 1000/one free domestic airport lounge visit on spending Rs. 1 lakh or above in a quarter.

- 5% cashback at select partner online merchants, including popular e-commerce websites like Amazon and Flipkart.

- 1% cashback on all other spends except fuel, rental, and government spends.

- Up to 20% discount on partner restaurants via Swiggy Dineout.

- Renewal fee waiver on spending Rs. 1,00,000 in the previous year.

Pros

- Get high 5% cashback on partner merchants like Myntra, Amazon, Zomato, Swiggy, Uber, etc.

- Renewal fee waiver on spending Rs. 1 Lakh in the card anniversary year

Cons

- You earn a low 1% cash back on offline/online spends at non-partner merchants

- The accelerated Cashpoints are capped at 1000 per statement cycle and you can earn 1000 Cashpoints at the normal 1x rate.

- A minimum of 500 Cashpoints are needed to redeem against the card statement balance

HDFC Millennia Credit Card Features and Benefits

Apart from the cashback benefit, the HDFC Millennia Credit Card also offers many other benefits to the cardholders. The benefits include bonus CashPoints as a welcome gift, complimentary airport lounge access, dining discounts, and many more.

Welcome Benefits

In the form of welcome benefits, the cardholders will receive 1,000 bonus CashPoints on the successful realization of the joining fee.

Dining Benefits

Up to 20% discount at partner restaurants with Swiggy Dineout.

Quarterly Spend Benefit

On spends of Rs. 1 lakh or more each quarter, you shall be eligible to receive gift vouchers worth Rs. 1,000. Through this offer, you can earn Rs. 4,000 each year as gift vouchers while spending Rs. 4 lakh; this would also waive your annual fee.

OR,

The cardholders can also get 4 complimentary visits in a year to the domestic airport lounges with the HDFC Millennia Credit Card. This can be accessed by making spends of Rs. 1 lakh each quarter (Jan-Mar | Apr-June | Jul-Sept | Oct-Dec). Check the complete details here.

Fuel Surcharge Waiver

1% of the fuel surcharge is waived on a minimum payment of Rs. 400 at all petrol stations across India (the waiver amount is capped at a maximum of Rs. 250 per payment cycle).

Renewal Fee Waiver

This credit card comes with an annual fee of Rs. 1,000, which is eligible for a waiver if the cardholder is able to spend an amount exceeding Rs. 1,00,000 in an anniversary year.

Interest-Free Credit Period

You can get around 50 days of interest-free credit period on the credit card from the day of purchase. This depends on when the merchant submits the charge.

HDFC Millennia Credit Card Cashback

The cashback that you get by transacting through the HDFC Millennia Credit Card is posted as CashPoints to the card account. You can redeem these CashPoints against a variety of options (details below), including cashback (adjustment against the due balance on the card). HDFC Millennia Card earns you-

- A cashback of 5% on partner online merchants- Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber, and Zomato.

- A cashback of 1% on all other online and offline spends.

- The CashPoints earned under the 5% and 1% categories are capped at 1,000 CashPoints per statement cycle each (a maximum of 2,000 CashPoints can be earned in a given statement cycle).

HDFC Millennia Credit Card Reward Point Redemption

- As mentioned, the cashback earned on the HDFC Millennia Credit Card is credited as CashPoints to the card account at the end of the statement cycle. The CashPoints that you receive can be redeemed for a variety of options, which include cashback (i.e., adjusting them against the statement balance of the credit card), flight/hotel bookings via SmartBuy, product purchases from the bank’s catalog of products and partner airlines’ AirMiles.

| Value of CashPoints on Redemption | |||

| Product Catalog | Flights/Hotels on Smartbuy | Cashback | Airmiles |

| Rs. 0.30 | Rs. 0.30 | Re. 1 | 0.30 AirMiles |

- A minimum of 500 CashPoints are required for redemption against the card’s statement balance.

- CashPoints are valid only for 2 years and will expire thereafter.

- You have to pay a fee of Rs. 99 for every redemption request you make.

Exclusion on Rewards Points/Cashback

The following spend categories are not eligible to earn Cashpoints –

- Fuel Spends

- Rent payments and Govt Related transactions

- Cash Advance

- Payment of card fees and other charges

- Smart EMI / Dial an EMI transactions

Who Should Sign Up for an HDFC Millennia Card?

As the name suggests, The HDFC Millennia card should be the card of choice for young professionals who plan to begin their credit journey and build a strong credit profile. HDFC Bank, keeping its target customers in mind, offers extra shopping benefits from partner websites, including Amazon, Swiggy, Zomato, Uber, and Flipkart. Whether you are a travel enthusiast, a movie buff, a foodie, or a shopaholic, this card has something for you. Unlock your savings journey with the HDFC Millennia Card.

Eligibility Criteria for HDFC Millennia Credit Card

The following table illustrates the income-based and age-based eligibility criteria for HDFC Bank Millennia Credit Card-

| Criteria | Salaried Employees | Self-Employed Individuals |

| Age | 21 – 40 Years | 21 – 40 Years |

| Income | Minimum ₹35,000 Per Month | Minimum ₹6,00,000 Per Annum (As Per ITR) |

Compare HDFC Millennia Credit Card With Other Popular Cards

The following table compares HDFC Bank’s Millennia credit card with similar credit cards.

| HDFC Millennia Credit Card | IDFC Millennia Credit Card | SBI SimplyCLIK Credit Card | Axis Bank Ace Credit Card | |

| Reward Structure | Cashback (earned as CashPoints) | Reward Points | Reward Points | Cashback |

| Reward Rate at Partner Merchants | 5% cashback (earned as CashPoints) at partner merchants, including Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber, and Zomato.

1% cashback on all other online/offline spends. 1CP = Re. 1 as cashback, reward rate of 5% at partner merchants and reward rate of 1% at partner merchants |

3 Reward Points per Rs. 100 spent offline and online up to spends of Rs. 20,000

10 Reward Points per Rs. 100 on spends above Rs. 20,000. 1 Reward Point = Rs. 0.25 |

10 Reward Points per Rs. 100 spent at partner merchants, including Amazon, Cleartrip, BookMyShow, Lenskart, Apollo24x7, and Netmeds.

5 Reward Points per Rs. 100 on all other online spends. 1 Reward Point = Rs. 0.25, reward rate of 2.5% at partner merchants and 1.5% on all other online spends |

5% cashback on utility bill payments and mobile, and DTH recharges.

4% cashback on Zomato, Swiggy, and Ola. 1.5% cashback on all other spends with the card. |

| Reward Points/Cashback Maxcap | Max 1,000 CashPoints per month at the 5X rate and 1,000 CashPoints per month at the regular 1X rate- a total of 2,000 Reward Points in a given statement cycle | No max cap applicable | Max 10,000 Reward Points can be earned in a month at an accelerated (5X or 10X) rate | No max cap applicable |

| Additional Benefits | 20% discount on dining at partner restaurants. | 4 complimentary railway lounge access per quarter.

25% discount on movie tickets (up to Rs. 100) Up to 20% discount at over 1,500 restaurants across the country |

N/A | 4 complimentary domestic airport lounge access.

20% discount at partner restaurants with Axis Bank’s Dining Delights program. |

| Annual Fee | Rs. 1,000 per annum, waived off on a minimum annual expenditure of Rs. 1 lakh | Nil | Rs. 499 per annum, waived off on a minimum annual expenditure of Rs. 1 lakh | Rs. 499 per annum, waived off on an annual expenditure of a minimum of Rs. 2 lakh |

HDFC Millennia Credit Card Review

HDFC Bank’s Millennia credit card, one can say, is the ideal card for someone who has just started working and loves to shop online. Not only that, it gives you 5% CashBack on India’s most popular online shopping websites, Amazon and Flipkart. On non-partner brands, you get 1% cashback on offline and online spends. It is also one of the cards to vouch for building a solid credit profile. Like any other credit card, this card also requires you to maintain financial punctuality; otherwise, a debt trap at an early age can be really troublesome. Before you make up your mind, however, you may also have a look at the IDFC First Millennia Credit Card.

This was our review of the HDFC Bank Millennia Credit Card. Do share your reviews on this card with us in the comment section below!

Can you please share any proof like any customer get rupay variant of hdfc millennia credit card?

Also minimum salary should be 30k,not 35k. Found from website.

Hello, Sir. HDFC Bank Millennia Credit Card does not come in the RuPay variant, and the minimum monthly salary is 35,000 for salaried individuals.

Hi all,

I do have this HDFC millenia credit card for almost an year. i would say their Cash Back Credit does not get adjusted automatically in the statement. The redemption process is cumbersome either you should have HDFC bank account to get back the cash amount or need to download a redemption form from bank site, fill it & post it. So literally this Cash Back offer is just an eyewash to lure the customers to buy it.

In my experience Axis Flipkart is the best. Cash back credits get adjusted automatically to every month statement. Axis Flipkart card has unlimited cash back power so best of all.

Other cards like Yes Bank BYOC, SCB Smart card etc have monthly cash back limit of Rs.1000 per statement.

ICICI HP Super Saver card with 4% cashback on HP pumps with Rs.400 max credit per month.

All the banks are highlighting 1% fuel surchage waiver as cash back benefit but as far as i know that is a standard feature comes with all the credit cards in the market.

Even Airtel Axis Bank Credit Card is a good cashback card. It gets directly adjusted in the limit.

HDFC credit cards are now becoming popular because of their wide range and variety of cards which fulfills almost all financial needs of an individual. Plus the presentation by CardInsider.com is well enough to understand each and every point about a credit card.