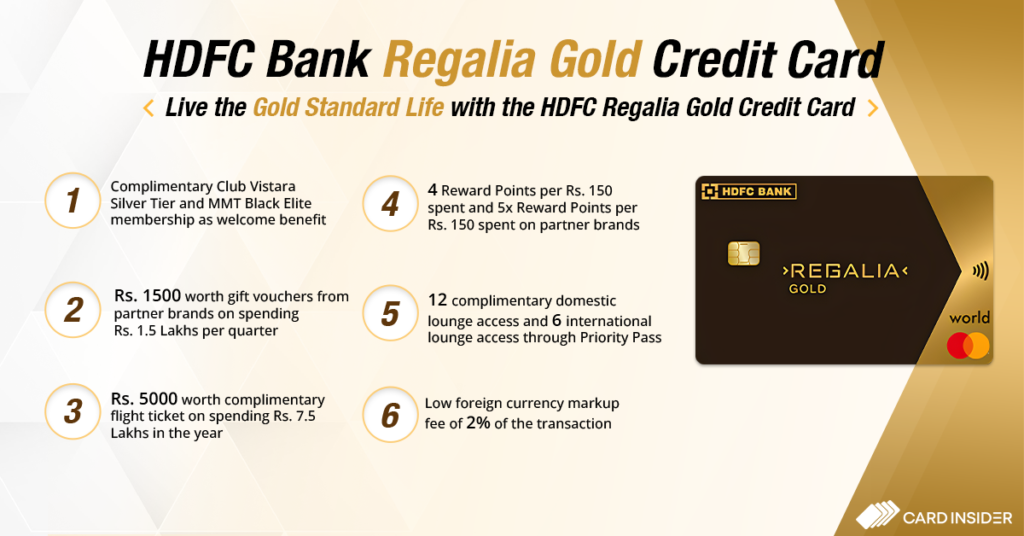

The Regalia credit card range is one of the most sought-after offerings by HDFC Bank, offering cardholders some of the best-in-class travel and lifestyle privileges. The bank recently launched the new Regalia Gold credit card with which you can travel in luxury and shop in style thanks to its exclusive rewards and offers.

The Regalia Gold card comes at an annual fee of Rs. 2500. It offers a complimentary MMT Black Elite and Club Vistara Silver Tier membership on spending over Rs. 1 Lakh within 90 days of getting the card issued. Individuals get 4 Reward Points on every retail spend of Rs. 150 and accelerated 5x Reward Points on every Rs. 150 spent in-store and online at Nykaa, Reliance Digital, Myntra, and Marks & Spencer.

The reward points you earn can be redeemed through Netbanking or Smartbuy on flight/hotel bookings, transfer to Airmiles, products, vouchers on the Exclusive Gold Catalogue, and even cashback. Other than this, the Regalia Gold card also offers premium travel and insurance benefits to the cardholder. Keep reading our HDFC Bank Regalia Gold credit card review to know more about this premium lifestyle card by HDFC Bank.

HDFC Bank Regalia Gold Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

20% Discount via Swiggy Dineout

Rewards Rate

Get 4 Reward Points on every spend of Rs. 150 on retail including utilities, insurance, and education. Get 20 Reward Points on every spend of Rs. 150 on Myntra, Marks and Spencers, Nykaa, and Reliance Digital

Reward Redemption

Redeem RPs for flight/hotel bookings via the Smartbuy portal at the rate of 1 RP = Rs. 0.50, convert RPs into airmiles through Netbanking at the rate of 1 RP = 0.50 Airmiles, Redeem RPs for products and gift vouchers on the Smartbuy portal at the rate of 1 RP = Rs. 0.35, and Redeem RPs against the Exclusive Gold Catalogue on Smartbuy at the rate of 1 RP = Rs. 0.65

Travel

Complimentary Flight Tickets on Reaching Spend Milestones

Domestic Lounge Access

3 Complimentary Domestic Airport Lounge Access Every Quarter (12 Each Year)

International Lounge Access

6 complimentary international lounge access

Golf

NA

Insurance Benefits

Accidental air death cover up to ₹1 crore, emergency overseas hospitalisation cover worth ₹15 lakhs, credit liability cover up to ₹ 9 lakhs

Spend-Based Waiver

Renewal Fee Waiver on Spending Rs. 4 Lakh in a Year

Rewards Redemption Fee

Rs. 99

Foreign Currency Markup

2% on all forex transactions

Interest Rates

3.6%

Fuel Surcharge

N/A

Cash Advance Charges

2.5% of total amount or Rs. 500, the higher one

- Complimentary MMT Black Elite and Club Vistara Silver Tier membership on spending over ₹1 lakh within 90 days of getting the card issued.

- 1500 worth of vouchers from any one of M&S, Myntra, Reliance Digital, or Marriott on spending Rs. 1.5 Lakhs each quarter

- 5,000 worth of complimentary flight vouchers on spending Rs. 7.5 Lakhs in the card anniversary year

- 4 Reward Points on every retail spend of Rs. 150 and 5X accelerated Reward Points on every Rs. 150 spent on purchases at M&S, Nykaa, Myntra, and Reliance Digital

- 12 complimentary lounge access in India at both international and domestic terminals every year

- 6 complimentary lounge access outside India through the Priority Pass

- Air death cover up to Rs. 1 Crore and Rs. 9 Lakh lost card liability cover

- Renewal fee waiver on spending Rs. 4 Lakhs in the card anniversary year

- Low foreign currency markup fee of 2%

Pros

- Enjoy the exclusive 24/7 concierge service that comes with the Regalia Gold Credit Card.

- You can enjoy access to both domestic and international lounges, with 12 and 6 visits per year, respectively.

Cons

- A fee of ₹99 is applicable for reward redemption.

- Card renewal fee waiver is at a high cost of ₹4 lakhs.

HDFC Bank Regalia Gold Credit Card – Features & Benefits

The new Regalia Gold card by HDFC Bank is loaded with exclusive travel and shopping benefits. It offers a great reward rate on all retail spends and 5x reward points on purchasing from partner brands and merchants. Let’s know more about the features and benefits of this newly launched credit card in detail.

Welcome Benefits

After successfully paying joining fees, you shall receive a gift voucher worth ₹2500. You shall receive a complimentary MMT Black Elite and Club Vistara Silver Tier membership on spending over ₹1 Lakh within 90 days of getting the credit card issued. The welcome benefits must be claimed within 60 days from the benefit end date, and the complimentary memberships is valid for a 1-year period.

Club Vistara Silver Tier Membership –

- 1 complimentary class upgrade voucher

- Added check-in baggage allowance both inside and outside the country

- Priority check-in

- 9 CV Points on every Rs. 100 spent

MMT Black Elite Membership –

- 10% extra discount on selected hotels

- Early check-ins, free room upgrades, discounts on beverages, food, etc., at specific hotels

- Make travel spends on MakeMyTrip and get My Cash. You can use the My Cash for a booking.

- Exclusive access to MMT Black Fest

Milestone Benefits

- You get complimentary flight tickets and gift vouchers for achieving annual and quarterly spend-based milestones.

- On spending Rs. 1.5 Lakhs in a calendar quarter, you get Rs. 1500 worth of vouchers from M&S, Myntra, Marriott, and Reliance Digital. You can redeem just 1 voucher from any merchant per quarter.

- On spending Rs. 5 Lakhs, you shall get Rs. 5,000 worth of flight vouchers.

- On spending Rs. 7.5 Lakhs in the card anniversary year, you receive additional flight vouchers for Rs. 5000.

Domestic Lounge Access

- Get 12 complimentary domestic lounge access at Indian airports every year for both international and domestic terminals.

- Just use your Regalia Gold card and get complimentary lounge access. All visits after finishing the complimentary quota are charged by the airport lounge accordingly. Visit this link to check out the list of lounges accessible in India.

International Lounge Access

- Get 6 complimentary international lounge access every year through the Priority Pass for both the primary and add-on cardholders.

- After you complete at least 4 transactions on your Regalia Gold credit card, you can apply for the Priority Pass membership. All visits after finishing the complimentary quota cost USD 27 plus GST.

Airport Pick and Drop

You can avail of this service only if you book flight tickets through the Regalia Gold Unified Smartbuy portal. You have to generate your voucher code and use it in the Ola application for the airport pick-and-drop service.

Annual Spend-Based Waiver

You can get the card renewal fee waived on spending Rs. 4 Lakhs in the card anniversary year.

Insurance Benefits

- You get an accidental air death cover up to Rs. 1 Crore

- You can get an emergency hospitalization cover up to Rs. 15 Lakhs

- Get credit liability cover worth Rs. 9 Lakhs

HDFC Bank Regalia Gold Credit Card Reward Structure

- Get 4 Reward Points on every spend of Rs. 150 on retail, including utilities, insurance, and education, with a maximum cap of 2000 RPs per month on grocery transactions and 2000 RPs per day on insurance transactions.

- Get 20 Reward Points on every spend of Rs. 150 on Myntra, Marks and Spencers, Nykaa, and Reliance Digital with a maximum cap of 5000 RPs across all brands.

Reward Points Redemption

- You can redeem RPs for flight/hotel bookings via the Smartbuy portal at the rate of 1 RP = Rs. 0.50

- You can convert RPs into Airmiles through Netbanking at the rate of 1 RP = 0.50 Airmiles

- Redeem RPs for products and gift vouchers on the Smartbuy portal at the rate of 1 RP = Rs. 0.35

- Redeem RPs against the Exclusive Gold Catalogue on Smartbuy at the rate of 1 RP = Rs. 0.65

- You can also redeem the RPs as cashback against your card statement balance at the rate of 1 RP = Rs. 0.20. There is a maximum cap of 50,000 RPs per month on cashback redemption.

HDFC Bank Regalia Gold Credit Card Eligibility

You should go through the eligibility requirements of any credit card thoroughly before applying for it. The following are the age and income requirements for the Regalia Gold credit card.

| Particulars | Self-Employed People | Salaried |

| Age | 21 to 65 Years | 21 to 60 Years |

| Income | Minimum Rs. 12 Lakhs per annum | Minimum monthly income of Rs. 1 Lakh |

Apart from these requirements, you must have a good credit score and credit history to be approved for the credit card.

Who Should Apply for the Credit Card?

This is one of the best HDFC Bank credit cards in the rewards and travel categories and suits high-spenders who use their credit card for most of their spends. This allows them to make the most of the reward points earned, and the reward points can be redeemed against various options like products/vouchers, converted to air miles, and against the Exclusive Gold Catalog.

You should get the card if you plan to make high spends with it and collect reward points. The rewards can be redeemed for premium brands, travel, etc. Also, as a milestone benefit, the card offers travel vouchers instead of bonus points, and you should definitely go for the card if you travel frequently.

HDFC Bank Regalia Gold Credit Card Review

The HDFC Regalia range of cards is one of the most popular by HDFC Bank, and you get some of the best lifestyle and travel benefits with the Regalia Gold credit card. You get exciting welcome and milestone benefits with this card and reward points on every retail spend.

There are partner merchants on which you can earn accelerated reward points and redeem your points against cashback, flight/hotel bookings, Airmiles, or products from the Exclusive Gold Catalogue. For frequent travelers, the card also offers flight vouchers on reaching spend milestones and complimentary domestic and international airport lounge access.

If you are a responsible credit card user, the Regalia Gold credit card is worth getting because of its excellent benefits and reward program. Let us know your thoughts about the new Regalia Gold credit card in the comments and if you are willing to get this card.

FAQs:

- You get 4 Reward Points on every spend of Rs. 150 on retail including insurance, utilities, and education.

- You get accelerated 20 reward points on every spend of Rs. 150 on Mark and Spencers, Myntra, Nykaa, and Reliance Digital.

- You can redeem RPs for flight/hotel bookings via the Smartbuy portal at the rate of 1 RP = Rs. 0.50

- You can convert RPs into airmiles through Netbanking at the rate of 1 RP = 0.50 Airmiles

- Redeem RPs for products and gift vouchers on the Smartbuy portal at the rate of 1 RP = Rs. 0.35

- Redeem RPs against the Exclusive Gold Catalogue on Smartbuy at the rate of 1 RP = Rs. 0.65

- You can also redeem the RPs as cashback against your card statement balance at the rate of 1 RP = Rs. 0.20. There is a maximum cap of 50,000 RPs per month on cashback redemption.

Want to Apply HDFC Regallia Credit card

Click on the Apply Now button appearing on the screen. You shall be taken to the official HDFC Credit Card Application page. There you just have to fill in your details and submit your application.

I had a question regarding educational fees payment on this card. My son’s educational fees is paid via SBI collect which charges more than 1-1.5% if paid via credit cards. Does Regalia Gold or any other credit cards in the market still provide any cashback or rewards on these fees? If not ,will use Netbanking option only

Will if you are looking for a premium credit card. Then go with the Yes Bank Marquee Credit Card it would offer you reward points for educational spends also along with others.

Are there any special offers or discounts for booking flights or hotels with this card?

Yes, you can redeem Reward Points for flights and hotels through SmartBuy.

I had 4186 reward points in Millenia’s credit card, which had a value of 1 Rs per reward point, after upgrading the credit card to Regalia Gold. My value of initial points to be redeemed against cash is degraded to just Rs 837 instead of Rs. 4186 why?

Because the value of 1 Reward Point = 1 Rs for cash redemption in Millennia CC. Whereas for Regalia Gold the value of 1 Reward Point = Rs. 0.20 for cash redemption. So you got the right amount. You can check the above given conversions for more information.

Absolutely loving my HDFC Bank Regalia Gold Credit Card! The benefits are unmatched rewards, exclusive discounts, and top-notch service. From travel perks to lifestyle privileges, this card has it all. If you’re looking for a credit card that goes beyond expectations, this is the one. Highly recommend it to anyone who wants to elevate their financial game.

The Regalia Credit Card Series by HDFC Bank is quite popular.

The HDFC Bank Regalia Gold Credit Card is a premium credit card offered by HDFC Bank in India. It is positioned as a high-end credit card catering to the needs of affluent customers. Here are some key features and benefits associated with the HDFC Bank Regalia Gold Credit Card:

Travel Benefits: Cardholders may enjoy various travel-related benefits such as complimentary travel insurance, fuel surcharge waiver, and discounts on flight and hotel bookings. Book now by aaehalo

Welcome Benefits: Typically, new cardholders are offered welcome benefits such as bonus reward points, vouchers, or discounts on joining fees.

Reward Points: The card usually offers reward points for every transaction made using the card. These points can be redeemed for a variety of rewards including vouchers, merchandise, or even cashback.

Lifestyle Benefits: HDFC Bank Regalia Gold Credit Card often provides lifestyle benefits such as complimentary access to airport lounges, concierge services, golf privileges, and exclusive dining and hotel offers.

Which is the best credit card for travel in India? Is HDFC Regalia Gold better or Scapia?

Should ideally offer rewards on every flight booking, dining, fuel and other regular spends.

You’re comparing a premium card to a forex card.

Scapia is just another Niyo Global, while HDFC Regalia Gold is a premium card that offers more than just travel benefits.

Thinking of upgrading to this one.

Its a decent and rewarding credit card.