SBI Card is one of the most popular credit card issuers in India, with a large share of the credit card market. Recently, it has started issuing RuPay Credit Cards, which can be linked with a UPI application. RuPay is gaining a lot of popularity in India, and SBI Card has responded by introducing its own range of RuPay Credit Cards, suitable for shopping, rewards, travel, and more. From small to large, with an SBI RuPay Credit Card, you can easily make payments to various businesses and vendors from your mobile.

RuPay was launched in 2014 and since then has expanded its foothold in India. With this, you can make secure and fast transactions across the country. With distinct benefits, indigenous making, and a rewarding structure its quite beneficial to have an SBI RuPay Credit Card. Keep on reading to learn more about SBI RuPay Credit Cards in India.

Table of Contents

Top SBI RuPay Credit Cards List

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Fuel

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Fuel

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Compare Top Features of SBI Bank RuPay Credit Cards

Let us now compare popular RuPay Credit Cards from SBI Card.

| Features | SBI SimplySAVE Credit Card | Shaurya Select SBI RuPay Card | IRCTC SBI RuPay Credit Card |

| Joining Fee | Rs. 499 + GST | Nil | Rs. 500 + GST |

| Renewal Fee | Rs. 499 + GST | Rs. 1499 + GST | Rs. 300 + GST |

| Best Suited For | Shopping | Shopping | Travel |

| Welcome Benefits | Spend Rs. 2000 Within 60 Days of Card Issuance to Earn 2,000 Reward Points | N/A | 350 Reward Points on a Transaction of Rs. 500 Within 45 Days of Card Issuance |

| Movie & Dining | 10X Reward Points Per Rs. 150 Spent on Movie and Dining | 10X Reward Points Per Rs. 100 Spent on Movie and Dining | N/A |

| Travel | N/A | N/A | 4 Railway Lounge Acess in a Year |

| Rewards Redemption Fee | Rs. 99 | Rs. 99 | Rs. 99 |

Advantages of SBI Bank RuPay Credit Cards

Reward Points

Earn reward points with SBI RuPay Credit Cards. Earn while making spends with your RuPay Credit Card.

UPI Spends

You can now link your SBI RuPay Credit Card to your UPI application and make convenient payments from your phone.

Secure Transactions

RuPay is a domestic card network that provides added security to your transactions.

Fast and Convenient

Make fast payments with your RuPay Credit Cards in India.

SBI Bank RuPay Credit Cards

SBI SimplySAVE Credit Card

The SBI SimplySAVE is an excellent credit card for beginners. It charges an annual fee of Rs. 499 and offers a welcome bonus of 2000 reward points. You can earn bonus reward points on purchases made at grocery stores, movie theatres, and departmental stores with the card, making it ideal for people who are new to credit cards and want to save money on everyday expenses. In addition to rewards, you can also get an annual fee waiver by spending Rs. 1 lakh or more with the card. However, the card has limited travel, dining, or entertainment privileges as it is designed primarily for beginners who are looking for an entry-level credit card.

Shaurya Select SBI RuPay Card

The Shaurya Select SBI Credit Card is exclusively designed for individuals serving the nation in defense services, including the Army, Navy, Paramilitary, and Air Force. The card has zero joining fee and charges a renewal fee of Rs. 1,499 per year starting from the second year. However, the renewal fee is waived if you spend over Rs. 1.5 lakhs in the previous year. With this credit card, you can earn up to 10 Reward Points on every Rs. 100 spent and redeem them for a variety of options. Additionally, you receive 1,500 bonus Reward Points every time you renew your card membership.

IRCTC SBI RuPay Credit Card

The IRCTC Rupay SBI Credit Card is a credit card that is co-branded with IRCTC. It offers exclusive rewards and benefits and is ideal for frequent railway travelers. The joining fee for this card is only Rs. 500. You can earn 1 Reward Point for every Rs. 125 spent on retail purchases and railway ticket bookings through the IRCTC website or mobile app. As a welcome bonus, you can earn 350 reward points, where 1 Reward Point is equal to Re. 1. You can also enjoy great travel benefits, such as four complimentary railway lounge access every year and accommodation at over 5000 hotels across 350 leading cities in India.

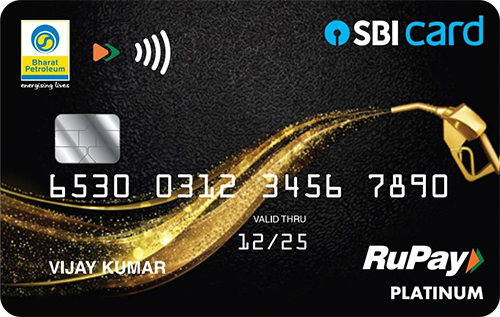

BPCL SBI Card Octane

SBI Card launched BPCL SBI Card Octane in December 2020. It is an upgraded version of the BPCL SBI Credit Card. While the Octane variant does offer better rewards and offers, it also carries a much higher annual fee of Rs. 1,499, whereas the other variant had a fee of only Rs. 499. BPCL SBI Card Octane gives you a 7.25% value back on fuel purchases at Bharat Petroleum fuel stations: 6.25% as reward points (25x reward rate), along with a 1% fuel surcharge waiver. You also receive 10x reward points for spending on dining and movie tickets, apart from the fuel benefits. As far as travel benefits are concerned, the card entitles you to 4 complimentary accesses to domestic airport lounges every year (maximum 1 per quarter).

Shaurya SBI RuPay Card

The SBI Shaurya Credit Card is one of two SBI Credit Cards designed specifically for individuals serving the nation, such as defense personnel. The other card available is the SBI Shaurya Select Credit Card, which is an upgraded version of this card. The Shaurya SBI Card has a joining fee of Rs. 250 and rewards new customers with 1,000 bonus Reward Points, equivalent to the joining fee itself. Additionally, cardholders can earn up to 5 Reward Points for every Rs. 100 spent. These points can be redeemed against outstanding balances or for a variety of products and gift vouchers.

Yatra SBI Credit Card

The Yatra SBI credit card is a co-branded travel credit card that was launched in partnership with Yatra.com. Travelers can enjoy various benefits and privileges with this card. You can avail of Rs. 1000/- off on domestic flight bookings and Rs. 4000/- off on international flight bookings using this card. Additionally, you get a welcome gift of a Yatra e-gift voucher worth Rs. 8,250 after paying the membership fees. With this credit card, you earn one reward point for every Rs. 100 spent and six reward points for every Rs. 100 spent. Moreover, you receive an air accidental insurance cover of Rs. 50 lakh.

How to Apply for SBI RuPay Credit Cards Online?

Apply for a RuPay Credit Card with Card Insider. Compare different features of credit cards on our website and choose the card most suited for you. You can then click on the “Apply Now” button to apply for the card. Keep a few documents (PAN Card & Aadhaar Card) with you as they might be needed while filling out your credit card application.

You can also apply for a SBI RuPay Credit Card offline by visiting the nearest SBI Branch.

Conclusion

The introduction of the Unified Payment Interface (UPI) has changed how we make day-to-day payments. From small amounts at the grocer to large purchases, we use UPI for everything, and now, with RuPay Credit Cards, you can easily link your card to UPI. This makes the SBI RuPay Credit Cards the most appealing. Whether you are someone who is looking for an entry-level credit card or if you are looking for a card to use through UPI with an SBI Credit Card, you are sure to find the best fit.

Rewards, safe and convenient transactions, and quick payments are all made easy with a SBI RuPay UPI Credit Card. Tell us your views on these RuPay Credit Cards offered by SBI Card.