Launched by SBI Card in partnership with BPCL, SBI BPCL Credit Card is a co-branded fuel credit. It is an entry-level offering and comes with a nominal membership fee of just Rs. 499 per annum. Being a fuel credit card, it provides a total value back of 4.25% (3.25% reward rate and 1% surcharge waiver) on fuel transactions at all BPCL stations.

In addition to fuel benefits, you also get accelerated 5X Reward Points on spends on departmental stores, dining, movies and grocery categories. Since it is an entry-level credit card, you do not get any other value-added travel or lifestyle benefits. Although this card provides a lot of benefits in the essential category, you can also check out If, BPCL SBI Card Octane.

Keep reading the article to learn more about this fuel credit card–

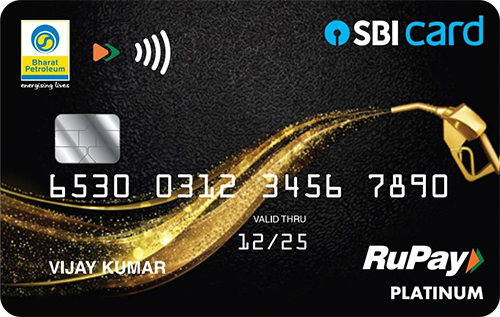

BPCL SBI Credit Card

Joining Fee

Renewal Fee

Best Suited For

Fuel |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

5X Reward Points on movie and dining spends

Rewards Rate

1 Reward Point per Rs. 100 (reward rate = 0.25%), 5x RPs on dining, movies, departmental stores, and groceries (reward rate = 1.25%), 13X RPs at BPCL pumps (reward rate = 3.25%)

Reward Redemption

Reward Points are redeemable against gift vouchers on sbicard.com or on the SBI mobile app, for purchases at BPCL petrol stations and against cash (card’s statement balance). 4 Reward Points = Re. 1.

Travel

N/A

Domestic Lounge Access

N/A

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

Renewal fee is waived off on a minimum spend of Rs. 50,000 in an anniversary year.

Rewards Redemption Fee

Rs. 99 (plus applicable taxes) per redemption request

Foreign Currency Markup

3.5% of the transaction amount

Interest Rates

3.5% per month (42% per annum)

Fuel Surcharge

1% fuel surcharge waived off at all fuel stations across India for transactions up to Rs. 4,000 (max waiver capped at Rs. 100 per month)

Cash Advance Charges

2.5% of the withdrawn amount (subject to a minimum charge of Rs. 500)

- 2,000 Activation Bonus Reward Points worth Rs. 500 on payment of joining fee.

- 1 Reward Point per Rs. 100 spent with the card on non-fuel transactions.

- 5X Reward Points on departmental stores, groceries, dining, and movie spends.(Up to 5000 Reward Points per month)

- 13X Reward Points on fuel spends at BPCL filling stations. (Maximum 1300 Reward Points per billing cycle)

- 1% fuel surcharge waived off at all filling stations across India for transactions up to Rs. 4,000(max waiver capped at Rs. 100 per month).

- Annual renewal fee waived off on expenditure of Rs. 50,000 in the preceding year.

Pros

- This card offers great reward points on fuel transactions at BPCL petrol pumps in India.

- BPCL SBI Credit Card can be availed at a low joining cost of Rs. 499.

Cons

- This card doesn’t offer any domestic or international lounge access.

- There are no insurance benefits provided with the BPCL SBI Credit Card.

BPCL SBI Credit Card Features and Benefits

BPCL SBI Credit Card Welcome Benefits:

2,000 Bonus Reward Points worth Rs. 500 on the realization of the annual fee (credited after 20 days of the payment of the joining fee).

Milestone Benefit:

The renewal fee of Rs. 499 for this credit card can be waived if the cardholder is able to spend Rs. 50,000 or more using his credit card in an anniversary year.

Movie and Dining Benefits:

5X Reward Points (5 Points per Rs. 100) on movie and dining spends.

Fuel Surcharge Waiver:

- 1% fuel surcharge waiver at all fuel stations across India on every transaction of up to Rs. 4,000.

- The maximum surcharge waiver is capped at Rs. 100 per statement cycle.

BPCL SBI Credit Card Reward Points

- 1 Reward Point for every Rs. 100 spent on non-fuel transactions using this card.

- 5 Reward Points on every Rs. 100 spent on groceries, departmental stores, dining, and movies (max 5,000 Reward Points per month at an accelerated rate).

- 13 Reward Points on every Rs. 100 spent on fuel purchases at BPCL stations (max 1,300 Reward Points per month at an accelerated rate)

- Annual savings of nearly 50 litres of fuel.

- No reward points are earned on wallet reloads and recharges.

BPCL SBI Credit Card Rewards Redemption:

Reward points can be redeemed in the following ways:

- On sbicard.com or on SBI’s mobile app for purchasing gift vouchers.

- Against cash (i.e. against the statement balance of the card) by writing an email or calling SBI’s customer care.

- At BPCL fuel stations.

- 4 Reward Points are equivalent to Re. 1.

- The reward points earned expire after 2 years (24 months) from the date of accumulation.

BPCL SBI Credit Card Fees and Charges

Given below are the fees associated with the BPCL SBI Credit Card.

Joining/Annual Fees:

With this card, you would have to pay jogging and renewal charges of Rs. 499 plus applicable taxes.

Reward Redemption Fees:

BPCL SBI Credit Card holders are charged a Rs. 99 reward redemption fee.

Late Payment Charges:

- Amount due from Rs. 0- Rs. 500 – Nil

- Amount due is between Rs. 500 and Rs. 1,000 – Rs. 400

- Amount due is more than Rs. 1,000 and up to Rs. 10,000, then Rs. 750

- Rs. 950 for the amount due of more than Rs. 10,000 less than 25,000

- Rs. 1,100 for an amount greater than Rs. 25,000 but less than Rs. 50,000

- If the amount due is greater than Rs. 50,000, then Rs. 1,300 is chargeable

How To Apply for a BPCL SBI Credit Card?

Easily apply for a BPCL SBI Credit Card with Card Insider. You can click here to apply now!

BPCL SBI Credit Card Limit

The specific credit limit for your BPCL SBI Credit Card is not revealed in advance. You will receive this information upon delivery of your card. Your credit limit depends on several factors, including your credit history and monthly income.

BPCL SBI Credit Card Review

BPCL SBI Credit Card is a decent fuel credit card in the entry-level segment. You not only get a total value back of 4.25% (including the surcharge waiver of 1%) on fuel purchases but also a good reward rate on movie, dining, grocery and departmental store spends. Fuel is a basic necessity in today’s world. This credit card can help you save on this necessary expense.

What are the criteria for applying for a BPCL SBI credit card? Does it offer 10X reward points on online spending, like Simplyclick SBI credit card?

The BPCL Sbi credit card has 499 renewal fee, is there any chance that it lauches a LFT card?