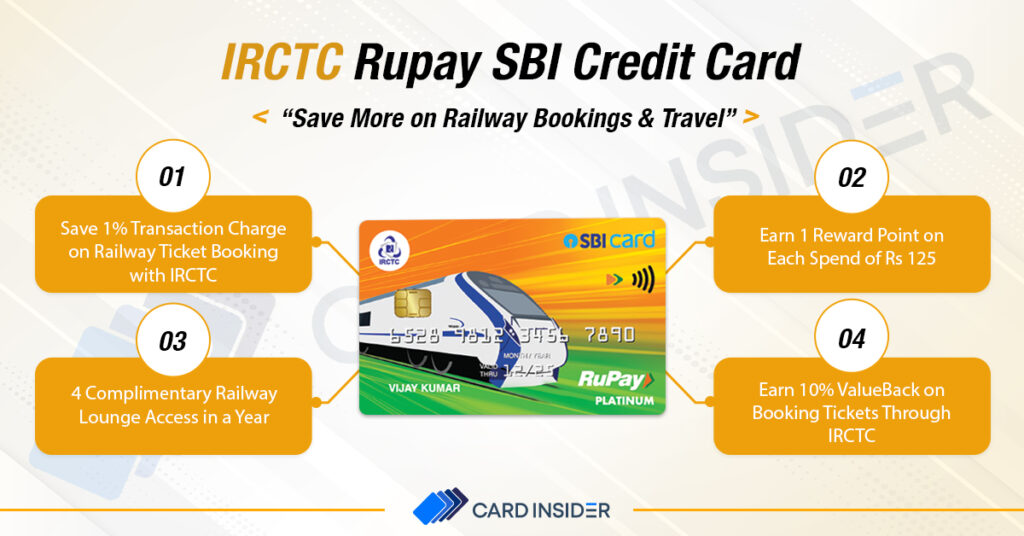

The IRCTC Rupay SBI Credit Card is a co-branded credit card that provides exciting rewards and benefits in partnership with IRCTC. The card comes with a joining fee of just Rs. 500 and is best suited for people who travel more through railways. With this card, you get 1 Reward Point for every Rs. 125 on retail purchases and on railway ticket bookings through the IRCTC website or mobile app. It provides you exciting welcome benefits, including a welcome bonus of 350 reward points, where 1 Reward Point is equal to Re. 1. Moreover, you get great travel benefits, such as 4 complimentary railway lounge access every year and accommodation at over 5000 hotels across 350 leading cities in India. To know full details about the IRCTC Rupay SBI credit card, its benefits, and fees & charges, you must keep reading the information given below:

IRCTC Rupay SBI Credit Card

Joining Fee

Renewal Fee

Best Suited For

Travel |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

NA

Rewards Rate

1 Reward Point on every spend of Rs. 125.

Reward Redemption

The RPs you earn are credited to your IRCTC Rupay SBI credit card.

Travel

You get complimentary railway lounge access every year through the Railway Lounge Program and accommodation at more than 5000 hotels across 350+ cities in India.

Domestic Lounge Access

4 complimentary domestic railway lounge access every year (1 per quarter).

International Lounge Access

NA

Golf

NA

Insurance Benefits

NA

Spend-Based Waiver

Nil

Rewards Redemption Fee

Rs. 99

Foreign Currency Markup

3.5% per foriegn conversion

Interest Rates

3.5% per month (42% per annum)

Fuel Surcharge

1% fuel surcharge waiver across all petrol pumps in India for all transactions between Rs. 500 to Rs. 3,000. You can get a maximum waiver of Rs. 100 in a statement cycle.

Cash Advance Charges

2.5% or Rs. 500 (whichever is higher)

- Get 1 Reward Point for every Rs. 125 spent on retail purchases, including railway tickets booked at the IRCTC Website or IRCTC mobile app.

- Get 350 bonus reward points on a transaction of over Rs. 500 within 45 days after the card set-up date as a welcome gift.

- On buying AC1, AC2, AC3, and AC CC tickets through IRCTC, you get up to 10% value back as reward points.

- Get 4 complimentary railway lounge access every year.

- You can save the 1% transaction charges on your railway ticket booking through IRCTC.

IRCTC Rupay SBI Credit Card Rewards

You get 1 reward point for every Rs. 100 you spend on retail purchases and railway ticket bookings through IRCTC.

Value Added Rewards

You can earn up to 10% of the value back as reward points when you buy tickets through the IRCTC website & IRCTC Mobile App (for Android only) for AC1, AC2, AC3, and AC CC. Reward Points will be transferred to the cardholder’s IRCTC Loyalty Account redeemed via the IRCTC website or mobile app (android only).

IRCTC RuPay SBI Credit Card Features

Welcome Benefits

- You get 350 bonus reward points as a welcome gift on your first transaction of over Rs. 500 if done within 45 days after receiving the card (other than fuel or cash spends).

- Earn assured cashback of Rs. 100 on your first ATM cash withdrawal within the first 30 days after receiving the card. These reward points are credited to your IRCTC Rupay SBI credit card within 45 days of the eligible transaction.

Travel Benefits

- You get access to 4 domestic railway lounges every year (1 per quarter) through the Railway Lounge Program.

- You can book your airline tickets at IRCTC at amazing prices.

- With the IRCTC SBI Platinum credit card, you can save 1% on transaction charges on railway ticket booking on IRCTC’s website.

- Avail custom-made tour packages from adventure wildlife to leisure and pilgrimage across India from the IRCTC Website.

UPI Spends

The IRCTC RuPay SBI Credit Card can easily be linked to the UPI application of your choice, like Google Pay, PhonePe, etc.

Fuel Surcharge Waiver

You get a 1% fuel surcharge waiver on all fuel transactions across all fuel stations in India on transactions between Rs 500- Rs 3000. You get a maximum surcharge waiver of Rs 100 per statement cycle.

Other Benefits and Privileges

- Convert your transactions of Rs 2500 and above into easy monthly Installments using Flexipay.

- Get a draft or cheque against your cash limit at your doorstep using Easy Money.

- Transfer the outstanding balance of other banks to your card and pay them back through easy EMIs at a lower interest rate.

Eligibility Criteria for IRCTC SBI Credit Card

For the issuance of the IRCTC SBI Platinum credit card, there are some basic eligibility criteria-

- One should be at least 18 years or above.

- Regular source of Income, whether the person is salaried or self-employed.

- One should have a decent credit score or credit history (Preferably above 700).

Review of IRCTC RuPay SBI Credit Card

Keeping all its benefits in mind, the IRCTC Rupay SBI credit card would be an excellent choice for you if you travel frequently through Railways. However, railway benefits are not the only advantage of this card; it also provides its customers with exciting rewards and savings offers. The complementary Railway lounge access provided by this card is one of the most significant reasons why you should choose the IRCTC Rupay SBI credit card. Also, it provides you with hotel accommodation at over 5000 hotels in India, which might be a thing you are looking for. If you want to have a credit card with several benefits and special benefits on Railways, you can go with the IRCTC Rupay SBI Credit Card.

want to cancel this card