We all love using a credit card for making payments, so why not pay our recurring and repeating taxes with them? For every purchase or bill settled with a credit card, we are rewarded with tons of rewards. But can you make income tax payments with a credit card, and should you? Many questions arise about making income tax payments with a credit card, and therefore, we are here to assist you and enlighten you with information related to making tax returns via credit card.

In this article, we are going to talk about the process of making Income Tax payments using a credit card and whether or not you should use your credit card for the same. To learn more about the usage of credit cards for income tax payments, keep reading.

Income Tax Payments via Credit Cards

Earlier, Taxpayers were able to make Income Tax payments only through the net banking of some of the famous commercial banks. However, with recent advancements, taxpayers now have multiple payment options like NEFT/RTGS, UPI, and credit cards. Making payments with a credit card carries a charge on the payment amount.

Before we discuss that, let’s first understand the process of tax payments via credit cards.

How to Pay Income Tax in India Via Credit Card?

Following are the steps that would assist you in making an Income Tax payment via Credit card:

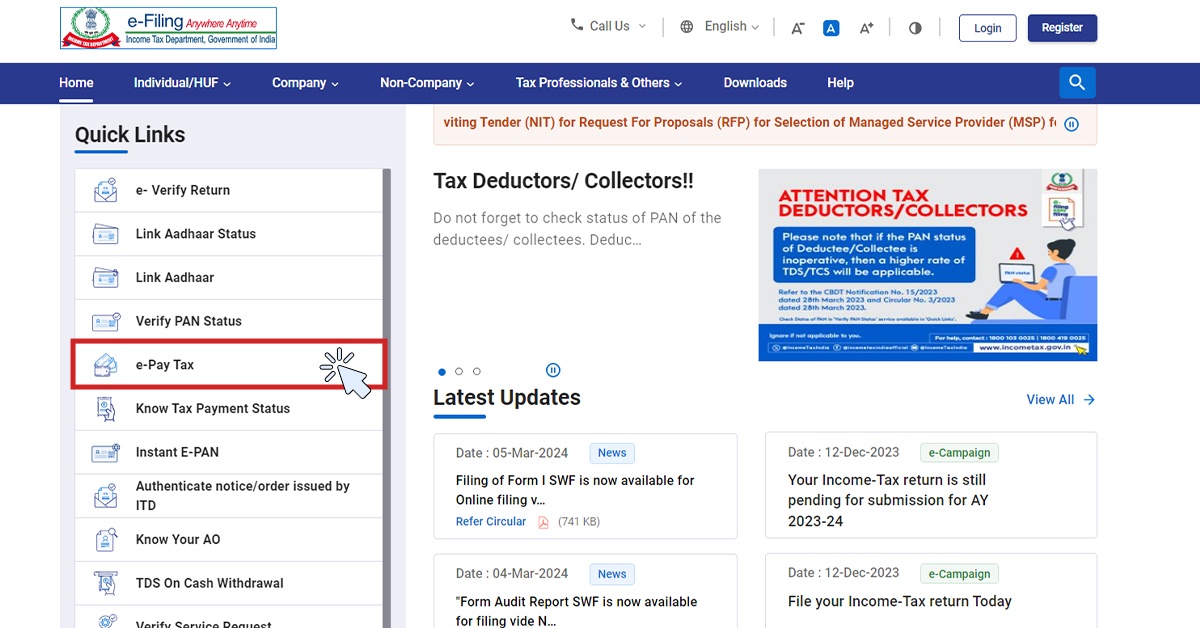

- Visit the official portal of Income Tax India. On the Homepage, you will find the Quick Links tab on the left side of your screen. Under the list, Click on E-pay.

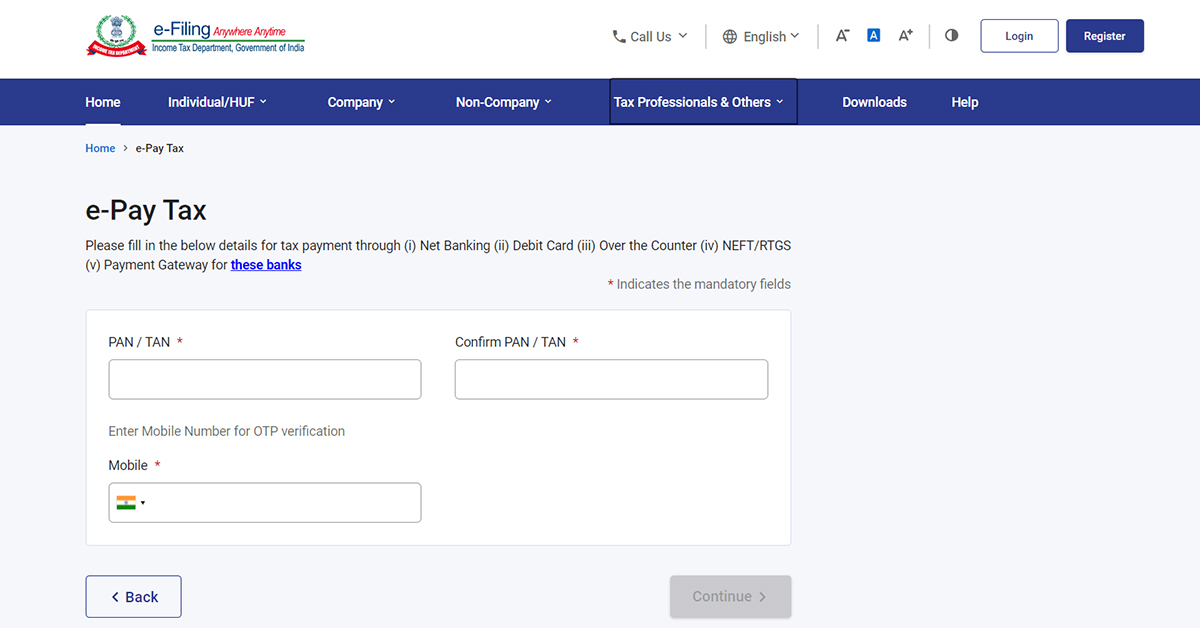

- In the next step, you will be required to enter your PAN Card Number along with your contact details. After that, you will be asked to enter the OTP received on your contact number.

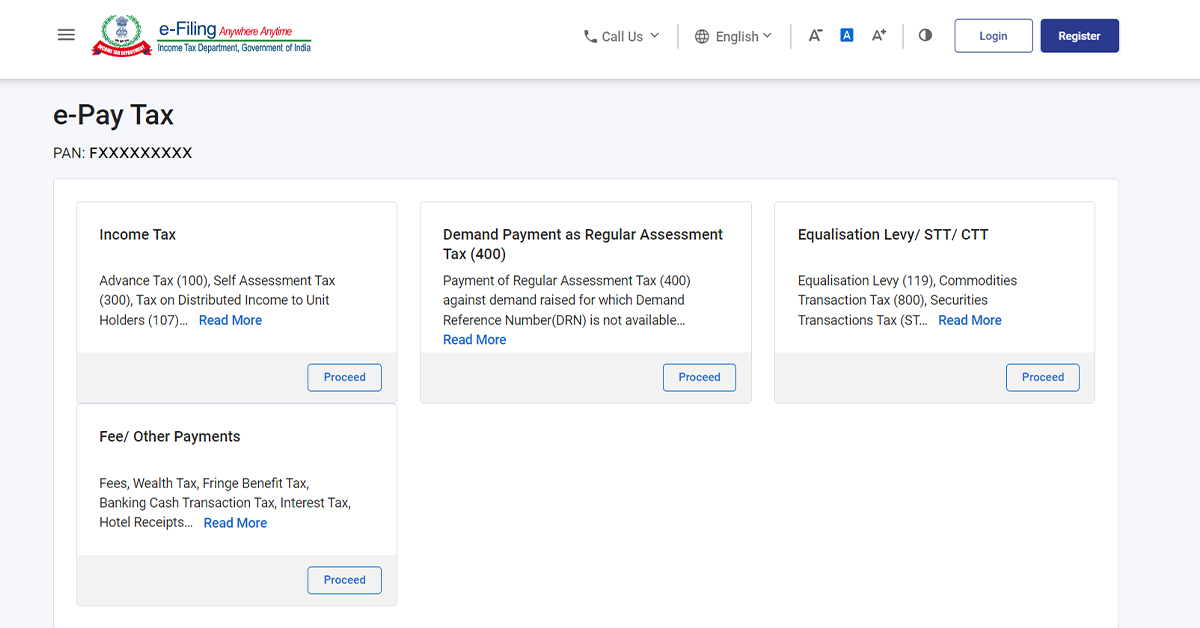

- In this next window, select the 1st option of Advance Tax and click the proceed button.

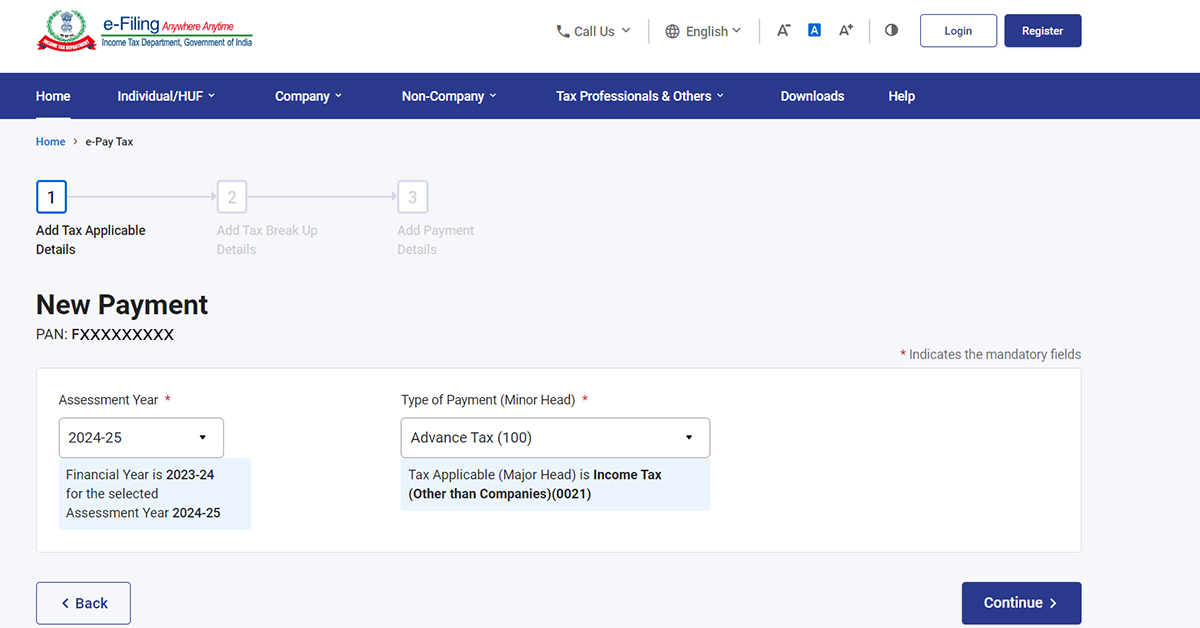

- Now, you have to select the assessment year and the type of payment.

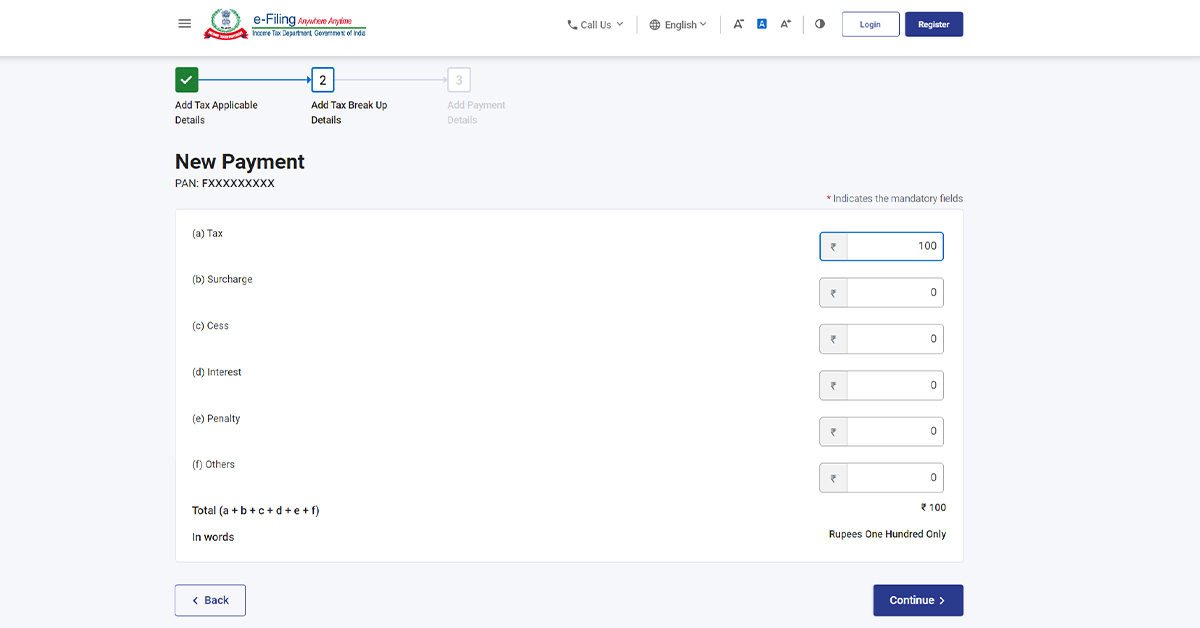

- In the next tab, you will be asked the amount of tax to be paid, as well as any surcharge, cess, interest, or penalty applicable to the tax amount. We have taken the tax amount of Rs. 100 as an example.

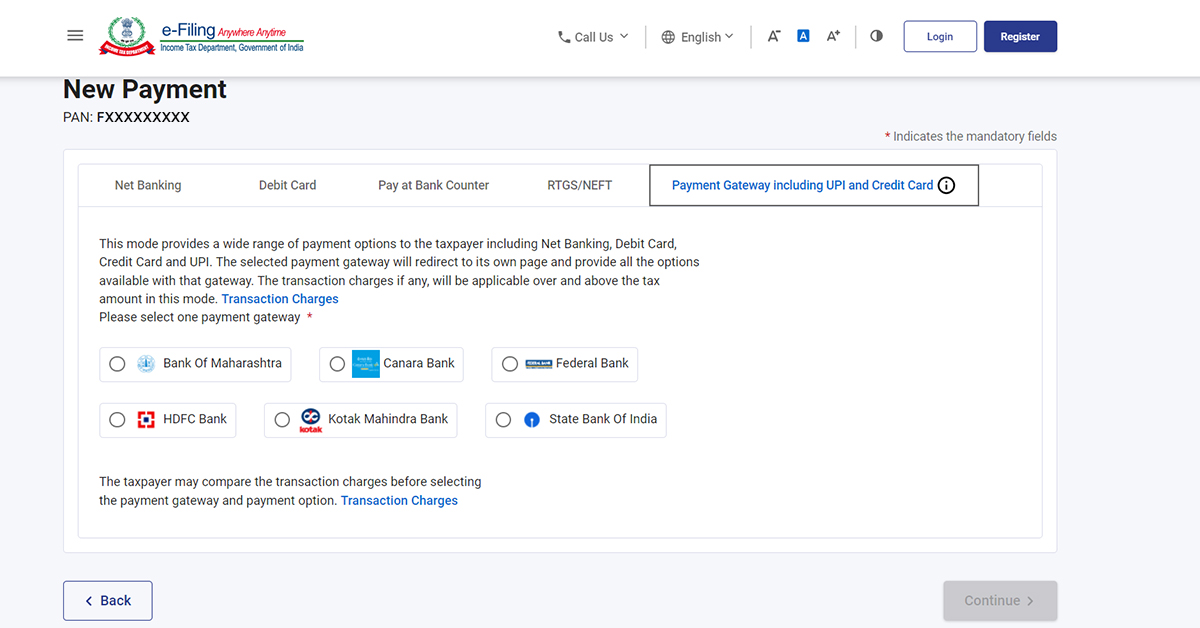

- Now, to make the payment via credit card, select the Payment Gateway option and hit continue. For making a payment via credit card, a transaction fee would be applicable to the transaction amount. The rate applicable depends upon the Gateway used.

- Review the details entered and check all the amounts to see whether they are correct or not. After doing the same, click on the Pay Now button and agree to the terms and conditions.

- Next, select the payment option via credit card and then enter all the details of your credit card: Name, Card number, Expiry date, CVV, Mobile number, and Email. Once you are done, click on Pay, and you will receive an OTP on your registered number, which you have to enter to make the transaction.

- Note that credit cards issued with Visa, Mastercard, and Rupay network processors are acceptable for payments via credit cards. You won’t be able to make payments with an AmEx variant credit card.

Fees and Charges Applicable for Income Tax Payment With Credit Card

Making income tax payments with a credit card attracts a certain transaction fee or payment charge. Earlier, there was only one Payment Gateway (Federal Bank), which carried a transaction charge of 0.85% plus taxes, but now the cardholders have more options to choose from. Following are the Payment Gateways available currently:

Payment Gateway Charges – Federal Bank

| Mode of Payment | Transaction Charges (INR) |

| Credit Card (Federal Bank) | 0.85%* |

| Credit Card (Other Bank) | 0.85%* |

| Unified Payments Interface (UPI) (BHIM-UPI) | NIL |

Payment Gateway Charges – Kotak Mahindra Bank Limited

| Mode of Payment | Transaction Charges (INR) |

| Credit Cards (Master/Visa/RuPay) | 0.80%* |

| Credit Cards (International) | 2.75%* |

Payment Gateway Charges – Canara Bank

| Mode of Payment | Transaction Charges (INR) |

| Credit Card (Canara Bank) | 0.90%* |

| Credit Card (Other Bank) | 0.90%* |

| Unified Payments Interface (UPI) (BHIM-UPI) | NIL |

Payment Gateway Charges – HDFC Bank

| Mode of Payment | Transaction Charges (INR) |

| Credit Card (HDFC Bank) | 0.72%* |

| Credit Card (Other Bank) | 0.80%* |

| Unified Payments Interface (UPI) (BHIM-UPI) | NIL |

Payment Gateway Charges – SBI Bank

| Mode of Payment | Transaction Charges (INR) |

| Credit Card (SBI Bank) | Not Applicable |

| Credit Card (Other Bank) | Not Applicable |

| Unified Payments Interface (UPI) (BHIM-UPI) | NIL |

Payment Gateway Charges – Bank of Maharashtra

| Mode of Payment | Transaction Charges (INR) |

| Credit Card – Above Rs 2000 | 1.00% |

| Credit Card EMI- Master/Visa/RuPay | 1.00% |

| Unified Payments Interface (UPI) | NIL |

An extra GST of 18% will be levied on all transactions.

Which Card Offers You The Best Benefits?

Now that we have learned all about the various fees associated with credit card payments for income tax returns, we will look at the list of the best credit cards for income tax payments.

With the Axis Bank Atlas Credit Card, you can earn 2 EDGE Miles per INR 100 spent on your income tax payments.

Earn 6 CV Points per Rs. 200 spent on your advance income tax payments with the CV IDFC First Credit Card. You can also achieve your spend milestone benefit by paying your taxes with this credit card. Premium economy vouchers can be achieved by reaching the spend milestone benefit.

Tax payments made with this credit card shall also earn regular reward points; along with this, you can also achieve milestone spends with these. With the CV SBI Credit Card, you shall earn 3 CV (Club Vistara) Points per Rs 200 you spend.

Club Vistara SBI Card PRIME also offers you 4 CV (Club Vistara) Points per Rs 200 you spend on tax payments.

Should you Pay Income Tax via Credit Cards?

The following points will help you decide whether or not you should make Income Tax Payments via credit cards:

- Credit Card Rewards: One should use a credit card to make an income tax payment only if they are provided with reward points on the transaction. If they do, then the effective reward rate on the card should be 2x or 2%. This is because the payment charges applicable to credit card payments for income tax payments are 1.003% (0.85 plus 18% GST).

Though there are other payment gateways available as well that charge a lower or no charge, the cardholder should still be ready in case any of these gateways are not in service for the time being.

- Milestone Benefits: Another reason to make the payment via credit card should be that the cardholder is reaching the milestone spend and is getting the rewards associated with the credit card.

- Know the applicable charges: As mentioned above, the transaction processing charges applicable on credit card payments are 1.003% of the transaction amount. Therefore, taking the above example of Rs. 10,000 tax payment. The transaction charges on the same would be Rs. 100.3.

- High Interest on Unpaid Balance: Interest charges applicable on credit cards are much higher than any other payment option. If you make the income tax payment with a credit card and cannot settle the card bill on time, then you will face heavy interest charges on the due amount.

Bottom Line

Making the Income Tax Payment via credit card is a good choice as it provides you with multiple days to pay back. Also, if your card’s reward rate or milestone benefit outweighs the processing charges applicable, then it is worth going with a credit card. However, if you cannot pay back the amount, then you must not make the payment via credit card, or else you will face heavy interest rates. If you have any doubts regarding the same, let us know in the comments below.

Will making this income tax payment via credit card be considered as a cash advance (or) will it be a normal online transaction?

Normal credit card transaction, you won’t be charged interest

Is there a way to know under which MCC category this transaction will be charged?

definitely would be under government transactions

I think most cards are not giving rewards on government spends. Any idea which cards still give rewards on such spends, maybe income tax, property tax etc?

Hi,

Any idea if SBI Air India card gives reward points for Income Tax payment?