IDFC Bank Credit Cards – Revision in Payment Due Date and Minimum Amount Due

IDFC First Bank has made some new changes to its credit card payments and fee structure, which will be implemented […]

IDFC First Bank has made some new changes to its credit card payments and fee structure, which will be implemented […]

With the rise of RuPay credit cards, UPI payments have received a further boost. IDFC Bank has introduced an exciting

The FirstTap sticker is an innovative way of making payments easier and faster. It is a debit card, but not

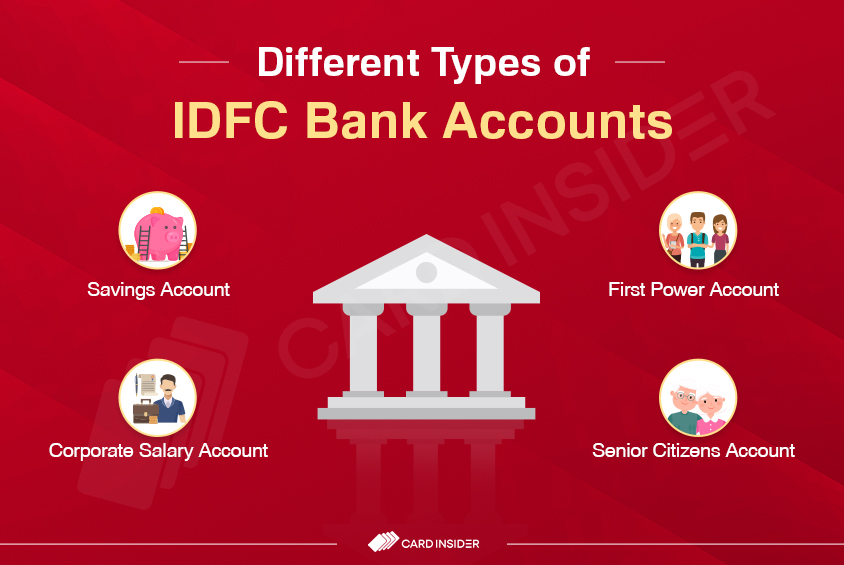

When it comes to managing our money, banks offer various accounts to suit our needs. Savings accounts are India’s most

We often forget that amidst all the news of devaluations and changing features, there are new, exciting, and rewarding credit

IDFC FIRST Bank is a private-sector bank in India that offers various financial services, such as savings and current accounts,

Selecting the right credit card can make a big difference in how you earn rewards and handle your money. The

The IDFC FIRST RuPay Digital Credit Card is a virtual card launched for making UPI payments. The IDFC Bank in

IDFC First Bank has recently introduced two new corporate credit cards, the FIRST Purchase and the FIRST Corporate Credit Card.

In today’s busy world, choosing the right credit card that helps manage expenses and has good features and rewards can

IDFC First Bank has followed the trend set by other banks and introduced its series of credit card devaluations. While

Known for its rewarding and lifetime free range of credit cards, IDFC First Bank has also joined the list of