IDFC First Bank has followed the trend set by other banks and introduced its series of credit card devaluations. While the bank has recently updated its terms and conditions for utility and rent payments made through its credit card, this is the first time this year that IDFC Credit Cards will undergo substantial changes. Whether it’s introducing higher spend-based criteria for lounge access or reducing rewards/offers, all IDFC credit cards have been affected except for the ultra-premium Private Credit Card. All of these changes shall be implemented from 1st May 2024.

We have provided all the details and updates regarding various IDFC Credit Cards. Those with these credit cards or who wish to apply for them should keep these new terms and changes in mind.

Club Vistara IDFC FIRST Credit Card

One of the most premium offerings brought by the collaboration of IDFC First Bank and Club Vistara is this credit card, which can be availed at a joining and annual charge of ₹4,999. Here are the latest changes to the IDFC Club Vistara Credit Card terms.

- IDFC Club Vistara Credit Card holders shall now need to spend at least ₹20,000 in a calendar month to avail themselves of premium lounge and spa access in the following month.

- Earlier also, there was a 1% + GST charge on rent transactions, but now these property and rent transactions (MCC 6513) shall be subject to a minimum of ₹249 per transaction or 1% + GST, whichever is higher.

FIRST Millennia Credit Card

One of the most popular lifetime-free credit cards in India, the First Millennia shall also undergo several changes from May 2024.

| Previous | New |

| 6X Reward Points on Online Spends Upto ₹20,000 | 3X Reward Points on Online Spends Upto ₹20,000 |

| – | 3X Reward Points on Education, Wallet Load, and Government Services. These Shall Not Be Included in the Calculation of the 10X Spend Threshold |

IDFC First Classic Credit Card

The IDFC First Classic Credit Card is a popular entry-level card. This card comes with zero annual or joining charges like many offered by IDFC First Bank.

- Reward points on online spends up to Rs. 20,000 in a statement cycle will be revised to 3X. Earlier 6X points were awarded for online spends.

- Reward points on Education, Wallet load, and Government services transactions will be revised to 3X. These transactions will no longer be part of the 10X threshold calculation

IDFC FIRST HPCL Power Credit Card

- 21X Reward Points on HPCL Fuel up to 700 Reward Points (₹175) in a statement cycle.

- Fuel Surcharge Waiver shall be removed as equivalent Reward Points are included in the new fuel rewards category.

- UPI transactions will earn 2X Reward Points across all categories (Except Fuel, Insurance, and EMI). There is no capping on UPI Reward Points.

IDFC HPCL First Power Plus Credit Card

A popular fuel credit card, the First Power Plus is a co-branded card offered by IDFC Bank in association with HPCL. With an affordable fee of ₹499 + GST, this card offers benefits on all fuel purchases made at HPCL pumps. Given below are some of the latest updates on this card.

- 30X Reward Points on HPCL Fuel up to 2400 Reward Points (₹600) in a statement cycle

- Fuel Surcharge Waiver shall be removed as equivalent Reward Points are included in the new fuel rewards category.

- UPI transactions will earn 3X Reward Points across all categories. [Excluding Fuel, Insurance, EMI]. There is no capping on UPI Reward Points.

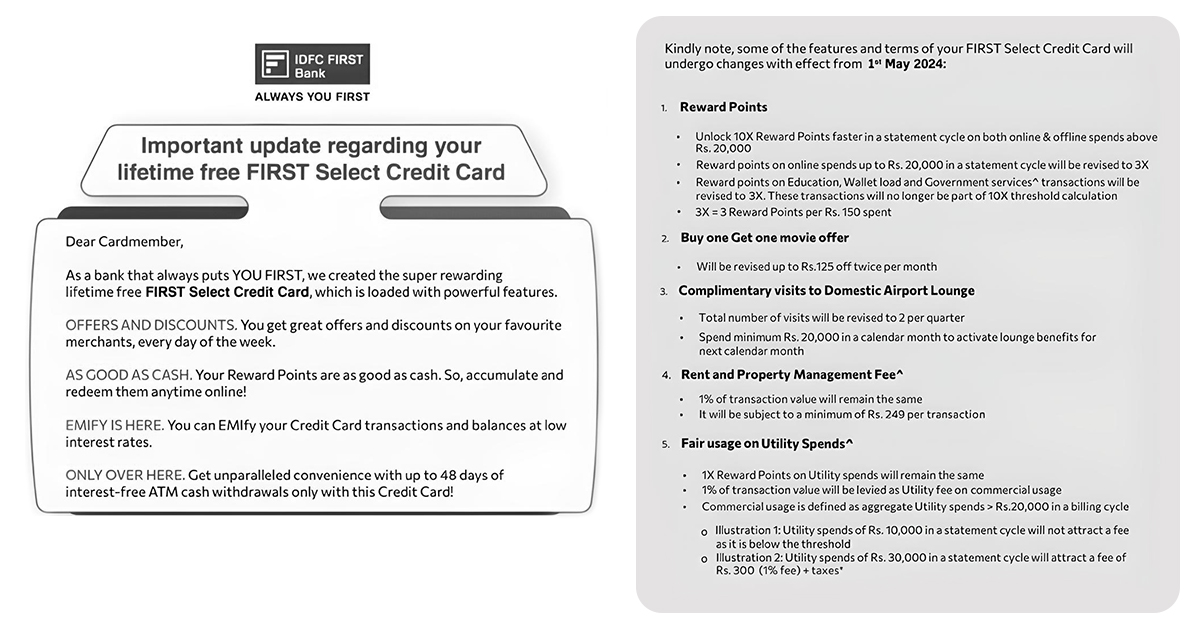

IDFC First Select Credit Card

- The Buy One Get One offer on Paytm movies shall be revised from ₹250 to ₹125.

- The number of free domestic airport lounge visits has been reduced from 4 each quarter to 2. IDFC First Select Card holders shall also have to spend ₹20,000 each month to be eligible for lounge access in the next month.

- Refer to the table below to better understand the changes made to the reward-earning structure of this card.

| Previous | New |

| 10x Reward Points/₹125 Spent on Online and Offline Purchases Above ₹25,000 | 10x Reward Points/₹125 Spent on Online and Offline Purchases Above ₹20,000 |

| 6X Reward Points/₹125 Spent Online | 3X Reward Points/₹150 Spent Online (Upto ₹20,000) |

| – | Education, Wallet, and Government Services Spends Shall Earn 3X Reward Points/₹150 and Shall Not Be Eligible for 10X Threshold Calculation |

IDFC First Wealth Credit Card

- The value of the BOGO offer on Paytm movies has now been reduced from ₹500 to ₹250 twice a month.

- There’s a new limit on lounge access for the IDFC First Wealth Credit Card. You’ll now be able to access both domestic and international airport lounges twice per quarter, down from the previous limit of four visits. This change applies to both types of lounges.

- The airport lounge access benefit can only be unlocked by spending a minimum of ₹20,000 in the previous month.

Charges on Utility and Rent Payments

As updated before, there shall be a 1% + GST charge on all utility payments that exceed ₹20,000 in a statement cycle. This is being termed as a charge on utility transactions that are made for commercial purposes and shall not affect ordinary users. This change is applicable to all IDFC Credit Cards except the FIRST Private Credit Card, LIC Classic Credit Card, and LIC Select Credit Card.

Bottom Line

Yesterday, IDFC First Bank announced changes to its terms regarding utility and rental spends. Many customers were concerned that these changes would be as severe as those recently introduced by Yes Bank. However, upon careful analysis, it can be said that IDFC Credit Card holders will not be affected by the 1% charge on utility payments. This is because those who are not using their cards for commercial purposes will have utility spends around the threshold of ₹20,000. Additionally, the bank has only introduced a moderate charge of ₹249 per transaction or 1%, whichever is higher, for rental payments.

But as was expected, the bank has now announced significant devaluations for many credit cards. In addition to charges on utility and rental payments, IDFC Credit Card holders will now have to spend ₹20,000 to access lounge access. Furthermore, many significant offers such as Buy One Get One on movies have been reduced. There even have been changes to the reward structure of some of the most popular IDFC Credit Cards. All of this will undoubtedly have an impact on card users. Many might even consider some of these changes to be righteous as the bank is curbing business/commercial spends.

However, IDFC First Bank still offers some of the most rewarding credit cards available, many of which are lifetime-free. Are you an IDFC First Credit Card user? Share your opinions on this latest move by the bank in the comments below.