Which is the Best IDFC Bank Account You Should Opt for?

When it comes to managing our money, banks offer various accounts to suit our needs. Savings accounts are India’s most […]

When it comes to managing our money, banks offer various accounts to suit our needs. Savings accounts are India’s most […]

In today’s unpredictable financial world, it’s important to keep our hard-earned money safe and growing. A savings account is a

Today, credit cards are not just for buying things. They can help you manage your money, earn rewards, and save

Debit cards are a simple way to pay for things. They look similar to credit cards but work differently. When

Debit cards provide easy access to funds in your bank account and can be used for various transactions, including online

Many people tend to prioritize immediate satisfaction over responsible financial behavior and find it almost tempting to convert large purchases

India’s business sector has seen significant growth recently. It has become a busy area for startups and multinational companies, offering

If you are considering applying for an IndusInd Bank credit card or already have one, this article will prove to

Opting for insurance is what adulting is all about. Many of us opt for insurance for peace of mind, whether

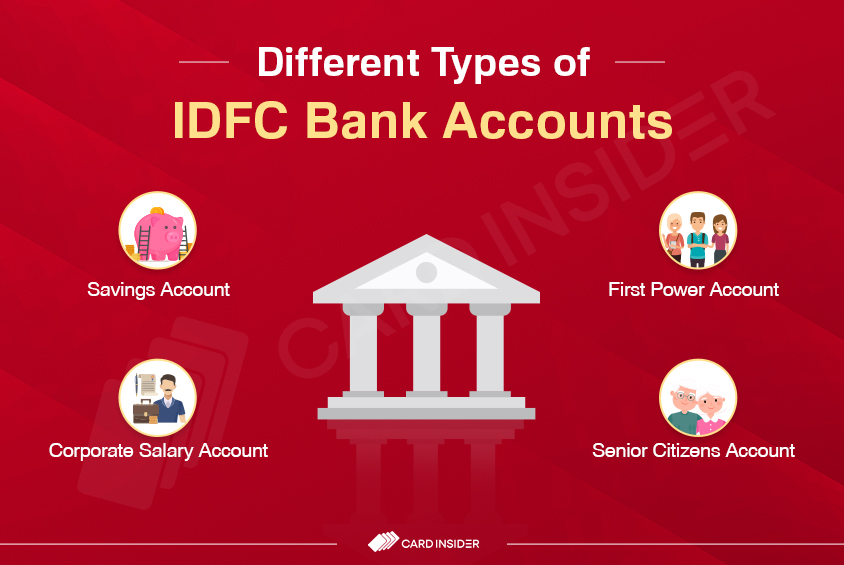

IDFC FIRST Bank is a private-sector bank in India that offers various financial services, such as savings and current accounts,

Saving money is an important habit that helps secure one’s financial future and manage unexpected expenses. A savings account is

Smartwatches are like tiny computers you wear on your wrist. They tell you the time, yes, but they can also