One of India’s top cashback credit cards, the co-branded Flipkart Axis Bank Credit Card is exclusively for people who shop online at Flipkart, a popular e-commerce store. Whether you are looking to buy daily household items, apparel, electronics, books, or simply doing some festive shopping, the Flipkart Axis Bank Credit Card will get you instant 5% cashback on Flipkart. One of the best features of this card is that there is no capping on cashback earnings. The card also provides 4% accelerated cashback to popular merchants like Swiggy, PVR, Uber, Cleartrip, and cult.fit along with travel, dining, and fuel benefits.

Loaded with numerous features, the Flipkart Axis Bank Credit Card has a low joining fee of ₹500 + GST which is recouped when you receive a welcome benefit voucher of the same amount. Apart from great cashback on popular brands and platforms, you will also be eligible for free airport lounge access across India. Keep reading about the Flipkart Axis Credit Card to learn more and find out where this card stands compared to other popular cards, such as the ICICI Amazon Pay Credit Card.

- Earn Unlimited Cashback With Flipkart Axis Credit Card

- Welcome Benefits

- Dining and Movie Benefits

- Travel Benefits

- Compare Other Cashback Cards to Flipkart Axis Bank Credit Card

- Why Apply for a Flipkart Axis Bank Credit Card?

- Flipkart Axis Bank Credit Card – Application and Eligibility

- Check Axis Bank Flipkart Credit Card Application Status Online

- Latest News on Flipkart Axis Bank Credit Card

- Review of Flipkart Axis Bank Credit Card by Card Insider

- FAQ

Flipkart Axis Bank Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Cashback |

Welcome Benefits

Movie & Dining

Up to 15% off at partner restaurants under Axis Bank's exclusive Dining Delights program

Rewards Rate

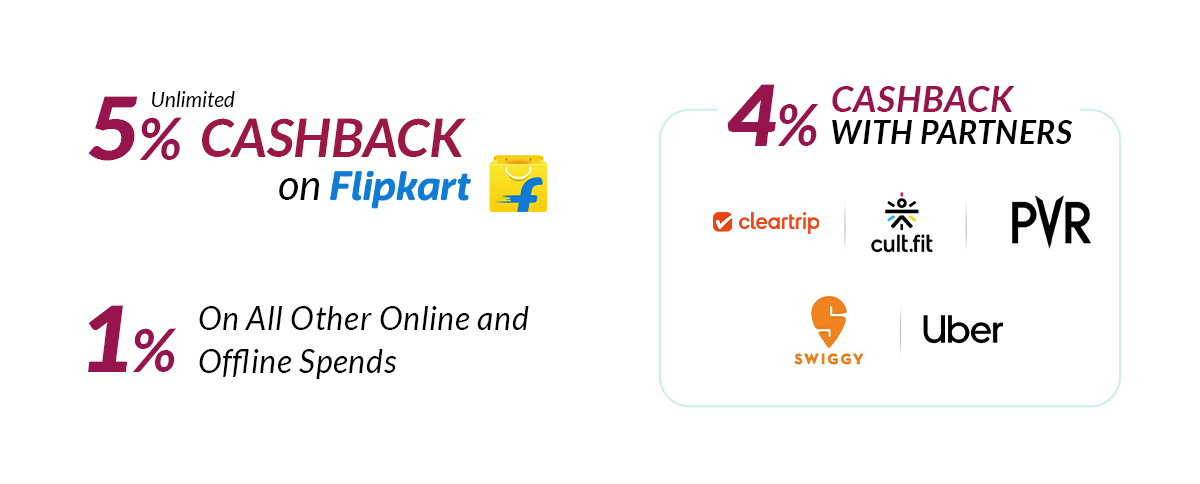

5% cashback on Flipkart, 4% cashback on preferred partners (Swiggy, Uber, PVR, and cult.fit), and 1% cashback on all other spends.

Reward Redemption

N/A

Travel

Accelerated Cashback (4%) on Uber Rides

Domestic Lounge Access

1 Free Domestic Airport Lounge Access Every Quarter (4 Each Year)

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

Annual fee waived on spends of Rs. 3.5 lakhs

Rewards Redemption Fee

NA

Foreign Currency Markup

3.5% of the total amount

Interest Rates

3.6% per month (52.86% annually)

Fuel Surcharge

1% surcharge for fuel purchases between Rs. 400 & Rs. 4,000 (max waiver capped at Rs. 400/month).

Cash Advance Charges

2.5% (Min. Rs. 500) of the withdrawn amount.

- Welcome gifts worth Rs. 600.

- 5% cashback on Flipkart.

- 4% cash back on preferred partners, including Swiggy, Uber, PVR, and cult.fit

- 1% cashback on all other retail spends (with a few exceptions).

- 4 complimentary airport lounge access within India on spends of Rs. 50,000 in the previous three months.

- 1% fuel surcharge waiver across petrol pumps in India for purchases worth Rs. 400 and Rs. 4,000. The maximum waiver is Rs. 400 per statement cycle.

Pros

- Flipkart Axis Bank Credit Card offers a very good reward rate of 5% on all spends on the e-commerce website Flipkart. Apart from Flipkart, you also get a good reward rate of 4% on spends at partner merchants, including famous names like Swiggy, Uber, PVR, and cult.fit.

- Another advantage of the Flipkart Axis Credit Card limit is that the card rewards you with cashback, which is directly adjusted against the card’s statement balance every month. Also, there is no upper limit on the amount of cashback that can be earned on the Flipkart Axis Bank Credit Card in a given month.

Cons

- Flipkart Axis Bank Credit Card is definitely one of the best credit cards as far as online shopping is concerned, mainly if you prefer Flipkart for most of your purchases. You also get a cashback of 4% on online food delivery via Swiggy and on Uber rides. However, if you are someone who loves shopping offline at shopping malls or other small retail stores, Flipkart Axis Card is not the best pick for you as you get a cashback of 1% on offline spends.

- Flipkart Axis Bank Credit Card does not offer any insurance benefits like air accident cover or cover against loss/delay of luggage.

Earn Unlimited Cashback With Flipkart Axis Credit Card

- 5% unlimited cashback on all eligible purchases made on Flipkart.

- 4% cashback on preferred partners, including Swiggy, Uber, Cleartrip, PVR, and cult.fit.

- 1% cash back on all other online and offline spends, including Myntra.

- There is no limit on the cashback earned with the Flipkart Axis Bank Credit Card.

- Spending money on Flipkart Smart Store (‘Bills and Recharges’ section) earns you a cashback of 1% only (the same as applicable to all other transactions).

Welcome Benefits

You will receive welcome benefits worth ₹600 with this credit card. To be eligible for cashback, you need to make transactions of at least ₹100.

₹500 Worth of Flipkart Vouchers

- Simply make a transaction within the first 30 days of card issuance to take advantage of this offer.

- You shall receive your Flipkart voucher in your e-mail.

- This gift voucher cannot be redeemed for cash or credit.

50% on Swiggy Orders

- 50% instant discount on your first purchase on Swiggy.

- Maximum discount capped at ₹100.

- A minimum cart value of ₹129 is needed, and this offer can be availed once per cardholder.

- To redeem this offer, use the code “AXISFKNEW” while checking out on Swiggy. Apply the code in the “Apply coupon” section to claim your discount.

Dining and Movie Benefits

- Dining benefit under the Axis Bank Dining Delights program that gives you 15% off up to Rs. 500 on dining bills at partner restaurants. This offer is valid at 10,000+ restaurants in India.

- 4% cashback on food delivery with the Swiggy app. This accelerated cashback is not valid for Instamart or Genie.

- Accelerated cashback (4%) on PVR movie tickets.

Travel Benefits

- 4 complimentary lounge access every year at select airports within India. From 1st May 2024, cardholders shall only be eligible for airport lounge access if they have made spends of a minimum of ₹50,000 in the last three calendar months. For newly issued cards, the first month, followed by the next three, is waived to calculate spend-based criteria.

- 4% direct cashback on preferred partners you can help save on commuting expenses. Earn accelerated cashback on Uber rides with this card.

- 4% cashback is also offered on flight and hotel bookings with Cleartrip.

Compare Other Cashback Cards to Flipkart Axis Bank Credit Card

The Flipkart Axis Bank Credit Card is an online shopping credit card best suited for shoppers who rely on Flipkart for their online shopping needs. Many other credit cards currently available in the market offer a higher reward rate on spending at a particular online merchant. Some credit cards that provide a neck-to-neck competition, to the Axis Bank Flipkart Credit Card, include the Amazon Pay ICICI Bank Credit Card. The following table compares the top features of Flipkart Axis Bank, SBI Cashback, and Amazon Pay ICICI Credit Card.

| Features | Flipkart Axis Bank Credit Card | Amazon Pay ICICI Credit Card | SBI Cashback |

| Reward Structure | Cashback is adjusted every month against the card’s statement balance. | Cashback is added to the Amazon Pay balance. | Cashback is adjusted every month against the card’s statement balance. |

| Reward Rate With Partners |

|

|

|

| Reward Rate On Other Spends | 1% | 1% | 1% |

| Cashback Max Cap | No Cap | No Cap | ₹5000 Monthly |

| Additional Benefits |

|

Minimum 15% discount at partner restaurants under ICICI’s Culinary Treats Program. | N/A |

| Membership Fee | ₹500 + GST | Lifetime Free | ₹999 + GST |

Why Apply for a Flipkart Axis Bank Credit Card?

Those who regularly shop from Flipkart should definitely opt for this card. Unlimited cashback is one of its main unique features. This card can save you big, as you will get 5% cashback on your purchases whether it’s mobile phones, electronics, home furniture, or any other eligible category. Furthermore, this credit card is also advantageous for online food ordering, movie bookings, and cab bookings, as it offers 4% cashback on preferred merchants. These merchants include Swiggy, PVR, and Cleartrip, making it a versatile choice for a wide range of online spending activities.

Flipkart Axis Bank Credit Card – Application and Eligibility

Salaried individuals with a monthly income of ₹15,000 or more and self-employed individuals who earn more than ₹30,000 monthly can easily get the Flipkart Axis Credit Card. You can apply for the Flipkart Axis Bank Credit Card online with CardInsider. All you have to do is follow these simple steps.

- Click on the “Apply Now” button on your screen,

- Enter all the necessary details and upload all the documents required to submit the application,

- Submit your application.

Check Axis Bank Flipkart Credit Card Application Status Online

Once you have applied for the Axis Bank Flipkart Credit Card, the bank usually takes 10 to 15 days to process your application. To track your credit application anytime post submission of the application along with the required documents-

- Visit Axis Bank’s credit cards application tracking page.

- You can track your credit card application using your Application ID or mobile number/PAN.

- Select your desired method of application tracking, enter the captcha, and click/tap on Submit.

- You will now be able to view the status of your credit card application on the page that opens.

Latest News on Flipkart Axis Bank Credit Card

April, 2024 Update

Important changes have been made to most of the major Axis Bank Credit Cards, and many cards have been devalued. Below are the changes that will be applicable to the Flipkart Axis Bank Credit Card from 20th April 2024.

- Starting from 20 April 2024, all transactions made using the FLIPKART AXIS BANK Credit Card, except for those made on Flipkart, preferred merchants, and cashback-excluded categories, will earn a base cashback of 1% instead of the previous 1.5%.

- The free airport lounge access benefits will now be based on spending in the previous three calendar months. To avail of complimentary lounge access from 1st May 2024 onwards, you must have spent a minimum of Rs. 50,000 in the previous three months.

February, 2024 Update

Starting from February 15th, 2024, TataPlay will no longer be considered a preferred merchant for the Flipkart Axis Bank Credit Card. This means that all eligible transactions made on TataPlay using the Flipkart Axis Bank Credit Card on or after February 15th, 2024, will earn a base cashback of 1% only.

January, 2022 Update

When the Flipkart Axis Bank Credit Card was initially launched in July 2019 on the MasterCard platform, an annual fee of Rs. 500 was applicable. However, after RBI imposed restrictions on MasterCard, Axis Bank relaunched the card on the Visa payment network as a lifetime free card with no annual fee. The bank has now reintroduced the annual fee of Rs. 500 for the Flipkart Axis Bank Credit Card.

Review of Flipkart Axis Bank Credit Card by Card Insider

The Axis Bank Flipkart credit card gives you excellent returns if you love to shop online, and Flipkart is the e-commerce platform of your choice. Apart from Flipkart, you also get fairly good rewards (4%) from preferred merchants, including famous names like Swiggy, Uber, cult.fit, and PVR. Although an entry-level card, it offers four complimentary domestic lounge access and dining benefits under Axis Bank’s Dining Delights program.

The only competitor of this card in the market is the Amazon Pay ICICI Bank credit card, which has a zero membership fee but offers fewer additional benefits. Now, if you’re an online shopaholic, you can not go wrong with either of the two. You can even sign up for both, or if you have to choose between the two, you must evaluate your needs- whether you need complimentary lounge visits and how important the additional cashback benefit you get with other merchants is. Before you make a choice, you should have comprehensive information about the benefits each of the two cards offers.

What do you think of this co-branded credit card? Which one would you pick between the two? Please let us know in the comments below.

When we have to repay our credit card spend of Flipkart axis Bank credit card

Usually you would have to pay your credit cards dues between a cycle of 30 to 50 days.

I am writing to express my disappointment with my recent experience with Flipkart. Despite assurances of a 5% cashback on my Flipkart Axis Credit Card at the time of purchase, Axis Bank denied the cashback for my order. This issue was compounded by Flipkart’s return policy, which does not allow returns, resulting in overall dissatisfaction with the transaction. This experience has highlighted the challenges of relying on cashback offers without clear disclosure of potential limitations, significantly affecting my trust in Flipkart’s promotional transparency and customer service reliability.

Do we get 1.5% chasback on LIC insurance payment using the Flipkart Axis Bank Crdit Card?

No, insurance payments are not eligible for cashback.

This is now useless card. Much changes by Axis Bank so now zero use. in my statement I see zero cashback on utilities, insurance, govt service like exam fee payment.

Are there any hidden perks or features of the Flipkart Axis Bank Credit Card that we might miss?

All benefits are mentioned above.

I am confused between the Flipkart Axis Bank Credit Card and the Amazon Pay ICICI Bank Credit Card. Can you help me choose the best option?

If you regularly purchase from Flipkart you should opt for the Flipkart Axis. Whereas Amazon loyalist should go with the Amazon ICICI Bank Credit Card. These co-branded cards have their unique benefit and are centered around one or the other e-commerce platform.

Here , for offline transactions cashback is 1%

But on flipkart app it is showing 1.5% for the same..

HOW

Because from 20th April the terms regarding the card shall be changed. This page reflects the latest updates.

I got this card last week. As i am a Axis bank account holder plus have their other credit card, they have given me this within a week time. Every time i use this card for any purchase for any amount on Flipkart, Myntra i get 5% cash back except for EMI transactions. 4% on Uber and Uber eats. 1.5% on all other spends (like used in any stores). As a joining benefit will get Rs.500 Flipkart voucher. The cashback will be added after few days to the card statement. I would definitely recommend this card for everyone.

How much time will it take to reach the customer after applying for a Flipkart Axis Bank credit card?

You shall receive the card in 7 to 10 days once application is approved.

Earlier when my husband received the card, he got more welcome benefits, but when I got my Flipkart Axis credit card I received fewer welcome benefits.

Yes, welcome benefits have now been reduced.

I own an HDFC credit card and i receive 1000 points as a welcome bonus, but they’re no bonus at all on the Flipkart Axis Bank credit card. Moreover, the cashback i got from Axis Bank is only redeemable on Flipkart.

I own this card firstly there was zero welcome bonus from the bank, Secondly the minimum annual expenditure is very high for such a card, I want to switch to another card coz m not getting any special benefits even some other cards with no annual fee are offering better.

There is an error redeeming the voucher when i was redeeming it said the voucher was already redeemed. The problem was solved later on but it should not be happening.

What is your interest rate for due payments, and how many did you inform your customer regarding bill payments? Do you guys also increase the card limit for long-term users If so, for how long one has to hold the card?

How many cards can i hold at a time and how to apply? What are the advantages of using it abroad and can i also increase the limit of this card?

I want to exceed the limit of this credit card what are the requirements for that?

You can check your Bank’s app or contact the bank directly to see if you are eligible for any upgrades.

Flipkart Axis Bank Credit card has a lot to offer but at the same time, it also has a unique appearance in terms of reliability and accessibility. Guidance given by the cardinsider.com is good?

Is this card offer cashback on mobile recharge????

You shall get 1% cashback for this.

They cancleled my card even though i regularly used it. These mass cancellations by Axis Bank were just wrong.

Love the Flipkart Axis Bank card! 5% cashback on Flipkart is amazing, especially for frequent shoppers like me. Plus, the 4% on other partnered stores is a nice bonus. Easy application process and great customer service too!

Switched to the Flipkart Axis Bank card recently, and I’m glad I did. The cashback structure, especially on Flipkart and partner stores, is fantastic. The card also offers other benefits like fuel surcharge waiver, making it a well-rounded option.