HDFC Bank is the largest and one of the most trusted banks in India. It is the fourth largest bank by market capitalisation in the world as of 2023 after its takeover of parent company HDFC. HDFC Bank issues credit cards for Indian citizens, which offer a wide range of benefits such as discounts, cashback, deals and much more. RuPay is an Indian financial and payment service system launched by the National Payments Corporation of India (NPCI) in 2014. This is a secure network through which we can make fast and easy spends.

Whether looking to spend offline or online with an HDFC RuPay Credit Card, you can shop for fashion or daily essentials while earning rewards. Not only this, you can also link your RuPay Credit Card to the UPI application of your choice and make online payments on the go. Today, let’s have a look at all the RuPay Credit Cards HDFC Bank has to offer.

Table of Contents

List of Most Popular HDFC Bank RuPay Credit Cards

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Fuel

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Compare Features of HDFC Bank RuPay Credit Cards

| Categories | HDFC Bank UPI RuPay Credit Card | HDFC Bank MoneyBack Plus Credit Card | Tata Neu Infinity HDFC Bank Credit Card | Shoppers Stop HDFC Bank Credit Card |

| Joining/Renewal Fees | Rs. 250 + GST | Rs. 500 + GST | Rs. 1,499 + GST | Nil |

| Best Suited For | Shopping | Shopping | Shopping | Shopping |

| Welcome Benefits | N/A | 500 CashPoints | 1,499 NeuCoins on Tata Neu App | Voucher Worth Rs. 500 |

| Movie & Dining | 3% Cashpoints on Dining spends | Up to 15% off on Dining at Over 2,000 Premium Restaurants | N/A | N/A |

| Rewards Rate | 3% Cashpoints on groceries, dining, and supermarket spends, 2% Cashpoints on utility spends, 1% Cashpoints on other spends, with some exclusions | 2 CashPoints for every Rs. 150 you spend on retail purchases, 5X CashPoints per EMI spends at select merchants, 10X CashPoints on partner brands | 10% cashback (in the form of Neucoins) on the Tata Neu app, 5% cashback on Tata partner brands, and 1.5% cashback elsewhere | Earn 6 First Citizen Points on every Rs.150 spent on Private Label Brands and 2 First Citizen Points on every Rs.150 spent on all other retail transactions except fuel and wallet |

| Domestic Lounge Access | N/A | N/A | 8 Per Year | N/A |

| International Lounge Access | N/A | N/A | 4 Per Year | N/A |

Benefits of Having an HDFC Bank RuPay Credit Card

RuPay payment system was launched by National Payments Corporation of India in 2014. And in a short span of time, it has become prevalent in the country. You can easily make payments while earning rewards through a RuPay Credit Card. Here are some of the advantages of having an HDFC Bank RuPay Credit Card.

Convenient & Quick UPI Payments

In India, only RuPay credit cards can be linked to our UPI applications, such as GPay, PhonePe, etc. In such a case, RuPay Credit Cards offer us the unique benefit of easy payments at the touch of a button.

Earn Cashback and Rewards

With your HDFC RuPay Credit Cards, you can earn cashback and discounts on your UPI Spends.

| RuPay Credit Card | Reward Points Earned on UPI Spends |

| Tata Neu Plus HDFC Bank Credit Card | 1% Back as NeuCoins |

| Tata Neu Infinity HDFC Bank Credit Card | 1.5% Back as NeuCoins |

| HDFC Bank RuPay IRCTC Credit Card | 1 CashPoint for Every ₹100 Spent |

| HDFC Bank MoneyBack Plus Credit Card | 1 RP For Every ₹150 Spent |

| HDFC Bank Freedom Credit Card | 1 RP For Every ₹150 Spent |

| IndianOil HDFC Bank Credit Card | 1 RP For Every ₹150 Spent |

| Shoppers Stop HDFC Bank Credit Card | 2 First Citizen Points for Every ₹150 Spent |

Maximum 500 Reward Points can be earned in a month on UPI Spends.

EMIs

You can easily convert your RuPay Card spends into EMIs.

Contactless Payments

With an HDFC RuPay Credit Card, you can easily make contactless payments.

Secure & Safe Transactions

Being a domestic card network, our transactions are extremely safe when made through RuPay.

Information About HDFC Bank RuPay Credit Cards

Let’s have a look at all the details about HDFC Bank RuPay Credit Cards.

Tata Neu Plus HDFC Bank Credit Card

The Tata Neu Plus HDFC Bank Credit Card is a co-branded card that has been launched through a partnership between Tata Group and HDFC Bank. This credit card is ideal for individuals who are loyal to both Tata Brands and HDFC Bank, as it comes with a number of benefits. When shopping at Tata Brands, you can earn 2% of the transaction amount in the form of NeuCoins. With an extensive list of brands that includes Tata 1MG, Croma, Air Asia, Titan, Tanishq, and more, there are plenty of places where you can make the most of this offer. Additionally, you can also receive 1% cashback while spending on non-Tata brands using this credit card. As a welcome benefit, cardholders will receive bonus NeuCoins. Furthermore, you can earn additional NeuCoins by shopping on Tata Neu’s mobile app or website, which comes with a great introductory offer.

Tata Neu Infinity HDFC Bank Credit Card

HDFC Bank partnered with Tata Neu to launch the Tata Neu Infinity HDFC Bank credit card. The Infinity card is the premium variant, the other being the above-mentioned Tata Neu Plus Card, and offers exclusive privileges across various categories. The annual fee for the card is Rs. 1,499 plus GST and provides benefits equivalent to its monetary value. With a reward rate of up to 10%, it can be considered one of the top shopping credit cards available in the Indian market.

HDFC Bank RuPay IRCTC Credit Card

HDFC Bank recently partnered with IRCTC to launch a co-branded travel card – HDFC IRCTC RuPay Credit Card. SBI Card already offers co-branded cards with IRCTC, and now, this newly launched card by HDFC Bank gives direct competition to those cards. The IRCTC HDFC Bank Credit Card includes a joining and annual membership fee of Rs. 499 plus applicable taxes.

HDFC Bank MoneyBack Plus Credit Card

HDFC Bank MoneyBack + Credit Card is a popular card in India. This credit card is most suited for individuals who are just starting their credit journey and would like a simple but rewarding card. With this card, you can earn vouchers worth Rs. 500 every quarter on spends of Rs. 50,000 or more. Although this card comes with a joining fee of Rs. 500, you also get 500 cash points on successful submission of it.

HDFC Bank Freedom Credit Card

The HDFC Bank Freedom Credit Card is designed as a basic entry-level credit card for first-time cardholders. It operates on a Reward Points-based system and has a low membership fee of only Rs. 500 per annum. Additionally, if you spend a minimum of Rs. 50,000 in an anniversary year, the renewal fee can be waived. With this credit card, you can earn 1 Cash Point on spend of every Rs. 150.

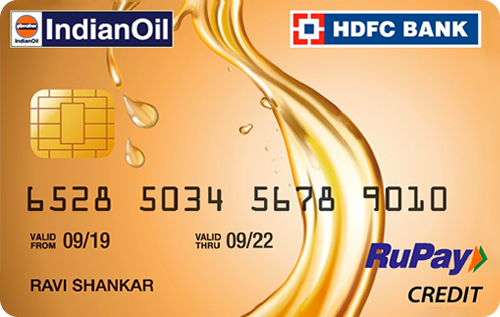

IndianOil HDFC Bank Credit Card

This is a co-branded credit card launched by HDFC Bank in association with Indian Oil. The IndiaOil HDFC Bank Credit Card is primarily for transactions on fuel. This card allows you to earn fuel points, which can be later converted into cash points. This card is very beneficial for customers as fuel is one of the most necessary and essential expenditures of our daily lives. Not only this, but you can also redeem your fuel points for various products. You can avail of this card at a low joining fee of Rs. 500.

HDFC RuPay Shoppers Stop Credit Card

Shoppers Stop HDFC Bank Credit Card is a lucrative card for people who love to shop at Shoppers Stop and like to stay updated on fashion trends. It offers complementary Shoppers Stop Membership to people who avail of this card. This co-branded credit card is specially designed for consumers seeking generous rewards while purchasing at Shoppers Stop.

HDFC Bank UPI RuPay Credit Card

HDFC Bank has launched a new card that aims to provide its customers with both convenience and easy credit. The card enables safe and secure transactions on BHIM and other UPI apps like GPay, Paytm, and PhonePe. The UPI RuPay credit card offers up to 3% cashback on both UPI and regular transactions on specific spend categories. It’s worth noting that this card is purely virtual, and no physical card will be delivered to the customer.

What are the Requirements for HDFC Bank RuPay Credit Cards?

You would need to fulfil the following conditions to successfully apply for an HDFC RuPay Credit Card.

- You must be a citizen of India,

- Minimum age of 21 years,

- Maximum age of 60 years for salaried employees and 65 for self-employed,

- Stable monthly income,

- Decent CIBIL Score.

How to Apply for HDFC Bank RuPay Credit Cards?

If you meet the above-given criteria, you can easily apply for an HDFC Bank RuPay Credit Card. Just follow these steps-

Step 1 – Choose your preferred card,

Step 2 – Click on “Apply Now.”

Step 3 – You will now be redirected to the official HDFC website.

Step 4 – Fill in your particulars.

Step 5 – Your application for a new credit card will be submitted.

Bottom Line

RuPay credit cards are becoming more and more popular in the country each passing day. Not only are these safe and secure, but also offer their users great deals and discounts. You can easily earn more cashback and rewards with an HDFC Rupay Credit Card. Not only this, with an HDFC RuPay Credit Card, you can also earn rewards on UPI spends. Forget having to carry multiple cards every time you go out. Simply add your RuPay Credit Card to your favourite UPI mobile application and pay.

Tell us what your thoughts are about HDFC RuPay Credit Cards in the comment below.