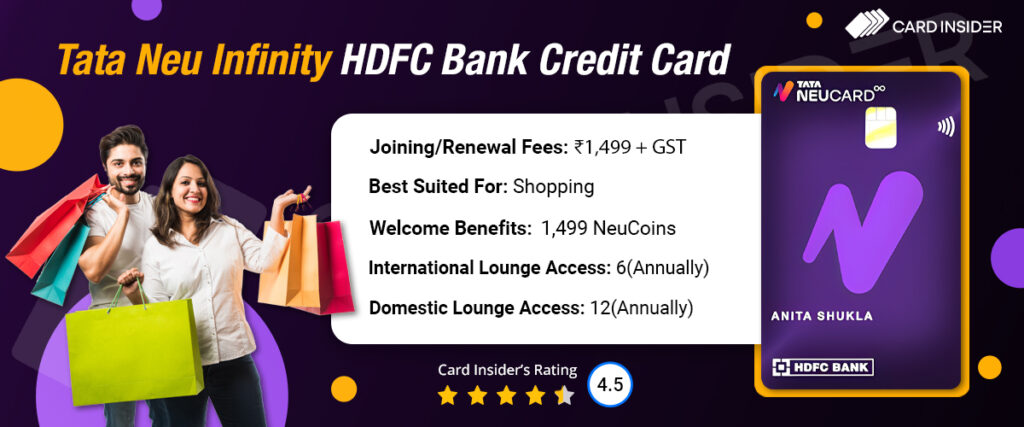

HDFC Bank has collaborated with Tata Neu to introduce the thrilling Tata Neu Infinity HDFC Bank credit card. The bank has unveiled two co-branded credit cards, namely the Tata Neu HDFC Bank Infinity Credit Card and the Tata Neu HDFC Plus Credit Card. The Infinity variant is the premium one and comes with many exclusive privileges across different categories. It comes with an annual fee of Rs. 1,499 and welcomes the cardholders with benefits of an equivalent monetary value. With a reward rate of up to 10%, it can be considered one of the best shopping credit cards available in the Indian market.

The card offers benefits beyond shopping, including travel, insurance, and lifestyle perks. Additionally, cardholders receive free access to domestic and international airport lounges. You also get an air accident insurance cover, card liability cover, and several other benefits with this card. You can make fast and easy contactless payments with this card. For detailed information on the features, fees, and charges of the Tata Neu Infinity HDFC Bank Credit Card, please keep reading:

Tata Neu Infinity HDFC Bank Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

NA

Rewards Rate

10% cashback (in the form of Neucoins) on the Tata Neu app, 5% cashback on Tata partner brands, and 1.5% cashback elsewhere.

Reward Redemption

The earned Neu Coins can be redeemed against Tata partner brands on the tata Neu app at a rate of 1 Neu Coin = Re. 1.

Travel

NA

Domestic Lounge Access

8 complimentary domestic lounge access every calendar year

International Lounge Access

4 complimentary international lounge access each year

Golf

NA

Insurance Benefits

Insurance cover worth ₹1 crore against air accidents, cover worth ₹15 lakhs against emergency hospitalization and lost card liability cover worth up to ₹9 lakhs.

Spend-Based Waiver

The renewal fee is waived off on achieving annual spends of Rs. 3 lakhs or more.

Rewards Redemption Fee

Nil

Foreign Currency Markup

2% of the total transaction amount.

Interest Rates

3.49% per month, i.e, 41.88% per annum

Fuel Surcharge

1% fuel surcharge waiver for all fuel transactions in India between ₹400 and ₹5,000.

Cash Advance Charges

2.5% of the withdrawn amount, subject to a minimum fee of Rs. 500.

- Welcome bonus of 1,499 Neu Coins.

- Get 10% NeuCoins on your spends on Tata Neu app.

- Get 5% NeuCoins on Tata’s partner brands and 1.5% Neu coins on other spends.

- Get complimentary domestic and international lounge access.

- Low foreign currency markup fee of 2%.

- 1% fuel surcharge waiver up to Rs. 500 per month.

- Spend-based waiver of the renewal fee.

Pros

- 10% cashback on the Tata Neu app.

- Low foreign currency markup of 2%.

Cons

- NeuCoins expire after a period of one year.

- The minimum spend for the annual fee waiver is at a high price of ₹3 Lakhs.

Tata Neu HDFC Bank Infinity Card Features and Benefits

The Tata Neu Infinity Card is a co-branded shopping card recently launched by HDFC Bank in partnership with Tata Neu. With exciting shopping benefits, the card comes with several additional privileges such as complimentary lounge access, insurance cover against air accidents, etc. The detailed benefits and features of the Tata Neu Infinity Card are given below:

Welcome Benefits

- The cardholders get 1,499 bonus Neu Coins as a welcome benefit, which is equivalent to the joining fee of this card.

- In order to avail of this welcome benefit, the cardholders need to make at least one transaction using their Tata Neu Infinity Card within the first 30 days of card issuance.

Travel Benefits

The HDFC Tata Neu Infinity Credit Cardholders also get exciting travel benefits as follows:

- 8 complimentary domestic lounge access every year (capped at 2 visits per quarter) with both Visa and RuPay variants of the cards.

- You are entitled to four free visits to international lounges every year with your priority pass, either with your RuPay or Visa card variant. However, these visits are limited to one per quarter. If you visit a lounge outside of India more than the complimentary number of times, you will be charged a usage fee of $27 plus GST per visit.

Insurance Benefits

The insurance benefits offered with the Tata Neu Infinity Card are as follows:

- Get an insurance cover worth Rs. 1 Crore against accidental air death.

- Get an emergency overseas hospitalization cover worth Rs. 15 lakhs.

- Get a lost card liability cover worth Rs. 9 lakhs.

Spend-Based Waiver

The renewal fee of Rs. 1,499 is waived off if the cardholder achieves an annual spend of Rs. 3 lakhs or more in the previous anniversary year.

Fuel Surcharge Waiver

With the Tata Neu Infinity Card, you get a 1% fuel surcharge waiver on all fuel transactions between ₹400 and ₹5,000. The maximum waiver is capped at Rs. 500 per statement cycle.

TataNeu Infinity HDFC Bank Credit Card Rewards

The Tata Neu Infinity HDFC Credit Card Rewards you in the form of Tata Neu coins and the reward rates in different categories are as follows:

- You get 5% NeuCoins on all TataNeu app/website purchases.

- Receive an additional 5% NeuCoins on activating Neu Pass on the mobile application.

- You get 5% NeuCoins on partner Tata brands, including AirAsia India, Tata 1mg, Tata CLiQ, Croma, cult.fit, Big Basket, Westside, IHCL, and a few more.

- You get 1.5% NeuCoins on UPI spends (maximum 500 NeuCoins per calendar month)

- No NeuCoins are accrued on wallet reloads, fuel purchases, rent, cash withdrawals, and EMI transactions.

Reward Redemption

The Neu Coins earned using this credit card can be redeemed against the following brands via the TataNeu app/website:

- AirAsia India, Bigbasket, Croma, Westside, Tata CLiQ, Tata CLiQ Luxury, Hotel Bookings/Purchases on IHCL, TATA 1MG, and Qmin.

- The monetary value of 1 NeuCoin = ₹1.

TataNeu Infinity HDFC Bank Credit Card Fees and Charges

Some of the important fees and charges associated with the HDFC Bank Tata Neu Infinity Credit Card are mentioned below:

- The joining/annual membership fee of this credit card is Rs. 1,499. The renewal fee (second year onwards) is waived off if the cardholder spends Rs. 3 lakhs or more in the previous year.

- The interest rate on this credit card is 3.49% per month, i.e, 41.88% per annualized.

- The cash advance charges on the HDFC Tata Neu Infinity Card are 2.5% of the withdrawn amount or Rs. 500 (whichever is higher).

- The foreign currency markup fee on this credit card is 2% of the total amount that has been spent in a foreign currency.

Tata Neu HDFC Bank Infinity Credit Card Eligibility Online

There are some basic eligibility requirements that you will have to fulfill in order to get approved for the HDFC Bank Tata Neu Infinity Credit card, which are as follows:

- The age of the applicants should be between 21 years and 65 years for self-employed people and 21 years to 60 years for salaried people.

- For salaried employees, the minimum eligible income is Rs, 1 lakh per month.

- For self-employed people, the minimum eligible income is Rs. 12 lakhs per annum.

Documents Required

The documents required to apply for the Tata Neu Infinity HDFC Bank Credit Card are listed below:

- You will have to submit identity proof, such as Aadhar Card, PAN Card, Voter’s Id, Passport, driving license, etc.

- You also need to submit address proof, such as later utility bills, rent agreement, aadhar card, Passport, etc.

- As income proof, you can submit the latest bank statements/salary slips, or the latest audited ITR in the case of self-employed people.

How To Apply For The Tata Neu HDFC Bank Infinity Credit Card?

You can apply for the Tata Neu HDFC Bank Infinity Credit Card online as well as offline at your convenience. To apply offline, visit the HDFC Bank branch nearest to you with all the required documents.

After that, take the credit card application form from the bank officials, fill in the form carefully and submit it. To apply online, you will have to follow a few simple steps as mentioned below:

- Visit the HDFC Bank’s official website.

- Under the ‘Borrow’ section, click on the ‘Credit Cards’ option.

- You will be redirected to a page where all the HDFC Credit Cards have been categorised based on their features.

- Under the ‘Lifestyle’ category, select the Tata Neu Infinity Credit Card.

- Click on apply now option under that.

- Proceed further accordingly by filling in the digital application form and completing all other required formalities.

Tata Neu Infinity Hdfc Bank Credit Card Review

Is this credit card the best choice for you? The Tata Neu Infinity Credit Card offered by HDFC Bank seems an excellent option for avid shoppers, especially those loyal to the Tata brands. The reward rate provided with this card is outstanding, and the earned Tata Neu coins are redeemable against various brands. The airport lounge access provided by the card at such a nominal annual fee is an additional advantage that might attract many individuals. You can quickly get approved for it if you fulfil the basic eligibility requirements, so if it suits your needs, you should go for it.

Now that we know about the Tata Neu HDFC Bank Infinity Credit Card. Let us know your thoughts and views on this credit card in the comment section below!

Does this card valid/pass as regular HDFC card, like where one can get instant bank discounts, since this is a co-branded card?

Yes, you shall get instant HDFC Bank discount offers with this card also.

Does 1500 Amazon voucher offer is applicable on Tata Neu credit card as well?

Please explain how to use and Rupay benefits of this card.. Shall we get reward points on rupay spending ??

You can link this credit card to your UPI app likr Google Pay and make payments through there. You shall be rewarded for these payments in the form of NeuCoins which can be redeemed for Tata brands.

Is there a maximum limit on neucoins that can be accrued on a single transactions. And what is limit on monthly neucoins that can be accrued.

For ex if I purchase goods worth 5lakh on partner tata brand on Tata neu will I get 50000 neucoins

Tata Neu Cards follow a fair usage policy. But yes, there are different caps on maximum NeuCoins earnings for different Tata brands. But these caps are very high. For example, you shall be eligible for 5% NeuCoins on purchases made on Croma for up to 6 lakhs.

3rd Class Card. Dont apply. .every 3rd persons account is getting restricted (even if genuine) if u r buying more on tata neu app. . And all points and benefits being blocked. . After that no matter how much you try they wont respond.

Tata Neu Fraud App

Can I convert my HDFC Regalia credit card to Tata Neu Infinity HDFC Bank Credit Card along with the points in the regalia credit card.

No, since the Neu Credit Card is in association with Tata and offers rewards as Neu Coins.