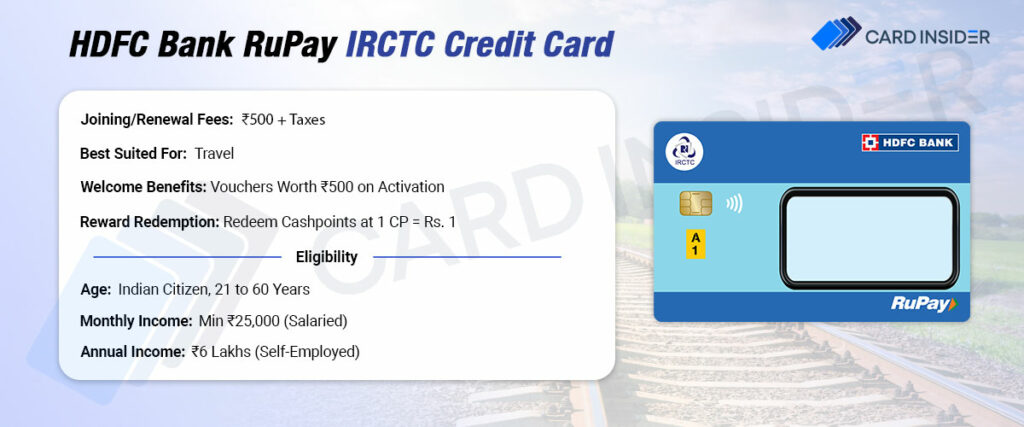

HDFC Bank recently partnered with IRCTC to launch a co-branded travel card named HDFC IRCTC RuPay Credit Card. SBI Card already offers co-branded cards with IRCTC, and now, this newly launched card by HDFC Bank gives direct competition to those cards. The IRCTC HDFC Bank Credit Card includes a joining and annual membership fee of Rs. 499.

One can waive the annual fee by meeting the required spending from the previous year. Talking about the reward benefits of this card, you get rewarded in the form of Cash Points that can be redeemed against various options. You can earn up to 5 Cash Points on every Rs. 100 you spend, which is a good reward rate. Moreover, this card also offers complimentary railway lounge access every quarter, and hence, you can now make your train travel experiences much better with the least charges.

The HDFC Bank IRCTC Credit Card has a lot more advantages. To know all of them, continue reading the article:

HDFC Bank RuPay IRCTC Credit Card

Joining Fee

Renewal Fee

Best Suited For

Travel |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

NA

Rewards Rate

1 Cash Point for every retail spend of Rs. 100 and 5x Cash Points on IRCTC bookings.

Reward Redemption

The earned Cash Points can be redeemed against travel bookings via IRCTC and several other options. 1 Cash Point = up to Re. 1.

Travel

Get 8 complimentary access to IRCTC Executive Lounges.

Domestic Lounge Access

NA

International Lounge Access

NA

Golf

NA

Insurance Benefits

NA

Spend-Based Waiver

The renewal fee is waived on spending Rs. 1.5 lakhs or more in the previous year.

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.5% of the transaction amount

Interest Rates

3.6% per month.

Fuel Surcharge

1% fuel surcharge waiver on all fuel transactions.

Cash Advance Charges

2.5% of the cash amount or Rs. 500 (whichever is higher)

- Amazon voucher worth Rs. 500 as a welcome benefit.

- 1 Cash Point for every Rs. 100 spent on retail purchases.

- 5x Cash Points on IRCTC spends.

- Complimentary railway lounge access every year.

- Spend-based waiver of the renewal fee.

- 1% fuel surcharge waiver.

Pros

- Highly beneficial card for frequent travels with complimentary access to Executive Lounges of IRTC (8 in a calendar year).

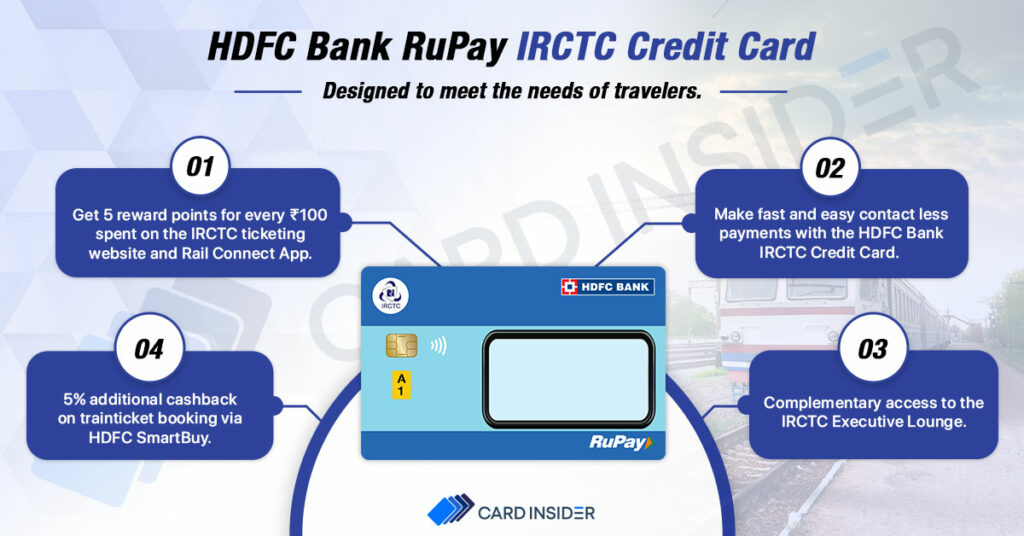

- 5 reward points on each ₹100 spent on the IRCTC website and app and an additional 5% cashback on train ticket purchases through HDFC SmartBuy.

Cons

- There is a minimum 100-point limit for redemption of rewards.

- The reward points can only be used to purchase train tickets on the HDFC SmartBuy platform.

IRCTC HDFC Bank Credit Card Features and Benefits

The newly launched HDFC Bank IRCTC RuPay Credit Card is a travel-based credit card that comes with a good reward rate and various other benefits across different categories, including travel and more. Some of the most significant benefits of this credit card are given below:

Welcome Benefits

The card offers you an Amazon voucher worth Rs. 500 if you activate your card and make the first transaction within the first 30 days of the card issuance.

Travel Benefits

With the HDFC Bank IRCTC Credit Card, you get 2 complimentary railway lounge access (IRCTC Executive Lounge) every quarter (8 every year).

Waiver of Transaction Charges

Generally, there are some transaction charges applicable to railway bookings using credit cards. But, with this credit card, you get a transaction charges waiver for transactions between Rs. 400 and Rs. 5,000.

Fuel Surcharge Waiver

You get a 1% fuel surcharge waiver on all fuel purchases between Rs. 400 and Rs. 5,000. The waiver is capped at Rs. 250 per billing cycle, i.e. you get can a maximum waiver of Rs. 250 in a billing cycle.

Renewal Fee Waiver

The renewal fee of Rs. 500 is waived if the cardholder spends Rs. 1,50,000 or more in the previous anniversary year.

Milestone Benefits

You shall receive gift vouchers worth ₹500 on spends of ₹30,000 or more every 90 days.

UPI Enabled

The HDFC Bank RuPay IRCTC Credit Card can be accessed through UPI.

HDFC Bank IRCTC RuPay Credit Card Rewards

The IRCTC HDFC Bank Credit Card comes with decent reward rates across different categories as mentioned below:

- You get 1 Cash Point on every retail spend of Rs. 100.

- You get 5x Cash Points on IRCTC bookings.

- The cardholders can avail of an extra 5% discount on making IRCTC bookings via HDFC SmartBuy.

Reward Redemption

The Cash Points that you earn using this card can be redeemed against various options as listed below:

- 1 Cash Point = Re. 1 for redemption against railway bookings through the IRCTC app/website.

- 1 Cash Point = Re. 0.30 for redemption against flight/hotel bookings through IRCTC and other options, including cashback.

IRCTC HDFC Bank Credit Card Fees and Charges

Some of the most important fees and charges associated with the HDFC Bank IRCTC RuPay Credit Card are mentioned below:

- The card comes with a joining and annual membership fee of Rs. 500 plus applicable taxes. The renewal fee is waived on spending Rs. 1.5 lakhs or more in the previous anniversary year.

- The cash advance fee of this credit card is 2.5% of the withdrawn amount, subject to a minimum of Rs. 500.

- The interest rate on the HDFC IRCTC RuPay Credit Card is 3.6% per month.

- The foreign currency markup fee on this credit card is 3.5% of the total transacted amount.

HDFC Bank IRCTC RuPay Card Eligibility Criteria

The basic eligibility requirements for the IRCTC HDFC Bank Credit Card are mentioned below:

- The applicant’s age should be between 21 years and 65 years.

- The applicant should either be self-employed or salaried with a stable monthly income.

HDFC Bank RuPay IRCTC Credit Card Review

If you frequently travel through the railways in India for business or vacations, this card is ideal for you. It provides premium access to the IRCTC Executive Lounge (up to 8 times in a calendar year). After 30 days of joining, you will also get a welcome benefit of coupons worth Rs.500.

Enjoy benefits across multiple spheres with the amazing HDFC Bank RuPay IRCTC Credit Card.

Rs.1,50,000 – spending limit per annum is too much.

The “Apply now” option on this site takes you nowhere. Please fix the bug.

Fixed.

Is there anyone who currently possesses this card? I’ve heard that some applications are being rejected for reasons that don’t seem justified.