Tata Neu Plus HDFC Bank Credit Card is a co-branded card launched by the partnership of Tata Group and HDFC Bank. Individuals who are loyal to both Tata Brands and HDFC Bank can benefit greatly from using this credit card. When shopping at Tata Brands, 2% of the transaction amount will be returned in the form of NeuCoins. As of this year, the list of famous brand names includes Tata 1MG, Croma, Air India, Titan, Tanishq, IHCL, and many more.

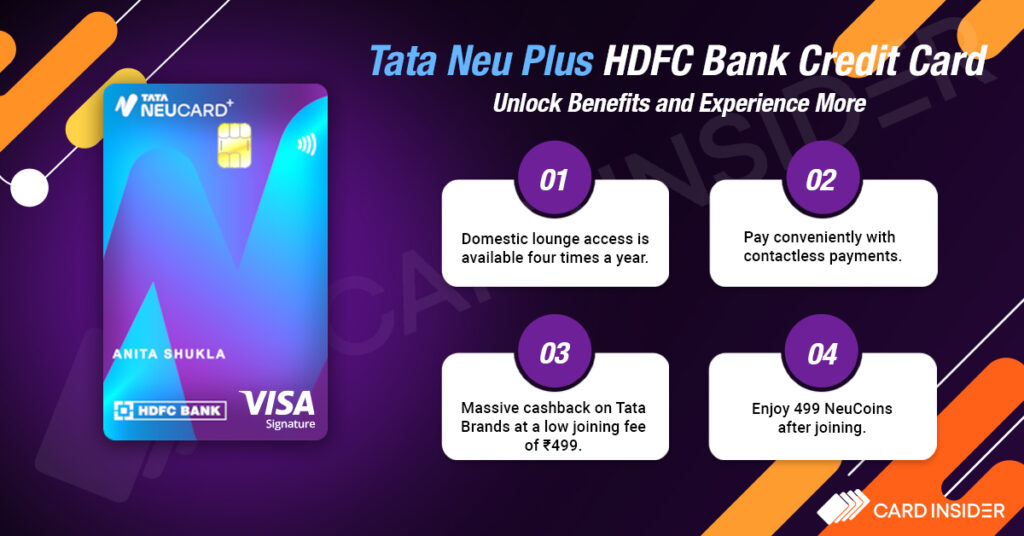

Additionally, this credit card offers 1% cashback on spending with non-Tata brands. Cardholders also receive a bonus of 499 NeuCoins as a welcome benefit (not applicable to lifetime and first-year free variants of the card). Apart from NeuCoins, cardholders will also get additional benefits such as complimentary access to domestic airport lounges, surcharge waivers on fuel transactions, spend-based renewal fee waivers, zero liability protection, etc. All in all, this credit card is a great launch that provides some exclusive benefits. Discover all the exciting features of the Tata Neu Plus HDFC Bank Credit Card by continuing to read this article in detail:

Tata Neu Plus HDFC Bank Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

NA

Rewards Rate

2% & 1% cashback in the form of NeuCoins while shopping on Tata and non-Tata Brands respectively. Additional 5% back as NeuCoins on the Tata Neu app or website.

Reward Redemption

The earned NeuCoins can be redeemed via the Tata Neu application or website on specified Tata brands.

Travel

Complimentary access to domestic airport lounges.

Domestic Lounge Access

4 complimentary visits to the domestic airport lounges, limited to 1 visit per quarter.

International Lounge Access

NA

Golf

NA

Insurance Benefits

NA

Spend-Based Waiver

The renewal fee of Rs. 499 is eligible for a waiver if the cardholder spends an amount increasing Rs. 1 Lakh in the previous year.

Rewards Redemption Fee

Rs. 99 per redemption request

Foreign Currency Markup

3.5% on the cross currency transactions

Interest Rates

3.75% per month (45% annually)

Fuel Surcharge

1% of the fuel surcharge will be waived off on fuel transactions.

Cash Advance Charges

Higher of 2.5% of the amount withdrawn or Rs. 500.

- 499 NeuCoins in the form of a welcome benefit.

- 2% back as NeuCoins while shopping at Tata brands.

- 1% back as NeuCoins while shopping at Non-Tata brands.

- Additional 5% back as NeuCoins on the Tata Neu app or website after registering for Tata NeuPass

- Complimentary access to domestic airport lounges.

- 1% surcharge waiver on fuel transactions up to Rs. 250 per month.

- Spend-based waiver of renewal fee.

Pros

- Make a transaction within the first 30 days of card issuance and enjoy 499 NeuCoins as a welcome benefit.

- Waive off the renewal fees with a spend of ₹1,00,000 in a calendar year.

- Save big on purchases from Tata Brands like Tanishq and cult.fit with the Tata New Plus HDFC Card, whether you’re a fitness enthusiast or shopping for jewellery.

Cons

- This one is a big disappointment for travellers as there is no international lounge access.

- One major con of the Tata Neu Plus HDFC Bank Credit Card is that it provides no movie or dining benefits.

- The NeuCoins are only valid for a period of 365 days.

Tata Neu HDFC Bank Plus Credit Card Features and Benefits

Let us now examine all the unique features and amazing benefits offered by the dynamic Tata Neu Plus HDFC Credit Card. Renowned for its high rewards, you would be glad to opt for one.

Welcome Benefits

Credit cardholders will get 499 NeuCoins on the Tata Neu Application only when they perform a successful transaction using their credit card within the first 30 days of the card issuance date. The NeuCoins will be credited to their account within 60 days from the date of the transaction. This welcome benefit is not applicable on First Year Free and Lifetime Free credit cards.

Introductory Offer

After downloading the Tata Neu application and registering for the Tata NeuPass, you can earn an additional 5% of the amount transacted on select categories back in the form of NeuCoins when you spend on the Tata Neu application or website.

Travel Benefits

With this credit card, the cardholders will get 4 complimentary visits to the domestic airport lounges. This visit is limited to 1 visit per quarter. Rs. 2 per visit to the lounge will be charged on the VISA/RuPay Credit Card Variants. All details regarding airport lounge access with the Tata Neu Plus Credit Card are available here.

Fuel Surcharge Waiver

The cardholders will receive a 1% fuel surcharge waiver on all fuel transactions between Rs. 400 and Rs. 5,000 at all fuel stations in India. The surcharge amount is capped at Rs. 250 per statement cycle.

Spend-based Waiver

The renewal fee of the Tata Neu Plus HDFC Bank Credit Card will be waived if the credit cardholder spends an amount of Rs. 1 Lakh or more using his credit card in an anniversary year.

Tata Neu Plus HDFC Bank Credit Card Reward Points

- 7% NeuCoins on the Tata Neu app/website (including 5% coins that you earn on activating the NeuPass)

- 2% of the amount was transacted back in the form of NeuCoins on non-EMI spends on Tata-partnered brands.

- 1% of the amount transacted back in the form of NeuCoins while spending on Non-Tata brands and merchant EMI spends.

- NeuCoins will not accrue on transactions done towards wallet loads, fuel transactions, rent, and smart EMI.

- You can get a maximum of 1000 NeuCoins per month from grocery transactions.

| Spends | NeuCoins |

| Spends on Tata Brands | 2% |

| Spends on Non-Tata Brands | 1% |

| UPI Spends | 1% |

| Merchant EMI Spends | 1% |

Reward Redemption

- The NeuCoins earned with the Tata Neu Plus HDFC Bank Credit Card can be redeemed to make purchases on the Tata Neu Application or Website for Tata partnered brands such as Tata 1mg, Air India Express, Croma, Westside, Bigbasket, Tata CLiQ Luxury, Hotel Bookings/Purchases on IHCL, Titan, Tanishq, and Qmin.

- For the purpose of redemption, the monetary value of 1 Neu Coin = Re. 1.

- To redeem NeuCoins, you can select Tata Pay as the payment method when purchasing products on the Tata Neu Application or website.

- The NeuCoins are valid for a period of 1 year from the date of the transaction on which you earned NeuCoins.

Tata Neu Plus HDFC Bank Credit Card Eligibility Criteria

The applicant has to fulfill the below-mentioned points in order to be eligible for this credit card–

- The applicant should be an Indian resident.

- He should be either salaried or self-employed.

- In case the applicant is a salaried individual, he should be between 21 years to 60 years of age and should earn a minimum of Rs. 25,000 per month.

- If the applicant is a self-employed individual, he should be between 21 and 65 years of age and filing an ITR of a minimum of Rs. 6 Lakhs per annum.

Tata Neu Plus HDFC Bank Credit Card Review

Tata Neu Plus HDFC Bank Credit Card offers fantastic deals to loyal customers of both HDFC Bank and Tata brands. After the Flipkart Axis Bank Credit Card & Amazon Pay ICICI Bank Credit Card, this card might also become one of the best shopping credit cards in the country. You can earn NeuCoins not only while shopping Tata brands but also on non-Tata brands.

Apart from this, you will also get additional NeuCoins as a welcome benefit. This credit card is also a great option for those who frequently travel domestically by air, as it provides complimentary access to domestic lounges. Therefore, for an applicant who is an HDFC bank account holder and also shops quite frequently on Tata brands, this is a go-to card for him.

Can I purchase i phone on no cost emi on croma while using this card.

Yes, you shall also receive discount offers with this card for IPhone purchase on Croma.

Are there any TATA points per spending, i do not have a PAN card so can I still get the credit card application processed on the basis of my Adhaar card only?

A PAN Card is mandatory.

How old are you if you don’t have a PAN card

I have HDFC Millenia credit card it offers me 1000 points as a welcome, after the payment of the membership fee. I think TATA is missing that on this credit card. “The surcharge amount is capped at Rs. 250 per statement cycle” can you please elaborate this a bit more.