Since Axis Bank acquired Citi Bank, Citi cardholders have been anticipating their future credit card status. Many Citi credit cardholders were loyal customers of their bank prior to the sale of its consumer banking to Axis Bank. Just this past week, unconfirmed news broke out about the migration of Citi Rewards, IndianOil, and PremierMiles Credit Cards to Axis Bank.According to a post on Flyer Talk, there has been full preparation for an all-new premium credit card set to replace Citi Prestige.

All We Know About Axis Olympus Credit Card

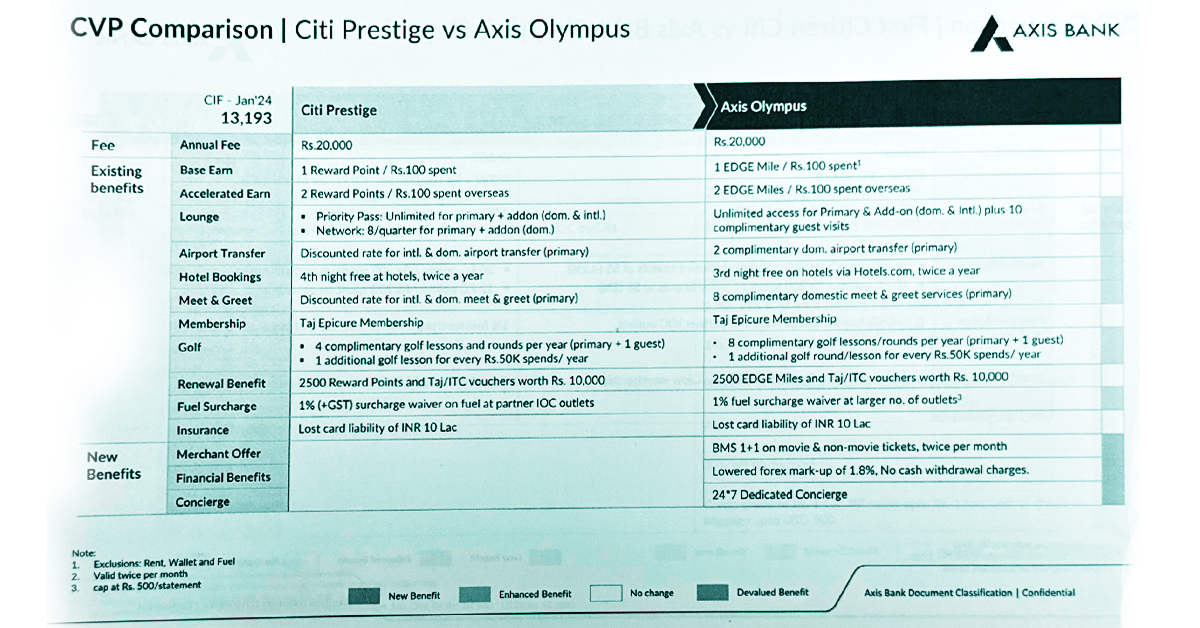

The rumored features of the new Axis credit card are similar to the Prestige credit card Axis Olympus. It has a joining fee of ₹20,000 and seems to be a premium card offering luxurious benefits.

| Features | Citi Prestige | Axis Olympus |

| Annual Fee | ₹20,000 | ₹20,000 |

| Base Earn | 1 Reward Point/₹100 Spent | 1 EDGE Mile/₹100 Spent |

| Accelerated Earn | 2 Reward Points/₹100 Spent Overseas | 2 EDGE Miles/₹100 Spent Overseas |

| Lounge |

|

Unlimited Access for Primary & Add-on (Domestic and International) Plus 10

Complimentary Guest Visits |

| Airport Transfer | Discounted Rate for International & Domestic Airport Transfer (Primary) | 2 Complimentary Domestic Airport Transfer (Primary) |

| Hotel Bookings | 4th Night Free at Hotels, Twice a Year | 3rd Night Free on Hotels Via Hotels.com, Twice a Year |

| Meet & Greet | Discounted Rate for International & Domestic Meet & Greet (Primary) | 8 Complimentary Domestic Meet & Greet Services (Primary) |

| Membership | Taj Epicure | Taj Epicure |

| Golf |

|

8 Complimentary Golf Lessons/Rounds Per Year (Primary + 1 Guest)

1 Additional Golf Round/Lesson for Rvery ₹50,000 Spends/Year |

| Renewal Benefit | 2500 Reward Points and Taj/ITC Vouchers Worth ₹10,000 | 2500 EDGE Miles and Taj/ITC Vouchers Worth ₹10,000 |

| Fuel Surcharge | 1% Surcharge Waiver on Fuel at Partner IOC Outlets | 1% Fuel Surcharge Waiver at a Larger Number of Outlets |

| Insurance | Lost Card Liability of ₹10 Lakh | Lost Card Liability of ₹10 Lakh |

Additionally, this new card does not offer reward points on rent. However, Citibank Prestige still offers reward points on rent payments.

Bottom Line

The Citi Prestige credit card is considered to be one of the most luxurious travel cards offered by Citi Bank. Since the acquisition of the bank by Axis Bank, Citi customers have been wondering about their cards. Now, with the recent release of some information regarding some Citi Bank credit cards, this curiosity was further fueled, especially by those who have the Citi Prestige card. According to one source who posted on a website, the Citi Prestige card would now be migrated to an all-new Axis Olympus credit card.

The Axis Olympus offers the same rewards as Citi Prestige, so those who previously held the Citi Prestige card will not be disappointed. It’s also worth noting that, according to us, some of the features mentioned above won’t be available on the card, such as the airport meet and greet, since, after the many devaluations in 2024, those have been removed from even the super-premium cards.

So, this is a 50% devaluation in redemption of points? Prestige to airline transfer ratio is 1:4 while edge miles is 1:2 . Which make this a deal breaker and will be the last nail in the coffin for me to lift and shift my citi portfolio to HDFC perhaps.

Atlas earns at 2 per 100 and Prestige at 1 per 100.

It is No devaluation. Number of points earned will be same for both.

Nope, they have pdf on their website , it says 1:4.