From 7 March 2024, Yes Bank will be updating certain terms and conditions regarding its credit cards. This move is set to affect rental and wallet spends made with Yes Bank Credit Cards. Earlier you could acquire Reward Points for such transactions which shall now not be possible.

Not only this customers can now only get Reward Points for utility spends made up to Rs. 25,000. No Reward Points shall be given after reaching the maximum spend cap.

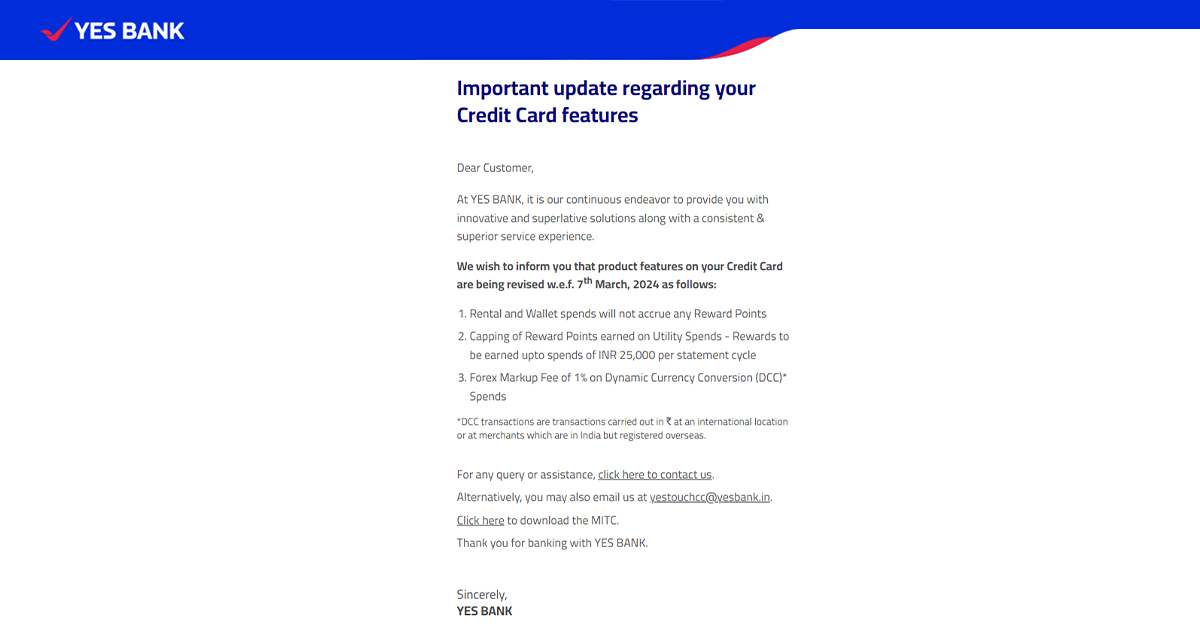

You can check all the updates given below.

- Rental and Wallet spends will not accrue any Reward Points.

- The capping of reward points earned on utility spends has been limited to ₹25,000 per statement cycle.

- Please note that there shall now be a Forex Markup Fee of 1% on all transactions made using Dynamic Currency Conversion (DCC). This fee applies to all DCC spends (merchants located in India but registered abroad or international transactions).

Bottom Line

Yes Bank recently revamped its credit card offerings and even introduced the new and premium Marquee Credit Card. However, the bank has since implemented a few restrictions on its credit cards. Firstly, they introduced spend-based criteria for airport lounge access from 1st April 2024. Now, the bank has limited its rewards program by not awarding Reward Points for rental and wallet transactions with Yes Bank Credit Cards. Additionally, reward points on utility bills will now be limited to spends of up to Rs. 25,000. This shall be implemented starting the 7th of March 2024.

This move is becoming increasingly common among banks, as many are not awarding reward points for rent and wallet transactions. Many banks are also charging DCC.

Share your thoughts on Yes Bank’s latest updates in the comments below.