Many of us wish for free access to airport lounges with our credit cards. To achieve this, a lot of people curate, research, and choose credit cards that come with complimentary lounge access. However, in recent times, this feature has been devalued or completely removed from many credit cards. As of April 1st, 2024, ICICI Bank will also update its terms of use regarding free airport lounge access. To be eligible for airport lounge access, you will need to spend a minimum of Rs. 35,000 in the preceding quarter.

Additionally, there are more changes to other features as well, such as the discontinuation of reward points for wallet loading and rental payments. ICICI Bank Credit Card holders will also be charged a Dynamic Currency Conversion fee of 1% on international transactions. For more information and details, please refer to the article below, which provides a complete overview of these changes.

Free Airport Lounge Access Update

From 1st April 2024, you would need to make spends of at least Rs. 35,000 in the preceding quarter to be eligible for free airport lounge access in the upcoming quarter. Calendar quarters are as follows: January-February-March, April-May-June, July-August-September, and October-November-December.

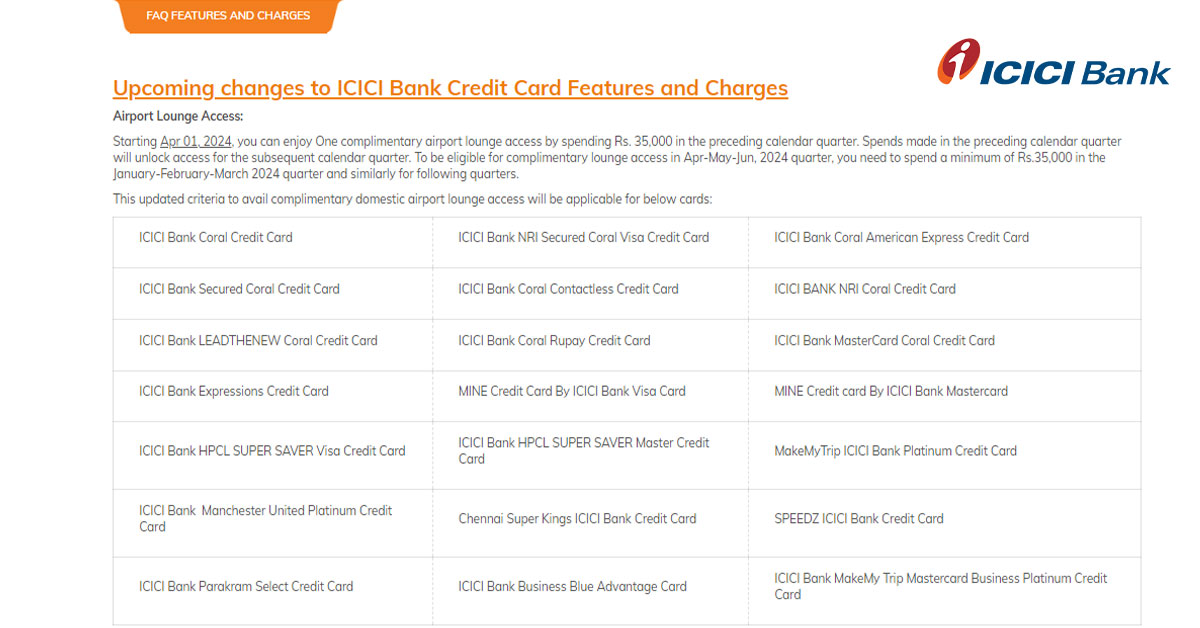

The updated terms shall be applicable for the following cards. For all other ICICI Bank cards, there is no change.

- ICICI Bank Coral Credit Card (All Variants)

- ICICI Bank Expressions Credit Card

- MINE Credit Card By ICICI Bank (All Variants)

- ICICI Bank HPCL SUPER SAVER (All Variants)

- MakeMyTrip ICICI Bank Platinum Credit Card

- ICICI Bank Manchester United Platinum Credit Card

- Chennai Super Kings ICICI Bank Credit Card

- SPEEDZ ICICI Bank Credit Card

- ICICI Bank Parakram Select Credit Card

- ICICI Bank Business Blue Advantage Card

- ICICI Bank MakeMy Trip Mastercard Business Platinum Credit Card

Reward Points Update

Rental Payments and Wallet Reloads

From February 1st, 2024, reward points will no longer be accrued for rent payments and wallet loading. This change shall not be applicable to Amazon Pay ICICI Credit Card.

Utility Bill Payments

Starting from 1st February, all government transactions will be categorized as utility bill payments. You will continue to earn reward points as before. This change is applicable to all credit cards issued by ICICI Bank.

Dynamic Currency Conversion Fee

A 1% DCC fee will be charged on all international transactions made in Indian currency or domestic transactions made to merchants registered abroad. This change applies to all ICICI Bank credit cards.

Bottom Line

Based on the updates mentioned above, it is clear that many features provided by ICICI Bank credit cards are being devalued this year. This includes earning reward points for rental payments and free airport lounge access. Although other banks like HDFC have already implemented a minimum spend limit to avail airport lounge access or discontinued it altogether, ICICI Bank has maintained a reasonable minimum spend of Rs. 35,000 per quarter, which can be easily achieved by most ICICI Bank Credit Cards.

This update has come at the beginning of the year. Do you think other banks will follow suit, and we shall see more devaluation of features as the year goes on? Share your thoughts in the comments section below.

I have Makemytrip signature card.

And it is not in above list.

Ao what will be the lounge access criteria then