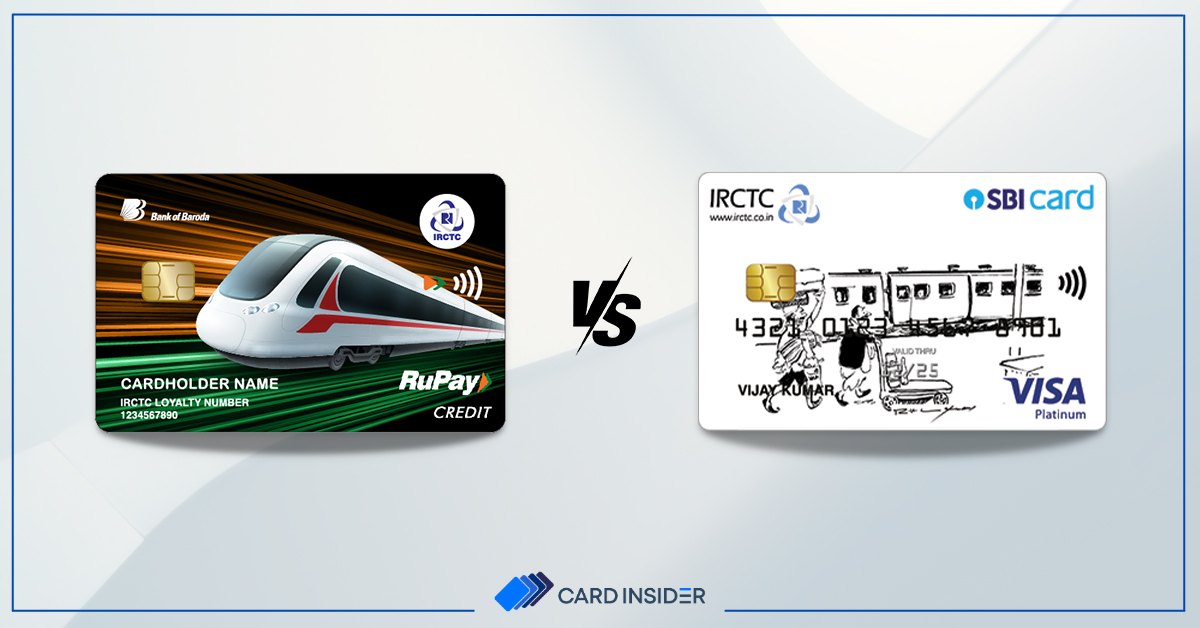

Railways is one of the oldest modes of travel in India, and every day millions of people travel through trains across the country. There are several travel-based credit cards in the country, and for individuals who regularly travel via trains, they can opt for an IRCTC co-branded credit card.

One of the top banks in India, SBI has the IRCTC SBI Platinum card launched in partnership with Indian Railways. The card has a low joining fee of Rs. 500 and offers decent rewards and benefits to the users. Along with a decent reward rate, the card offers value back as reward points on booking train tickets through the IRCTC app or website. Also, there are several other benefits like fuel surcharge waiver, travel perks, easy EMI conversions, and more that you can access with this card.

Similarly, Bank of Baroda partnered with Indian Railways for the IRCTC BoB RuPay credit card, exclusively for regular train travelers. The card works on the Indian RuPay platform and offers up to 40 reward points on train ticket bookings through the IRCTC website or mobile application. With this card, you even get complimentary railway lounge access, fuel surcharge waiver, free add-on credit cards, and much more.

Keep reading the article further to know more about both these IRCTC co-branded credit cards and how they compare against each other.

IRCTC BoB RuPay Credit Card

Bank of Baroda and IRCTC collaborated to launch their co-branded IRCTC BoB RuPay credit card, to cater to individuals who regularly travel via Indian Railways. At a nominal joining fee of Rs. 500, the card has plenty of benefits and privileges for customers whose preferred mode of travel is rail. You can earn additional reward points per Rs. 100 spent on departmental store and grocery spends, and on railway ticket bookings. The following are the features and benefits of this card –

Welcome Benefits

Bonus 1000 reward points on making a single transaction worth Rs. 1000 within 45 days of getting the card.

Reward Earning

- Up to 40 RPs per Rs. 100 spent on railway ticket booking via IRCTC mobile app or website

- 4 RPs per Rs. 100 spent on departmental store and grocery spends

- 2 RPs per Rs. 100 spent on other categories

Reward Redemption

You can redeem reward points against railway ticket booking via the IRCTC mobile app or website. Also, you can redeem reward points against the card statement balance, where 1 RP = Rs. 0.25.

Travel Benefits

The cardholder gets 4 complimentary domestic railway lounge access every year, max 1 per quarter.

Fuel Surcharge Waiver

1% fuel surcharge waiver on spends between Rs. 500 and Rs. 3000 all over India, maximum benefit is capped at Rs. 100 per month.

Railway Surcharge Waiver

You get a 1% transaction surcharge waiver whenever you book railway tickets via IRCTC mobile app or website using this credit card.

Additional Benefits

You can get up to 3 add-on credit cards lifetime free for your family members.

Fees & Charges

- The IRCTC BoB RuPay card has a joining fee of Rs. 500 and a renewal fee of Rs. 350

- The interest rate on the card is 3.49% per month and 41.88% per annum

- The card has a forex markup fee of 3.5% of the transaction amount

- The card charges Rs. 500 or 2.5% of transaction amount, whichever is higher, as cash withdrawal charges.

IRCTC SBI Platinum Credit Card

SBI is among the top card issuers in the country and the bank partnered with Indian Railways to launch the IRCTC SBI Platinum credit card that charges an annual fee of Rs. 500 plus applicable taxes. The card is great for Indian railway users because other than the welcome benefit, it also offers 10% value back on train ticket booking as reward points. Also, there are several benefits offered by the credit card and we will read it in the following section –

Welcome Benefits

Bonus 350 reward points on making a single transaction of Rs. 500 or above within 45 days of getting the card. Also, you get Rs. 100 cashback on the first cash withdrawal made with the card.

Reward Earning

1 reward point per Rs. 125 spent on retail spends, except on fuel. Also, you get 10% value back on railway ticket booking through IRCTC website or mobile application in the form of reward points. This offer is only applicable on AC CC, AC1, AC2, and AC3 categories.

Reward Redemption

The reward points earned for your spends can be redeemed against railway ticket booking on the IRCTC website or mobile app.

Travel Benefits

With this credit card, you get a 1% transaction charge waiver on booking railway tickets through the IRCTC website or mobile application. Also, you get exclusive accommodation at over 5000 hotels at more than 350 cities in the country.

You can get discounts on air ticket bookings with the card, and get custom made packages for wildlife, adventure, pilgrimage, etc. across the country.

Additional Benefits

- You can use Flexipay to convert transactions of Rs. 2500 or more into easy EMIs

- You can use Easy Money to get a cheque or draft against your credit limit

- You can transfer outstanding balance from other cards or banks to this card and pay back conveniently in EMIs.

Fuel Surcharge Waiver

Get 1% fuel surcharge waiver on fuel spends across the country, with the maximum benefit capped at Rs. 100 per card statement cycle.

Fees and Charges

- The card charges a joining fee of Rs. 500 and a renewal fee of Rs. 300 plus taxes

- The interest rate on the card is 3.5% per month and 42% per annum

- The forex markup fee on the card is 2.5% of the transaction amount

- For cash advances, the card charges 2.5% of the transaction amount or Rs. 500, whichever is higher

IRCTC BoB RuPay Credit Card vs. IRCTC SBI Platinum Credit Card – Quick Comparison

The following table features a side-by-side comparison of both the credit cards –

| Category | IRCTC BoB RuPay Credit Card | IRCTC SBI Platinum Credit Card |

| Joining/Annual Fees | Rs. 500 plus taxes | Rs. 500 plus taxes |

| Welcome Benefit | Bonus 1000 reward points on a single transaction of Rs. 1000 within 45 days of getting the card | Bonus 350 reward points on making a transaction of Rs. 500 or above within 45 days of getting the card |

| Reward Earning | Up to 40 RPs on booking railway tickets via IRCTC app or website 4 RPs per Rs. 100 spent on departmental stores and groceries 2 RPs per Rs. 100 spent elsewhere | 1 RP per Rs. 125 spent with the card 10% value back on railway ticket booking as reward points |

| Reward Redemption | RPs can be redeemed against railway ticket booking or against the card statement balance | RPs can be redeemed against railway ticket booking via the IRCTC website or mobile app |

| Travel Benefits | Complimentary railway lounge access | 1% transaction charge waiver on railway ticket booking via IRCTC website Exclusive accommodation offers at over 5000 hotels across the country |

| Forex Markup Fee | 3.5% of the transaction amount | 3.5% of the transaction amount |

Bottom Line

The IRCTC BoB RuPay and the IRCTC SBI Platinum credit card are both great options in the travel category. Being co-branded with Indian Railways, both these cards are great for people who travel via trains on a regular basis. Also, the joining fees on the cards is Rs. 500 which is quite affordable, and they offers various benefits and privileges for cardholders.

With the IRCTC BoB RuPay card, you can earn up to 40 reward points on train ticket bookings while the IRCTC SBI Platinum card gives 10% value back as reward points on railway ticket booking. You can redeem reward points earned on both these cards against train ticket bookings through the IRCTC app or website.

Overall, both these IRCTC co-branded credit cards are good and there is not much difference in the features and benefits offered by them. You can select either one of them based on your personal choice and preference.

Do let us know in the comments section about which card out of these two will you prefer getting.