After the RBI’s ban on HDFC was removed, it came up with a range of Paytm of co-branded credit cards, and a few more co-branded cards were also expected, including Emirates co-branded & Mariott co-branded cards. Now, the HDFC Bank has finally tied up with Emirates airlines and launched the ‘HDFC Bank Emirates Skywards Diners Club Credit Card.’ The ICICI Bank already offers three Emirates co-branded credit cards and to give direct competition to these cards, HDFC has come up with this new launch. This card is a premium travel card and is specially designed for those who travel more often via Emirates airlines. It rewards the cardholders in the form of Skyward miles, which are redeemable against travel bookings via Emirates airlines. For further information about this card, such as its features, fees & charges, etc, keep reading the article:

HDFC Bank Emirates Skywards Diners Club Credit Card

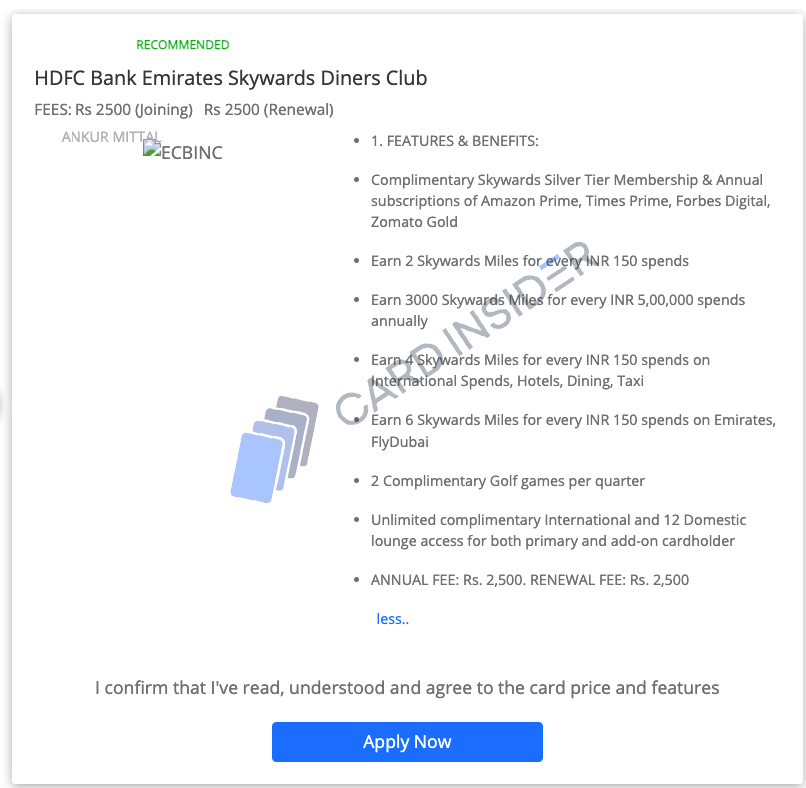

The HDFC Bank has recently launched the Emirates Skywards Credit Card on the Diners Club card network. The joining & annual fee of this credit card is Rs. 2,500, which seems to be worth it when we look at the features of this card. Along with a great reward rate across all the categories, the card offers exciting welcome benefits, complimentary airport lounge access worldwide, free golf rounds, and many more privileges. All its features and benefits are given below in detail:

- Welcome Benefits: The cardholders get the following introductory benefits with this card:

– Complimentary silver tier membership of Skywards.

– Free annual subscription to Amazon prime, Zomato Gold, Times Prime, and Forbes Digital. - Reward Rate: This card offers you Skyward Miles on all your spends, and the reward rates on different categories are as follows:

– 6 Skyward Miles on every Rs. 150 spent on Emirates and FlyDubai airlines.

– 4 Skyward Miles on every Rs. 150 spent on dining, hotel, taxi, and international purchases.

– 2 Skyward Miles on every retail spend of Rs. 150. - Milestone Benefits: 3,000 bonus Skyward Miles on spending Rs. 5 lakhs or more in an anniversary year.

- Lounge access: This card offers unlimited complimentary international lounge access and 12 free domestic lounge access every year to the primary as well as supplementary cardholders.

- Golf Benefits: The cardholders also get access to 2 complimentary golf rounds every quarter.

Also Read: Axis Bank to Launch Flipkart Axis Bank Super Elite Credit Card

Bottom Line

The launch of Emirates co-branded HDFC Credit Card seems to be a very good option for those who travel via Emirates airlines very often. However, it is offering great reward rates and benefits across other categories as well. Though the annual fee might look to be high at first, once you check all its features, it seems that paying a fee of Rs. 2,500 is totally worth it for such a card with multiple exclusive benefits. The launch of this card was awaited by many individuals as rumours of several co-branded credit cards planned by HDFC Bank were all across the social media & internet after the RBI’s ban on the issuer. We can also expect the launch of the ultra-premium Infinia Reserve credit card, which would be above the Infinia Metal Edition Card. Stay Tuned to get informed as soon as any new cards are launched by HDFC Bank. Also, if you have any further doubts about the Emirates Skywards HDFC Credit Card, feel free to ask us in the comment section below!

Is there an HDFC marriot co branded card except infinia?

Nopr

Nope

Please share the link to apply this card