Axis Bank Vistara Credit Cards are primarily travel credit cards with which you can earn Club Vistara Points on eligible spends. Now, Axis Bank has made certain changes to the terms and conditions for these credit cards. Starting 3rd January 2024, the following categories will not be eligible for earning CV Points. Spends made on these categories shall also not be considered for achieving milestone benefits.

- Government Transactions

- Spends Made for Utilities

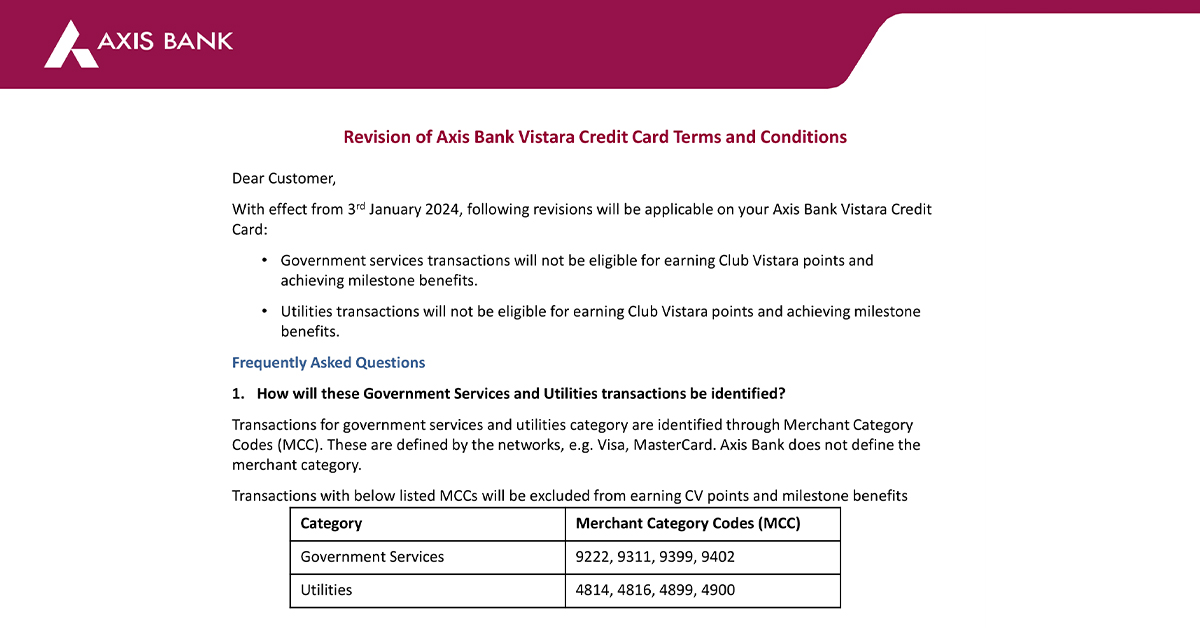

Let’s take a closer look at the MCC Categories that will not be eligible for CV Points starting from January 2024. The following MCC categories will not count towards earning CV Points and will also not be considered for milestone benefits.

| Categories | Merchant Category Codes (MCC) |

| Government Services | 9222, 9311, 9399, 9402 |

| Utilities | 4814, 4816, 4899, 4900 |

Quick Glance at Axis Bank Vistara Credit Cards

Vistara Credit Card

- Joining/Renewal Fee – Rs. 1,500 + GST

- 2 CV Points Per Rs. 200 Spent on Eligible Categories

- Welcome Benefit – Economy Class Ticket & Club Vistara Base Membership

Vistara Signature Credit Card

- Joining/Renewal Fee – Rs. 3,000 + GST

- 4 CV Points Per Rs. 200 Spent on Eligible Categories

- Welcome Benefit – Premium Economy Class Ticket & Club Vistara Silver Membership

- 2 Complimentary Domestic Lounge Access Each Quarter

Vistara Infinite Credit Card

- Joining/Renewal Fee – Rs. 10,000 + GST

- 6 CV Points Per Rs. 200 Spent on Eligible Categories

- Welcome Benefit – Business Class Ticket & Club Vistara Gold Membership

- 2 Complimentary Domestic Lounge Access Each Quarter

Bottom Line

Previously, with the Axis Bank Vistara Credit Card, you could earn CV Points for all transactions except a few, like rent and wallet reloads. However, the list of transactions that do not earn CV Points has now expanded to include government transactions and utilities. This change comes at a time when there has been a devaluation of credit cards in the Indian market. For instance, the Magnus Card has been affected, and HDFC Bank has removed lounge access from many of its cards. As a result, the credit card scene is undergoing significant changes, and many of the benefits previously offered by established banks in India are being revised.

Still, the Vistara Credit Card series is a decent one with three cards with varying joining fees and benefits. For people looking for a highly rewarding credit card, the Vistara Signature or Vistara Infinite is suitable. These cards have a higher joining charge and, at the same time, offer many more benefits. In comparison, the Vistara Credit Card offers the most basic features at a low joining cost.

What do you think of Axis Bank’s revised rewards program for Axis Bank Vistara Credit Cards? Will the changes affect new applicants? Let us know in the comments below.

I was thinking of applying for this card, but now I am not applying for it because it is devaluing it.

Where do I look for the Merchant Category Codes (MCC) before I make a payment?? never seen them before any transaction…. please clarify!!