The Indian credit card market has been experiencing significant changes in its leading products since the beginning of the year. These changes are not limited to one issuer or NBFC but can be found across the board. Even Yes Bank has had its fair share of announcements and notifications.

Yes Bank has recently announced more changes to its credit card offerings. Although some changes may not have an adverse effect on everyone – for example, from May 1st, there will be a decrease in the maximum fuel surcharge waiver applicable on some Yes Bank credit cards – other changes, such as a 1% charge + GST on all utility charges above Rs. 15,000 in a month made with Yes Bank credit card, will be felt by all customers.

- 1% charge on all utility transactions above Rs. 15,000 made with Yes Bank credit cards in a month.

- Rent and wallet transactions shall not be included while calculating joining or annual fee spend waivers.

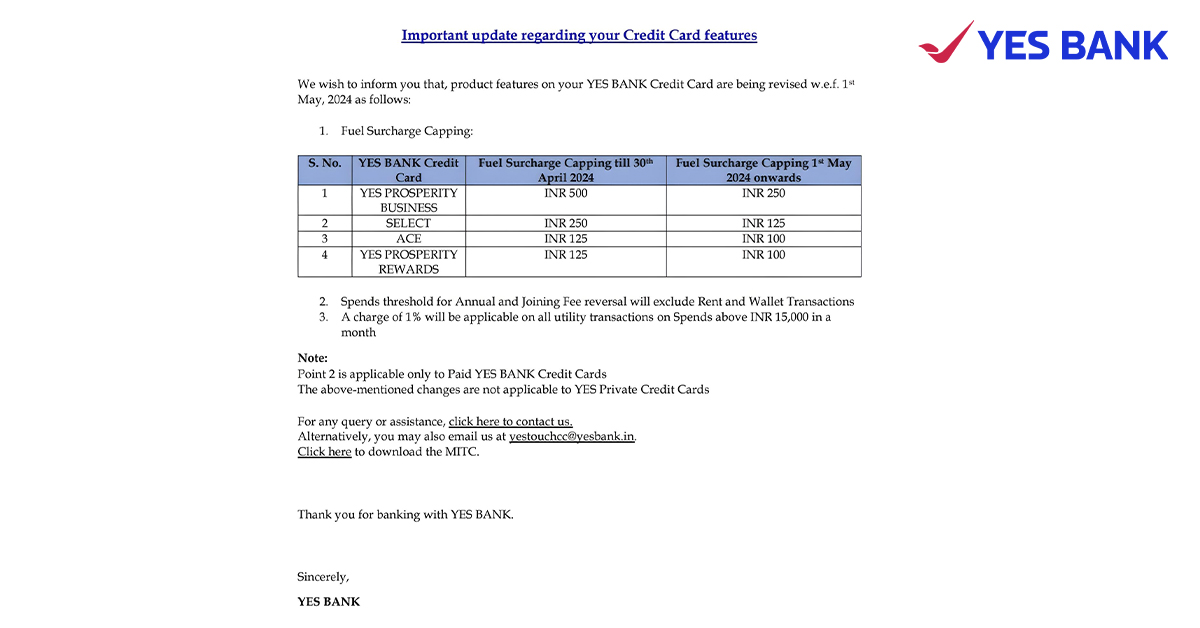

- There shall also be some major changes to the Fuel Surcharge Capping on some Yes credit cards, as given below.

| Cards | Current Capping | New Capping from 1st May 2024 |

| Yes Prosperity Business | ₹500 | ₹250 |

| Select | ₹250 | ₹125 |

| Ace | ₹125 | ₹100 |

| Yes Prosperity Rewards | ₹125 | ₹100 |

All of these changes shall not be applicable to Yes Private Credit Cards.

Bottom Line

One of the most important updates that all Yes Bank credit cards users should be well aware of is that from 1st May, there shall be a 1% + GST charge on all utility transactions above Rs. 15,000 in a month made with Yes Bank credit cards. The Yes Private credit cards are exempt from this charge as it is the most premium offering by the bank. However, all other cards will be affected by this change. This charge on utility payments would decrease the reward or savings Yes Bank credit card holders were earlier taking advantage of it. Since these payments are regular and recurring, this would significantly impact the experience of Yes credit card holders.

It is unlikely that the decrease in fuel surcharge capping will have a significant impact on Yes Bank credit cards as people usually use fuel credit cards for fuel expenses. It is even common for banks to exclude rent and wallet expenses from annual or joining fee reversal calculations, so many people may not be surprised by this. However, the recent decision to charge a fee for utility payments has discouraged many customers. Now from 1st May along with rent people shall also have to pay 1% for utility transactions (water, electric, gas, cable TV, internet, and mobile services). For those who would like to know how to save on utility bill payments can read our article here.

Are you holding a Yes Bank credit card at present? Are you planning to apply for one? How does this latest update from Yes Bank affect your savings? Share your views in the comment below.