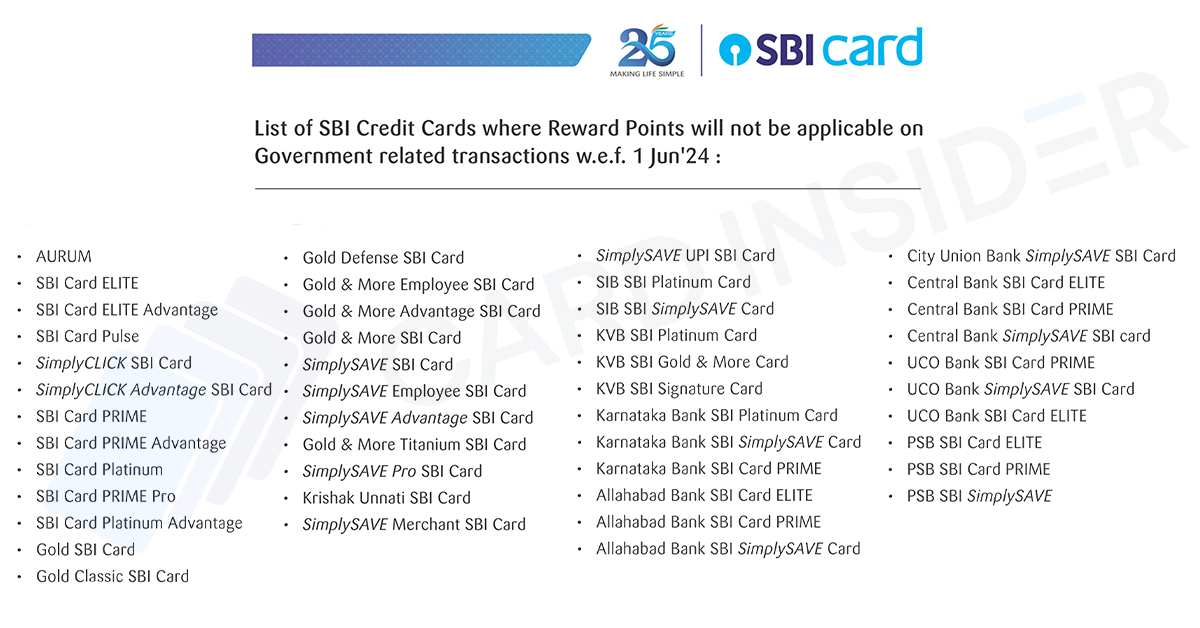

SBI Card is one of the largest credit card issuers in our country. It is known for its rewarding and affordable credit cards and includes some of the best cards in its portfolio, like the SBI Cashback Card. A few months ago, reward points for rental payments were removed for many SBI Credit Cards. Now, the same has been done for government transactions. Starting from June/July 2024, no reward points shall be awarded for government transactions.

June 2024 Update

With the latest June update, many co-branded credit cards have joined the list of cards that won’t earn reward points for government transactions. These include popular names such as Reliance and Air India co-branded credit cards. This change will be implemented from 15th July 2024 onwards.

Which SBI Cards Shall Be Affected?

Below are some of the most popular SBI Credit Cards, which shall no longer accrue reward points for government transactions.

- AURUM

- SBI Card ELITE

- SBI Card Pulse

- SimplyCLICK SBI Card

- SBI Card PRIME

- SimplySAVE UPI SBI Card

- Air India SBI Platinum Card

- Air India SBI Signature Card

- Central SBI Select+ Card

- Chennai Metro SBI Card

- Club Vistara SBI Card

- Club Vistara SBI Card PRIME

- Delhi Metro SBI Card

- Etihad Guest SBI Card

- Etihad Guest SBI Premier Card

- Fabindia SBI Card

- Fabindia SBI Card SELECT

- IRCTC SBI Card

- IRCTC SBI Card Premier

- Mumbai Metro SBI Card

- Nature’s Basket SBI Card

- Nature’s Basket SBI Card ELITE

- OLA Money SBI Card

- Paytm SBI Card

- Paytm SBI Card SELECT

- Reliance SBI Card

- Reliance SBI Card PRIME

- Yatra SBI Card

Bottom Line

SBI Credit Cardholders will be affected by a major change in rewards for government transactions. Super premium credit cards like Aurum and entry-level cards like SimplySave will no longer earn points for government transactions starting from 1st June. Now even co-branded SBI Cards have joined the list and shall be ineligible for reward point earnings on government transactions from 15th July 2024 onwards. Cardholders with these cards should take note and make future payments accordingly, as there will be no reward points for government transactions.