If you own Axis Bank credit cards, then you must stay updated regarding the terms and conditions of your card, as Axis Bank has announced some changes. The ever-popular Axis Bank Magnus and the super-premium Reserve credit card, along with the Select, ACE, My Zone, and Privilege credit cards are the ones that will undergo changes in their terms and conditions, with effect from 1st September 2023.

You will find updated terms regarding the cards’ welcome and annual benefits, spend-based milestone benefits and the renewal fee waiver conditions, changes to the Miles Transfer program and the conversion ratio of reward points, and more. Make sure to read them carefully so that you make spends with your cards keeping the updated terms in mind.

In the following article, we will go through all the new changes and terms and conditions related to these credit cards.

Axis Bank Magnus Credit Card – Updated Terms and Conditions

The following changes will be in effect from 1st September 2023 on the Magnus credit card–

Revision of Welcome Benefit

Customers that onboard on or after 1st September 2023 can choose a welcome voucher worth Rs. 12,500 from one of the following –

- Postcards Hotel gift voucher

- Luxe gift card

- Yatra gift voucher

The Tata Cliq voucher that was offered before is discontinued now.

Revision of Annual Benefit

- The annual fee on the card will be updated to Rs. 12,500 from the existing Rs. 10,000 for customers onboarded after 1stSeptember 2023.

- The annual benefit voucher worth Rs. 10,000 is discontinued

- Customers that onboard after 1stSeptember will have to make annual spends of Rs. 25 Lakhs in the year to receive an annual fee waiver.

- For customers onboarded before 1stSeptember, the annual fee waiver will be applicable on spending Rs. 15 Lakhs in the year but right after 1st September 2024, the waiver will be applicable on spends of Rs. 25 Lakhs.

Revision of Milestone Benefit and EDGE Reward Points

- The target spend for the annual fee waiver milestone will not consider utilities and government spends. These spend categories will also not accrue EDGE reward points.

- The milestone benefit of bonus 25,000 EDGE reward points on spending Rs. 1 Lakh in the month will also be discontinued from 1stSeptember 2023.

- Cardholders who reach the milestone in May and June 2023, the bonus points will be posted by July 31, and those who achieve the milestone in July will receive the bonus points by August 10 2023.

- After 1stSeptember, you will earn 12 EDGE RPs per Rs. 200 spent with the card until total monthly spends of Rs. 1.5 Lakhs. On making transactions after crossing this threshold amount, you will earn 35 RPs per Rs. 200 spent thereafter.

- Earn 60 RPs per Rs. 200 spent on the Travel Edge portal, up to cumulative spends of Rs. 2 Lakhs in a month. After crossing this amount, you will earn 35 RPs per Rs. 200 spent with the card.

Axis Bank Reserve Credit Card – Updated Terms and Conditions

The following changes will be in effect from 1st September 2023 on the Reserve credit card–

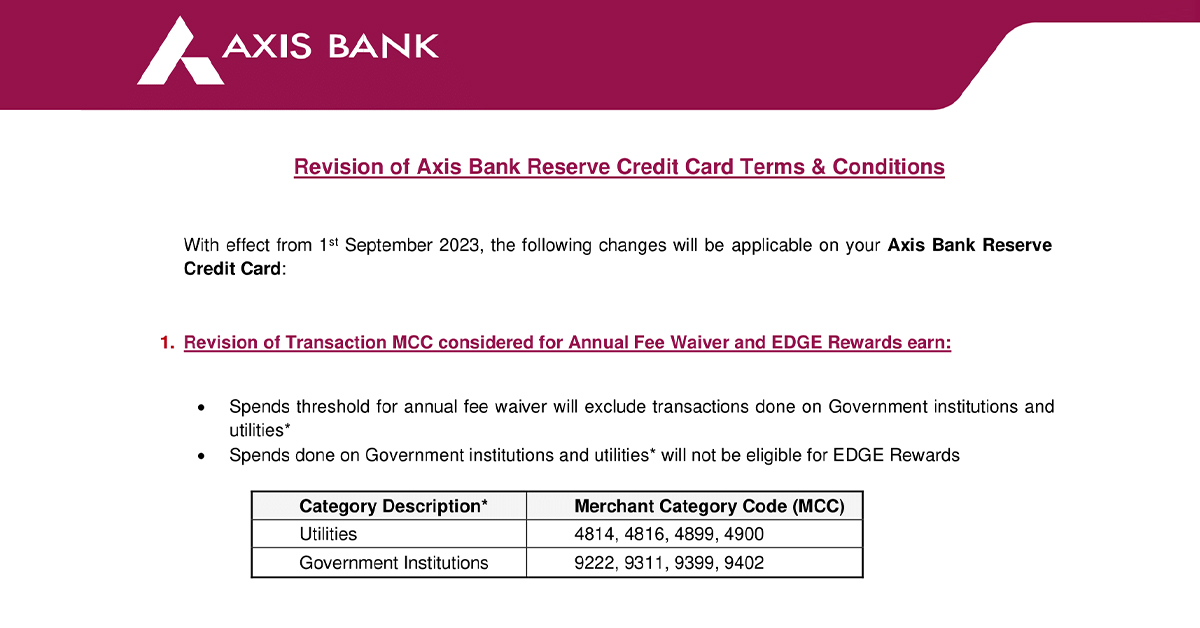

Revision of Transaction Categories that are Eligible for EDGE Reward Points and Annual Fee waiver

Transactions done on Government institutions and utilities are not considered for the annual fee waiver milestone as well as EDGE Reward Points earning.

Revision of Target Spend Threshold for the Annual Fee Waiver

Cardholders onboarded after 1st September 2023 will get an annual fee waiver of Rs. 50,000 on spending Rs. 35 Lakhs in the previous year. Customers that onboarded before 1st September 2023 will get the waiver on spending Rs. 25 Lakhs in the anniversary year. However, on card anniversary dates after 1st September 2024, the annual fee waiver will be applicable on spending Rs. 35 Lakhs.

Changes and Updates Common to Both the Magnus and Reserve Credit Card

The following changes will apply to both the Reserve and the Magnus credit card from 1st September 2023 –

Revision of Miles Transfer Program

- The EDGE RPs earned by you can be transferred to domestic as well international partner hotel and airline loyalty program points. The revised transfer ratio is 5:2, where 5 EDGE RPs = 2 Partner Miles/Points

- The total number of reward points you can convert in a calendar year is capped at 5,00,000 RPs for a single Customer ID. In 2023, cardholder can convert 5,00,000 reward points from 1stSeptember to 31st December 2023.

- You can just link one Customer ID to a partner program loyalty membership at a given time. If you want to link another ID, you will first have to delink the existing primary ID and add the new one.

- The cardholder must wait at least 60 days to update their partner program Customer ID at the Travel EDGE portal.

To continue with the current Miles Conversion ratio of 5:4 on the Reserve or the Magnus credit card, you will have to get a Burgundy Private account and a Burgundy Private credit card. The bank does not charge any extra fee for this special offering from the cardholders.

You will be eligible for the special offering if you have a Burgundy account where you maintain the balance. However, if you have an existing Burgundy account but you don’t maintain balance, you won’t be eligible for the special offering, and will be able to transfer reward points at a 5:2 ratio.

Updated List of Eligible Airport Lounges Accessible with the Priority Pass on Magnus, Reserve, and Select Credit Cards

You can access the following domestic lounges with the Priority Pass –

- Agartala – Primus Lounge

- Allahabad and Prayagraj – Zesto Executive Lounge

- Amritsar – Costa Coffee

- Bhopal – Primus Lounge

- Cochin – Earth Lounge

- Dibrugrah – Primus Lounge

- Guwahati – The Lounge

- Kannur – Pearl Domestic Lounge

- Madurai – Primus Lounge

- Varanasi – Take Off Bar

To access other domestic lounges at airports in India, you will need to use your credit card.

Revision of Axis Bank Ace Credit Card Terms and Conditions

The following changes will be applicable on the Ace credit card from 1st September 2023 –

Exclusion of Payments Made Towards Government Services from Cashback Eligibility

- Payments made towards government services won’t be eligible to earn cashback.

- Cashback will not be earned on fuel spends, wallet reloads, rental payments, cash advance, EMI spends, spends converted into EMI later, gold and jewellery purchases, insurance payments, payment of card fees, payment of outstanding balance, and other charges.

Revision of Axis Bank Select Credit Card Terms and Conditions

The following changes will be applicable on the Select credit card from 1st September 2023 –

Change in the Minimum Cart Value to get the Swiggy Discount

- The minimum order value to get the Swiggy discount has been increased from Rs. 400 to Rs. 500 per order.

- On orders above Rs. 500, you can get a discount of Rs. 200 on the Swiggy website or app

- The offer is applicable twicer per month on Swiggy per User ID, and you have to use the code ‘AXIS200’ during checkout

Capping on Accelerated EDGE Rewards Points on Retail Spends

Earn 20 EDGE RPs per Rs. 200 spent on retail shopping merchants up to cumulative spends of Rs. 20,000 per month.

Earn 10 EDGE RPs per Rs. 200 spent on retail shopping merchants after cumulative spends of Rs. 20,000 per month.

Revision of Axis Bank Privilege Credit Card Terms and Conditions

The following changes will be applicable to the Privilege credit card from 1st September 2023 –

Changes to the Annual Benefit

The annual benefit of 3000 EDGE RPs on achieving the spend based milestone of 2.5 Lakhs in the previous year will be discontinued.

Revision of Axis Bank My Zone Credit Card Terms and Conditions

The following changes will be applicable to the My Zone credit card from 1st September 2023 –

Change in the Minimum Cart Value to get the Swiggy Discount

- The minimum order value to get the Swiggy discount has been increased from Rs. 200 to Rs. 500 per order.

- On orders above Rs. 500, you can get a discount of Rs. 120 on the Swiggy website or app

- The offer is applicable twicer per month on Swiggy per User ID, and you have to use the code ‘AXIS120’ during checkout

Revision in the Calculation of Milestone Benefit for Paid Credit Cards

Spends made on wallet reloads and rental transactions will not be considered towards the renewal of the Sony LIV membership on paid cards.

Changes to the Miles Transfer Program Common to the Select, Privilege, and My Zone Credit Cards

- The total EDGE RPs that can be converted to partner airline or hotel points per year are capped at 5,00,000 RPs per Customer ID. A customer can convert 5,00,000 RPs from 1st September to 31st December 2023 this year.

- For each hotel or airline partner, customers can link just 1 partner program Loyalty ID at any time.

- If a customer wants to link another ID, then the existing or primary ID must be delinked.

- For every partner program, the customer must wait for at least 60 days after updating the partner Loyalty ID at the Travel Edge portal in order to update the new/secondary Loyalty ID.

- The RPs can be transferred to the existing 19 international and domestic hotel and airline partners.

There is no change to the transfer ratio of the Select, Privilege, or My Zone credit card.

FAQs Regarding the Updates on Magnus and Reserve Credit Cards

What is the updated Miles Conversion ratio if the cardholders don’t opt for the special offering?

Cardholders will be able to transfer reward points to domestic and international hotel and airline partners at the revised ratio of 5:2.

Will the monthly milestone benefit of 25000 EDGE reward points continue on the Magnus card?

No, the monthly milestone benefit of bonus 25000 Reward Points on spends of Rs.1 Lakh in the month will be discontinued after 1st September 2023. Spends made in August 2023 will be eligible and the bonus points will be credited within 90 days.

Will the updated Rs. 12,500 annual fee for the Magnus credit card be applicable to exisiting cardholders?

No, the existing cardholders will continue to pay Rs. 10,000 plus taxes and customers who onboard after 1st September 2023 will pay a fee of Rs. 12,500 plus taxes.

Bottom Line

The Axis Bank Reserve and the Magnus is among the most sought-after cards in the entire country. The bank has announced changes to the terms and conditions of these cards along with the Ace, Privilege, My Zone, and Select credit cards. Existing cardholders and those who planned to get any of these cards soon will certainly be annoyed with the devaluations announced by Axis Bank with effect from 1st September 2023.

The joining fee of Magnus will be increased, the welcome and annual benefits will undergo a change, the conversion ratio for the Miles Transfer program has been reduced as well. No doubt, all of these cards still have a lot to offer but people will surely be sad about the changes announced by the Axis Bank.

Make sure to go through the updated terms and conditions thoroughly, so you make spends with your credit card accordingly.