Whenever you apply for a credit card, or for that matter, a personal loan, the card issuer/lender uses a metric known as credit score to evaluate your creditworthiness. Your credit score is a three-digit number in the range of 300-900 assigned to you- the borrower that gives the card issuers/lenders a good idea of your credit behavior and therefore your creditworthiness. This credit score is assigned to all individuals/businesses in the country that have a credit history- i.e. have availed of any type of loan in the past- by independent financial agencies known as credit bureaus licensed by the RBI for this very purpose.

There are four credit bureaus that RBI has licensed in India- TransUnion CIBIL (or simply CIBIL), Equifax, Experian, and CRIF High Mark. These credit bureaus collect all the credit-related information about every individual/business in the country from banks and financial institutions and compile a report known as the credit report for every individual/business based on this information, and based on the credit report a three-digit number between 300 and 900 (the credit score) is also assigned to the borrowers by the credit bureaus- the higher the credit score, the more creditworthy the borrower.

See Also: Credit Bureaus in India Explained

Since your credit score is based on your credit report that contains all the information pertaining to your credit behavior in the past, any discrepancy in the credit report will also reflect in your credit score which might impact your eligibility to get a credit card/loan. It, therefore, becomes important to report any errors on your credit report to the credit bureau and get them fixed.

Monitor Your Credit Score/Report

In order for you to be able to spot any errors in your credit report, you must regularly monitor your credit report as generated by the credit bureaus. All credit bureaus allow you to check your credit report on their websites for free. Ideally, you should check your credit report every month at credit bureaus’ websites and keep tabs on changes. In case you notice any requests/loan accounts you are not aware of, you should immediately report the same to the bureau.

Types of Errors on Credit Report

There are mainly three types of errors possible in a credit report- Identity errors, reporting errors, and data management errors. We will discuss each one of these, one by one-

Identity Errors

Identity errors include errors in your identity information, for example, spelling mistakes in your name, incorrect PAN, incorrect address, or phone number. If you notice any of such errors on your credit report, you must get them corrected immediately as such errors might mean that when a lender requests your credit history and your credit score from the bureau, it might be provided with the information of another individual.

Reporting Errors

Reporting errors are the errors in your credit report related to your credit card/loan accounts. These errors include errors such as loan accounts wrongly reported as delinquent or open/closed, incorrect date of payment, incorrect current balance and credit limit, etc.

Data Management Errors

Errors like one credit account appearing multiple times in the report, erroneous credit information due to poor database management fall in the category of data management errors.

How to Dispute Credit Report Errors

In case you notice any discrepancy between your actual credit information and the information that you see on your credit report, you must report the same to the credit bureau immediately. Every credit bureau has a procedure in place through which you can report any errors on your credit report as compiled by the bureau.

How to Dispute Errors on Your CIBIL Report?

TransUnion CIBIL is the most reputed credit bureau in India and almost all the banks rely on CIBIL credit reports to establish the creditworthiness of a borrower. Therefore you must keep tabs on your CIBIL report and in case you find any discrepancy, you should immediately report the same. Here is a step by step procedure that you are required to follow to report any error on your CIBIL report-

- Step 1: Visit the official CIBIL website and click/tap on “Dispute Resolution” followed by “Consumer Dispute” Resolution.

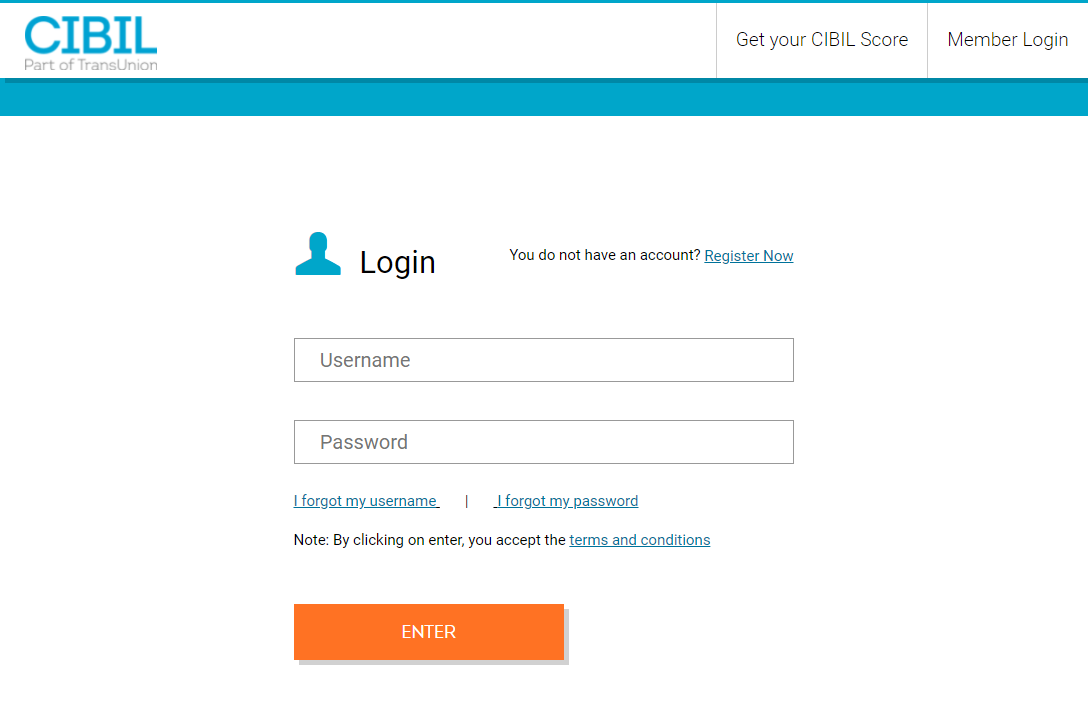

- Spet 2: On the page that opens, scroll down a bit and click/tap on “Click Here to Login” and log in to your CIBIL account with your username and password.

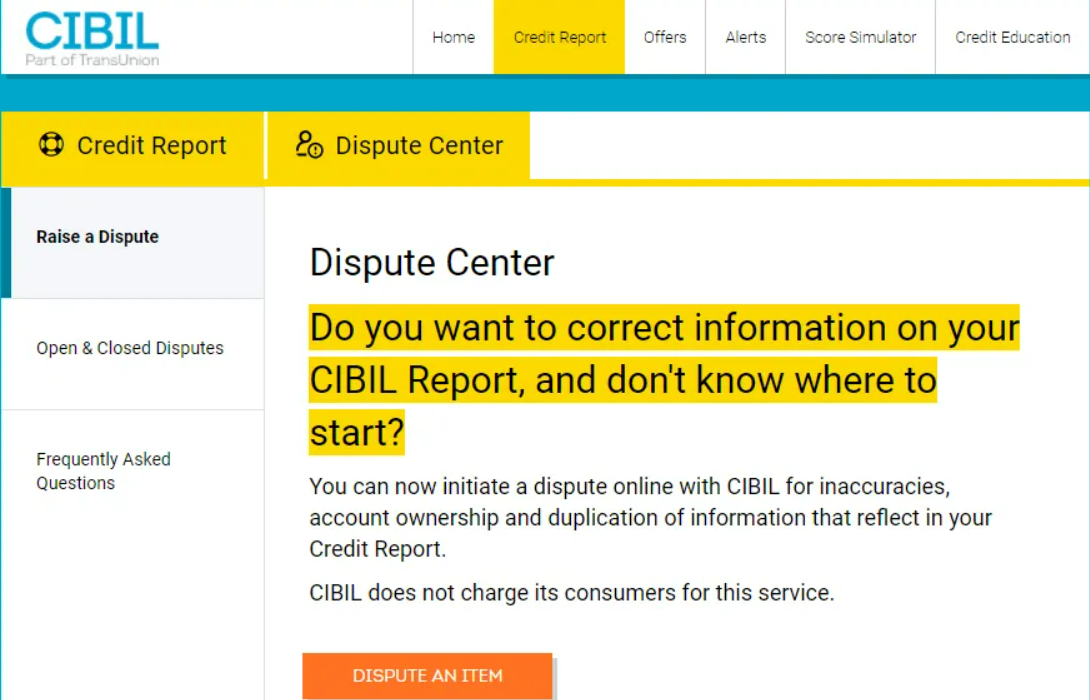

- Step 3: Once you have logged in, select “Dispute Center” followed by “Dispute an Item” from the “CIBIL Report” menu.

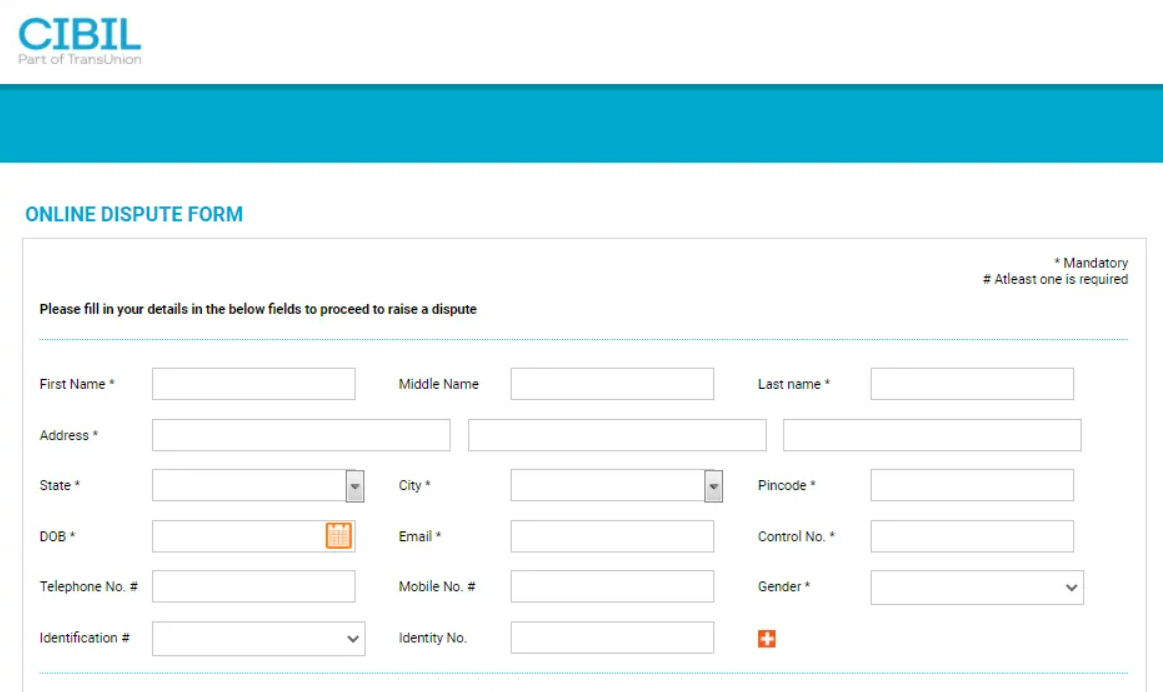

- Step 4: Fill in your details like name, address, DOB, and select the type of dispute. Once you have entered all the required details, click/tap on “Submit” and your dispute request is submitted to CIBIL.

Once the dispute has been successfully submitted, CIBIL will examine the authenticity of the discrepancy reported, and if found correct, your CIBIL credit report will be updated with the correct information.

How to Dispute Errors on Your Experian Report?

Experian is another RBI licensed credit bureau operational in India. Many banks/lenders also fetch your Experian report before approving your loan/credit card application. If you find any discrepancy in your Experian report, you can follow the below-mentioned procedure and report the same-

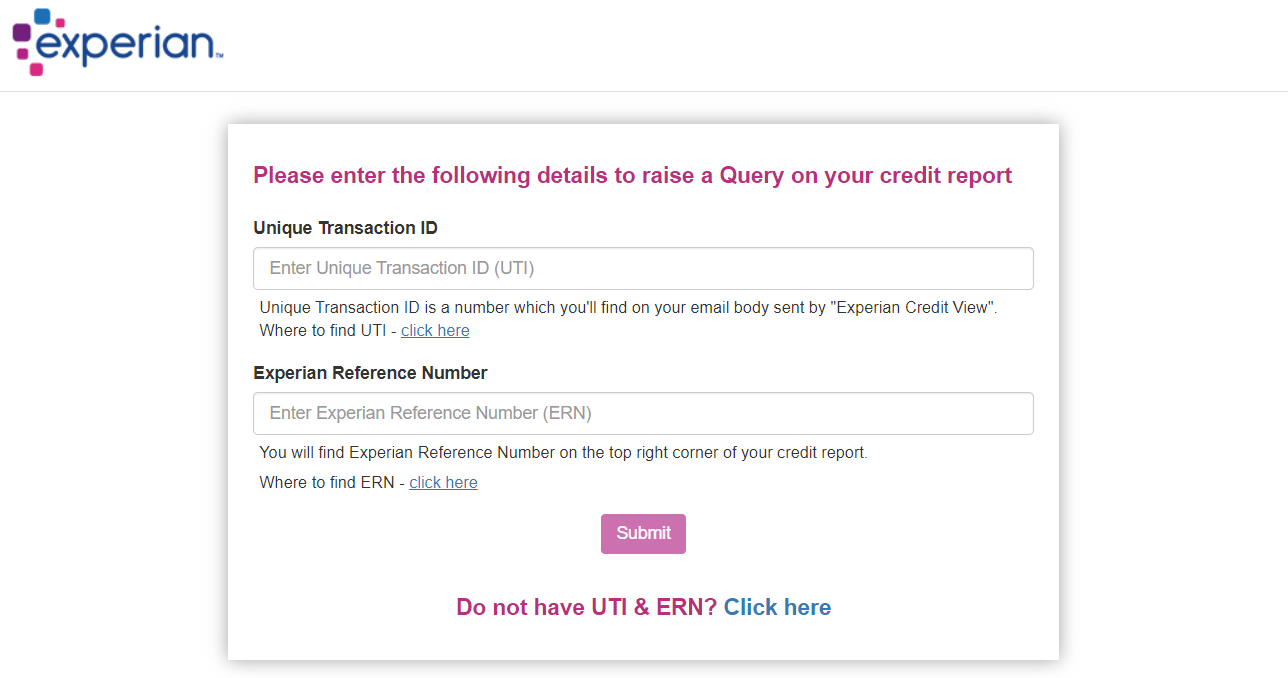

- Step 1: Visit the Experian Dispute Reporting Page on the official Experian website and enter your Unique Transaction ID (UTI) and Experian Reference Number (ERN) as mentioned on your Experian credit report (you can find your UTI and ERN at the top right corner of your Experian report) and click/tap on Submit.

- Step 2: Fill in your details including the disputed information in the form that opens and submit your request. Experian will investigate the authenticity of your dispute request and update the information accordingly if your request is found legit.

How to Dispute Errors on your Equifax Report?

To report an error on your Equifax credit report, you have to take the offline route- you need to first download, print, and fill the dispute resolution form from the official Equifax website and mail the same to Equifax along with self-attested copies of identity proof and address proof. The following steps elaborate the procedure to dispute an error on your Equifax credit report-

- Step 1: Download and print the dispute resolution from the official Equifax website.

- Step 2: Fill in all your details in the form including the details of the dispute you wish to raise.

- Step 3: Mail the filed form to Equifax postal address- Equifax Credit Information Services Private Limited, Unit No. 931, 3rd floor, Building no. 9, Solitaire Corporate Park, Andheri Ghatkopar Link Road, Andheri East, Mumbai – 400093 along with an ID proof and an address proof.

How to Dispute Errors on CRIF High Mark Report?

CRIF High Mark is another credit bureau licensed by the RBI to collect the information and maintain credit records of all the borrowers in the country. If you notice any discrepancy in your CRIF High Mark credit report, you can report it by following the steps mentioned below-

- Step 1: Send an email to [email protected] (with the CRIF High Mark Reference Number in the subject line) mentioning your issue with your CRIF High Mark credit report.

- Step 2: CRIF High Mark will generate a ticket number against your request and share the same with you. You can use this ticket number if you have any further inquiries with regard to your credit report.

- Step 3: CRIF High Mark will now investigate your request and rectify your report within 30 days of receipt of your application.

Bottom Line

Credit report/score is a very important metric that card issuers/lenders use to determine your eligibility for a loan/credit card. Therefore it is very important to keep your credit report error-free with all four credit bureaus. It is advisable that you check your credit reports at least once every month and make sure that there are no discrepancies. This will certainly help you maintain a healthy credit profile and you will be able to get easy approvals for credit cards and personal loans in the future.