TransUnion CIBIL (Credit Information Bureau of India Limited) is one of the four major credit bureaus in India. Established in 2000, it is the first and most trusted credit bureau that came into recognition in India. Various banks and financial institutions check your CIBIL report before approving/rejecting your credit card/loan applications and that is why your CIBIL score matters a lot. It gathers your credit information and history from various financial institutions and then prepares a report and score representing your creditworthiness which helps the card issuers/money lenders understand how risky or responsible you are as a borrower. If you are not aware of what a CIBIL score is and how you can check it, this article will help you understand everything you need to know.

What is a CIBIL Score?

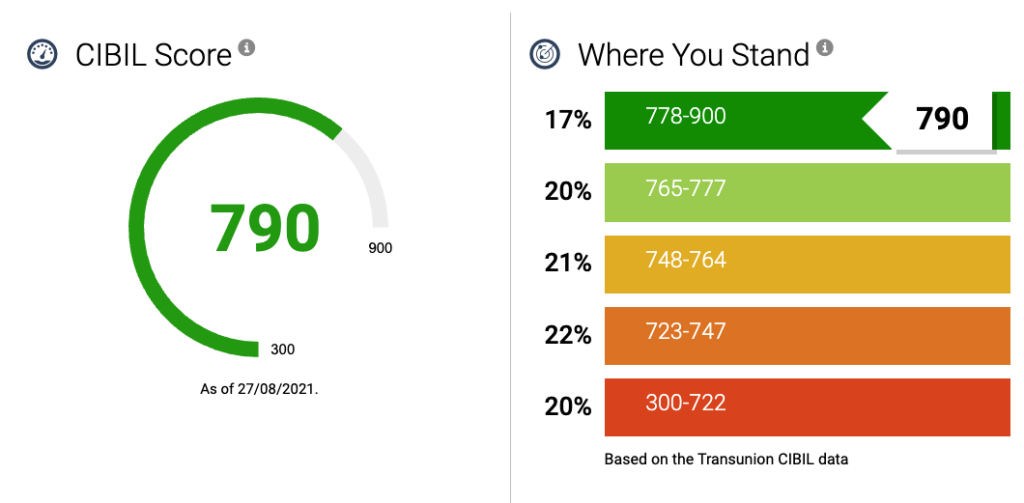

A CIBIL Score is a credit score prepared by the credit agency, TransUnion CIBIL. It is a three-digit number ranging between 300 to 900, which represents the creditworthiness of an individual. 300 is the lowest credit score, representing the non-responsible financial behavior of an individual, and 900 is the highest representing the excellent credit history of an individual. The higher your CIBIL score is, the higher are the chances of you getting a credit card or a loan. Your CIBIL score defines your creditworthiness as follows:

- A CIBIL score between 300 and 549 is considered poor. A poor CIBIL score represents that you have been a very risky borrower and hence the credit card issuers or money lenders will most likely not approve your credit card or loan applications.

- A CIBIL score between 550 and 649 is considered fair. A fair CIBIL score shows that you have missed or delayed payments several times and the card issuers/money lenders will not be very sure about approving your applications. However, some of them might believe you and provide you with loans/credit cards but with high interest rates.

- A CIBIL score between 650 and 749 is considered good. A good CIBIL score will make it way easier for you to get credit cards and loans and there are high chances that you will get approval for every credit card you apply for.

- A CIBIL score between 750 and 900 is considered excellent. If you have an excellent CIBIL score, the card issuers will provide you with credit cards without any doubt. You may even receive offers from the banks without applying for any loans/credit cards. Having an excellent score will also help you get credit cards with the lowest interest rates and great benefits.

How To Check Your CIBIL Report & Score?

Checking your credit report and score regularly is important in order to keep an eye on your financial behavior and to keep improving it. Here are the steps that you need to follow to check your CIBIL score:

- Visit the official website https://www.cibil.com.

- Click on the option ‘Get your CIBIL report and score.’

- Choose one of three subscription plans, which are:

- Basic Plan (Rs. 550) – Unlimited checks of credit score for a month.

- Standard Plan (Rs. 800) – Unlimited checks of credit score for six months.

- Premium Plan (Rs. 1,200) – Unlimited checks of credit score for a year.

- Fill in your personal details to create your CIBIL account.

- Verify your identity by entering the OTP on your registered mobile number.

- Make the payment and proceed.

How To Get Your CIBIL Report & Score for Free?

CIBIL also provides you with an opportunity to get your CIBIL report and score for free once every year. To get your free credit report, you can follow a few simple steps as mentioned below:

- Visit the page https://www.cibil.com/freecibilscore.

- Click on ‘Get your free CIBIL score.’

- A banner with subscription plans will appear on your screen. Click on ‘No Thanks’ if you don’t want to buy a subscription.

- Create your CIBIL account by entering your personal details.

- Verify your identity in the next step and get your free CIBIL report and score.

How To Raise A Dispute For Any Inaccurate Information in your CIBIL Report?

If you find any inaccurate information in your CIBIL report, it is generally a mistake of the financial institution or the bank and not of the credit bureau. So, when you raise a dispute, the information is sent to your respective financial institution and is corrected by them. Following are the steps you need to follow to raise a dispute if you find any inaccurate data in your CIBIL report.

- Visit the official website of CIBIL and log in to your account.

- Under the section ‘Credit Reports,’ click on the option ‘raise a dispute.’

- Fill in the online dispute form and select the relevant section under which you are raising your dispute.

- Fill in the correct value if you find any inaccurate data.

- Submit the form.

- The banks/financial institutions check the dispute and accept or reject it on the basis of the section chosen by you. Therefore, it is necessary for you to select the section carefully when raising a dispute.

- If the financial institution accepts your dispute, they make the corrections.

What Are the Things Mentioned in Your CIBIL Report?

Your CIBIL report contains the following information about you:

- Credit Summary & CIBIL Score – It is the section that matters the most in your CIBIL report. A summary of your credit history, your payment behavior, credit utilization ratio, and your creditworthiness are mentioned under this section.

- Personal Details – It is the section where all the necessary and relevant personal information of an individual is mentioned. It includes your name, date of birth, contact information, current/permanent addresses, etc.

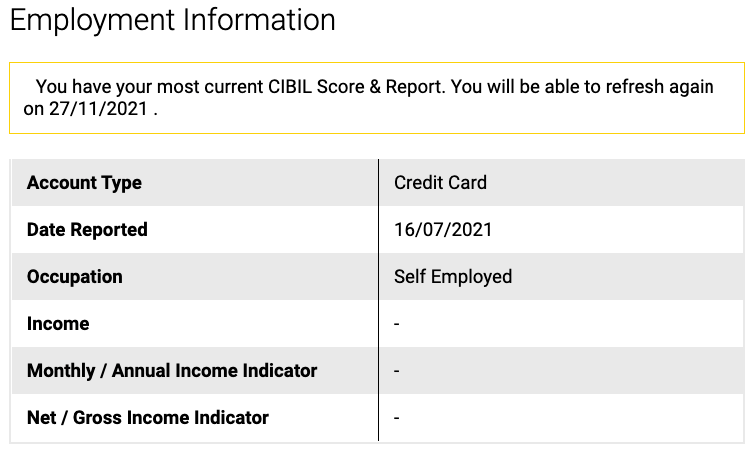

- Employment Details – A summary of your job profile is mentioned on your CIBIL report according to the latest information provided to them. For example, in the image shown below, the cardholder reported himself as self-employed in his latest credit card/loan application and that is what appeared in his CIBIL report. So, it just shows whether you are salaried or self-employed and nothing about your income is mentioned in it.

- Account Information – This section shows all the loans/credit cards you have availed of, your payment history, and all the hard/soft inquiries made on your account. However, nothing about your account savings or investments is mentioned in it.

Also Read: Things that are not mentioned in your credit report.

Why is it Important To Check Your CIBIL Report Regularly?

Many people believe that checking their own CIBIL report can affect their credit score negatively, which is not true. When you check your own credit report, it is known as a soft inquiry and doesn’t affect your credit score whereas when a financial institution or a card issuer bank checks your CIBIl report, it is known as a ‘hard inquiry’ and can have a negative effect on your credit score. Checking your CIBIL report is a good thing to do in order to improve your credit score. It helps you understand whether you possess responsible financial behavior or not. You can also be aware of what your card issuer is going to see in your report before you apply for any credit card. Moreover, checking your CIBIL reports can help you detect any inaccurate information on your report so that you can get it corrected then and there.

How To Improve Your CIBIL Score?

It is really important to build/maintain a good CIBIL score so that you can get approved for all the credit cards/loans easily when required. Here are the points that you need to keep in mind to improve your CIBIL score and maintain it if you already have a good one:

- Make sure to pay your credit card dues/loan EMIs on time. Your payment history makes 35% of your CIBIL score and is the most important factor affecting your credit score.

- Keep your credit utilization ratio low. Your credit utilization is the second most important factor that is taken into consideration while calculating your CIBIL score. You must try to spend only 30% or less of your credit limit to achieve a good credit score.

- Try to maintain a good credit mix by taking different types of loans (personal loans, home loans, mortgage loans, etc) & credit cards. Having only one type of credit is not advisable in order to achieve a good credit score.

- Don’t apply for so many credit cards or loans at a time as it leads to more hard inquiries on your credit profile and affects your credit score badly.

- Check your credit reports and credit scores regularly so that you can avoid the mistakes due to which your CIBIL score is not increasing.

Bottom Line

Checking your CIBIL report regularly is really essential in order to improve your score. CIBIL gives you a chance to check your credit report for free once every year, but it is advisable to check it at least once every month. Moreover, you must try to keep the above points in mind so that you can achieve an excellent CIBIL score that will help you a lot in getting approved for credit cards and loans easily. If you have any further doubts regarding the information provided above, you are free to ask in the comment section below. Also, make sure to share your experience of achieving a good CIBIL score if you have already done it.