Axis Bank offers the premium banking service called Burgundy to their high net-worth and other wealthy clients. Burgundy accounts offer a range of personal banking, wealth management, business, and lending solutions to clients through experienced relationship managers and wealth specialists.

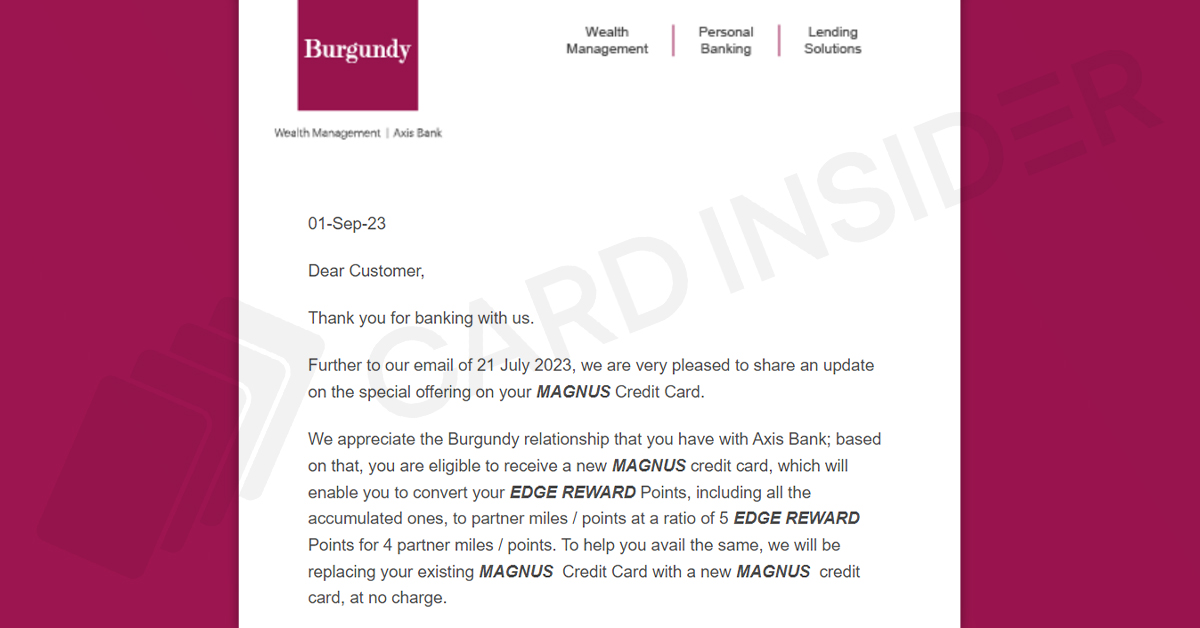

Recently, Axis Bank announced that customers who have a Burgundy relationship with the bank are eligible to receive a new Magnus credit card and they will be able to convert their Edge Reward points to partner airmiles/hotel points at a 5:4 ratio. The bank will offer a new Magnus card to replace your existing one without any extra charges. Read on to know more about this.

Axis Bank Offering New Magnus Credit Card to Burgundy Account Holders

Axis Bank is offering a new Magnus credit card to Burgundy account holders. Cardholders will be able to convert their Edge Reward points to partner airmiles/points at a ratio of 5:4. The bank will also replace your existing card with a new Magnus credit card without any extra costs.

Eligible customers will receive an email from the bank with further details to register for the new Magnus credit card. Once approved, your existing Magnus credit card will be updated and your existing reward points will be transferred to the new Magnus credit card.

To ensure a smooth transition, the redemption of reward points on your existing Magnus credit card are suspended in order to make the upgrade. You can stay tension-free regarding your old reward points as they will soon be able to convert to your favorite categories.

Updated Terms and Conditions of the Magnus Credit Card

The following changes have been made to Magnus credit card from 1st September 2023 –

Revision of Welcome Benefit

Customers that onboard on or after 1st September 2023 can choose a welcome voucher worth Rs. 12,500 from one of the following –

- Postcards Hotel gift voucher

- Luxe gift card

- Yatra gift voucher

The Tata Cliq voucher that was offered before is discontinued now.

Revision of Annual Benefit

- The annual fee on the card will be updated to Rs. 12,500 from the existing Rs. 10,000 for customers onboarded after 1st September 2023.

- The annual benefit voucher worth Rs. 10,000 is discontinued

- Customers that onboard after 1st September will have to make annual spends of Rs. 25 Lakhs in the year to receive an annual fee waiver.

- For customers onboarded before 1st September, the annual fee waiver will be applicable on spending Rs. 15 Lakhs in the year but right after 1st September 2024, the waiver will be applicable on spends of Rs. 25 Lakhs.

Revision of Milestone Benefit and EDGE Reward Points

- The target spend for the annual fee waiver milestone will not consider utilities and government spends. These spend categories will also not accrue EDGE reward points.

- The milestone benefit of bonus 25,000 EDGE reward points on spending Rs. 1 Lakh in the month will also be discontinued from 1stSeptember 2023.

- Cardholders who reach the milestone in May and June 2023, the bonus points will be posted by July 31, and those who achieve the milestone in July will receive the bonus points by August 10 2023.

- After 1stSeptember, you will earn 12 EDGE RPs per Rs. 200 spent with the card until total monthly spends of Rs. 1.5 Lakhs. On making transactions after crossing this threshold amount, you will earn 35 RPs per Rs. 200 spent thereafter.

- Earn 60 RPs per Rs. 200 spent on the Travel Edge portal, up to cumulative spends of Rs. 2 Lakhs in a month. After crossing this amount, you will earn 35 RPs per Rs. 200 spent with the card.

Revision of Miles Transfer Program

- The EDGE RPs earned by you can be transferred to domestic as well international partner hotel and airline loyalty program points. The revised transfer ratio is 5:2, where 5 EDGE RPs = 2 Partner Miles/Points

- The total number of reward points you can convert in a calendar year is capped at 5,00,000 RPs for a single Customer ID. In 2023, cardholder can convert 5,00,000 reward points from 1stSeptember to 31st December 2023.

- You can just link one Customer ID to a partner program loyalty membership at a given time. If you want to link another ID, you will first have to delink the existing primary ID and add the new one.

- The cardholder must wait at least 60 days to update their partner program Customer ID at the Travel EDGE portal.

- To continue with the current Miles Conversion ratio of 5:4 on the Reserve or the Magnus credit card, you will have to get a Burgundy Private account and a Burgundy Private credit card. The bank does not charge any extra fee for this special offering from the cardholders.

You will be eligible for the special offering if you have a Burgundy account where you maintain the balance. However, if you have an existing Burgundy account but you don’t maintain balance, you won’t be eligible for the special offering, and will be able to transfer reward points at a 5:2 ratio.

Updated List of Eligible Airport Lounges Accessible with the Priority Pass on Magnus Credit Card

You can access the following domestic lounges with the Priority Pass –

- Agartala – Primus Lounge

- Allahabad and Prayagraj – Zesto Executive Lounge

- Amritsar – Costa Coffee

- Bhopal – Primus Lounge

- Cochin – Earth Lounge

- Dibrugrah – Primus Lounge

- Guwahati – The Lounge

- Kannur – Pearl Domestic Lounge

- Madurai – Primus Lounge

- Varanasi – Take Off Bar

Bottom Line

The Burgundy accounts are the premium service offered by Axis Bank for their most wealthy and loyal customers, and the bank has announced a new benefit for them where they can get a new Magnus credit card to replace their old one.

The card will provide them the capability to transfer their reward points to partner airmiles and hotel points at a 5:4 transfer ratio even though the rate has been revised to 5:2 on the credit card. The bank will replace your existing Magnus card for you without any extra charges.

Let us know in the comments section if you are Axis Burgundy accountholder and if you plan on getting the new Magnus credit card for yourself.