If you are new to the credit scene and do not have a decent credit history or score, then a lifetime free credit card will be the perfect option for you to get started. SBI Lifetime Free credit cards will not charge any joining or renewal fee from the cardholder and you can avail of its features and benefits without having to pay any money for it.

There are credit cards meant for every category of people, right from high net-worth individuals to newcomers in the credit scene. Super-premium and mid-range cards have a ton of benefits but they have higher joining and renewal charges. Lifetime-free credit cards may not offer as many privileges as the superior variants, but they still offer a decent amount of privileges and benefits.

Table of Contents

List of SBI Credit Cards With Joining Fee Under Rs. 500

The following are the top SBI credit cards that you can get for a low joining and annual fee of Rs. 500.

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Card Details +

One of the top basic shopping cards by SBI, the SimplyCLICK credit card is really popular among new cardholders, especially those who prefer online shopping. You earn up to 10x reward points on popular merchants like BookMyShow, Dineout, Apollo 24×7, Cleartrip, Lenskart, and Netmeds. Available at a low joining fee of Rs. 500, the card even provides 5x RPs online and 1 RP on offline spends, per Rs. 100.

- Rs. 500 worth of gift vouchers from Amazon as a welcome bonus

- Rs. 2000 worth of Cleartrip gift vouchers on spending Rs. 1 Lakh and Rs. 2 Lakhs each

- Up to 10x RPs per Rs. 100 spent on online merchants like BookMyShow, Dineout, Apollo 24×7, Cleartrip, Lenskart, etc.

- Up to 5x RPs per Rs. 100 spent online and 1 RP on offline spends, except fuel

- 1% fuel surcharge waiver and spend-based renewal fee waiver

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Card Details +

The SimplySAVE credit card by SBI offers 2000 bonus reward points as a welcome benefit and is available at a nominal Rs. 500 joining fee. On departmental store, movies, and grocery spends, you can earn accelerated reward points and this makes the card popular among new cardholders who want to get rewarded for their daily spends. It does not have premium travel, entertainment, or dining benefits, but is ideal for people new to credit.

- 2000 bonus RPs as a welcome benefit on spending Rs. 2000 or more in 60 days of getting the card

- 1 RP per Rs. 150 spent

- Up to 10 RPs per Rs. 150 spent on grocery, movies, and departmental stores

- 1% fuel surcharge waiver and spend-based renewal fee waiver

Joining Fee

Renewal Fee

Best Suited For

Fuel

Reward Type

Reward Points

Welcome Benefits

Card Details +

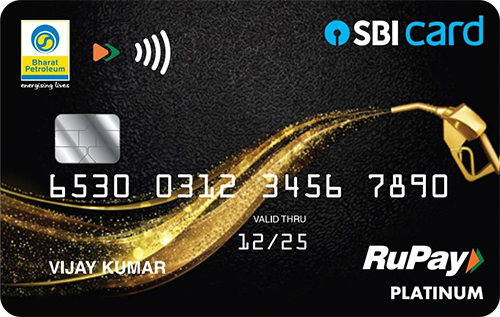

A fuel credit card in collaboration with BPCL and SBI, this is an entry-level card that charges Rs. 500 as joining fees. You can earn up to 4.25% value back on your fuel spends at BPCL stations. Apart from fuel, you get 5x reward points on your grocery, dining, movies, and departmental store spends. As this is a fuel credit card, you don’t get many privileges across other categories.

- Bonus 2000 RPs on paying the joining fee

- 1 RP per Rs. 100 spent

- 5 RPs per Rs. 100 spent on grocery, dining, movies, and departmental store

- 13 RPs per Rs. 100 spent on BPCL fuel outlets

- 1% fuel surcharge waiver and spend-based renewal fee waiver

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

A co-branded credit card by SBI and IRCTC, this IRCTC RuPay card has a low Rs. 500 joining fee and is the ideal choice for regular train commuters. Apart from a generous welcome benefit, cardholders earn 1 reward point per Rs. 125 spent with the card on retail and IRCTC website railway ticket booking transactions. Frequent travelers can also enjoy complimentary railway lounge access and exclusive accommodation at more than 5000 top hotels in our country.

- 1 RP per Rs. 125 spent on retail and IRCTC website or mobile app train ticket booking

- Bonus 350 RPs as a welcome benefit on a single transaction of more than Rs. 500 within 45 days of getting the card

- Up to 10% as value back on purchasing AC1, AC2, AC3, or AC Chair Car tickets via the IRCTC mobile application or website.

- 4 Complimentary railway lounge access every year, maximum 1 per quarter

- Book train tickets through the IRCTC website and get a 1% waiver on transaction charges

Benefits of SBI Lifetime Free Credit Cards

The following are the benefits provided by SBI lifetime free and other low joining fee credit cards –

- First and foremost, these cards do not charge any joining or annual fees from the customers.

- You have to go through a simple and convenient process to apply for these cards. Make sure you meet the eligibility criteria and provide the required documents when applying for the card.

- Other mid-range and premium credit cards are meant for high-net-worth individuals and lifetime free cards cannot compete with those cards. However, lifetime free cards still offer many exciting deals and discounts for customers.

- You can enjoy benefits across travel, entertainment, lifestyle, shopping, movies, dining, etc. with the cards.

- You can use the card to improve your credit score and build a decent credit history and profile.

- The reward rate on these cards is impressive and you can redeem your points against a host of products or vouchers, against card statement balance, transfer to Airmiles, and more easily.

- You can perform multiple tasks with these credit cards and it is easy to upgrade to better, premium cards in the future.

Eligibility Criteria and Documents Required

You must meet the following eligibility criteria to apply for lifetime free credit cards and you must provide the necessary documents as well along with your application –

- The applicant must be between 21 to 70 years of age.

- The applicant must be an Indian citizen.

- The applicant must have a decent credit score

- The applicant should be self-employed or salaried with a stable source of income.

The following documents must be provided when applying for lifetime free and other credit cards –

ID Proof – Aadhar Card, PAN Card, Driver’s License, Passport, etc.

Address Proof – Aadhar Card, Rent Agreement, Ration Card, Passport, Latest Utility Bills, etc.

Income Proof – Salaried individuals need to provide the latest 2 months’ salary slips and bank statements. Self-employed individuals need to provide their audited ITR of the previous year.

Credit Cards Comparison

In the following table, we will compare some of the best and most popular SBI lifetime free and some other affordable, low joining fee credit cards.

| Category | SBI SimplySAVE Credit Card | BPCL SBI Credit Card |

| Joining/Annual Fees | Rs. 500 + GST | Rs. 499 + GST |

| Welcome Benefit | 2000 Reward Points | 2,000 Activation Bonus Reward Points |

| Reward Earning | 1 Reward Point for Rs. 150 spent. 10X RPs for spends made in movies, grocery, dining, & departmental stores. | 13X for Fuel Spends and 5X for Dining, Movies and Grocery Spends |

| Reward Redemption | Redeem points earned for gift vouchers on sbicard.com or the SBI mobile app. Also, for paying the card’s outstanding balance. (1 Reward Point = Rs. 0.25) | Reward Points are redeemable against gift vouchers on sbicard.com or the SBI mobile app, for purchases at BPCL petrol stations, and against cash (card’s statement balance). |

| Travel Benefits | N/A | N/A |

| Spend-Based Waiver | Renewal fee can be waived on spending Rs. 1 Lakh or above in the last year | Renewal fee can be waived on spending Rs. 50,000 |

How to Apply for SBI Lifetime Free Credit Cards

Follow these steps to apply for SBI lifetime free and other credit cards –

- Click on Apply Now.

- Fill out the given form with some basic details of yours.

- Submit your application for approval.

- Once approved your card shall be delivered to your selected address.

Bottom Line

Generally, a lifetime free card does not charge any annual, renewal, or joining fees from the cardholder and SBI lifetime free credit cards are some of the best ones in this category. LTF cards do not provide elite-level benefits and privileges like some super-premium and mid-range cards, but they are still quite advantageous for cardholders.

SBI Credit Cards are great for young professionals who are new to the credit scene. They do not make extensive use of the card and use it responsibly to improve their credit history and credit score. People can use these lifetime free credit cards to get a decent credit score and build a good credit profile so they can apply for better, premium credit cards and loans in the future.

In the above article, we talked about the best SBI lifetime free credit cards and some other affordable, budget-friendly cards offered by the bank. Let us know if you plan on applying for any of these credit cards or your experience of using one, in the comments section below.