Credit exposure is certainly making people more vulnerable in their finance management. The more you are exposed to credit, the more financial strain it might cause, if you are not financially stable. Most of the time people unable to pay off their debt, default. Default is a term used for the borrower who has not returned the borrowed credit to the lender even after numerous warnings.

There is a list prepared by CIBIL for defaulters and surely you wouldn’t want to be one of those names. Because they are theoretically blacklisted from borrowing any more credit from any financial institute. So, what happens when you default? Normally, their credit score goes down to the bottom, and their credit history and report become a mess. But for lenders, the situation might take a U-turn.

In case, you already have a lot of issues in repaying your loan but you are not a defaulter yet and the lender is ready to provide you with a loan, they might have already prepared a security net for you. The lender in cases of high credit risk might use Credit Default Swap.

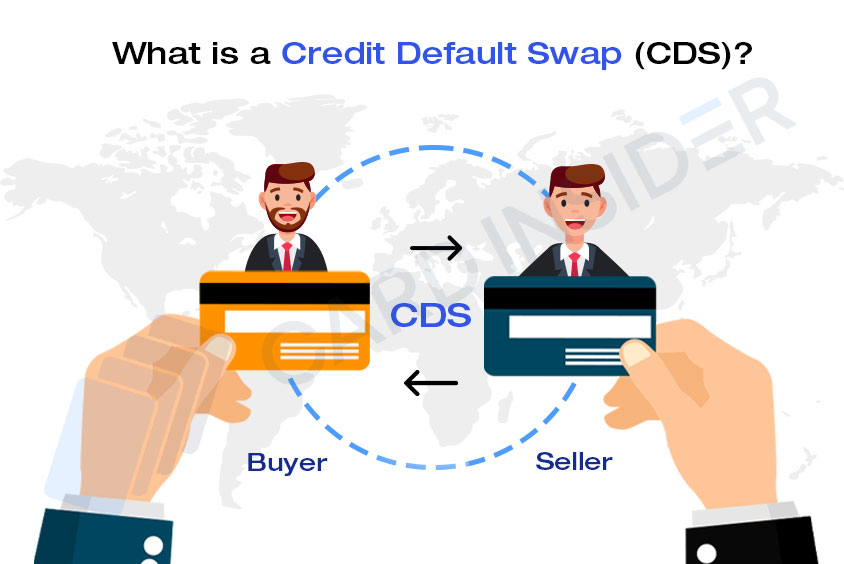

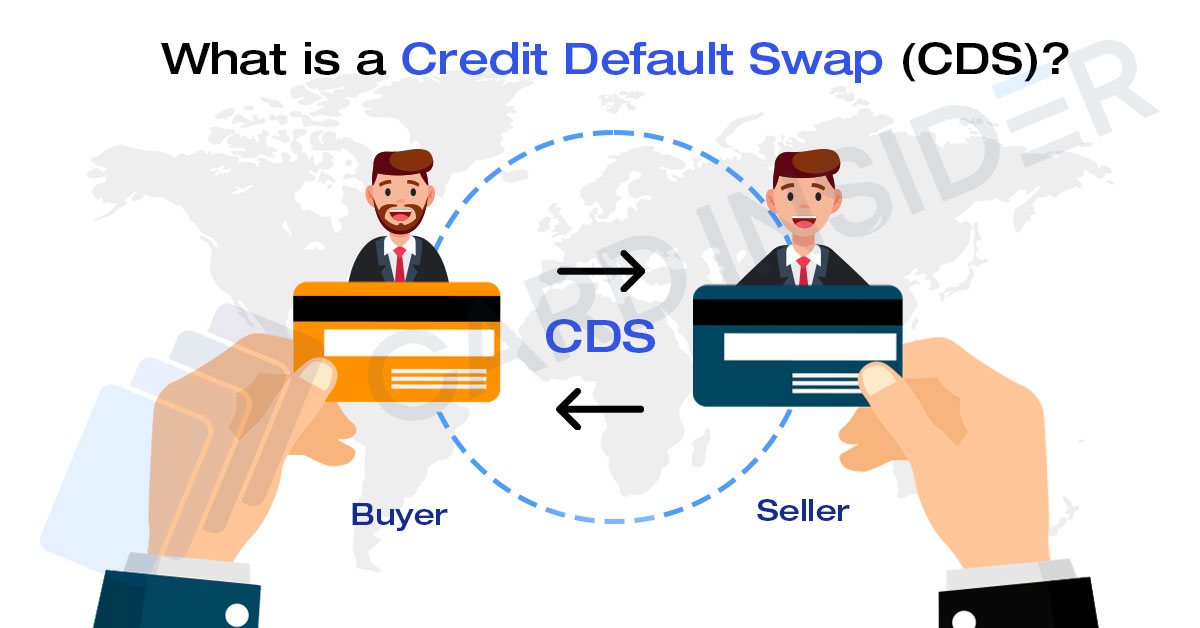

What is Credit Default Swap?

A Credit Default Swap is a financial contract that allows the lender to shift all the risk exposure from them to a CDS Seller. Here the buyer or the lender swap to protect themselves in case of default on corporate debts, government bonds, and sovereign bonds.

CDS is a type of insurance that protects lenders or financial institutions against payment defaults by the borrower. In case of default, the CDS seller has to pay the entire agreed amount with interest to the lender, and then the risk shifts towards the seller. CDS are used so that the lender could shift the burden of risk in cases of payment defaults.

For Example – A XYZ Company issues a bond; here the bondholder bears the risk of non-payment and to shift their risk exposure, bondholders can buy a CDS from a third party. It is a type of premium or insurance that will shift the burden of risk from the bondholder to the CDS seller or the third party from which you have bought the premium. In return, the bondholder or buyer of CDS pays interest periodically. Usually, these third-party CDS sellers are banks or insurance companies.

Now how does it profit the third-party CDS Seller? Just by bearing the burden of risk, the CDS seller like ICICI Bank, SBI Bank, etc. can earn the premium paid by the bondholder. This will make them profit periodically if there is no default by the XYZ company. CDS is bought for hedging, speculation, arbitration, and leveraging portfolios.

Advantages of Credit Default Swap (CDS) Explained

- Reduces the risk to lenders – CDS acts as an insurance that is designed to protect the lender from bearing the risk in case of default. The risk is swapped with the CDS seller by prosing to pay them the premium periodically.

- No Asset exposure – You are not required to purchase any underlying fixed-income assets.

- Seller can spread risk – By CDS the lender’s risk is shifted to the CDS seller for default payments and the CDS seller can sell multiple swaps to further spread the risk.

Disadvantages of Credit Default Swap (CDS) Explained

- Can give a false sense of security to lenders and investors – This can make the investors feel that they don’t have any risk at all with the investment.

- Traded over-the-counter – The CDS are prone to additional risks due to being traded on OTC markets.

- Seller inherits the risk – The CDS Seller inherits the risk in case the borrower defaults.

Bottom Line

Credit Default Swap is a safety net for the lender when it comes to default payments. This is a type of insurance provided by third parties such as banks and insurance companies. Lenders usually buy CDS to protect themselves from the burden of risk from the default of government bonds, corporate debts, and sovereign bonds. CDS has both advantages and disadvantages. But the risk swap it provides can give lenders a sense of security for their money and the interest promised because, in case of default, the CDS seller is liable to return the money with the interest to the lender.