How convenient it is to go to any store and make a payment with just a swipe. But the process of actually getting the payment done is quite tricky itself. This method can cause some expenses to the merchants accepting the payment. Whenever a merchant accepts a credit card as a method of payment, there are some fees that they have to pay for the privilege of doing so.

This fee is called interchange fee which is a transaction fee that the merchant has to pay whenever the customer uses a credit or debit card for payment. This fee must be paid with every credit and debit transaction. Interchange fees can be different from merchant to merchant and card to card which is decided by the financial institutions.

Interchange Rate

The term ‘interchange’, itself suggests that this is an exchange fee. This fee is charged by the credit card issuers to the merchant for the user to use the card against the expenses. In exchange for accepting the credit risk, card issuing companies set these interchange rates and handling charges. These rates are set by the financial institutions and are revised periodically.

Interchange rates are critical components of payment networks that affect both merchants and card issuers. The payment networks such as VISA, MasterCard, etc play a significant role in determining the rate of accepting credit card payments.

The rate structure is quite complex and varies depending on many factors including the type of transaction, merchants’ industry and level of risks associated, etc. These rates are usually a percentage of the transaction amount along with a flat fee sometimes. These rates typically cover various costs which include processing, fraud prevention, and reward programs.

In addition to the interchange fee, another fee may be included by the credit card processing companies to retailers as a part of their processing fees. Many merchants pass on this fee directly to the customers as an additional surcharge, especially under a specific amount. But the majority of businesses include the interchange fee in their products and services.

How Interchanged rates are determined?

As stated earlier the Interchange rates are finalized by the credit card companies like VISA, MasterCard, Discover, etc. And the rates are usually divided between the merchant and the credit card issuer. With VISA and MasterCard, the rate is usually finalized on a semi-annual basis, i.e., two times a month. These two times are in April and then in October. Other companies might be different. There are some factors as well which can fluctuate the transactional fee, which is as follows –

Transactional factor

Different cards from the same card company may have different charges. Because the rate charged is a percentage of the transactional value and there is a flat fee sometimes as well. The interchange fee can be a combination of both sometimes. The size of the merchant’s business can also impact the associated fee, the rates can be higher for small businesses. This is because the volume of sales is typically lower than the large merchants or retailers with a national presence and they can negotiate lower rates with the companies.

Interchange fee regulation

Financial service companies are one of the most heavily regulated entities in today’s economy and with no surprise the interchange rates also fall under their range. +The interchange fee, as mentioned earlier is initiated or charged by the card processing companies like VISA, Rupay, American Express, etc.

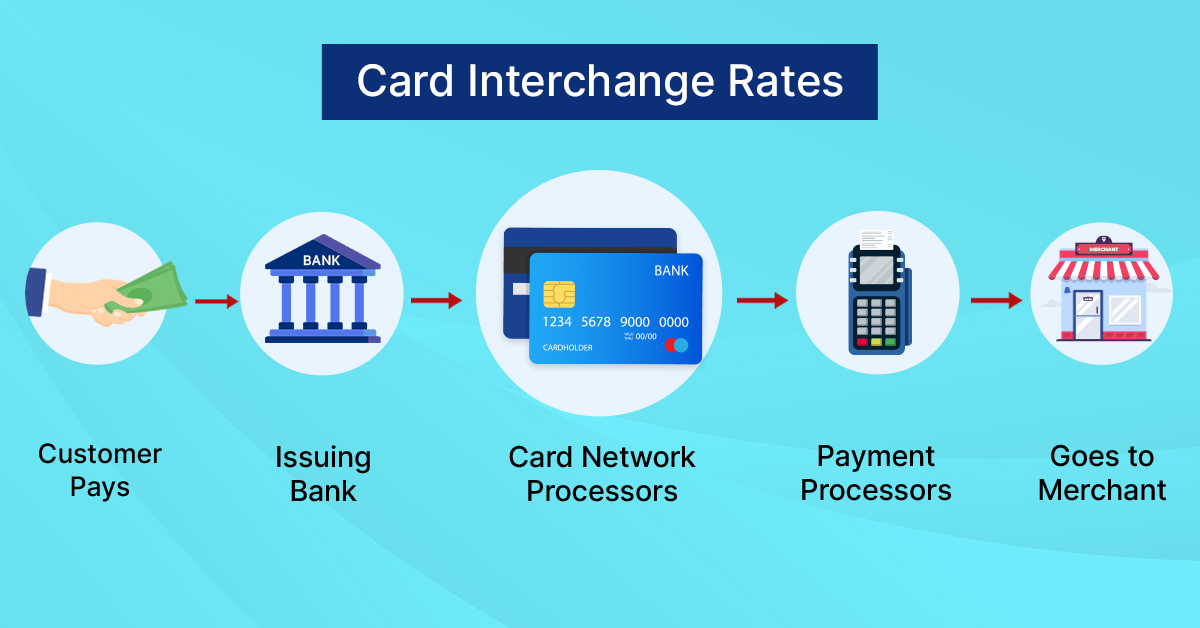

The companies are a wide web or network of the cards market. So be it a credit card or a debit card payment, everything works only by going through this network. If you wish to make the payment through a credit card, the process is quite lengthy as first the payment will reach your card issuer company, then the network, and then your bank. After the bank gives you a green flag, then the information goes back to your network, then your credit card company, and then your payment is completed.

Conclusion

The interchange fee is charged to any merchant having the privilege of making payments by using a credit or debit card. This payment is charged by the credit card processing companies and the fee is regulated promptly. This fee is interdependent on the type of payment you are making and the business scale of the merchant. Many other factors can impact the amount of the payment. As the interchange fee is a percentage of the total transaction, there can be a flat fee added to the charges.

This fee might be negotiated by the merchants but the small businesses might not. With a high presence, businesses can make the case for more sales and can still negotiate the amount to be charged to them, but a small business does not have the option.

The interchange rates are charged by the card processing network companies for the risk associated with the payment. The bigger the payment, the higher will be risk and so is the interchange fee.