In a sudden and surprising move, the Reserve Bank of India instructed card network giants Visa and Mastercard to suspend all commercial payments made by corporations and small enterprises. In a recent circular, RBI highlighted its concerns regarding certain payments and corporations.

What Does RBI Say?

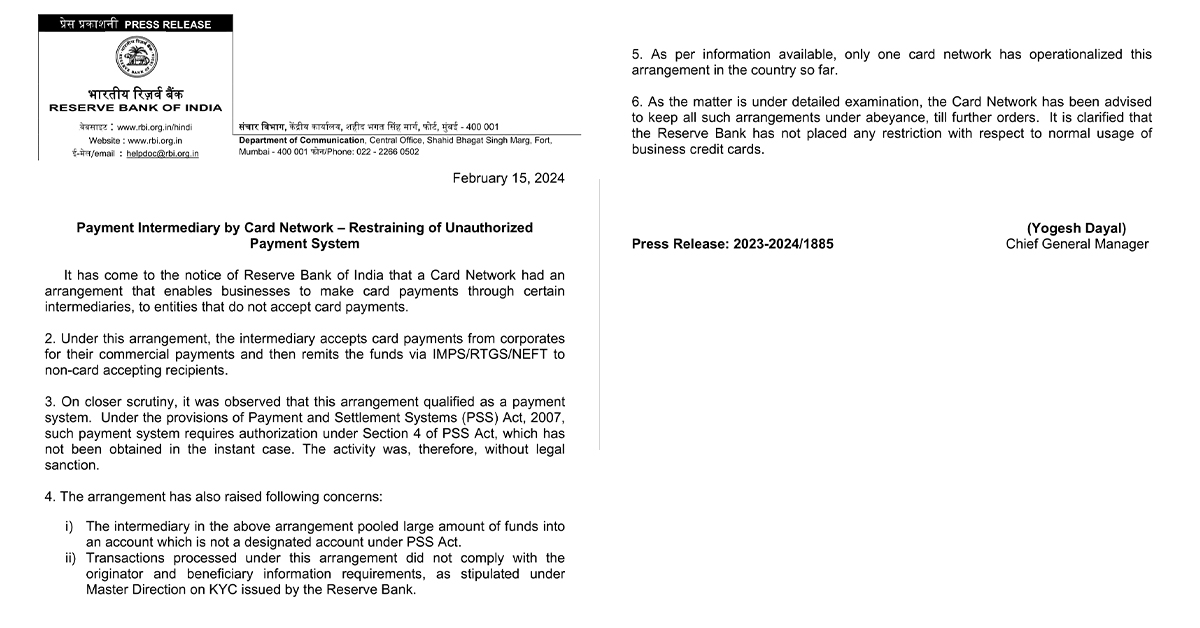

On 15th February, RBI released a circular titled Payment Intermediary by Card Network – Restraining of Unauthorized Payment System. In which the Reserve Bank of India shared its concerns.

The Reserve Bank of India has become aware of an arrangement by a Card Network that allows businesses to make card payments through intermediaries to entities that do not accept card payments.

In this arrangement, the intermediary accepts card payments from corporates for their commercial payments and then transfers the funds via IMPS/RTGS/NEFT to non-card-accepting recipients. According to RBI, this qualifies as a payment system, and no authorization has been obtained for the same.

All of this shall have a strong impact on Fintech companies who prefer card-based payment systems. It is also being said that rental payments and tuition payments shall also be affected by this. According to sources within the industry, the central bank is worried about the movement of money via card payments to non-KYC-ed merchants. Although these merchants may have KYC-ed bank accounts, they are typically not authorized to accept card payments as merchants.

RBI clarified that the general usage of business credit cards shall not be affected while it examines this issue.

What Do Visa and Mastercard Say?

Here is the notice given out by Visa: “We have been directed by the regulator to ensure that all Business Payment Service Provider (BPSP) transactions be kept in abeyance till further notice. Hence, we kindly ask that all BPSP merchants registered by yourselves with Visa be immediately suspended till advised by us to the contrary. For avoidance of doubt, any transaction authorized prior to the communication would be settled in the ordinary course of business. We kindly ask that you send us a confirmation at the earliest that such merchants/merchant IDs have been blocked and transactions ceased. Failure to adhere to these instructions could result in regulatory sanction and non-compliance assessment under the Visa rules.”

Mastercard has put out no message or communication.

Who Shall Be Affected by This?

Fintech platforms like Cred, NoBroker, Bharatnxt, and RedGiraffe, which facilitate rental and tuition payments, are said to be most affected by this movement. All of this comes in the background of strict actions being taken against Paytm after non-compliance with rules. All companies are taking these orders seriously and stopping all payments as ordered by the RBI.

Bottom Line

We shall keep our readers updated as more information comes in, but now, it is known that RBI has ordered a halt on Visa and Mastercard commercial payments due to the above-mentioned reasons. This move is aimed at corporations, mainly Fintech companies. Earlier the precise reasons for this were unknown, which have now been clarified by the circular issued by RBI.

A day after the RBI instructed payment networks Visa and Mastercard to stop enabling business credit card issuances by fintech aggregators, the central bank stated on Thursday that there were other violations, including payments made to illegal merchants. RBI said that a card network had an arrangement that enabled businesses to make card payments through certain intermediaries, to entities that do not accept card payments.

In this setup, the intermediary accepts card payments from corporates for commercial purposes and then transfers the funds via netbanking to non-card-accepting recipients.

The regulator said that until further investigation, the card network has been advised to suspend all such arrangements until further notice. RBI clarified that it has not imposed any restrictions on the regular usage of business credit cards.

According to bankers, there are close to six fintech aggregators issuing business credit cards. This could not be independently verified with fintechs. Bankers said that the move would not hurt their credit card business as these business cards were acting as a substitute for working capital finance, providing businesses with free one-month credit for vendor purchases.

Greatly Explained!!

Everything is very open with a really clear description of the issues.

It was really informative.