The grace period is between the billing cycle date and the due date of a credit card payment. During this time, you can pay your credit card bill without collecting any interest charges, and paying your bill on time and before the due date allows you to enjoy an interest-free grace period. But you won’t be eligible for the interest-free grace period without an unpaid balance. Grace periods can vary depending on the lender and the type of credit product. Some credit cards offer grace periods, while some loans might not. The length of the grace period can also differ, ranging from a few days to sometimes even a month, though the latter is less common.

For example, let’s say you have a credit card bill due on the 1st of the month. If your credit card has a grace period, you might have until the 4th of the month to make that payment without facing any late fees or paying interest on the balance. This doesn’t mean you should habitually pay after the due date, but it can provide some breathing room if you’re a few days late.

It’s important to note that grace periods usually only apply to purchases. If you take a cash advance or a balance transfer, you might start accumulating interest immediately, without the benefit of a grace period. Also, if you don’t pay the total balance by the end of the grace period, you’ll likely owe interest on the remaining amount.

A grace period can be a helpful feature that gives you extra time to pay off your bill without extra costs. Still, knowing how it works for your credit accounts is essential to avoid unintended penalties or interest.

The 3 Day Grace Period Rule

The 3-day grace period rule for credit cards is a helpful provision that gives cardholders a short extension past their payment due date to settle their bill without paying any late fees or interest charges. Typically, credit card issuers provide a grace period between the end of the billing cycle and the payment due date, during which no interest is charged on new purchases if the previous month’s balance was paid in full. The 3-day grace period rule extends this concept by offering a small buffer beyond the due date, often to account for delays in payment processing or to give cardholders extra time to make their payment due to unforeseen circumstances. It’s always best to aim to pay your credit card bill on or before the original due date to maintain a healthy credit score and avoid unnecessary interest.

Do All Banks Offer Grace Periods on Credit Cards?

The grace period is a supporting feature for customers who are unable to pay their credit card bills on time. If you pay your credit card bill within this period, you won’t have to pay any extra charges like interest. This is quite helpful for those who might be a few days late on making credit card bill payments and don’t want to pay interest charges.

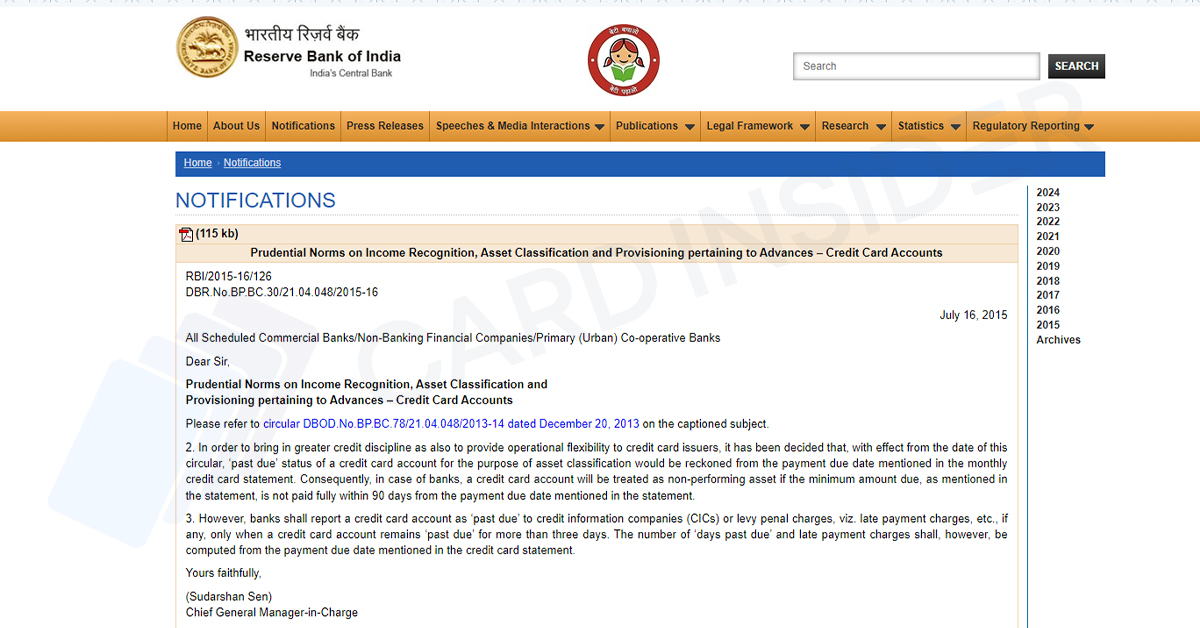

Recently, the Reserve Bank of India notified all banks and instructed them to give their customers a 3-day grace period. Before, not all banks provided a grace period, but after this notification, it is mandatory for every bank, be it a commercial bank or a primary cooperative bank, to provide a grace period to its users.

Bottom Line

Understanding the 3-day grace period rule for credit cards offers a beneficial option for managing finances more effectively. This rule allows cardholders to pay their credit card bill three days before the due date without paying late fees or interest charges. It’s a safety net designed to help with minor payment delays, ensuring that unexpected situations don’t cause financial penalties for users. However, it’s crucial to remember that this grace period is not an extension to delay payments habitually.

Using the grace period for payments too often can make you regularly pay late, which may affect your credit score. So, it’s best to aim to pay on or before the due date. Banks offer this grace period as a convenience, not a standard practice, so it’s essential to understand your bank’s policies. While this grace period can help in tight situations, it’s best to use it sparingly to stay financially healthy and avoid unnecessary fees.