Credit Cards are undoubtedly one of the best financial instruments to manage your finances. They not only allow you to make quick payments but also provide multiple compelling privileges including, travel benefits, dining benefits, rewards on transactions, and much more. However, it might become challenging for someone who is holding more than one credit card or someone who cannot manage their multiple credit card bills. The best way to get out of this is to deactivate the credit card. Other than this, there might be several reasons why one wants to deactivate their Credit Card.

If you hold any SBI Credit Card and want to deactivate it due to some reasons, then we are here with this article, to help you in deactivating your SBI Credit card. Also, you will come to know the things that one should take care of before deactivating and the after-effects of the same. Therefore, keep reading this article, to know more about the deactivating process for the SBI Bank Credit Cards.

What to Do Before Deactivating the SBI Credit Card?

The process of Deactivating any SBI Credit Card is straightforward and quick. SBI Card has provided multiple ways for its customers to deactivate their credit cards. Before we move further with deactivating the card, let’s first understand some things that one should consider doing before deactivating their credit card. Following are the points one should know before deactivating their SBI Credit Card:

Settle Outstanding Balance in Full

Before you request SBI Card, to deactivate your credit card, you should first check if there is any unsettled amount on your credit card. The Bank will initiate the process of deactivating your credit card only if the card’s statement is settled in full, ie, there is no due amount on the card. If you find any due amount, it is better to settle the same first and then request the deactivation.

Close all Auto Payments

In case you have set Auto Payments for merchant subscriptions like Youtube Premium, Netflix, etc, with your SBI Credit Card then it is better to cancel all of them or the same would be reflected in your statement. The bank will again not initiate the process of deactivating if you don’t settle your dues.

Claim your Rewards

Before you deactivate your SBI Credit card, it is better to check whether you have any Reward Points that were not redeemed earlier. If you do have some reward points, it is advisable to redeem them before making the request. Otherwise, all your reward points would be lost and you will not be compensated for them in any way.

Outcomes of Deactivating the SBI Credit Card

Once your SBI Credit card is deactivated, there might be some possible consequences of the same. It might impact your credit score, reduction in total credit, etc. Following are some of the after-effects of deactivating the SBI Credit card:

Increase in Credit Utilization

If you were using multiple credit cards before and then deactivating the card if the total expenses remained the same, the credit utilization would increase on other credit cards. This, however, will not happen in case you are using only one credit card.

Impact on the Credit Score

Deactivating a credit card does not impact your credit score. However, over-credit utilization as mentioned above, may impact your credit score to some extent. Also, if the reason to deactivate the card is because of poor credit history and unsettled balance, then your credit score would be impacted.

Impact on Add-on Credit Cards

If your family members were also using the add-on card issued against your SBI Credit Card, then the services on the additional cards would also be discontinued. Your family members would not be able to use the add-on credit cards anymore.

How to Deactivate the SBI Credit Card?

Now that we have understood all the information related to deactivating a credit card and the impact of the same, now is the time to know the process of deactivating the SBI Credit Card. The SBI Cards has provided quick and easy ways for its cardholders to deactivate their credit cards. Following are the methods by which you can get your SBI card deactivated:

By Contacting the SBI Credit Card Customer Care

You can close your SBI Credit card account by contacting the SBI Bank’s officials through the following contacts:

18601801290 / 18605001290 or 39 02 02 02 (Prefix local STD code).

By Visiting the Branch

Visit your nearest SBI Bank branch and request the bank officials to close your SBI Credit card account. You might be required to submit the request by filling in an application form.

By Submitting a Letter

You can also deactivate your credit card by submitting the deactivation letter at,

SBI Card,

PO Bag 28,

GPO, New Delhi 110 001.

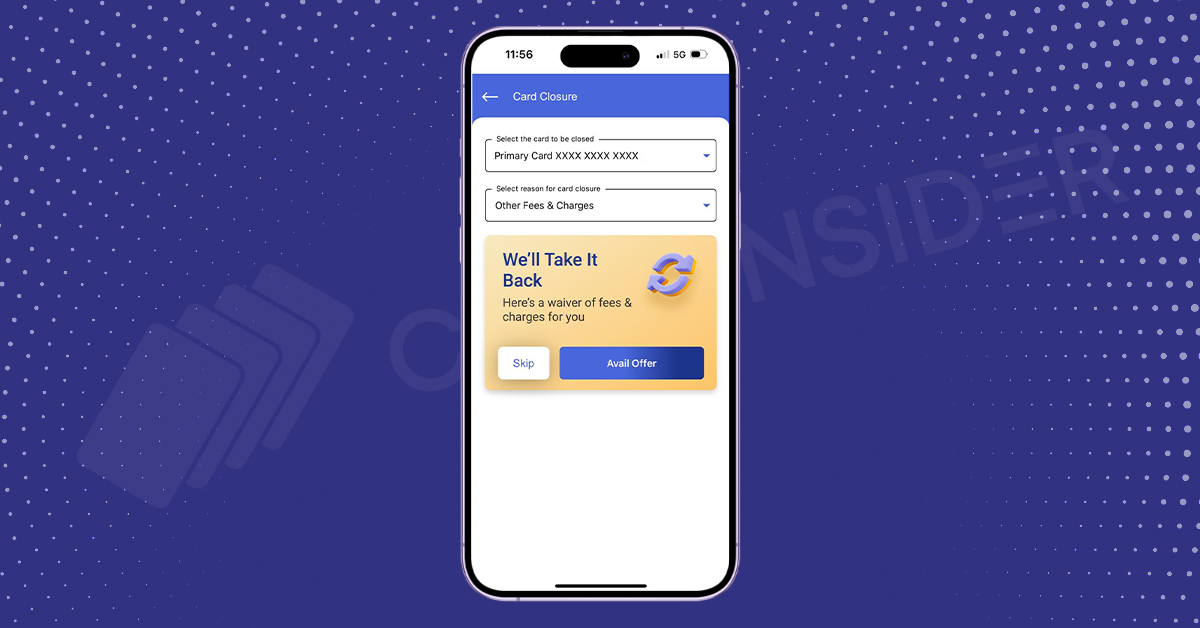

Through the SBI Card App

Simply go under Services > Card Closure Request to close your SBI Credit Card. You would need to provide a reason for the deactivation of your credit card. Sometimes you might even get an offer of an annual fee waiver if you are closing your card due to the fees.

Bottom Line

Closing an SBI credit card account is a quick and easy process. One should deactivate a card if they are not able to maintain and afford their bills. Otherwise, credit cards are the best way to build a credit score along with the benefits they provide. If you still have any doubts regarding deactivating your SBI Credit card, then let us know in the comment section below.

You can close SBI card through app as well using following steps:

01. Click on more (bottom right button)

02. Then click on Services

03. Card Closure Request (2nd last option under services)