Credit Cards are influential Financial Tools that everyone wants to get their hands on. But for some, this might not be possible for a few years and there are some others as well who have ruined their chances of doing so. Yes, in many cases an applicant might not be eligible for a credit card due to their age, salary, or maybe due to any other documents, in these cases, people can still apply after they are eligible or have made new documents, or earning enough now. But there are cases as well where an applicant has a bad credit score due to which their application gets rejected.

Now in the second scenario, the applicant has to wait for at least 7 years in order to remove any default or errors made by the applicants on their credit history. Any defects such as missed payments, no payments, etc will be noticed and can be seen in the Credit history. Not just the credit history, bad debt or delinquencies and late payments or no payments can also decrease the Credit Score.

What is a Credit Score?

A credit Score is a score given by financial credit bureaus like CIBIL and Experian, etc to the applicants to mark their “creditworthiness.”. As the word determines, “creditworthiness” means whether the applicant is worthy of the credit or not. Be it in the future or the past, the Credit Score tells the financial standard and responsibility of the user.

The credit score is the major factor that can help you get good credit cards and can also impact your chances of getting one as well. This can often be observed when we apply for a Credit Card, every document is in place but sometimes the application gets rejected. The reason in these cases is the credit history of the applicant where your credit score also comes into light.

Financial Institutions tend to look at these documents to decide whether the applicant is eligible for the applied credit card or not. However, we have you covered, here are a few ways which you can follow and try to blend in your Credit process so that you can avoid getting your credit score impacted –

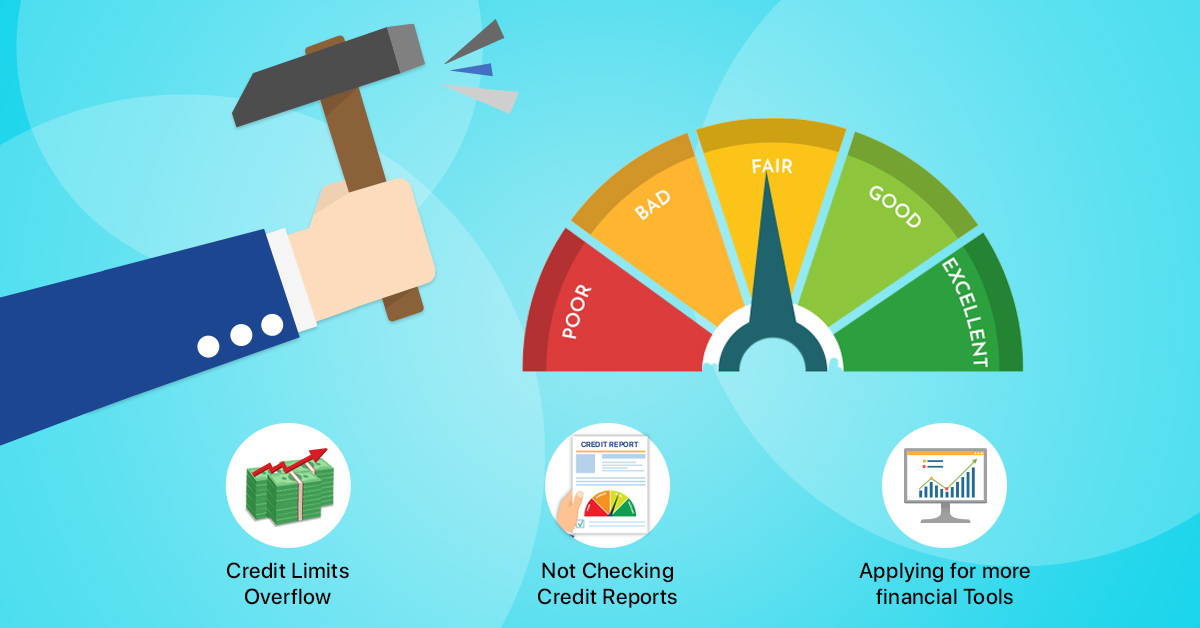

Maxing out your credit limits each month

Let’s say you pay your bills on time and never miss, but the amount keeps getting high. This is the biggest problem. Mostly, people make purchases with their credit cards up to certain limits. Sometimes, we can have some extra necessities which can lead us to make use of our credit limits to the borderline. This can happen at times or two but doing so all the time is not worth it.

The usage of your Credit Card Limit should optimally remain at somewhere 30%, this is what we call credit utilization. Credit utilization is a rate up to which a person should utilize their credit limit. This utilization rate helps you refrain from spending much and keep your credit score healthy.

Not checking the Credit Reports Regularly

For many people checking their credit report is a very tiring job. This is very important for people to know being updated with their credit report and credit history is very important. This can also be in favor of the applicant as there can be errors due to which your credit report is faulted.

Your credit report is very important and needs to be checked to not repeat the mistakes which can lower your credit score. the Credit score is a very important part but not the whole report, the report also includes your credit history, purchasing pattern, and repaying behavior as well. This can also help you plan accordingly to pay off your debt and increase your score.

Applying for more financial Tools at a time

Sometimes applying for more financial tools can look very astonishing and pleasing to people but that is not the case in the financial world. When you fill out financial applications involving credits, the lender you applied to will lead a hard inquiry about your credit health. This will trigger your credit score and it can go down from your original score temporarily. Hence in cases where an applicant has filled out more than one application, the hard inquiry from the creditor will impact the credit score more harshly.

In this case, an applicant must not apply for more than one tool at a time.

The above-mentioned are just the tools that can help you manage your credit well. These tips will help you abstain from getting your credit score impacted.

Conclusion

A credit score is a very important part of one’s credit history and financial status. In economic terms, a credit score determines the creditworthiness of the user which further helps the creditors determine whether or not they want to accept the application.

Sometimes users forget a lot of things while planning out their applications including their credit history, credit score and their purchasing and repaying behaviours. This can extremely impact ones chances of getting accepted. A low credit score can also make you loose your chances of getting any credits further in the future.