In today’s world, credit cards follow an ideology wherein customers can travel without physically carrying cash with them. They have been designed to provide ease to mankind so that they can enjoy their leisure trips without worrying about cash loss or theft. Also, credit cards also help the members to enjoy various benefits and privileges that come along with a credit card, like buying a product or service and paying for them in installments. But have we ever wondered why while making all these spends using a credit card, what are the different types of credit card transactions involved behind it?

Whenever you use a credit card for a transaction, there are 4 different types of entities involved in the completion of such type of transaction, namely – the customer, the merchant, the merchant’s bank, and the credit card issuer. When you initiate a transaction, approval is taken from all these entities within a fraction of a second to complete such transaction. Here, in this article, we will discuss in detail the different types of credit card processing transactions that are involved in the successful completion of a transaction.

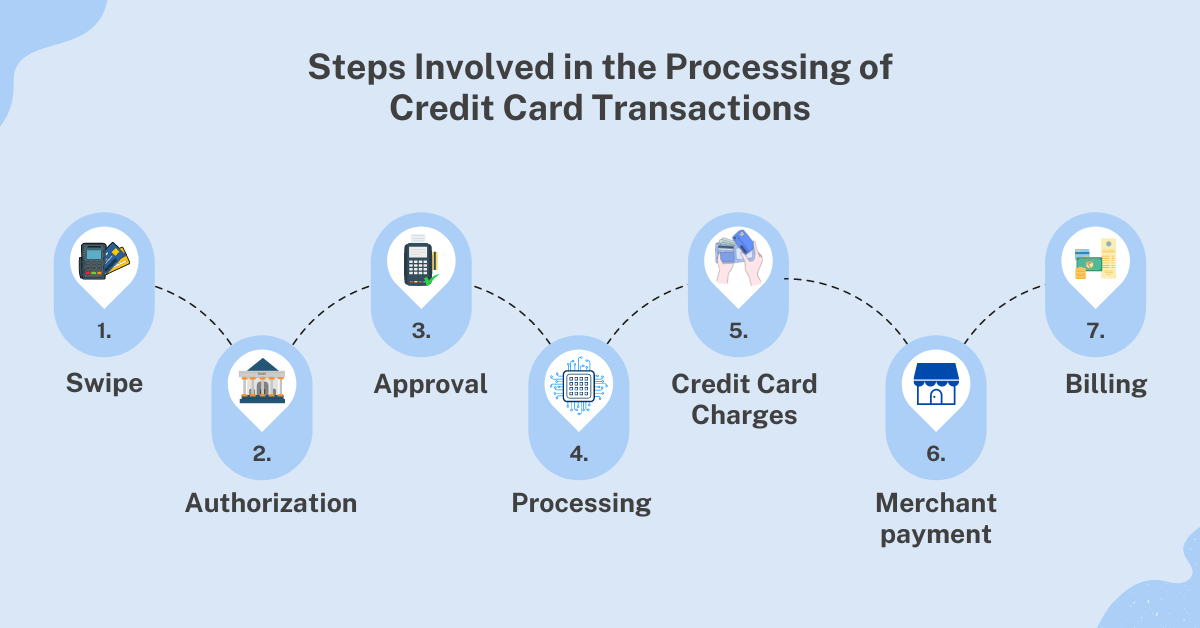

Different types of credit card processing transactions

Credit card processing includes a variety of transactions outside the common purchase, where the customer uses the credit card to pay for a purchase and the owner of the business receives the funds from the transactions. You might have to use your credit card for a variety of purposes, such as getting fuel for your car tank, purchasing any item, etc. In each of these situations, there are different types of transactions that run in the background for the completion of the initiated transaction.

Swipe

The first step of initiating a credit card transaction is to swipe a credit card. If you would like to pay at a merchant outlet using your credit card, you will have to swipe your credit card with him to start the transaction. The merchant will hence communicate with the bank regarding the transaction and then the bank will decide if this transaction can be approved or not.

Also Read: 5 Things You Should Know Before Swiping Credit Card

Authorization

After this, the bank with which the merchant has linked contacts the payment gateways such as Visa, MasterCard, etc to seek authorization for the purchase. The card issuer will then send a code for the completion of the transaction and if in case the transaction gets declined, the customer will have to get in touch with the credit card issuer to clarify the reason for the decline.

Approval

After the code is being verified, the merchant bank will approve the transaction. Once the transaction has been approved, the cardholder will get a receipt for the payment that he has made to the merchant. But this will not mean that the merchant’s account has been credited with the payment amount and neither your card has been charged for the said amount. Your credit card statement will not show any such transaction immediately after you have swiped your credit card.

Processing

This step is also known as settlement, which is generally done at the end of the working day by the merchant. The merchant will send all the credit card payment receipts to the bank and then the bank will further send these receipts to the concerned payment network to process these transactions.

Credit Card Charges

The respective credit card network will then communicate all the due payments to the credit card issuer. The card issuer will then keep a certain percentage of the fee as per the agreement which they had already decided upon.

Suggested Read: Types of Credit Card Charges and Ways To Avoid Them

Merchant payment

Once the credit card company has kept a certain fee with itself, it will transfer the remaining amount to the merchant. The bank to which the merchant’s account is linked will charge a fee before depositing this amount into the merchant’s account.

Billing

This is the last step of credit card transaction processing. Card issuers will bill the customer once the charges have been deposited. The customer then has the option to either pay the bill in full or in installments.

Bottom Line

Processing credit card payments is a routine affair and the merchant should be well aware of all the steps and charges that are involved in the completion of a transaction. Though this is a complex process and involves many parties in between, having a clear understanding of all these steps will help the business owner guide the customers in a proper way if they have any queries related to this process.