The SBI Cashback credit card was newly launched by the bank that comes at no joining fee and Rs. 999 renewal fee. As you can tell from its name, it offers cashback for every offline and online spends made by the cardholder.

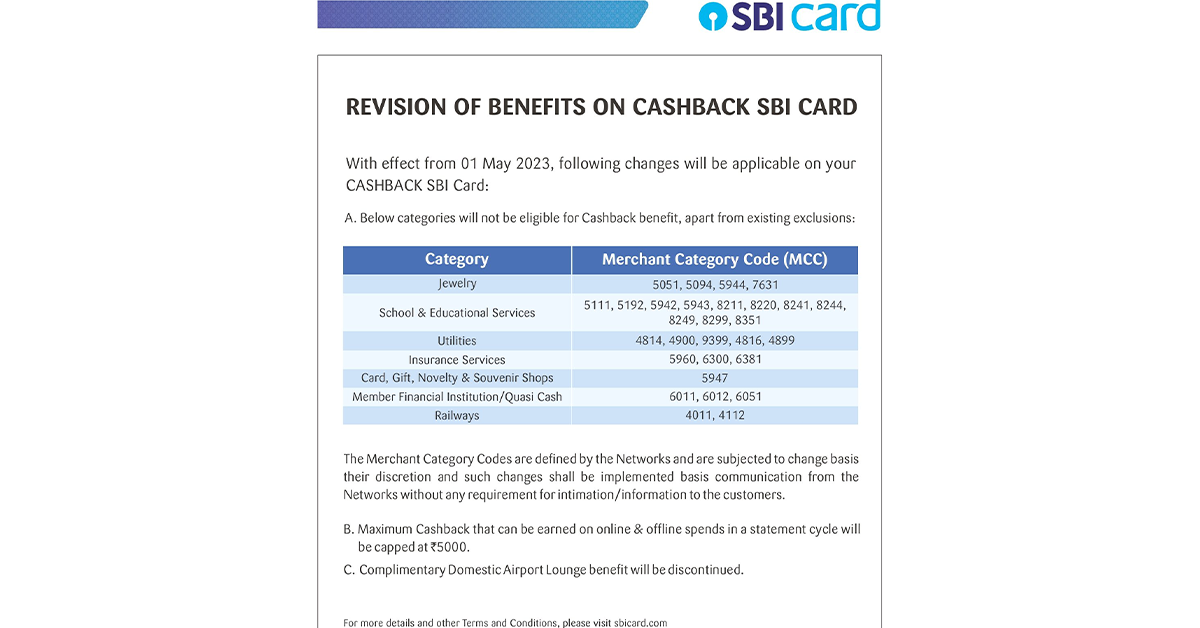

However, SBI recently announced that from 1st May 2023, the cashback benefits on this credit card will be revised and multiple categories won’t be available for the cashback benefit anymore. Keep reading to know about the changes made to the credit card benefits by the bank;

Revision of Cashback Benefits on the SBI Cashback Credit Card

Earlier, just fuel transactions were ineligible for cashback on the credit card while online transactions earned you 5% cashback and offline transactions earned you 1% cashback. However, effective from 1st May 2023, the following categories won’t accrue cashback –

- Jewellery

- Utilities

- Educational & School Services

- Card, Gift, Souvenir, and Novelty Shops

- Insurance Services

- Railways

- Quasi Cash/Member Financial Institution

Apart from the above exclusions for cashback benefit, the maximum cashback you can earn per month on both offline and online spends will be Rs. 5000. The complimentary domestic lounge access benefit is also discontinued from the SBI Cashback credit card.

Bottom Line

The revision of cashback benefits is certainly a blow to SBI Cashback credit card customers given its high Rs. 1000 renewal fee. Earlier, the card offered 1% cashback on utility payments but this will be discontinued come 1st May 2023. Cardholders will not get cashback on many major payments like utility bills, school fees, insurance premium, etc.

Moreover, the card offered 1 complimentary domestic lounge access per quarter to the cardholder and this benefit will be removed as well. Paying Rs. 1000 for a credit card without even complimentary lounge access is not very good.

Stay tuned for more information and updates regarding the SBI Cashback and other popular credit cards in the country.