Launched in mid-2023, the Swiggy HDFC Card is considered one of the most impressive and rewarding cards in the online food ordering and dining category. It offers 10% cashback on all spends made on Swiggy and 5% cashback on popular brands like Myntra and Amazon. Despite the great cashback and decent earning cap, many people were not satisfied with the mode of cashback received. The cashback was received as Swiggy Money and had to be spent on the platform itself. This drawback led many to opt for other cashback cards like the SBI Cashback or HDFC Millennia instead.

Now in May 2024, HDFC Bank has announced significant changes to the Swiggy HDFC Credit Card. The cashback, previously received as Swiggy Money, will now be directly adjusted against the credit card statement. Many consider this move a game-changer. In a season of never-ending devaluation, this revaluation of a credit card by HDFC Bank has been hailed by many.

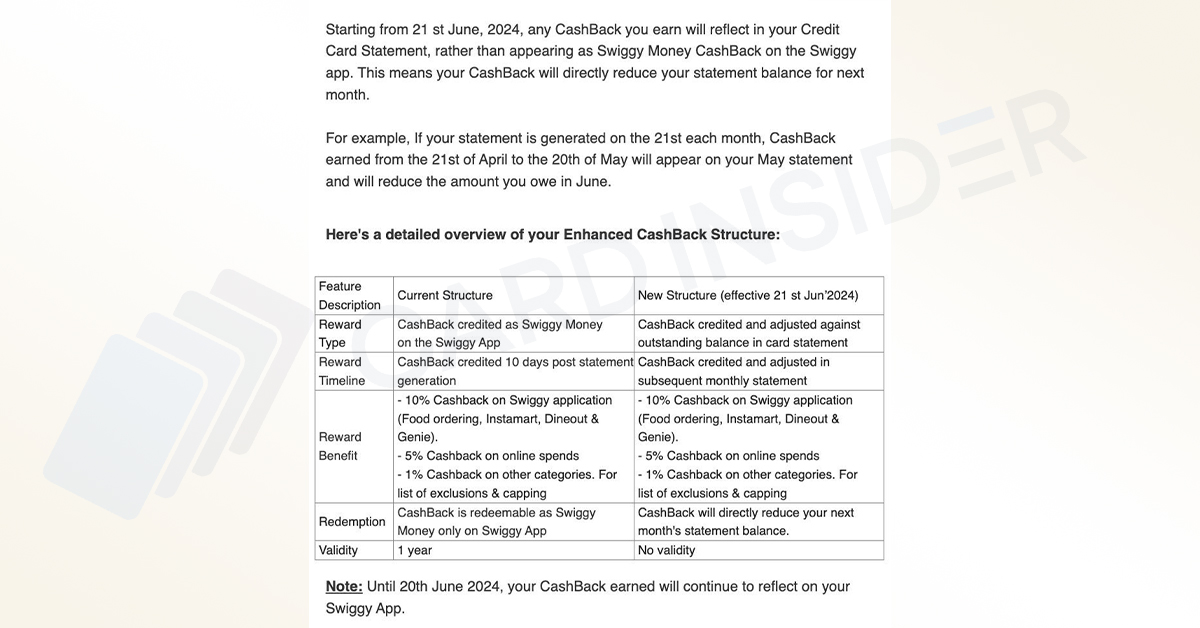

Consider this, if your Swiggy HDFC Card statement is generated on the 15th of each month, then the cashback you earned between July 15th and August 14th will be reflected in the August statement and will reduce the amount you owe in September. Given below are the changes applicable to the Swiggy HDFC Card from 21 June 2024, before which you shall be receiving the cashback as Swiggy Money only.

| Features | Current | From 21st June Onwards |

| Cashback | Cashback As Swiggy Money on the Swiggy App | Cashback Adjusted Against Card Statement |

| Cashback Posted | Cashback Credited After 10 Days of Statement Generation | Cashback Shall Be Adjusted in the Statement of Subsequent Month |

| Validity | One Year | N/A |

Details on Swiggy HDFC Credit Card

This card comes with a Joining/Renewal Fee of ₹500 + GST, which can be waived by spending ₹2 lakh in a year. Cardholders can earn 10% cashback on all spends made on the Swiggy app (up to a maximum of ₹1,500), 5% cashback on online spends with popular brands and platforms (up to a maximum of ₹1,500), and 1% cashback for all other eligible spends made with the card (up to a maximum of ₹500).

Additionally, cardholders will receive a complimentary 3-month Swiggy One membership and enjoy MasterCard World tier benefits. This cashback credit card is a great entry-level option due to its excellent benefits.

Why Apply for this Cashback Credit Card?

Earlier, many people were hesitant while applying for the Swiggy co-branded credit card because the cashback they would receive would be credited to their Swiggy Wallet. They were worried that they would be restricted to spending this money only on the Swiggy application. Now that this issue has been resolved, as the cashback received shall be adjusted against the statement from 21st June 2024 we believe that the Swiggy HDFC Credit Card is a must-have cashback credit card for everyone.

While many users have reported receiving lifetime free Swiggy HDFC Credit Card offers recently, even those who haven’t received it can easily apply for this card as the fees are quite affordable. You would even get a complimentary 3-month Swiggy One membership.

Some of you might already have an HDFC Credit Card and might wonder if you can apply for another one. Well, even those who already have an HDFC Credit Card can apply for this co-branded card and unlock monthly savings of ₹3,500 and yearly savings of ₹42,000.