The National Payments Corporation of India (NPCI) has announced new features for RuPay credit cards. These features will come into effect by 31st May 2024 and will be related to UPI applications and usage. RuPay credit cards have received wider acceptance in recent times, this is due to their rewarding features and sole acceptability on the UPI platforms (presently only RuPay credit cards can be linked to UPI). The new features will only lead to an increase in popularity and ease of usage for UPI applications linked with credit cards.

Here are all the new features and updates we can expect from card issuers and other financial institutions by 31st May 2024.

EMIs

RuPay credit card holders can easily opt for EMI on the UPI application of their choice. Customers shall be-

- Able to convert past purchases into EMIs.

- Convert fresh/new purchases into easy EMIs through the UPI app.

This new feature to convert purchases into Easy Monthly Installments would further boost the popularity of RuPay credit cards.

Credit Card Bill Payments/Installment

With the latest features, RuPay credit card holders will be able to make credit card bill payments using the UPI application. This would allow users to manage their finances better.

- To enable this, the Payer PSP shall create a UPI ID to receive credit account bills/installment payments.

- UPI App shall provide a view for the user to access the details of linked credit card outstanding bill/ credit line installment details (minimum amount due, the total amount due, bill due date, etc).

- The issuer bank will clear the dues immediately upon receiving payments and make the updated balance available for use.

Credit Card Limit Management

All RuPay credit card holders shall be able to apply for and receive credit limit enhancements in the UPI app itself. This would significantly impact the user experience for all those actively using UPI applications with their linked credit cards.

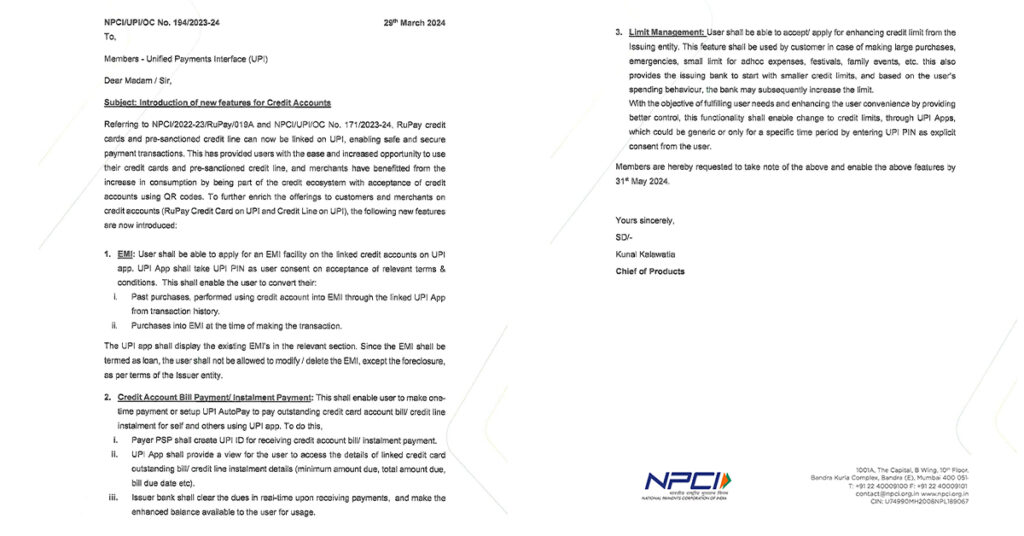

If you’re curious to check out the official notification by NPCI, we have got you covered! You can take a peek at it right here.

Bottom Line

The introduction of RuPay credit cards to the UPI platform has resulted in increased popularity and usage by the general public. GooglePay, PhonePe, Paytm, and Cred are some of the most popular household names when we think of making payments with a UPI application. Whether it is small grocery purchases or large expenditures the combination of RuPay on UPI has provided ease and convenience to all. Now with these new initiatives by NPCI, customers will experience greater convenience, which will further boost their preference for RuPay credit cards.