Many people have started using their RuPay credit card to make UPI payments on popular applications like Paytm, BHIM, PhonePe, Google Pay, Payzapp, etc. Before you start using the credit card for payments, you must first link and add your card to the particular UPI app you use.

Read further to know how to link your card to some of the most commonly used UPI applications.

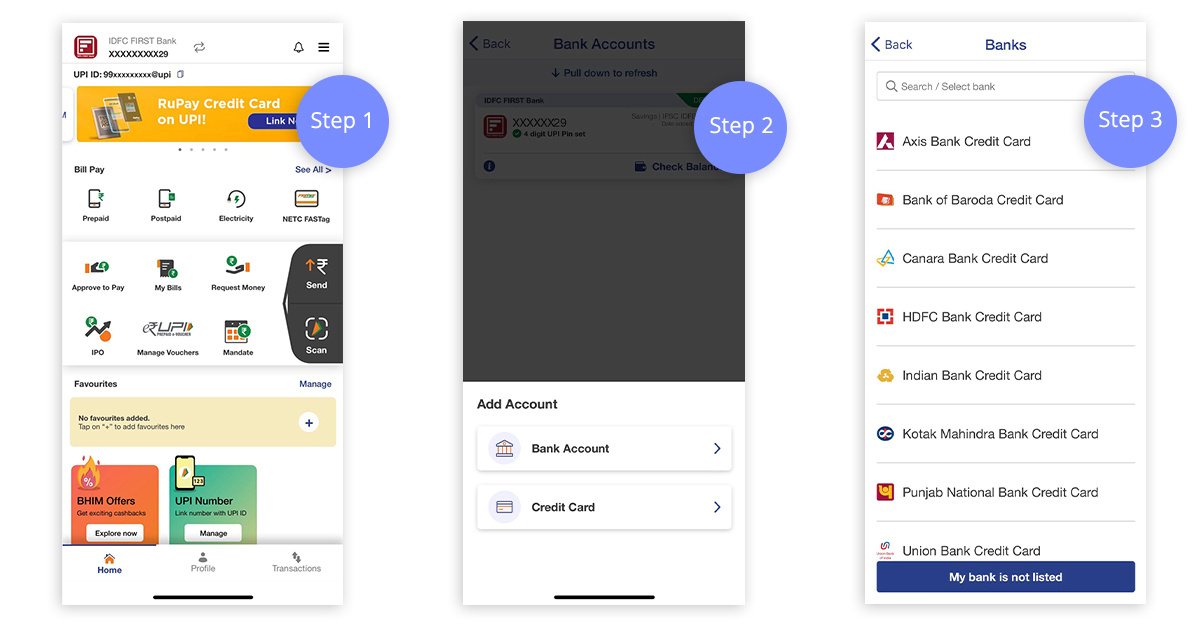

How to Link Your RuPay Credit Card to BHIM App

Follow these steps to link your RuPay credit card to the BHIM app –

- First, download or open the BHIM application on your iOS or Android smartphone.

- Sign up or log in to the application.

- Next, click on the Bank Accounts section near the top of the screen.

- Click the Plus button near the bottom right and then click on Credit Card.

- Choose your credit card issuer bank, and the application will show all eligible credit cards.

- Enter the necessary details, and your RuPay credit card will be added to the BHIM app.

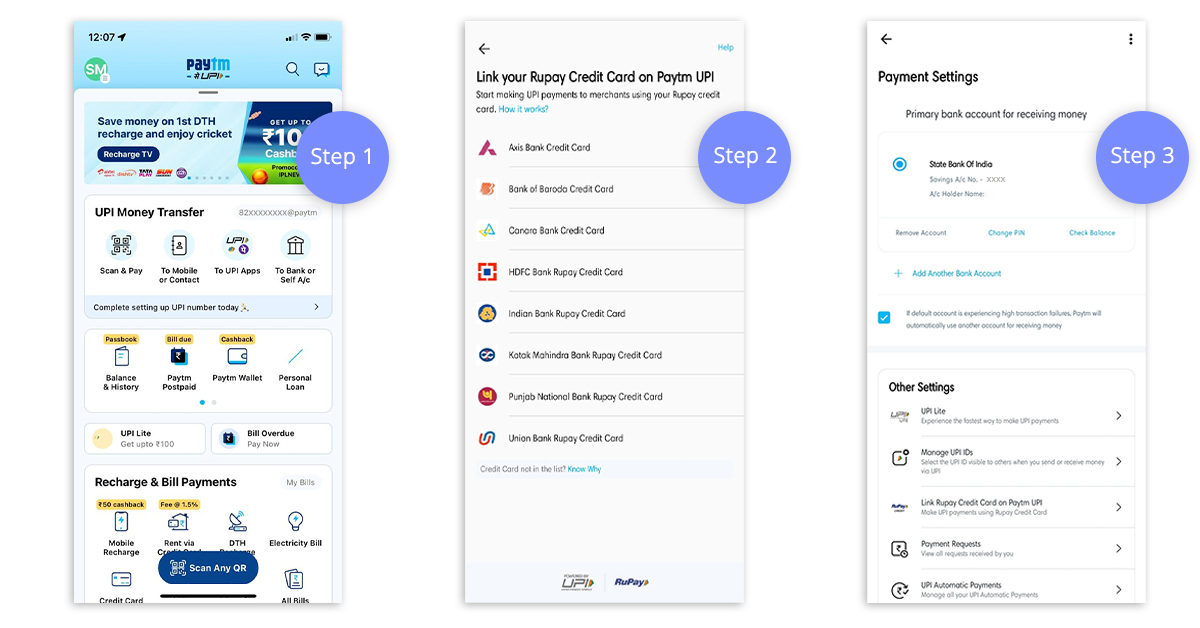

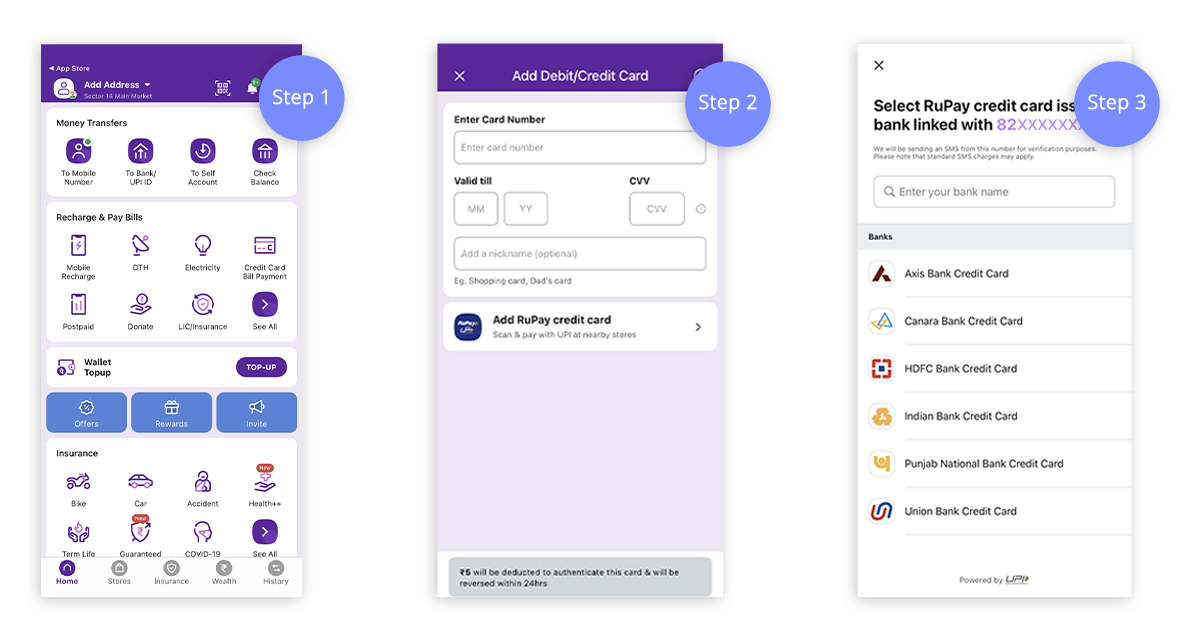

How to Link Your RuPay Credit Card to the Paytm App

Follow these steps to link your RuPay credit card to the Paytm app –

- Open the Paytm application and tap on the home page’s top left corner

- Scroll down and click on UPI and Payment Settings

- Open the ‘Other Settings’ section and click on Link RuPay Credit Card to Paytm UPI

- You will see all eligible banks that offer RuPay credit cards.

- Click on the bank whose credit card you have and the application will fetch the details related to your credit card.

- Authenticate your credit card and then set the 4 or 6-digit UPI ID if you haven’t done it already. Your RuPay credit card will be linked and ready to make UPI payments after this.

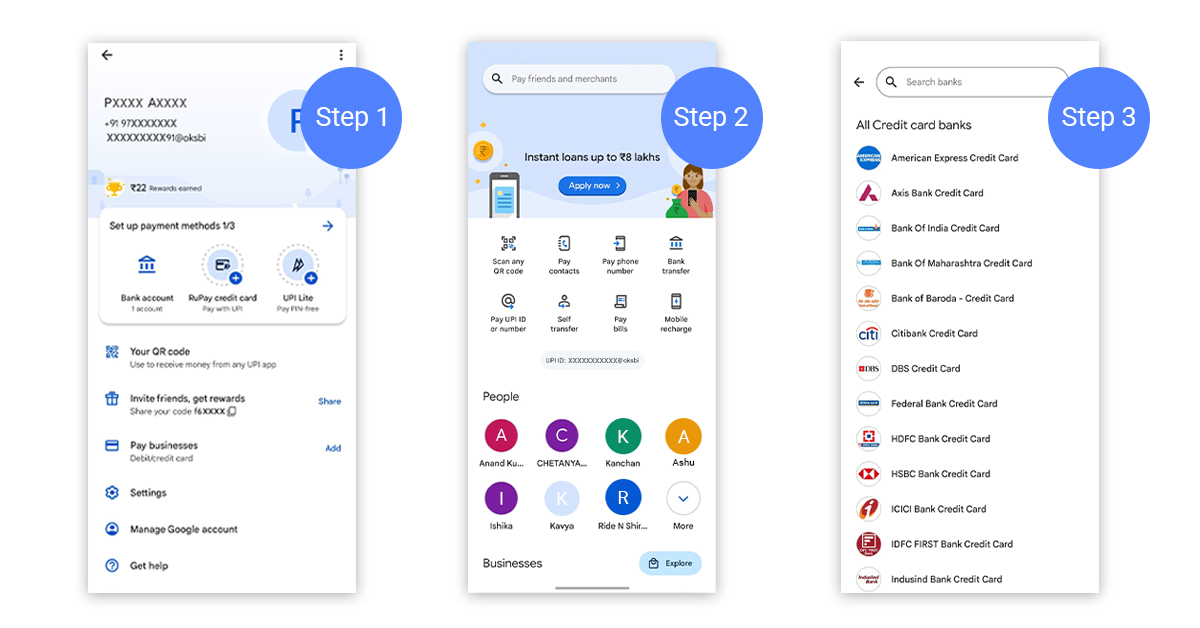

How to Link Your RuPay Credit Card to Google Pay App

Follow these steps to add your RuPay credit card to the Google Pay application –

- Download and open the Google Pay application on your smartphone.

- On the top right of the app, click on your Profile Picture and then click on Bank Account and Cards.

- Next, tap ‘RuPay Credit Card’ under the ‘Set up Payment Methods’ section.

- Now, the screen will show all the eligible banks offering RuPay cards.

- Click on the bank whose RuPay card you have, and the application will fetch your card details. Authenticate your card, and it will be ready to make UPI payments through Google Pay.

How to Link Your RuPay Credit Card to PhonePe App

Follow these steps to add your RuPay credit card to the PhonePe application –

- Download and open the PhonePe application on your iOS or Android smartphone.

- Click on the Profile icon near the app’s top left corner.

- In your profile, keep scrolling down and then click on ‘View All Payment Methods’ when you see it.

- Now, you will see all the payment methods you have added to PhonePe until now.

- You will see the Credit/Debit cards sub-heading. Click on the ‘Add Card’ option right next to it.

- You will see the Add RuPay credit card option now. Click on it.

- The screen will show all eligible banks that issue RuPay cards. Click on your card issuer bank.

- The application will fetch your credit card details, and you can fill in the necessary details.

- After filling in everything needed, click on Add. Your RuPay credit card will be linked to PhonePe and ready to make payments.

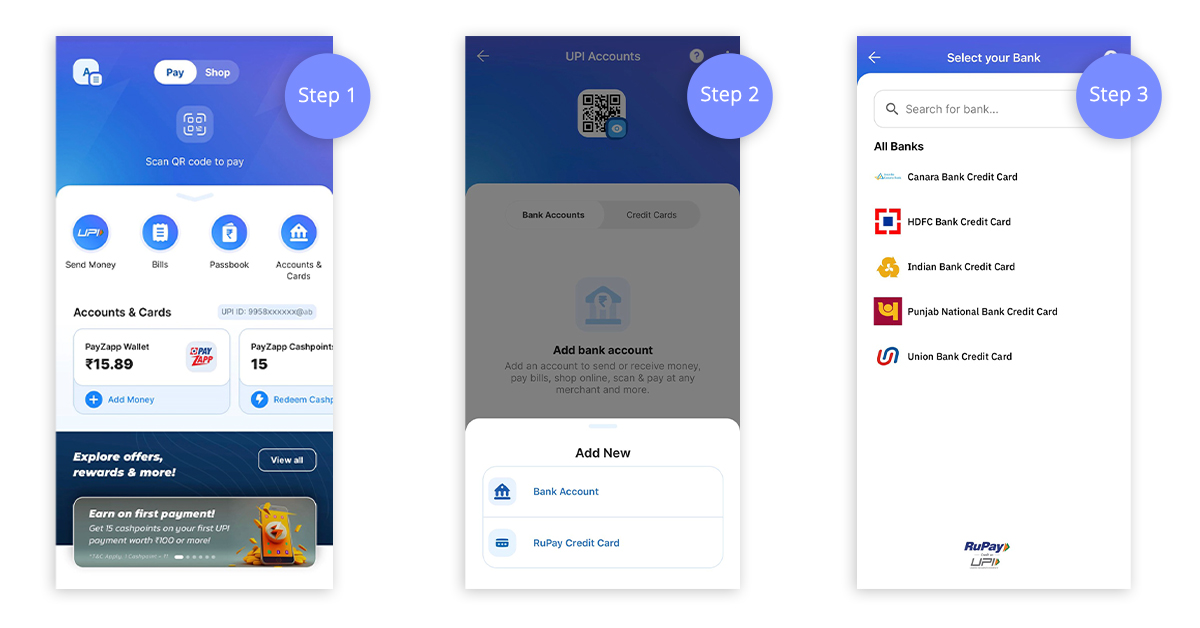

How to Link Your RuPay Credit Card to PayZapp App

Follow these steps to add your RuPay credit card to the PayZapp application –

- Download and open the HDFC PayZapp application on your smartphone.

- On the Homepage, scroll down, and under the offers section, click on UPI Payments on RuPay Credit Cards.

- Click on this offer, and you will reach the page with your linked bank accounts and credit cards.

- Click on ‘Add New’ near the bottom of the screen. You will see two options Bank Account and RuPay Credit Card. Choose the latter option.

- You will see a list of banks whose RuPay cards can be added. Click on your RuPay credit card’s issuer bank.

- Next, you have to enter the necessary details of your credit card to link it with PayZapp.

- Set up your four or 6-digit UPI PIN if you haven’t already, and your RuPay card will be ready to make UPI payments.

How to Make UPI Payments with RuPay Credit Cards?

After you have linked your RuPay card to your UPI ID, you can start making payments with it. Follow these steps to make UPI payments on different apps with your RuPay credit card-

- Open the UPI application Paytm, BHIM, PayZapp, Google Pay, or any other through which you wish to make the payment. Make sure your RuPay credit card is linked and added to the application before you use it for payments.

- Scan the merchant’s QR code and enter the amount you want to pay.

- Make sure to choose your UPI-linked RuPay credit card out of all available payment options.

- Enter your four or 6-digit UPI PIN, and the payment will be made through your RuPay credit card.

UPI Payments with RuPay Credit Cards – Important Points to Remember

- You can use the RuPay credit card for UPI payments only to merchants. You cannot send money to your friends or family members through a RuPay credit card. Scan the QR code of the merchant to whom you have to pay money.

- Make sure you know the 4 or 6-digit UPI PIN to complete the transaction. You won’t need your card’s CVV or any OTP and can complete the payment through the PIN, similar to other UPI transactions.

- Stay updated regarding the benefits and privileges offered by your RuPay card. You can save a decent amount of money and avail of other benefits if you use your RuPay credit card correctly.

Also Read This: Tips to Earn the Most Reward Points on Credit Card

Bottom Line

Since RBI launched the UPI facility, it has become a hit among Indians. People everywhere love the convenience and versatility offered by UPI. Prominent businessmen and small-time local vendors, everyone prefer digital payments via UPI, and the rate of usage is firmly increasing day by day.

However, people could use their bank accounts or debit cards for UPI applications. As RBI has now allowed the linking of RuPay credit cards to UPI applications, people are getting the best of both credit and convenience. You can get the comfort and ease of UPI payments, all while getting the benefits of a traditional credit card.

Many small vendors and local merchants needed POS card machines and could not accept card payments. Now, people can use their credit card anywhere where UPI is accepted and can earn rewards and benefits for both small-time daily expenses as well as big-ticket purchases. We read about the best RuPay credit cards in India that can be used for UPI payments and the procedure to link your card to UPI apps and start using it for payments.

Head over to the comments section and tell us about your opinions regarding the linking of RuPay cards to UPI apps, if you have used this privilege for yourself, and your experience of it.