As all the major credit card issuers are coming up with exclusive offers on insurance payments, HSBC has also launched a similar offer providing 5x Reward Points on insurance premium payments. The offer will be applicable on all the insurance payments worth a minimum of Rs. 10,000 made using non-Premier HSBC Credit Cards. It is a limited period offer and hence cardholders can avail of the accelerated Rewards only during the offer period and not after that, but it provides them with a great opportunity to earn up to 2,000 additional points under the offer.

However, there are some terms and conditions of the offer that you must understand before proceeding further to register yourself for the offer. Read on the article to understand all about the offer and its terms & conditions:

The HSBC Credit Card Insurance Payment Offer

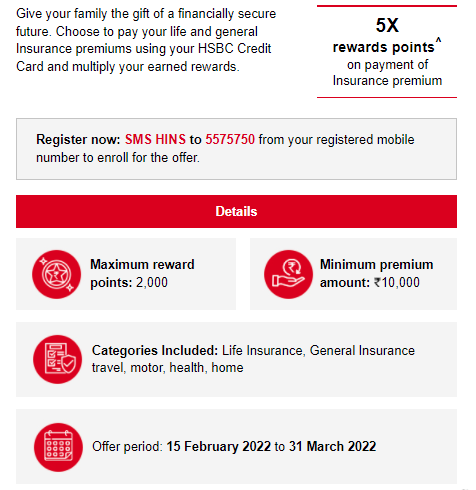

HSBC Credit Cardholders can now earn 5x Reward Points (i.e, five times the Reward Points they generally earn) on insurance payments worth more than Rs. 10,000. The 5x Reward Points will be earned as a bonus and cardholders will also earn the regular Reward Points on insurance payments (if applicable). The maximum cap on the additional Reward Points that can be earned under this offer is capped at 2,000 points per credit card. Moreover, the offer is only valid from February 15, 2022, to March 31, 2022. Following are the additional important details about the offer:

Eligible/Non-Eligible Cardholders

– Only Non-Premier HSBC Credit Cardholders who are residents of India are eligible for the offer.

– Corporate and Cashback Credit Cardholders will not be able to avail of the benefits of the offer.

– The cardholders who have not paid their minimum amount due will not be eligible for the offer.

How To Register For The Offer?

To register yourself for the offer, send SMS ‘HINS’ to 5575750 from your registered mobile number. It is mandatory to register for the offer to avail of its benefits. You can register anytime during the offer period and your insurance transactions made during the whole offer period will be considered for the offer. For example, even if you register on March 15, 2022, all your insurance payments from February 15, 2022, to March 31, 2022, will be considered for the offer. But, registration after the end of the offer period will not be considered valid.

Also Read: Get Up To Rs. 2,000 Cashback On Insurance Payments Using Your ICICI Bank AmEx Credit Cards

Offer Terms & Conditions

- You can not participate in the offer without registration.

- The additional Reward Points will be credited to the cardholders’ accounts by May 31, 2022.

- All the insurance payments made using add-on cardholders will be added to the insurance payments done through the primary card and all the reward points will be credited to the primary cardholder’s account.

- Cardholders can make multiple insurance payments using their HSBC Credit Cards to earn bonus Reward Points.

- HSBC Bank reserves the right to modify, alter, change or cancel the offer anytime.

For more detailed terms and conditions, click here.

Bottom Line

The insurance payments offer launched by HSBC Bank is providing an exciting opportunity to earn up to 2,000 bonus Reward Points to the Cardholders. Recently, ICICI Bank, Standard Chartered Bank, American Express, SBI Card, and YES Bank, also launched different offers on Insurance payments. The offer on insurance payments using Standard Chartered Credit Cards is very similar to this offer launched by HSBC Bank. So, if you have a credit card from any of these banks/card issuers, you can earn exciting reward points/cashback benefits on insurance payments. Make sure to read the terms and conditions of the offer carefully so that you can get the maximum benefit out of it.