In today’s era, the young generation, be it a student, wants to be financially independent. There are so many activities and courses that we wish to do but are sometimes unable to do because of financial constraints. Every individual these days wants to gain financial independence, but little do we know that the first step toward financial independence is to build a good credit score. Your credit score and credit history are very important aspects that determine your eligibility to apply for loans and other financial opportunities throughout your lifetime.

In India, credit cards can be issued to students on completing 18 years of age. By that time the students start enjoying their college phase. It is a time of change and growth for the students. They experience financial independence and freedom for the first time. It becomes the prime time when they meet new people and start moving out with them. This is where they require financial independence the most. Now, this is where credit cards come into existence. It comes very handily while paying bills related to daily needs and utilities.

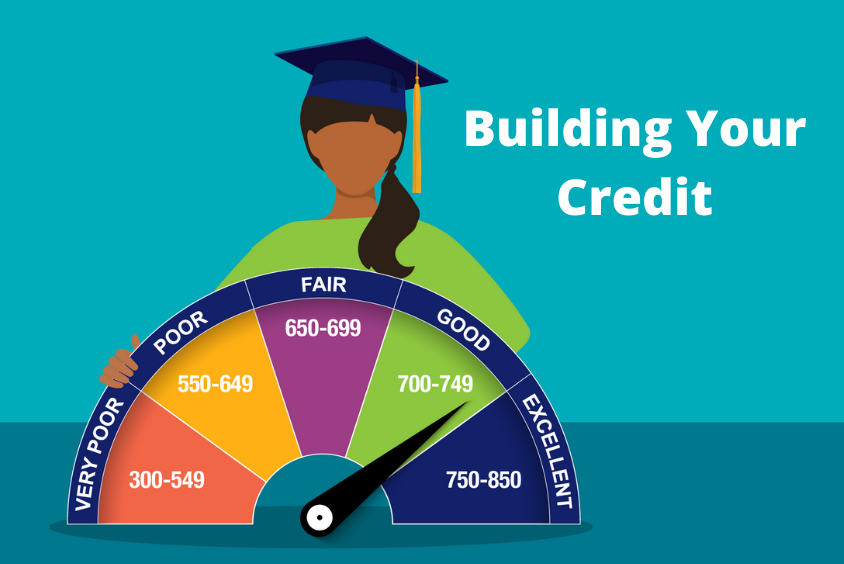

But on the other hand, it is very important to have knowledge about how one should use his/her credit card. This is because if the card is used in an improper or unaligned way, it can badly ruin your credit score and will make it quite difficult for you to avail of various facilities in the near future in which credit score plays a major role. Like while applying for a car loan, personal loan, home loan, credit cards, etc. your CIBIL score is checked and if you do not carry a good CIBIL Score, then you will not be able to avail such facilities. Hence, building and maintaining a good credit score from the very start is very important.

This article will discuss the ways in which you can build a credit score as a student. Keep reading the article to know more about it.

-

- Avail a credit card only if you have a source of income:- The first and foremost thing is that you should opt for credit only when you have some source of income. Most of the students these days either work part-time or are into freelancing jobs that serve them as a source of income. From this income, they can pay off their credit cards bills and enjoy the facilities that the credit card offers.

- Pay off your bills every month:- As a student, you should understand and take care that you use a credit card only when it is very important. You can use a credit card to make payments and earn cashback and rewards but the amount should be swiped within your affordable limits only. This is because if you will not be able to pay the amount due on the due date, then interest will be charged on the balance amount and this will put a negative impact on your credit score. Hence, you should use only that amount which you would be able to pay later.

- Avoid paying on behalf of your friends:- While being a student, you should take care that you should never initiate any transaction on behalf of your friends. Your friends might ask you to complete any of their transactions because you are a credit card holder but he might elope at the time of repayment. In this case, your credibility will be at stake. Non-payment of bills will lead to a drop in your credit score and will make it difficult for you to avail the facility of loans in the near future. But even if in a case, you are doing any transaction for your friend, make sure that you repay the bills on time.

- You can apply for a Student Credit Card:- Student credit cards come with a lower credit limit as compared to the other credit cards offered by the banks. Generally, it offers a credit limit between Rs. 15,000 to Rs. 20,000. This is done considering the fact that the cardholder, who is a student, does not start spending unnecessarily and ends up spoiling his credit score.

Also Read: How Can A Student Get A Credit Card

-

- Use only 1 credit card:- As a student, you should avoid using multiple credit cards as it will just increase your credit liability. It is better to use one card and maintain that. This will help you in building credit.

- Start with a secured credit card :- Both the cards, secured and unsecured work in a similar manner. The major difference is the security deposit. You have to use the secured credit card in the same manner as you use the other credit card. You can simply use it for your day-to-day transactions and then pay your monthly bill on time. The risk of the credit card issuer reduces because of the security deposit. Any default in the payment would be recovered from the collateral.

Check Here: List of Best Secured Credit Cards

-

- Try to keep your debts low:- Having a good credit limit available depicts your spending and well as your ability to keep the balances low. One of the major factors in determining your credit score is the credit utilization ratio, which is the amount of credit you are using at a particular time compared to the limit available. The lower the ratio, the better it is.

Bottom Line

Building your credit while you are still a student can help you in preparing for the realities of life after your education. You will always need a good credit score for availing of different facilities, like your own house, your own car, etc. You can start building your credit by repaying your debts on time and in full, by starting with a secured credit card, and in many other ways that are mentioned in the article above. Working on building good credit at the initial stages of life can help you in a better life post your education. The sooner you realize it, the better it is.